sihuo0860371

Simon Property Group (NYSE:SPG) has fallen substantially more than the market in the 2022 downdraft and yet its fundamentals have outperformed. It has gotten unreasonably cheap and I see it as a great buying opportunity.

The Buy Thesis

At 8X forward FFO and 9.2X forward AFFO compared to a REIT average of about 15X and 17X, respectively, SPG is priced for either declining earnings or extreme risk. In analyzing the fundamentals, however, I don’t see either of those in the base case scenario.

In fact, I see significant growth to FFO per share due to a series of fundamental tailwinds creating a highly favorable leasing environment which is allowing SPG to significantly improve occupancy and start to ratchet up lease rates. Balance sheet and debt pricing imply lower than normal risk, and the retail environment is generally stable to good.

Overall, I view the multiple as far too low relative to the fundamental strength and see significant upside.

Mismatch between debt pricing and equity pricing

When a company is in trouble it will often be reflected in debt pricing before equity pricing. Equity investors have a wide range of factors to focus on whereas debt investors have fixed upside and are thereby laser focused on the risk.

SPG debt investors do not seem to see abnormal risk. We can measure this in two ways:

- The rate investors demand at issuance

- Credit default swap movement since issuance

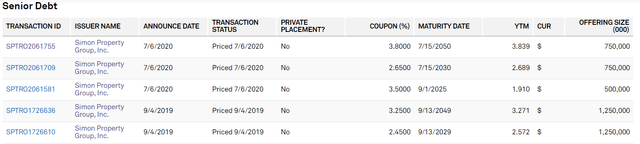

SPG has consistently been able to issue debt at very low coupons and long maturities. Shown below is their senior debt with coupons ranging from 1.91% to 3.8%. The 3.8% debt is a bit higher because it has a maturity date in 2050.

S&P Global Market Intelligence

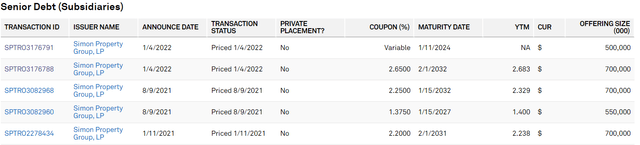

Even in the post-COVID world, SPG has been able to issue debt via its subsidiaries at very favorable terms with the latest issuance in January of 2022 with a 2.65% coupon and 10-year maturity.

S&P Global Market Intelligence

One should note, however, that SPG’s common market price declines largely occurred since January of 2022, so perhaps something happened recently that made it suddenly much riskier.

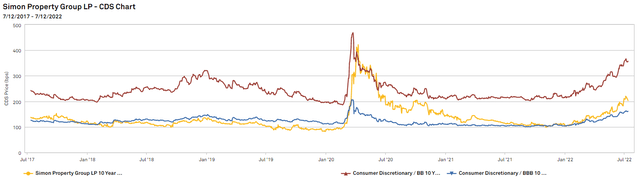

Well, if we examine credit default swap pricing, we can see that SPG’s CDS measured risk spiked up during the initial COVID lockdown because nobody knew what would happen to malls but has since come back down and now sits quite tight with investment grade consumer discretionary.

S&P Global Market Intelligence

Basically, SPG’s debt investors are showing SPG as having risk commensurate of a company with a fairly strong balance sheet.

If SPG is not particularly risky, that leaves two potential reasons why it might trade at such a low FFO multiple: Weak/declining earnings or mispricing. My money is on the latter, but let us examine the earnings outlook.

Overall retail environment

Retail is broadly performing well. I know there are all sorts of headlines about supply chain issues. A few months ago the challenge was that they couldn’t get enough inventory in stock and now it appears to have all arrived at once and there’s talk of increased discounting to try to unload the glut of inventory.

It’s not that retail is without challenges, but rather that there are always challenges and retail finds ways to adapt to them. The events that truly hurt retail are those that happen so quickly that it’s hard to adapt fast enough with the most recent such event being the pandemic.

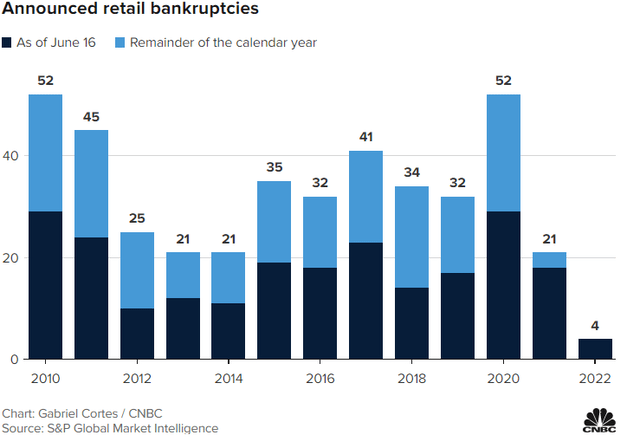

Over long stretches of time roughly 30 retailers go bankrupt each year with new companies coming in to replace them. The pandemic increased bankruptcies to 52 in 2020, but it seems to have pulled forward bankruptcies of retailers that were already weak rather than creating additional bankruptcies.

S&P Global Market Intelligence

The result is that the remaining retailers are strong leading to only 21 bankruptcies in 2021 and just four in 2022. Note that a majority of retailer bankruptcies happen in the first half of the year, so 2022 full year is very likely to come in below 10 which would be lower than it has been in over a decade.

There are six factors influencing the supply and demand dynamic:

- Standing inventory

- Supply growth

- Supply churn

- Existing demand

- New demand

- Demand churn

I will go over each briefly so as to get a picture of the overall leasing environment.

Supply – Standing inventory, development and churn

It has long been known that the U.S. is over-retailed. While the U.S. has higher GDP per capita than most of the world and therefore better sales per capita, it still had a disproportionate amount of retail square footage even after adjusting for spending levels.

The excess supply has challenged retail for over a decade, but is moderating substantially. In the past 15 years there has been almost no new development. On the flip side, there has been substantial churn of supply. In addition to properties that age out such as an old shopping center or mall getting demolished, the struggles of lower tier malls have accelerated the demise of properties.

Malls usually are built centrally in population dense areas with good ingress and egress. This makes it prime land for many types of real estate. I have seen malls converted to apartments, hotels, data centers, logistics warehouses and even office.

It’s a rare phenomenon in real estate to see net supply growth of a property type actually go negative.

The result is that square footage has shrunk to a much healthier number and more importantly, the remaining square footage is of higher quality. I suspect there will be a couple more years of redevelopment as there are still some mid-tier malls that need to go, but overall supply levels already look about right.

National mall vacancy was 8% in the first quarter of 2022 which is an OK number. I would like to see it closer to 5% and I think it will get there by 2025.

Demand – existing, churn and growth

The 8% national vacancy figure is in many ways a measure of existing demand too. If we were to look at that in isolation I would say tenants are mildly favored over landlords in negotiations.

However, demand looks to substantially outpace supply on the growth side. Demand churn is abnormally low right now due to the lack of bankruptcies. Retail sales, and particularly those in brick-and-mortar, have been strong in 2022 so there should be a reduced level of store closures.

Demand growth is coming from a wide variety of sources with the big ones being:

- Resurgence in experiential spending post-pandemic – restaurants, bars, barbers, salons, etc.

- E-commerce and digitally native opening physical stores.

- In-storing of inventory. Supply chain challenges have encouraged retailers to keep more inventory in stock. This increases the square footage requirements for store footprints.

The International Council of Shopping Centers held a major conference (ICSC) in May of 2022 which had 22,000 attendees, up from 10,000 last year. Fellow mall REIT Macerich (MAC) was in attendance and detailed their experience at the REITWEEK conference in June. They described the mood of ICSC as overwhelmingly positive and said it was the best retail leasing environment in over a decade.

David Simon (CEO of SPG) echoed similar sentiments on the latest SPG call.

Leasing fundamentals look good to me and the commentary seems to match the fundamental data. Hard data is usually more reliable than commentary, but I like to look at both because the commentary is more up to date whereas hard data tends to be lagging by a quarter or so.

SPG specific leasing

Simon Property owns the highest tier of malls, so its demand tends to come in above the national average. With overall leasing looking healthy, SPG should be able to source substantial leasing volume.

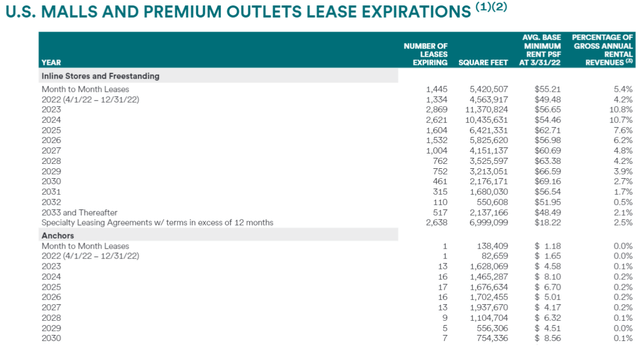

There’s little churn to offset the inflow of new leases as SPG has only 5.4% of leases rolling in 2022 and 4.2% in 2023.

Supplemental

As such, I anticipate significant net growth in occupancy with stable to slightly up lease rates.

Market lease rates in 2022 are up substantially from 2021 and 2020, but we should note that it is not the year over year comparison that hits FFO/share.

The new lease rate would have to be compared to the lease rate of the expiring lease so that could be a vintage anywhere from 2012-2021 depending on how long the initial terms were.

So while market rents are up compared to last year, they are not up compared to say 2014-2016 when malls in general were much stronger. Thus, the actual lease rolls will likely be a mixed bag of some roll-ups and some roll downs.

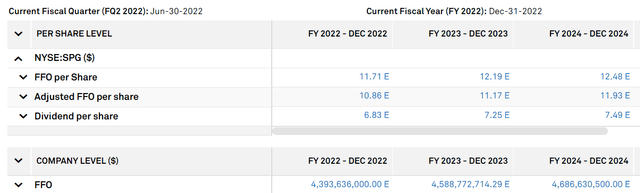

With rent per square foot flattish and occupancy increasing a percentage point or two I would anticipate moderate organic NOI growth leading to moderate organic FFO growth. This is largely in-line with analyst estimates which have FFO/share going from $11.71 in 2022 to $12.48 by 2024.

S&P Global Market Intelligence

Malls do incur significant tenant improvement costs and leasing commissions so I would generally recommend valuing them on AFFO rather than FFO. SPG’s AFFO is expected to be $10.86 in 2022 and scale to $11.93 in 2024.

Argument could be made for further negative adjustment for redevelopment costs. It’s a bit of a gray area as to whether redevelopments are growth capex or maintenance capex. Each project is anticipated to generate a fairly substantial IRR, so SPG argues that it’s growth investment, but with how frequently the retail landscape changes, some space becomes antiquated and must be redeveloped to maintain its revenue.

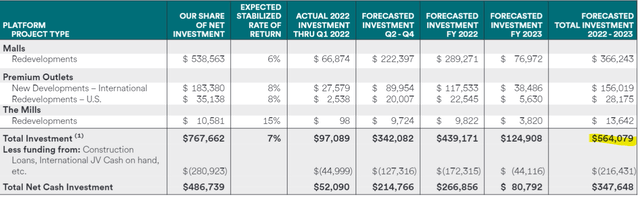

In other words the revenue generating capacity of the space has declined and it must be redeveloped to restore it to its former revenue generating glory. The truth is probably somewhere in the middle with some of the capital spend being maintenance and some of it truly being growth. Below is a summary of SPG’s $564 million of developments in 2022 and 2023.

SPG

The $156 million of new developments are unequivocally growth. They are not replacing anything, just new buildings that will generate new revenues.

This brings the redevelopment spend in 2022 and 2023 down to about $400 million or a pace of about $200 million per year.

2023 AFFO is estimated at $4.2 billion. If we reduce this number by the full $200 million of redevelopment, that is $4B of AFFO or about $10.63 per share.

At today’s price of $95.82 that puts SPG at 9X conservatively calculated 2023 AFFO.

SPG stock valuation

SPG is on pace to grow AFFO/share by 7% in 2023 which is right in line with the average REIT, yet SPG trades at about half the AFFO multiple.

|

AFFO growth rate |

AFFO multiple |

|

|

SPG |

6.8% |

9X |

|

Average REIT |

6.9% |

16.4X |

16.4X is not an expensive multiple. It’s actually rather low compared to the last decade.

SPG is just really cheap right now. Its incredible discount is not justified by growth as growth looks healthy and it is not justified by risk as SPG’s balance sheet is healthy with plenty of liquidity and an investment grade rating.

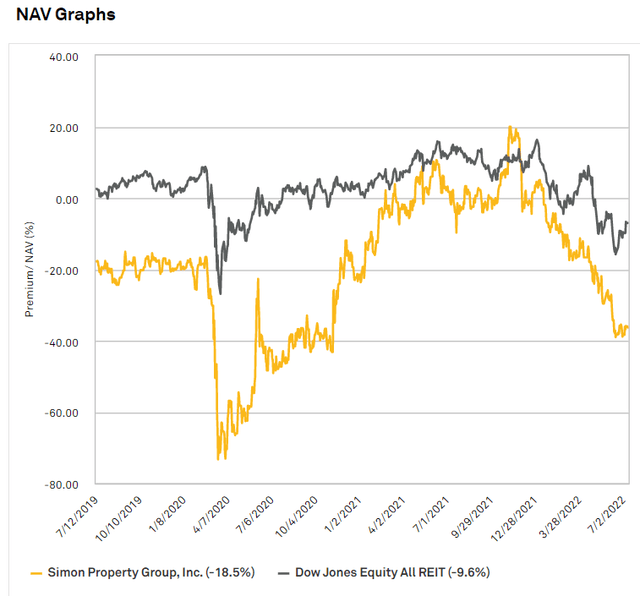

I suspect that due to pent-up fear of malls SPG will continue to trade at a discount to REITs, but the magnitude of discount available at present is fairly rare. Until recently, SPG consistently traded at a premium multiple to the REIT index.

SPG’s valuation also looks attractive from an NAV standpoint as it trades at about 61% of net asset value.

S&P Global Market Intelligence

Risks to owning SPG

Exposure to retail does make SPG somewhat cyclical. Due to long leasing contracts its revenues do not fluctuate as severely as those of its retail tenants, but leasing prospects will improve or decline with the economy.

As such, SPG’s growth may disappoint if a recession were to manifest. In my opinion the depth of SPG’s market price discount has more than priced in a recession scenario, but it’s still something to watch for.

I’m happy to own shares of a long tenured, high quality, mega-cap REIT at this opportunistic price.

Be the first to comment