wallix

Dear readers/followers,

Investors tend to get somewhat leery when we enter problematic macro and the topic of investing in industrials comes up. The reasoning is, by and large, understandable. There is plenty of uncertainty in such an environment and this can certainly impact industrial companies as well as other sectors. However, class-leading industrials like Siemens (OTCPK:SMAWF)(OTCPK:SIEGY) do have upsides that have very little to do with short-term disruptions, such as these.

Let’s review Siemens and see what we can expect from the company going forward.

Reviewing Siemens

Siemens is a German industrial legacy. Years ago, when I spent time in southern Germany, I was in villages where the entire population, one way or another, worked at a variety of Siemens plants, or offices. In some ways, it’s like a company that “is” an entire region or that at least owns the employment (or 90% of it) in an entire area.

This company is a business that’s active in a variety of different fields. It’s an industrial conglomerate that’s gone from a corporate structure similar to General Electric (GE) to a structure somewhat different following some spin-offs, divestments, and rotations.

It’s my oldest German investment that I still own in my portfolio from “day 1”. I’ve held my Siemens stake for over 9 years at this point Siemens has a market capitalization of over €90B. It’s the largest industrial manufacturing business in all of Europe, with 300,000+ employees across the globe.

The company’s shift in structure has come as a benefit to its shareholders. We’ve lowered our direct risk, while increasing or maintaining diversification in the investment. During the last decade and more, Siemens has very much shifted its corporate structure. From a large conglomerate with a multitude of segments, Siemens decided to start spinning off its various businesses into their own publicly-listed companies, usually while maintaining some type of stake in them.

I’ve not yet provided full articles on things like Gamesa (OTCPK:GCTAF) (OTCPK:GCTAY) or Healthineers (OTCPK:SEMHF) (OTCPK:SMMNY), but several of these do deserve this.

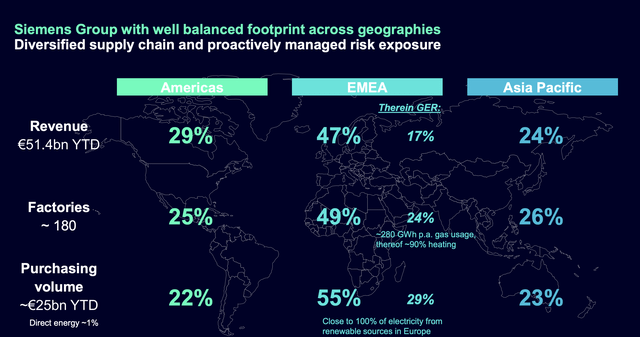

Siemens today is a balanced (geographically) business with an EU-heavy focus in terms of revenues, production sites, and volumes.

When talking about current trends in several companies, not just Siemens, but industrials specifically, we can speak to top-line and bottom-line results. A current typical trend is excellent top-line growth, meaning growth in orders and revenues, and volumes, but troubles in the bottom line/margin department.

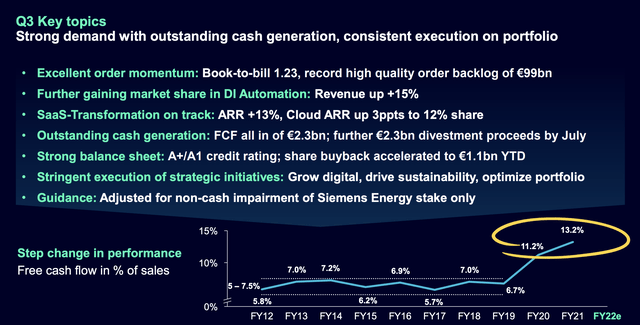

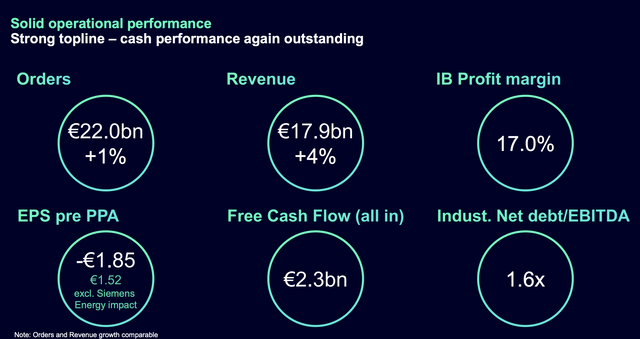

Siemens is handling this better than you might expect. Orders, revenues, and backlog numbers, all of these are firmly up. Book to bill is at 1.23x, and the backlog is almost at €100B, with sector-specific revenue gains showing extremely impressive trends. Take a look at FCF % sales.

Also, remember fundamentals. Siemens is one of the best-rated industrials on the planet – so any sort of fundamental concern here in terms of safety is quite unlikely for the time being.

