metamorworks

Sixth Street Specialty Lending Inc. (NYSE:TSLX) continued to perform well in the second quarter, despite the stock’s performance. While the stock remained stagnant throughout the second quarter, the business development firm reported strong 2Q-22 results.

Sixth Street Lending can easily sustain its current dividend payment because it continues to cover its dividend pay-out with adjusted net investment income. The BDC’s first lien emphasis and high portfolio yields protect investors from loan and book value losses.

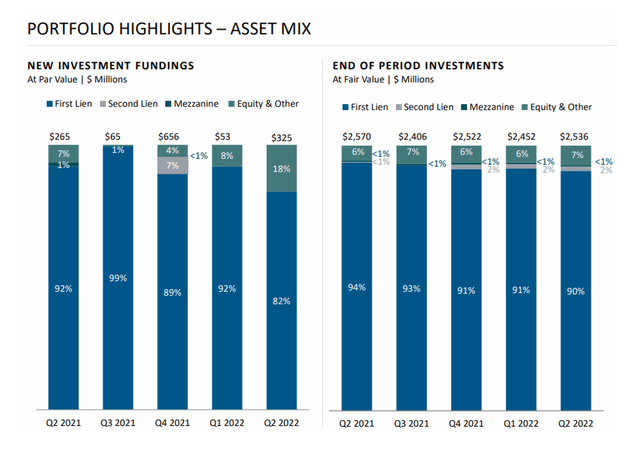

First Lien-Focused, High Quality Investment Portfolio

Sixth Street Lending is a high-quality business development firm because it focuses primarily on the highest quality types of debt, First Liens.

Despite the fact that the BDC also invests in Second Liens, Mezzanine Debt, and Equity, the company has built a reputation as a conservative investor in the highest-interest-rate debt.

First Liens accounted for 90% of Sixth Street Lending’s investments based on fair value, a 1% decrease QoQ. The majority of new investments in 2Q-22, 82%, were also in First Liens, with equity investments accounting for the remaining 18%. Sixth Street Lending and its shareholders stand to benefit from equity investments in terms of valuation.

Portfolio Highlights (Sixth Street Specialty Lending)

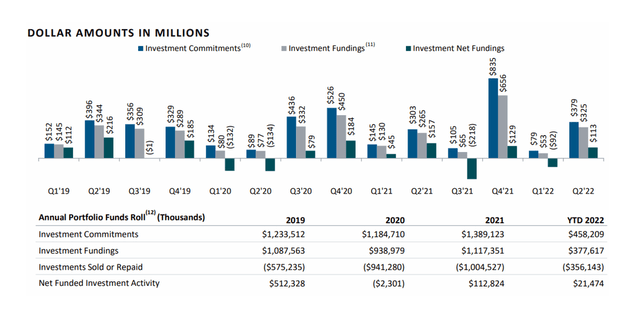

Sixth Street Lending had a good second quarter in terms of investment activity. The business development company received $378.9 million in new investment commitments, with $324.8 million (or 86% of the total) funded.

Sixth Street Lending has received $458.2 million in new investment commitments this year, with 82% of them funded. Sixth Street Lending’s total net funded investment activity in 2Q-22 was $21.5 million, with $356.1 million in repayments.

Sixth Street Lending may not exceed totals from the record year of 2021 in terms of new loan commitments, but 2022 is not going to be a bad year either.

Investment Activity (Sixth Street Specialty Lending)

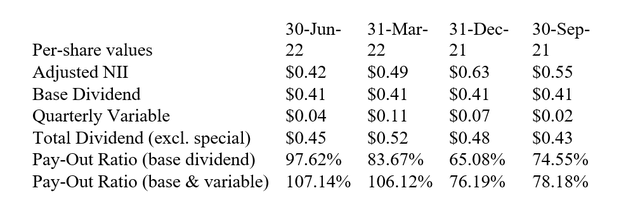

Dividend Coverage Remains Excellent

Sixth Street Lending’s dividend pay-out ratio remained below 100% in 2Q-22, as adjusted net investment income of $0.42 exceeded the BDC’s base dividend pay-out of $0.41 per share.

Sixth Street Lending has paid out $1.64 per share in (base) dividends and earned adjusted net investment income of $2.09 per share over the last twelve months. The BDC’s twelve-month pay-out ratio was only 78%.

Dividend Coverage (Author Created Table Using Company Disclosures)

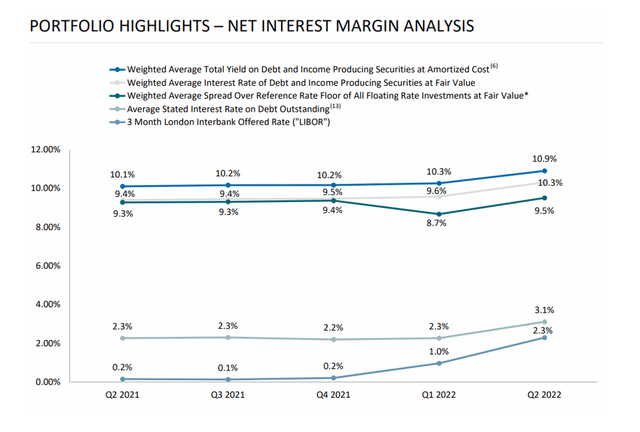

High Portfolio Yields

Funding costs for business development companies are rising as a result of the central bank’s actions in June and July, which resulted in two large 75-basis-point increases, which may make it more difficult for them to earn consistently high portfolio yields.

Having said that, Sixth Street Lending’s portfolio yields have not yet been impacted by the increase in funding costs. Sixth Street Lending’s weighted average yield on debt and income-producing investments was 10.3% in 2Q-22, up from 9.6% in 1Q-22.

Net Interest Margin Analysis (Sixth Street Specialty Lending)

Buy Before The Rebound

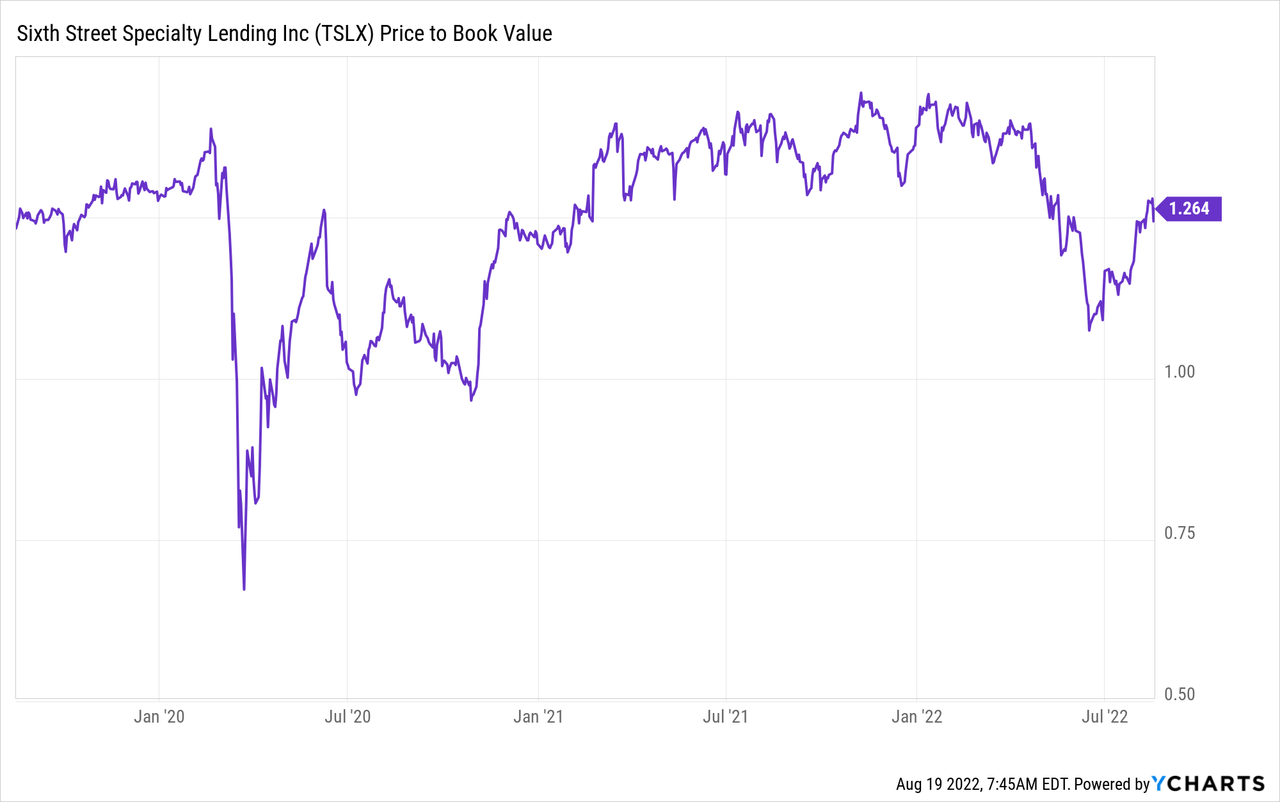

TSLX traded in a relatively narrow range of $22-24 before beginning to consolidate in April and May. The stock is currently trading at $19.57 per share, representing a 20% premium to net asset value.

TSLX has traded at higher NAV-multiples in 2022, and I believe the stock has a good chance of returning to its previous trading range given its 2Q-22 results, the portfolio remaining stable (albeit slightly growing) and the announcement of a 2.4% increase in its base dividend. TSLX stock now pays an 8.6% dividend yield based on the new dividend payout (not including variable and special dividends).

Why Sixth Street Specialty’s Stock Could Decrease In Value

A recession may cause an increase in loan defaults, resulting in a lower net asset value, which is the primary benchmark for valuing business development companies. TSLX will likely continue to trade at a premium valuation because Sixth Street Lending is a higher quality BDC. If it does not, I will most likely purchase more.

My Conclusion

Sixth Street Lending’s new investment commitments for the year to date continue to demonstrate strong demand for debt capital.

Even if new investments do not reach the highs of 2021, the BDC continues to easily cover its dividend with net investment income.

Portfolio yields are also rising slightly, indicating that higher interest rates are not yet a threat to margins.

Sixth Street Lending is one of my favorite dividend stocks right now because it is a higher quality BDC with a strong focus on First Liens.

Be the first to comment