Nordroden

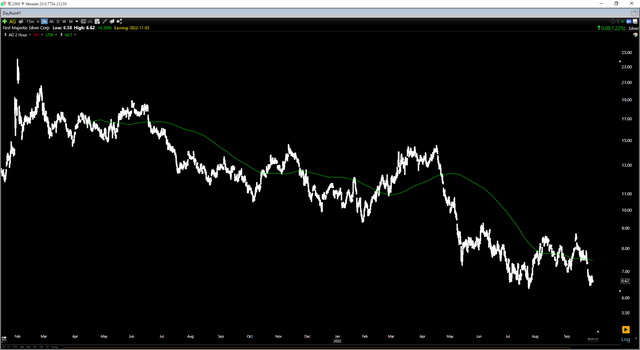

It’s been a rough year thus far for the Silver Miners Index (SIL), which is down 42% year-to-date, a violent reversal from its brief outperformance relative to the S&P 500 (SPY) to start the year. While the depth of the correction makes sense in laggards like Endeavour Silver (EXK) and Hochschild Mining (OTCQX:HCHDF) which have razor-thin margins, it makes much less sense in a new producer, SilverCrest Metals (NYSE:SILV), which could weather a correction to $10.50/oz silver and still be profitable on an all-in sustaining cost basis.

Therein lies the opportunity in the stock market, especially the precious metals sector, with the group trading homogeneously like a school of fish and the babies often thrown out with the bathwater. In SilverCrest’s case, it can be bought at less than 0.90x P/NAV, a valuation reserved for a low-margin silver producer with a spotty track record, not a top-2 producer from a margin standpoint with a glowing track record, with a team that sold its last company for a 35% premium even in a treacherous bear market. Given SILV’s management quality, best-in-class mine economics, and considerable exploration upside, I see this as a low-risk area to start a position in the stock.

The State Of The Industry

Just 18 months ago, investors were stampeding into the Silver Miners Index to buy promises of growth that may never develop at any price and chants of a silver squeeze that would double and triple margins for these companies. Not surprisingly, this didn’t pan out well and buying cyclical stocks into massive overnight gaps higher delivered the opposite effect than intended for many investors. Now, eighteen months later, many investors are crying manipulation, stuck with unprofitable positions, but they didn’t know what they were buying in the first place.

First Majestic Silver – 18-Month Chart (TC2000.com)

As I discussed last year, silver producers were far less attractive than gold producers, given that while gold producers had already gone through their hangover of difficult year-over-year comps and many of their executives had learned from past cycles, silver producers had the opposite setup. This was because gold topped in Q3 2020 above $2,000/oz and created difficult comps in H2 2021, while silver peaked in Q1 2021 and remained elevated for Q2 2021, creating very tough year-over-year comparisons for this group which already had very weak margins to begin with.

However, the piece that was missed more than the difficult year-over-year comps is that inflationary pressures have been much worse than expected. While some investors are using all-in-sustaining costs to measure the viability of these businesses, all-in costs for many silver producers are above $25.00/oz. So, while these producers may appear to be getting by or pinched a little at $19.00/oz, they’re in difficult shape, forcing them to either see cash outflows or make short-term decisions like high-grading some assets to pretty up their quarterly numbers.

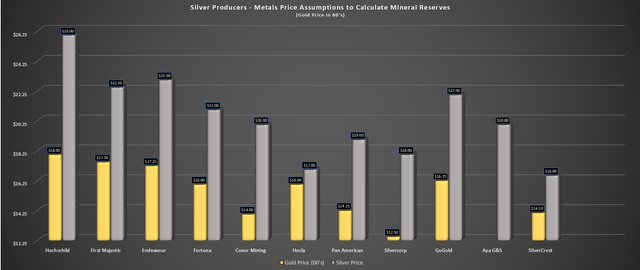

Silver Producers – Metals Price Assumptions for Reserves (Company Filings, Author’s Chart)

In addition, many silver producers have used the strength in metals prices to hide any declines in their reserves, lifting their metals price assumptions to calculate reserves (mineable ounces) to $20.00/oz or higher, or in Hochschild’s case, over $25.00/oz. This has created a risk of reserve deletions for the group, with a potential double-whammy, given that silver prices have fallen well below metals price assumptions and inflationary pressures will increase cut-off grades, pulling more marginal ounces of their mine plans, which could show up early next year in year-end Reserve & Resource updates. This is not the case for gold producers, who mostly use $1,300/oz or lower to calculate reserves and have been very conservative.

Suppose we combine a group of companies (silver producers) that have relatively short mine lives on balance, may need to raise their cut-off grades to incorporate higher input costs (labor, cyanide, steel, fuel), and have no room to raise metals prices in most cases medium-term. In that case, it does not paint a rosy picture. So, the strategy many employ to own the highest-cost producers to get the most leverage is a strategy destined for investment failure in the environment we’ve found ourselves in. Most high-cost silver producers could become stuck between a rock and a hard place (stop/slow production at marginal mines, high-grade these assets, or sell them in a market where few companies are interested/able to pay up).

When it comes to development-stage silver companies and silver explorers, the outlook is even bleaker, and in many cases, their 70% declines are justified. This is because these companies have to spend more to drill (contractors), hire/retain employees, and commission studies, and they have much higher hurdles to bringing ounces into mine plans. The former issue leads to more dilution, with each dollar going a shorter distance than it used to pre-COVID-19. The latter is an even more significant issue because the old 200-gram per tonne silver grade is the new 270-gram per tonne grade with the inflationary pressures we’ve seen over the past three years.

For developers that believe they have an economic deposit, they are now tasked with financing this in a much less favorable environment, given the higher-cost debt and the need to raise money with share prices at multi-year lows. Some have gone ahead and decided to finance, like Marathon Gold (OTCQX:MGDPF). Given the share dilution needed to complete construction, the smarter move was probably to hunker down and wait for a more favorable environment, especially with the deal done at multi-year lows with half warrants attached.

So, what does all of this mean?

In an industry with roughly thirty stocks to choose from (silver producers, silver developers, advanced-stage silver juniors), the list of investable names has plummeted from thirty to about four. Obviously, the size of this list depends on one’s risk appetite. Still, in an already inherently risky sector (given that mining is anything but a simple business), the goal should be to secure a solid upside case using conservative assumptions with the least amount of risk possible. For producers with $18.00/oz all-in sustaining costs, translating to $25.00/oz+ all-in costs, there is no investment thesis, there are just cash outflows, and that doesn’t change even if silver rallies back above $22.50/oz.

So, is SilverCrest Immune?

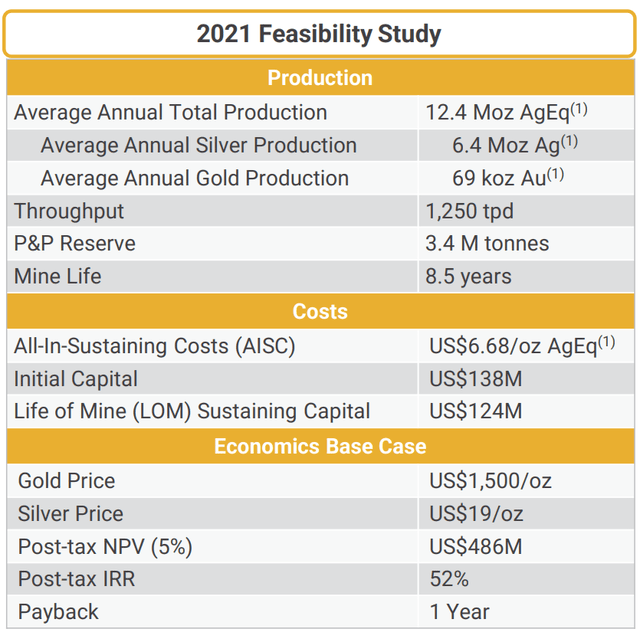

Unfortunately, no producer is immune to the inflationary pressures we’re seeing. While a few are finding a way to claw back lost margins (synergies, bringing higher-margin mines online), this is only possible with mergers (synergies) or if high-margin, low-capex mines are available. These lowish-capex, high-margins are not growing on trees. In SilverCrest’s case, the company’s previous Feasibility Study estimated ~$6.70/oz all-in sustaining costs, and these are set to rise in the updated H1 2023 Technical Report. As discussed, this is not company specific, but because we have seen material inflation industry-wide, and the new Las Chispas Technical Report will incorporate pricing changes over more than two years in an inflationary environment.

In addition, we could see more conservative mine planning now that the asset is in production, with the possibility of a slightly higher estimate for mine dilution vs. the 52% for all mining areas used in the 2020 Technical Report. On the positive side, it’s possible we could see a slight benefit from the better-than-expected metallurgical results to date and a possible lift in grades as new higher-grade ounces make it into the mine plan. The result is that all-in-sustaining costs at Las Chispas in the coming Technical Report could increase by 25-30%.

SilverCrest Previous FS (Company Presentation)

While this might disappoint some investors, it’s important to note that even if SilverCrest’s costs increase by 27% to $8.50/oz, this project is churning out free cash flow with a sub-1.3-year payback even at current metals prices. It’s also important to note that just as SilverCrest’s costs have risen, the industry’s costs have risen, and the previous industry-wide average [AISC] of $15.00/oz for silver producers is likely closer to $19.00/oz. However, after incorporating exploration expenses, interest, and corporate G&A, the industry average will likely be above $22.00/oz in 2023.

The result is that while SilverCrest’s AISC margins might dip from its previous projections, this is still a company that can weather even a 30% correction in the silver price from current levels. However, if these same technical reports for other assets were updated today, many of the mediocre primary silver assets in the silver space would become money-losers or very marginal at best. Hence, several producers are spinning their wheels at current levels, while the less fortunate ones are in trouble medium-term, like Endeavour Silver, which has all-in costs closer to $28.00/oz.

Obviously, a 40% rally in the price of silver fixes this, but that is not an investment thesis. The goal is to invest in businesses making money today, and ideally, even at 10% lower prices in an industry that are price-takers, not have to rely on a sharp rally. The goal is also to invest in businesses that are steadily replacing their output without the need for share dilution. Given these higher cost levels for the silver space, reserve deletion is a risk, and reserve replacement has become even more difficult. Acquisitions are an option, but unlike the major gold producers, most silver producers are not in a position to acquire with their current balance sheets unless they plan to use stock at multi-year lows – the result would be a decline in production growth per share.

One can cite manipulation as the reason for the depressed prices, and one can hold a belief that much higher prices are on deck. While these are both valid points, they don’t help these businesses today. The result of this current environment (sub $22.00/oz silver) is that high-cost producers, developers, and advanced exploration stories are likely to see much higher share dilution than previously modeled, limited free cash flow generation, and possible dividend cuts. At the same time, SilverCrest will thrive, is not at risk of dilution (~$100+ million in cash and generating free cash flow), and even if silver takes a dive below Q1 2020 levels, the company is still enjoying positive AISC margins.

To summarize, if an investor wants exposure to the price of silver and wants to take on as little risk as possible, the number of available investment options has shrunk; unless one is masochistic and likes what the market does to companies seeing margin compression, reserve deletions/shrinking mine lives, and potential share dilution. In my view, SilverCrest is the one clear name that doesn’t have these risks, and as investors, we should be looking from a downside first perspective, not an upside first perspective. As the saying goes, which typically leads to underperformance relative to the indexes in this sector:

“The fish sees the bait, not the hook; a man sees not the danger, only the profit.”

– Mongolian Proverb

So, what’s the good news?

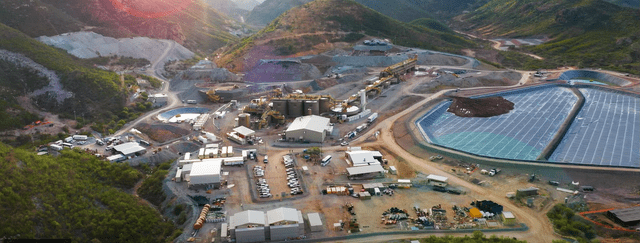

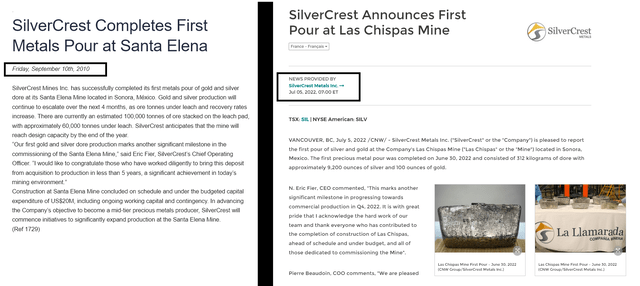

As discussed in my previous article, SilverCrest graduated to producer status at the end of June with its first pour at its high-grade Las Chispas Mine. This milestone typically helps with an upside re-rating. Unfortunately, the silver price has declined by over 10% in the period, the gold price has lost the psychological $1,700/oz level, and the general market continues to be a risk-off environment, with little love for small-cap stories, even if they’re extremely mispriced. The result is that SILV has lost $220 million in market cap since this upgrade to the investment thesis.

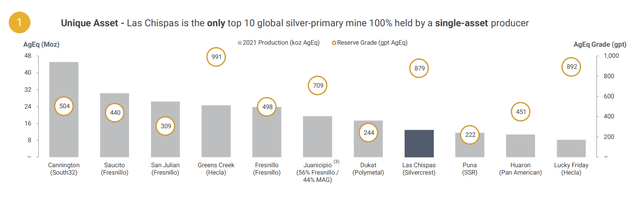

For those unfamiliar with Las Chispas, this is not your ordinary mine, and this upgrade to producer status is hardly an insignificant development. In fact, Las Chispas is capable of producing ~12.6 million silver-equivalent ounces [SEOs] per annum at sub $9.00/oz all-in sustaining costs, and this is based on a mine plan that doesn’t yet benefit from bonanza grades intercepted at the Babi Vista Footwall Zone (3,000+ grams per tonne silver-equivalent). Therefore, even after factoring in inflationary pressures due to higher labor, consumables, and fuel/power costs, I would expect SilverCrest to enjoy ~55% AISC margins even at a $20.50/oz silver price.

Las Chispas Mine (Company Presentation)

SilverCrest’s most recent update noted that the project was fully energized with grid power and should improve towards a steady state in Q4 2022. This is great news for the operation, with MAG Silver’s (MAG) share price taking a beating last year with the tie-in taking much longer than expected, delaying the processing of ore at Juanicipio and leading to much lower throughput rates. Additionally, recoveries, plant throughput, and plant availability are tracking favorably vs. Feasibility Study parameters, with recoveries at 90.7% silver-equivalent in August, well ahead of ramp-up estimates of 81.5%.

SilverCrest noted that since the start of operations, 53,600 tonnes of material were processed, translating to an average throughput of 784 tonnes per day, up 46% sequentially from July. The company expects throughput to reach design levels in Q4 of 1,250 tonnes per day, with SilverCrest on track to reach commercial production by year-end. Overall, this is encouraging news, and the company expects a small revenue contribution in Q3.

Combined with the team’s ability to come in on time and budget for construction in a difficult environment due to inflation should reinforce investors’ confidence in management. This is because the team has continued to execute flawlessly in an environment that’s been extremely difficult the past few years, evidenced by fast-tracking the project to production, financing with minimal dilution, and being very prudent with capital to ensure no funding gaps or weak balance sheet position that could place investors at risk, similar to what we’ve seen with Marathon and Argonaut (OTCPK:ARNGF) which diluted at the worst possible time at multi-year lows due to an inability to plan properly.

Of course, some of this execution success can be tied to the strength of this team, which cannot be overstated. In addition to having N. Eric Fier as CEO, who was a Senior Engineer and Manager with Newmont (NEM), and Project Manager at Eldorado (EGO), as well as COO as SilverCrest Mines (its previous mine that was acquired); the company has Pierre Beaudoin as COO, who led the design and construction of Detour Lake, Canada’s 2nd largest gold mine, and worked as COO for four years at the operation. Finally, the company is backed up by Chris Ritchie as President, who benefits from considerable capital markets experience and risk management, helping to raise capital efficiently and proactively (when it’s available, not when it’s suddenly desperately needed, like Argonaut), evidenced by SilverCrest’s very tight share structure. Let’s look at the valuation:

Valuation

Based on ~147 million shares outstanding and a share price of US$4.65, SilverCrest trades at a market cap of $684 million. This compares very favorably to an estimated net asset value of $830 million ($1,700/oz gold and $20.00/oz silver), which attributes upside to resources outside of reserves and exploration upside, and $30 million to El Picacho, a regional opportunity that could benefit the company later in the decade. El Picacho is currently being drilled and would be an opportunity to increase throughput and leverage off existing infrastructure at Las Chispas, assuming a large enough resource is identified here.

Usually, I would be much more conservative with exploration upside. However, this is one of the richest ore bodies globally from a grade standpoint, and the team has an exceptional track record of finding ounces. Hence, to think this team can’t find another 30+ million SEOs over the five years to fill in its mine plan with one-fifth of the land package untested and 15/45 known veins in the mine plan would take a very pessimistic view of Las Chispas’ potential. Finally, on El Picacho, I think $30 million is fair, considering it has meaningful upside if it can contribute to plant feed long-term.

Some investors might argue that it’s ambitious to assume metals prices of $1,700/oz gold and $20.00/oz silver, given that these are above spot prices currently. However, it’s important to note that these are averages over the 2023-2030 mine life.

It’s also important to note that if silver production continues to fall with more marginal assets going offline or running low on reserves, silver’s supply/demand picture should continue to improve, putting upward pressure on prices post-2025, making these medium-term silver price forecasts even more conservative. The cost to incentivize new mine building for primary silver mines is likely closer to $27.00/oz, similar to copper at $4.25/lb, meaning there simply aren’t many new mines waiting in the wings to be built.

Top Primary Silver Deposits vs. Las Chispas (Company Presentation)

To summarize, SilverCrest is now trading at arguably its most attractive valuation since March 2020, and this is a stock that could justify a P/NAV multiple of 1.60 once in commercial production. This is because there’s no company like it in the silver space, and it’s the most attractive takeover target. The reason is that it benefits from having a high-margin already built mine, with producers able to skip the risk of cost overruns, financing a project, and the time value of building a new mine.

However, even using a more conservative multiple of 1.45 translates to a fair value for SilverCrest of $1.19 billion ($8.10 per share), a 75% upside from current levels. Of course, this assumes relatively conservative metals prices ($1,700/oz gold, $20.00/oz silver), only modest exploration success, and no expansion to throughput later this decade.

Las Chispas – First Pour (Company Presentation)

The Upside Opportunity

While even a base case scenario with depressed metals prices points to a considerable upside to fair value, the upside here is worth pointing out and why SilverCrest is unique. Not only does the company offer defensive exposure to precious metals due to its industry-leading margins, but it offers considerable leverage in a higher metals price environment. The result is that investors get the best of both worlds, with a miner that can survive and even thrive in a secular bear market and not worry about reserve deletions like peers could suffer but offer considerable torque in a bull market.

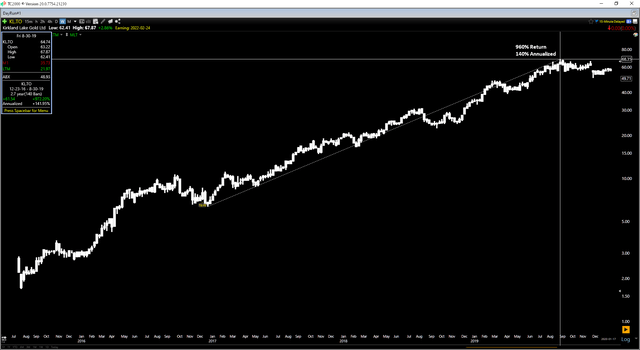

This is because when the sector is trading based on fundamentals, the cream always rises to the top, just as we saw with Kirkland Lake Gold in 2017-2019. In that period, the company enjoyed a ~900% return or 140% annualized, massively outperforming its peer group, helped by its industry-leading grades, industry-leading margins, and of course, new discoveries that boosted grades at its Fosterville Mine. The chart of the stock’s performance is shown below, and as we can see, even Kirkland Lake Gold did suffer sharp 40% corrections before this bull move began to buck investors out of their positions at the worst possible time.

Kirkland Lake Gold Chart (2016-2019) (TC2000.com)

Obviously, SilverCrest and the Kirkland Lake Gold of 2017-2019 have their differences. The main one is that SilverCrest is a single-asset producer in Mexico, while Kirkland Lake Gold was a dual-asset producer in Ontario and Australia. However, from a grade and margin standpoint, SilverCrest’s Las Chispas is very similar to Macassa and Fosterville (Kirkland Lake’s mines at the time), with SilverCrest’s Las Chispas Mine sitting head & shoulders above its peers from a grade/margin standpoint, with ~900 gram per tonne silver-equivalent grades, and 50% plus AISC margins.

While SilverCrest hasn’t been focused on exploration as much lately, given that it’s been working to play defense, this should change starting next year, with major spending complete and a shift from cash burn (construction period) to free cash flow generation. Not only will this increase news flow, but it will remind many investors why they bought this story in the first place, which is to have exposure to one of the highest-grade ore bodies in North America. Assuming SilverCrest were to make a new major discovery, which I wouldn’t put past a team that has several under its belt, we could see the stock gap up and begin a new uptrend and become very hard to buy, especially with over 5% of the float short (~6 million shares).

SilverCrest First Pour #1 and #2 (Santa Elena, Las Chispas) (Newswire, Company News)

Finally, it’s important to note that Las Chispas has a very modest plant size with the potential to expand throughput for limited incremental capital, meaning that a sizeable resource at El Picacho could boost production, providing growth above an already large production profile (~13 million SEOs per annum). With ~$100 million in the bank, this can easily be financed with zero share dilution. Plus, it can be done relatively quickly, as we’ve seen with Las Chispas and Santa Elena, that each went from first drill hole/acquisition to production in six years or less. However, with a plant already in place and El Picacho potentially being a satellite deposit, it could be done quicker (assuming an economic resource is delineated).

So, with the potential possible throughput expansion down the road, and separate higher-grade discoveries that could lift head grades and increase mine life, there is a significant upside here separate from higher metals prices. Therefore, with the stock under pressure due to tax-loss selling and trading devoid of fundamentals, there’s rarely ever been a better time to begin a new position in the stock with shares practically being given away, which is a far better time than chasing the stock after a high-grade discovery when sentiment in the sector improves.

That said, everyone has different investment strategies, but I prefer to accumulate into weakness when names are cheap/hated for absolutely zero reasons. In the upside case for SILV, nothing is stopping the stock from making new all-time highs above $13.00 once demand returns to the stock; given that it’s maintained its tight share structure, it has no warrant overhang to cap price as other developers/producers do, and it’s a much better story than it was 18 months ago, set to generate considerable free cash flow over the next few years.

Summary

In an industry group (silver producers) that’s mostly un-investable due to razor-thin margins and mediocre track records in many cases, SilverCrest is one of a kind. This is because the company has some of the highest margins industry-wide, a resource and a regional project with considerable exploration upside, and a team with a rock-solid track record, having sold its last company for a significant premium, also in Sonora State. So, if I were looking for silver exposure, I continue to see SILV as one of the better bets. To summarize, I see this as a low-risk area to start a position in SilverCrest, and I am amazed that the stock has found itself below $5.00 after its continued success.

Be the first to comment