EPS was down for the quarter YoY, but this was due to impairments from Siemens Energy – sans that impact, you’re looking at a stable EPS level, with €2.3B of FCF and an industrial net debt/EBITDA of 1.6x. This company has not been de-railed by the current trends, and current forecasts see it extremely unlikely that any negative is going to be persistent for the company. The combination of its segments, DI, SI, MO, and the huge stake in Healthineers coupled with its other stakes are extremely likely, as I see it, to continue to deliver very solid results on the backs of global trends, not regional ones.

The concept of “streamlining” a conglomerate is one that Siemens, therefore, over the past decade, has perfected. The main differentiator between Siemens and its closest peer GE is that GE is keeping its legacy turbine and other industrial activities while leaving behind the software. Siemens is doing the exact opposite of this.

This is a European approach. Schneider (OTCPK:SBGSY) and ABB (ABB) are approaching these problems in a similar manner, turning to tech focus and asset-lighter structures for more flexibility and slowly proving their profitability here.

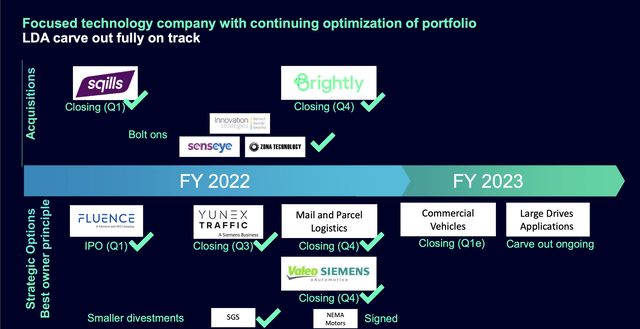

Some concrete examples are possible – including what the company is doing in Egypt, where a modern, sustainable rail system is being developed, or how its divestments and carve-outs are being even further focused on, with the current focus now on LDA. Take a look at the current M&A pipeline and you’ll see what’s happening here.

Siemens’ target is to be a very asset-light sort of company, with an inherent company focus on DI (showing superb market trends), SI (again, superb trends), MO (one of the best drivers given the global focus on sustainable infrastructure and mobility), with other segments being more secondary or “outside” of the company.

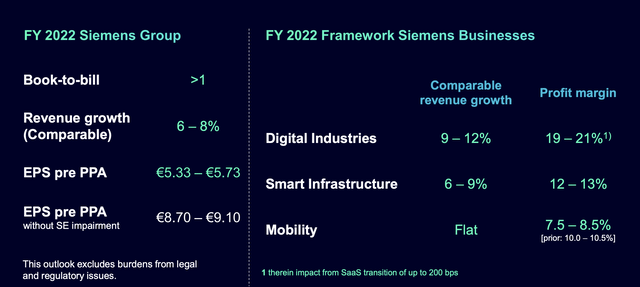

This has driven Siemens to become more forecastable, and more stable, enabling higher buybacks, growth in free cash flow, and logical capital management for the company. The company recorded an energy Impairment of around €2.7B for the year, which reduces the expected EPS to around €5.75 on the high end for the year, compared to €9.1/share for the high end when the company entered the year. However, as things stand and given the company’s dividend tradition, I consider it unlikely that a momentary impairment will cause Siemens to re-evaluate its dividend policy and payout tradition.

Siemens is a collection of impressively profitable segments – 3 of them – combined with stakes in several key impressive industries.

The company’s fundamentals reflect its stellar structure. It’s A+ rated and at the current price has a dividend yield of over 3.7% following the recent decline. The company’s dividend has a very strong tradition. Based on company guidance, Siemens at a native share price of €100-106/share is trading at less than 12X normalized P/E. This is a very low valuation for the company, historically and realistically.

Given continued superb trends in order inflow and business trends, I consider the 2022E impacts to be momentary and not at all influencing the long-term appeal of Siemens as an investment.

Let me show you trends in valuation.

Siemens Valuation

Siemens’s valuation remains complex in the sense that all of its various portfolio companies and assets need to be properly accounted for in every single model.

Since listing segments like medical and energy, it’s obvious that the company-wide margins should be able to be improved (given that Energy/Healthineers were relatively low-margin businesses), while at the same time being able to grow those sales due to the high penetration of software/SaaS.

In previous articles, I specified a DCF model that included 3-4% EBITDA growth but that drops to 3.0%. It’s important not to underestimate the company’s potential due to the correlation to infrastructure spending. Typically, we can expect Siemens to yield no higher than a 2-3% yield – the fact that we’re now up to 3.7 really quite good.

As I mentioned in my last piece, Siemens has several peers, but none as large or as significant as Siemens itself.

Schneider Electric is one, and ABB, Atlas Copco (OTCPK:ATLKY) exist as well. There’s Alstom (OTCPK:AOMFF) (OTCPK:ALSMY), Philips (PHG), and others as well. Including Alstom means a significant average P/E impact, but due to companies like Copco, the average P/E for this comp group is still close to 20X. Consider this when you’re thinking that 10-11X P/E still sounds high – for one of the world’s largest conglomerates, it is not high. Not in the least.

If this was a year ago, and Siemens was trading at 10-11X P/E, I would have been calling this my #1, no-nonsense, Strong “BUY”.

However, even now things aren’t really that bad. Yes, we’re expecting a YoY 25%+ EPS drop-down – but that’s followed by a significant EPS forecast increase for the next fiscal, followed by double-digit growth as some of these high-quality orders flow from backlog to “production”.

The upside on the back of this massive growth is nothing short of amazing when you consider A+ credit.

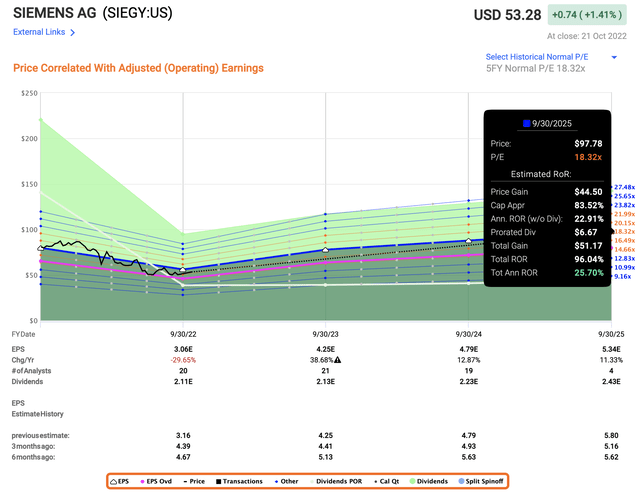

The ADR SIEGY has the company trading at a normalized 5-year P/E of 18.3x. Forecasting based on this gives us a 3-year upside of no less than 95%+ and potentially up to triple digits for a company such as this.

Siemens upside (F.A.S.T graphs)

Seeing this, you could understand why I’ve been pushing capital to work into SIEGY. Siemens is, according to the 22 S&P Global analysts currently following the business, massively undervalued in terms of price upside. A €74/share low target and €190/share high target means that an average of €143 gives us a 34% current upside, with 16 out of 22 analysts either at a “BUY” or equivalent rating here.

This upside is based not only on eventual EPS growth but dividend growth as well – also, growth in most top-and-bottom-line metrics over time.

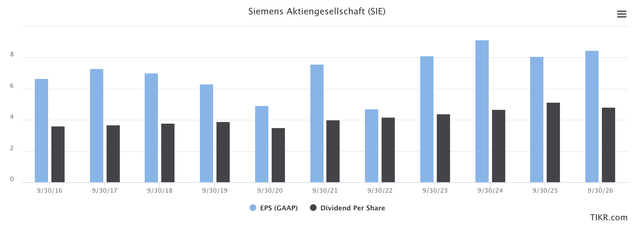

Siemens Forecasts (S&P Global/TIKR.com)

I personally expect a more conservative EPS growth rate, but even my current forecasts line up fairly well with what you see above, confirming that the company would be trading closer to 10-12x P/E than towards 15-18x P/E. Given such a discrepancy in the valuation, I am firm and confident in my stance on Siemens here.

Siemens can provide you with alpha – and alpha is what we’re looking for. I’ve already lowered my PT by €5/share to account for the massive market uncertainty here, and I refuse to impair, discount, or adjust it further.

When it comes to looking at Siemens, I look at the EU market as a whole – and while there are investments with a technically higher upside here, Siemens has the stability that these other businesses, such as BASF (OTCQX:BASFY) do not. Don’t get me wrong. BASF has a better yield and upside – that’s why I’m invested to the gills in BASF before I’m invested fully in Siemens. Both companies are A-rated or equivalent. Both are “BUY”.

Siemens currently trades well below 15X P/E. This is despite a significantly higher yield than peers, a better P/Book multiple, and a same-level EV/EBITDA multiple. I’m applying a 10% premium across the board for Siemens to reflect that it is better than all of the businesses mentioned in terms of diversification, size, and structure; only Schneider and ABB come close.

My current target for Siemens is €135/share.

Thesis

My thesis for Siemens is as follows:

- Siemens is a beyond-solid company. It’s so far beyond solid that it’s one of the 20 companies in my “Buy-and-hold-forever” list, along with businesses like BlackRock (BLK), Airbus (OTCPK:EADSY), and LVMH (OTCPK:LVMUY). On that list, we also find Swedish businesses like Castellum (OTCPK:CWQXF) and Axfood (OTCPK:AXFOF). These are businesses that I would buy, then be comfortable never checking on again, simply collecting those premiums until the end of my days.

- At the right price, this company becomes a “BUY” strong enough to make me ignore or put second most other investments. I’ve been pushing capital to work for months now, and my stake is now 2.8%.

- My PT for Siemens is €135 – and it’s a “BUY”.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment