DINphotogallery

Investment thesis

In our last article on Sinopec Shanghai Petrochemical Company Limited (OTCPK:SHIIY) of July 11, titled “Uncertainties Around Ability To Pass On Costs,” we gave it a Hold stance as we thought that there was uncertainty around what kind of profit margins they could achieve and if their dividend policy would become more stable.

We now have more financial data as their 2022 interim report for FH and some data from Q3 should help us to analyze if our concern about their margins was valid.

Sinopec Shanghai Petrochemical Co. logo (Sinopec Shanghai Petrochemical Co. website)

Background

Sinopec Shanghai Petrochemical Co., Ltd. is one of China’s major integrated refining and petrochemical companies.

It became the first internationally listed company in China, with its shares listed on the Shanghai Stock Exchange, the Stock Exchange of Hong Kong, and the New York Stock Exchange. In 2013, the Company completed the reform of equity separation. It has since been voluntarily delisted from NYSE.

The company has a primary crude oil processing capacity of 16 million tons per year. Products are gasoline, diesel, jet fuel, chemicals such as synthetic fibers, resins, and plastics.

Financials – Q3 and first 9 months of 2022

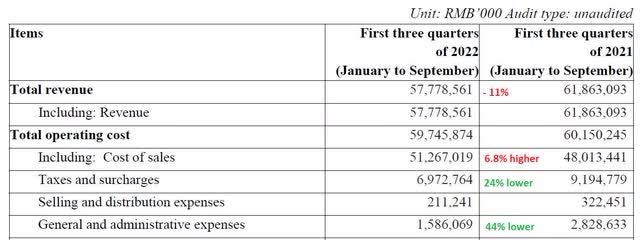

For the first 9 months of this year, Sinopec Shanghai had a net loss attributable to shareholders of RMB 1.93 billion, equivalent to USD 281 million, excluding non-recurring items. That was a decrease of 202% from last year. Most of this loss, RMB 1.53 billion, occurred in Q3.

From the beginning of the year to the end of the reporting period, the average price rise of petrochemical products was less than the average price rise of crude oil.

Another event that dragged down the result was an explosion that occurred at their ethylene glycol plant on the 18th of June 2022. The accident resulted in a shutdown which caused a significant decline in its performance.

Sinopec Shanghai’s main items to P&L of Q3 2022 (Sinopec Shanghai Petrochemical Co – Q3 of 2022)

Sinopec Shanghai’s had an attractive dividend last year but will certainly not pay anything close to the RMB 0.10 per share for 2021. Dividends are paid out once a year in the second half of July. It has been paid each year except for 2015.

If it would be the same for 2022, it would give investors a yield of 9.14% before a withholding tax. There is a withholding tax of 10% on dividends for mainland Chinese companies in Hong Kong.

However, we do not think there will a dividend close to the one for 2021. With the losses and the decrease in cash, we would not be surprised if they did not declare a dividend for 2022.

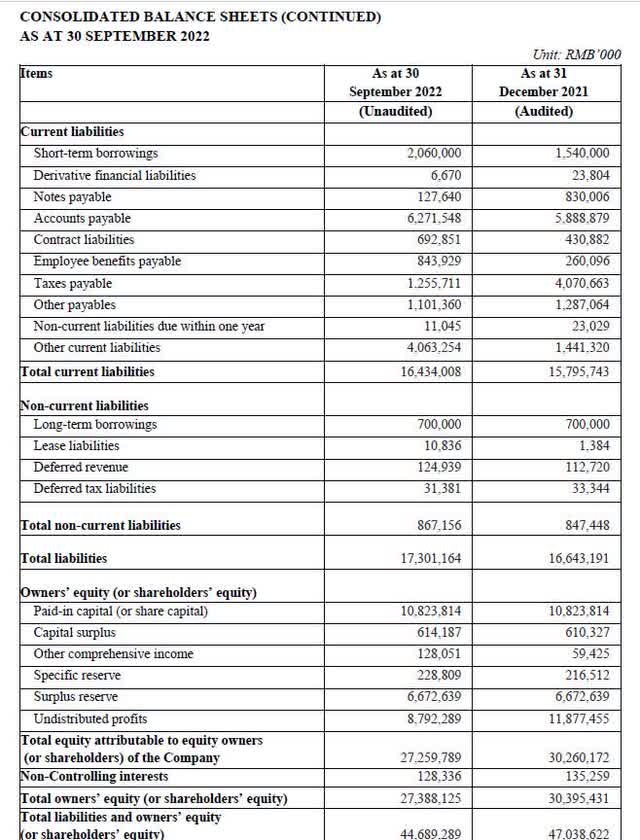

Their balance sheet has also deteriorated somewhat.

Sinopec Shanghai Petrochemical Co – balance sheet (Sinopec Shanghai’s Q3 of 2022)

Business development

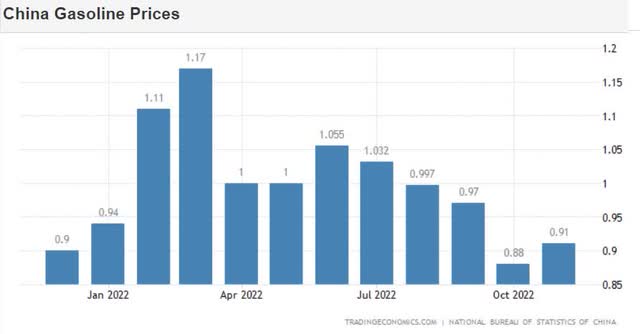

In our previous article, we raised our concern about whether Sinopec Shanghai could pass on the higher costs of making gasoline and the chemicals they produce.

We did seem to get the answer to this as can be seen in the financial performance. The costs of input did not match the selling prices reflected in their revenue. In their defense, the lower revenue must also have come from the accident at its ethylene glycol plant. Something one would expect not to happen again.

When we look at the price of gasoline in China, we can see that it has come down this year.

1-year price of gasoline in China (Trading Economics)

Delisting from the NYSE

We often get asked questions about what investors can do if they own ADSes of mainland Chinese companies that have delisted from either the NYSE or NASDAQ.

Our standard answer is that their broker should be able to help them in selling these depositary notes and hopefully buy the shares of the same company, trading on the stock exchange of Hong Kong or Shanghai.

Sinopec Shanghai notified NYSE on the 12th of August that it would voluntarily delist its ADSes representing Class H ordinary shares of the company.

The decision was based upon a number of considerations including the small number of underlying H shares represented by the ADSs relative to the total number of the Company’s H Shares as it was just 0.45% of the total shares outstanding. They also argued that there was a limited trading volume of the ADSs.

It also had a considerable administrative burden and cost of maintaining the listing of the ADSs.

These ADSs stopped trading on the NYSE on September 2, 2022. The termination of the ADR program is said to be on or about March 13, 2023. After the termination date, holders of these ADSs will have the right, until one year following the termination date, to surrender their ADSs to the depositary in exchange for the underlying class H ordinary shares traded on the stock exchange of Hong Kong.

One ADS represented 100 Class H shares on the Shanghai Stock exchange. There was a total of 10.82 billion shares outstanding through these ADSs.

It is currently trading on pink slips Over The Counter with the code SHIIY.

SHIIY (SA)

Risks to the thesis and conclusion

Let us remind the readers of what we said in our earlier article:

Most supermajors like Exxon Mobil (XOM) and especially Shell (SHEL) are transforming their business towards a less carbon-intense industry in the future. This costs money and will most likely result in a somewhat lower return on invested capital. To the best of my knowledge, SHIIY has not produced any ESG report since March 2021. In this report, they simply said they will follow the Chinese government’s policy on peak carbon dioxide emission by 2030 and carbon neutrality by 2060 as a goal. In the meantime, they keep burning mostly coal to provide the energy they require. In 2020 they burned 7.2 million tons of coal equivalent with a total carbon emission of 11 million tons. Concrete plans are in place to improve their carbon footprint through energy consumption revamp and substitution, such as replacing some of the coal used with natural gas. It remains to be seen how far they will go and at what costs.”

We see no improvement on their ESG front and their reporting standards. There is a risk that they do not take this seriously enough.

It is perhaps premature to conclude that they are unable to pass on the increased cost of raw materials, such as crude oil, and any other inflationary expenses. 47% of their sales last year came from products that were subject to governmental price controls.

We earlier thought that China could potentially benefit from the importation of oil from Russia, but the savings of roughly 30% lower-priced oil were not enough to deliver a profitable Q3 for Sinopec Shanghai.

At this point in time, we are not convinced that Sinopec Shanghai Petrochemical Company is a good company when we compare it to the super majors like Shell and Exxon Mobil.

We will give them some more time to prove that they can deliver an excellent return on their equity.

Therefore, it is still a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment