Oselote

Silver is known as “the poor man’s gold” because it has always been cheaper and more abundant than its yellow cousin. You will find approximately 19 times more silver in the earth’s crust than gold. Back when both metals were money, it took 16 to 25 ounces of silver to buy one ounce of gold. This relationship ended when President Nixon pulled the US out of the Bretton Woods Agreement in 1971 and severed gold’s connection to the US dollar.

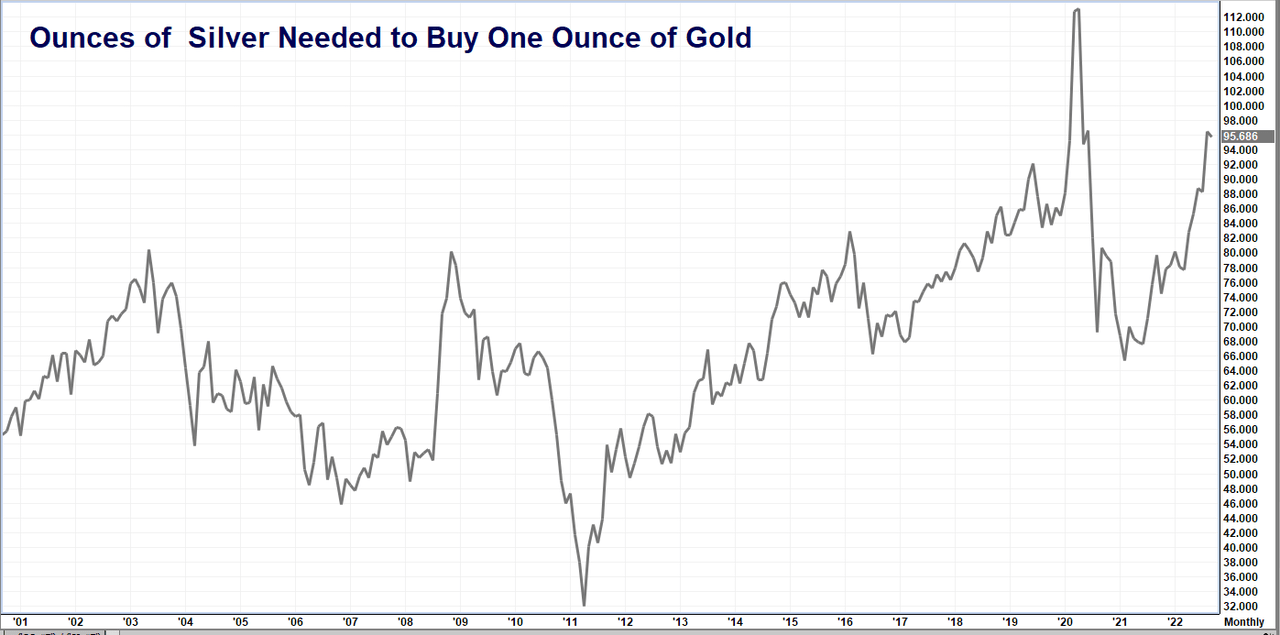

The chart below shows the ever-changing relationship of silver and gold going back to 2001. Silver is more volatile than its richer cousin. It tends to rise faster in bull markets and fall more quickly in bear markets. Because of this, the gold/silver ratio tends to be inversely correlated to the overall trend in precious metals: it has a history of peaking at the bottom of precious metal bear markets and of bottoming at the peak of bull markets.

FutureSource

A high gold/silver ratio tends to correspond with low silver prices. A low ratio tends to correspond with high silver prices. The ratio’s 21st century low (33 ounces of silver to buy one ounce of gold) occurred during silver’s incredible run to $49 per ounce in 2011. Its high (112 ounces of silver to buy one ounce of gold) matches up with silver’s fall to $11 per ounce when Covid struck in early 2020. The current ratio of 95.63 means silver is very underpriced compared to gold.

Why Silver – Why Now?

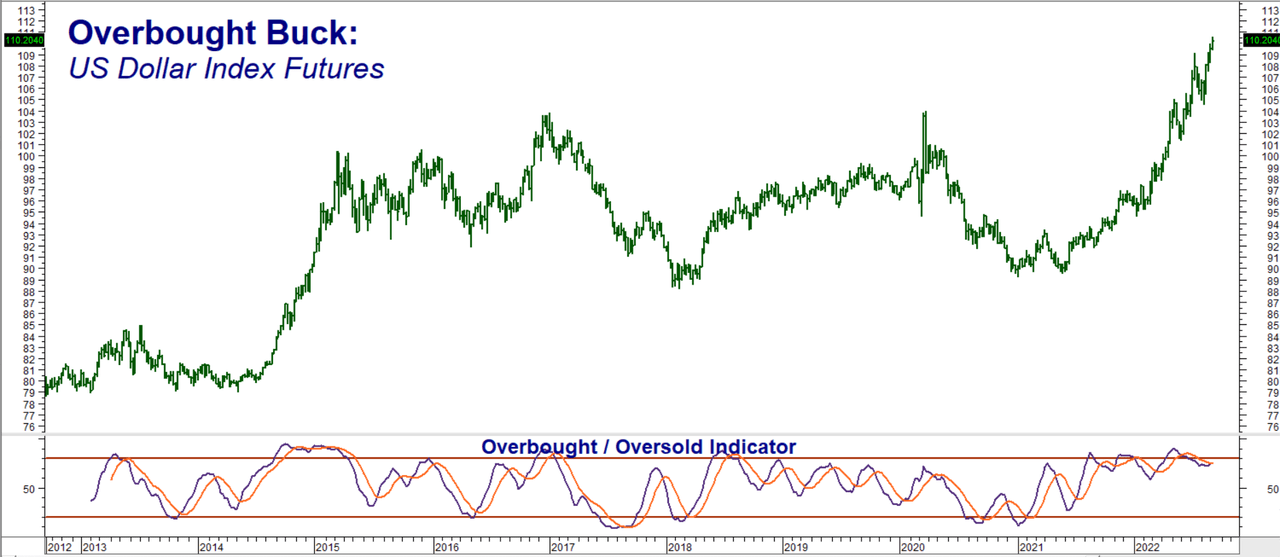

Why would anyone want to buy silver or gold, given their failure to rise in this inflationary environment? Inflation should have made them soar. The past two years have been extremely frustrating for gold and silver bulls alike. The problem is the strong dollar. By raising interest rates rapidly to combat inflation, the US Federal Reserve has made the dollar the only game in town.

The current Fed Funds rate of 2.50% is expected to climb as high as 3.25% soon. Other developed nations are raising their interest rates but at a far slower pace. The euro area short-term interest rate is currently 0.50% – up from zero a few months ago. This is significantly less than what Europeans can get by turning their euros into dollars and buying American T-bills. A strong greenback tends to drive down the dollar price of precious metals because it takes fewer of them to buy the same amount.

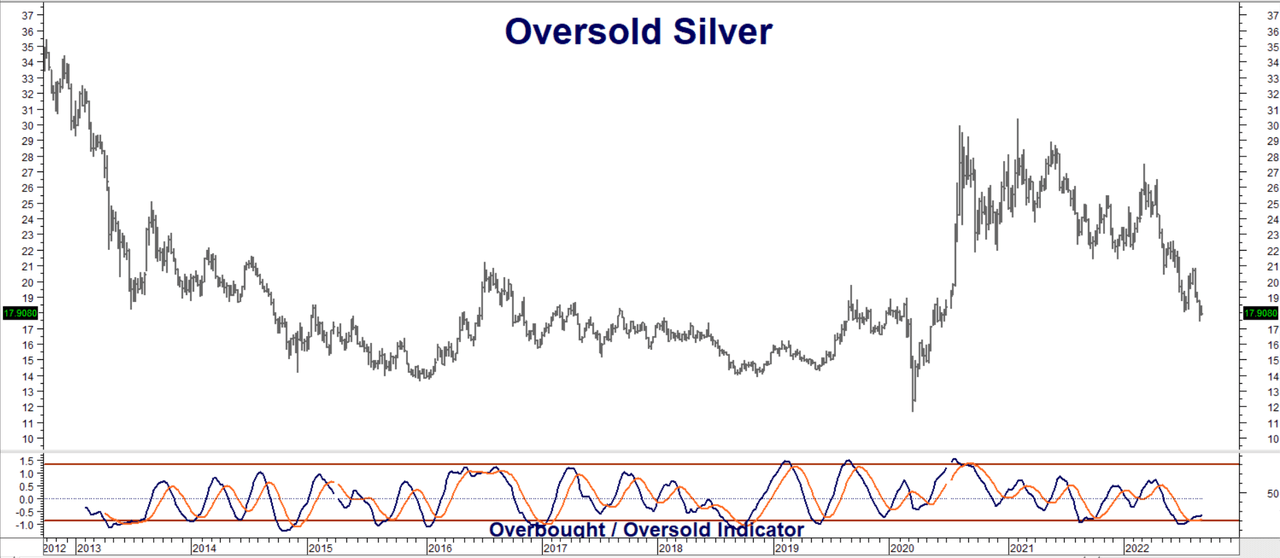

High-interest rates in the US also increase the opportunity cost of holding precious metals. Gold and silver earn no interest and, since both metals have been falling, investments in bullion have been double losers. We believe this may be changing. The US dollar is extremely overbought and overdue for a significant downward correction, while silver is underpriced and oversold.

Reuters/Datastream Reuters/Datastream

We Expect the Dollar “Carry Trade” to Reverse Soon

The huge gap in short-term interest rates between the US and nearly everyone else makes the dollar one of the best-performing inflation plays in town. The Fed began its tightening cycle on March 22, 2022 – just six months ago. Since then, the Dollar Index has risen 11.9%, easily beating inflation even without its current yield of 2.5%, which is expected to rise to at least 4.00%, and possibly higher in 2023. Why buy silver (or gold) when you can get both yield – which is increasing with every Fed meeting – and capital gains by simply holding dollars and investing them in risk-free T-Bills or 2-year notes?

Traders looking to leverage can take this one step further by borrowing in currencies with dirt-cheap yields like the euro, convert these into dollars, and use those dollars to load up on much higher-yielding US Treasury instruments. This is known as a “carry trade.” Carry trades tend to be self-reinforcing: the better they work, the more money they attract. This new money makes them work even better. Long dollar is an easy trade right now. It’s become too easy. That’s why we believe it cannot and will not last.

“Carry trades” tend to work extremely well until they don’t. They are notorious for collapsing under their own weight once they lose momentum. We see this happening sometime over the next few months.

Will Interest Rate Convergence Spark a Silver Boon?

The Fed does everything to the extreme. It kept rates too low for too long and will likely keep rates too high for too long. It will not act to reduce interest rates until something breaks. Will it be stocks? Housing? Bonds? We do not know. However, odds are good that whatever does break will be recessionary and perhaps even deflationary. We’ve already seen what happens when stocks and housing collapse. High borrowing costs and exploding interest expenses from a potential bond market collapse can suck trillions from the Federal Government’s operating budget. Consequently, we do not see the Fed letting things get out of hand in the bond market either.

We believe the Fed’s overzealous policies will force it to halt its tightening campaign and, depending on the damage, even reverse course. This will narrow the wide gap in interest rates fueling the dollar “carry trade.” In the meantime, soaring inflation in Europe could finally force the ECB to get serious and increase interest rates meaningfully. A Fed pause combined with ECB tightening could make the dollar “carry trade” a lot less lucrative in a hurry.

We expect the dollar to suffer and silver to benefit as global interest rates converge. High-interest rates may have helped the dollar and hurt silver, but they can also be used to help reduce the cost of the fixed-risk bullish position in silver we outline below.

Use COMEX Call Options to “Rent” Silver for Pennies-on-the Dollar

This strategy is designed to give RMB trading customers upside exposure to silver for a lower cost and risk than purchasing the metal outright, freeing up capital to generate a return somewhere else. Our strategy also insulates holders from the type of volatility that forced many bulls out of the post-Covid silver market.

We use 5,000-ounce COMEX silver options to create our “pennies on the dollar” strategy. Each option covers 5,000 ounces of silver, making each $1.00 per ounce move worth $5,000 and each 1-cent per ounce move worth $50. Buyers of silver call options pay money, known as a “premium,” for the right but not the obligation to be long silver futures at a specific price for a specific period.

Call option buyers do not buy the market; they merely buy the right but not the obligation to be long that market. The key phrase is “but not the obligation.” Should silver decline or fail to rally before the option expires, the option buyer will simply not exercise the right to buy the futures contract. All a silver call option buyer risks are the premium paid, plus any transaction costs.

Silver call option sellers receive money in exchange for the obligation to sell silver futures at a specific price for a certain timeframe. Notice how this definition is the exact opposite of call option buyers. Think of it this way: if you are an employer, you pay money to your employees. This gives you the right to tell them what to do. As an employee, you receive money from your employer, obligating you to do what your employer tells you. Options work the same way.

Combine Long and Short Positions to Reduce Risk

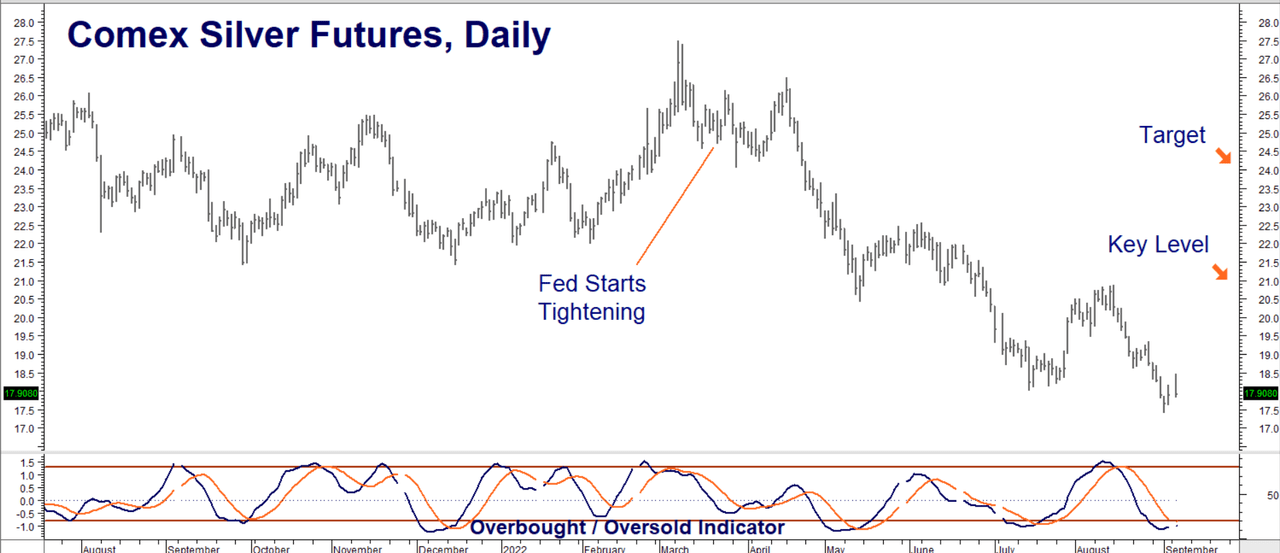

We can lower the cost and risk of our bullish position by combining long silver options with short silver options. Our upside target on silver is $24.00 per ounce, slightly below the price of silver when the Fed began tightening. We want to position ourselves to capitalize on a breakout over silver’s key resistance level of $21.00 per ounce without taking on a lot of risk.

Reuters/Datastream

One way we can do this is by purchasing a July 2023 Comex Silver call option with a strike price of $21.00 per ounce, while simultaneously selling a July 2023 Comex silver call option with a strike price of $24.00 per ounce. This “bull call spread” pairs the right to buy 5,000 ounces of silver at $21 per ounce with the obligation to sell 5,000 ounces of silver at $24 per ounce.

This spread currently costs 48 cents or $2,400 as of the close on September 6, 2022. Compare this to the roughly $89,500 it currently costs to buy 5,000 ounces of silver outright. July 2023 COMEX silver options expire on June 27, 2023. This gives us time for the trade to work. We will lose the amount we pay for this spread plus any related transaction cost should silver fail to rally above $21.00 per ounce prior to this date.

Selling the $24.00 call obligates us to sell silver at $24.00 per ounce, so we cannot participate in any rally above this level. This means the most our bull call spread will be worth is the $3.00 per ounce difference between the two strike prices times the 5,000-ounce contract size or $15,000 – not a bad outcome given our $2,400 (plus transaction cost) risk. Prices can and will change, so contact your RMB Group broker for the latest. Your RMB Group broker will work with you to match a strategy to your risk tolerance and market conditions.

Use Fed Rate Increases to Create Your Own “Silver-Backed” CD

The Fed policy responsible for both the strong dollar and weak silver can also be used as a tool to reduce the cost of our bullish silver position. Yields on T-bills and CDs have soared in the past few months. This makes it possible for silver buyers to lower their risk by creating their own “silver-backed” CD. Combine the bull spread strategy above with the purchase of a one-year CD, then use the interest received to help offset the cost of your bull spreads.

For example, Comex 5000 silver futures are currently trading for $17.90 per ounce, making each contract worth $89,500. Instead of buying 5000 ounces of silver bullion or a futures contract, one could purchase a 12-month FDIC-insured CD. A quick search of www.bankrate.com lists several 12-month CDs with APY yields of 2.90%. $89,500 invested at 2.90% works out to roughly $2,595. This more than covers the $2,400 cost of our bull call spread. Higher interest rates could mean even better outcomes.

Please be advised that you need a futures account to trade the options in this report.

Visit RMB Group to learn more.

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment