onurdongel

Sitio Royalties (NYSE:STR) and Brigham Minerals (NYSE:MNRL) are merging to create a combined company with an enterprise value of approximately $5.1 billion (based on Sitio’s current share price).

Sitio was formed from a merger of Falcon Minerals and Desert Peak in June, and this latest merger will result in a company with around 7x the production that standalone Falcon had in 2021.

Overall the combined company looks roughly fairly priced for long-term (after 2023) $70 WTI oil, although it should also be able to offer a high-single digits yield for 2023 based on current strip and a 65% payout ratio.

The Merger

Brigham shareholders will receive 1.133 shares of common stock in the combined company for each Brigham common share they own. Brigham shareholders will end up owning 46% of the combined company and Brigham will nominate four of the nine directors for the Board of Directors of the combined company.

Sitio shareholders will receive 1 share in the combined company for each Sitio share they own (resulting in 54% ownership of the combined company) and Sitio will nominate five directors. The combined company may have approximately 155 million diluted shares after the deal is complete.

Sitio is contributing more than 54% of the net royalty acres, total production and oil production to the combined company, but is getting 54% of the shares due to it also contributing most of the net debt to the combined company.

Combined Company Details

The combined company had around $862 million in proforma net debt at the start of September 2022. Its Q2 2022 pro forma production was 32,761 BOEPD (52% oil) and it has 259,510 net royalty acres.

Around 70% of the combined company’s net royalty acres are located in the Permian. The Permian also accounts for around 75% of total production and around 81% of the combined company’s oil production.

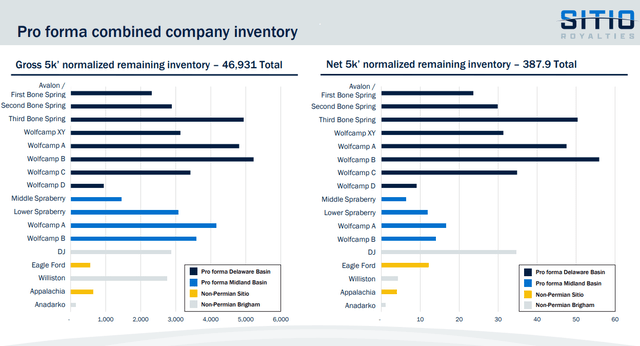

As well, approximately 86% of the combined company’s remaining net inventory is in the Permian. Another 9% is in the DJ Basin and 3% is in the Eagle Ford.

Notes On Hedging

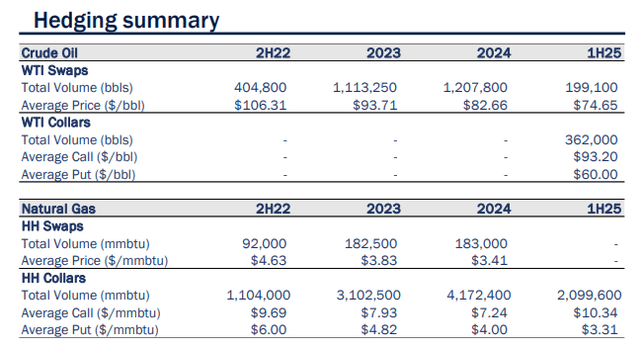

At last report, Brigham Minerals did not have any hedges, but Sitio Royalties had some hedges, which are shown below. The combined company has around 18% of its 2023 oil production and 15% of its 2023 natural gas production hedged. At current 2023 strip of $81 to $82 WTI oil and $5.10 Henry Hub gas, the combined company’s hedges have around $13 million in positive value. Its hedges for 2024 and the first half of 2025 also look to have some positive value at current strip.

Potential 2023 Results

I have modeled the combined company’s potential 2023 results based on 33,500 BOEPD (50% oil) in average production. This is a slight increase over its expected production from Q3 2022 to Q2 2023. At current 2023 strip of $81 to $82 WTI oil and $5.10 Henry Hub gas, it would be projected to generate $684 million in revenues after hedges.

|

Type |

Barrels/Mcf |

Realized $ Per Barrel/Mcf |

Revenue ($ Million) |

|

Oil (Barrels) |

6,113,750 |

$81.00 |

$495 |

|

NGLs (Barrels) |

2,445,500 |

$30.00 |

$73 |

|

Natural Gas [MCF] |

22,009,500 |

$4.35 |

$96 |

|

Lease Bonus and Other Revenues |

$7 |

||

|

Hedge Value |

$13 |

||

|

Total |

$684 |

The combined company is thus estimated to generate $517 million (around $3.34 per diluted share) in positive cash flow at current 2023 strip. The combined company has a target payout ratio of 65+% of discretionary cash flow.

|

$ Million |

|

|

Production Taxes |

$53 |

|

Gathering And Transportation |

$18 |

|

Cash G&A |

$21 |

|

Cash Interest |

$35 |

|

Cash Taxes |

$40 |

|

Total Expenses |

$167 |

Thus the combined company could pay out around $336 million ($2.17 per share) in dividends related to 2023 results at current strip and a 65% payout ratio. Around $181 million could go to reducing net debt, which could be reduced to a bit over $600 million by the end of 2023 with that payout ratio and no further acquisitions.

The combined company’s level of debt isn’t a significant concern, although combined may still keep its payout ratio closer to 65% than 100% to help pay down some of its debt.

Notes On Valuation

I estimate the combined company’s value at just under $28 per share in a long-term (after 2023) $70 WTI oil and $4.00 NYMEX gas environment. This assumes that the commodity prices follow current strip until the end of 2023 and then revert back to long-term prices after that point.

At long-term $75 WTI oil and $4.50 NYMEX gas instead, I would estimate the value of the combined company at nearly $30.50 per share. This is based on production of 33,500 BOEPD (50% oil) in 2023.

Conclusion

Sitio Royalties and Brigham Minerals are merging to produce a royalties company with an enterprise value of around $5.1 billion based on its latest share price. The combined company may keep its payout ratio below 100% (current target is 65+%) to help reduce its debt levels. This may result in a dividend yield in the high-single digits while it pays down its debt.

The combined company appears close to fairly priced for a long-term (after 2023) $70 WTI oil scenario, although it should also offer a high-single digits yield with a 65% payout ratio.

Be the first to comment