Pgiam/iStock via Getty Images

Dividend investors seeking to optimize income from their investments should look at ex-dividend dates and time their purchases accordingly.

Timing the market is difficult. Timing to maximize income from dividends, however, is much simpler. Buying a stock before the ex-dividend date qualifies you for the next upcoming dividend payment, whereas foregoing the next ex-dividend date should, in theory, give you a better entry price point as the stock is expected to trade with a discount on the ex-dividend date.

Investor Relations

Let’s now turn to the analysis. With such a reliable dividend payer and regarded by many as a pure income play, are we observing investors buying the stock in the run-up to the ex-dividend date? Are we observing people buying the stock after the ex-dividend date drop? Let’s find out as Ares Capital’s (NASDAQ:ARCC) next ex-dividend date on December 14 is looming around the corner!

Now, let’s get straight into the analysis itself!

To do so, I have analyzed how a $10,000 investment in Ares Capital has fared so far on each of the ex-dividend dates over the last 12 years (48 observations in total) by comparing stock prices the day before the ex-dividend date, on the ex-dividend date, and the day after. This also factors in a tax rate of 15%.

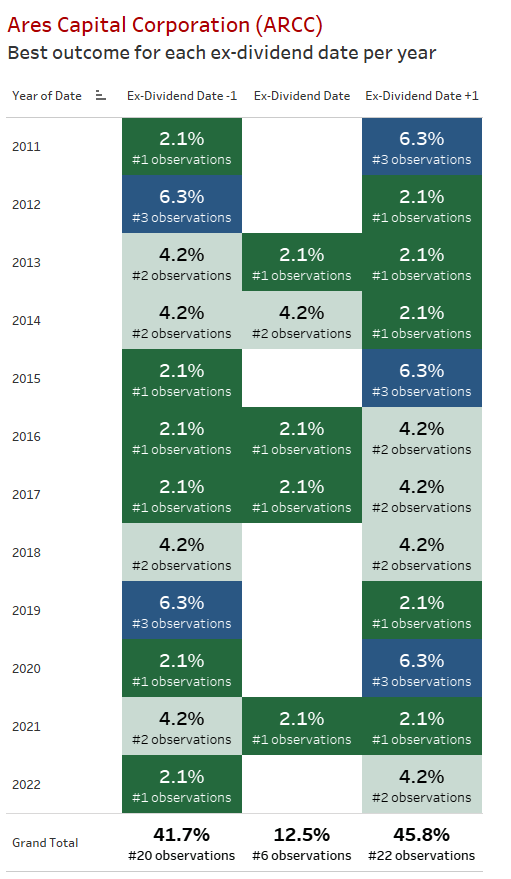

The results for these 48 ex-dividend dates are surprisingly balanced. Expressed in % of most beneficial outcomes (i.e., the strategy that yielded the highest return), it looks as follows:

- Buying the stock 1 day before ex-dividend date: 20 observations; 41.7%

- Buying the stock on the ex-dividend date: 6 observations; 12.5%

- Buying the stock 1 day after ex-dividend date: 22 observations; 45.8%

A slight majority of 58.3% of outcomes favors not buying before the stock goes ex-dividend whereas 41.7% of outcomes benefit from buying the stock prior to its ex-dividend date.

I have run that type of analysis on other stocks in the past and for instance stocks like AT&T (T) which also have a rich dividend history and have been a corner stone of many dividend income portfolios I was surprised that the results for Ares were far more balanced. In the case of AT&T my most recent analysis concluded that in at least 7 of 10 cases it was beneficial not to buy before the stock goes ex-dividend.

In the case of Ares a 58/42 overall ratio does not deliver a clear message and is more comparable to a coin toss than to a seeking alpha strategy. Nonetheless, here are the detailed results of that first stage of the analysis.

Figure 1: Overview of occurrences of best outcomes by stock by year

Ares Capital Corporation – Best Outcomes By Year (Designed by author)

In 7 of 12 years between 2011 and 2022 YTD, investors have fared better not buying the stock before the ex-dividend date. In 3 years it is a tie and only in 2 years (2012 & 2019) the strategy of buying the stock prior to its ex-dividend date outperforms the counter strategy.

Advancing the analysis

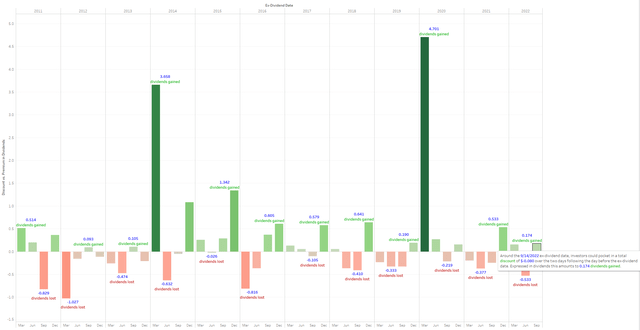

Next, I have calculated the actual price changes of the stock around the ex-dividend dates (you can interact with the dashboard) as follows:

- Change Day 1. (Opening price ex-dividend date) – (Closing price ex-dividend date -1)

- Change Day 2. (Opening price ex-dividend date +1) – (Closing price ex-dividend date)

- Total Change. Day 1 + Day 2

- Total Discount/Premium. Total Change – Dividend per share

This total change over the two days has been put in relation to the actual dividend payment, which serves as a proxy for by how much the stock price would have been expected to drop if it were solely to reflect that change.

By putting that total discount/premium in relation to the actual dividend per share, we get something I have termed “discount/premium in dividends” and which is depicted below for all the ex-dividend dates contained in the analysis.

Discount(-)/premium(+) in dividends: (Total Discount/Premium)/Dividend per share

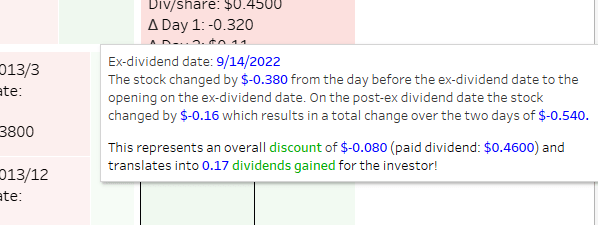

A simple reading example for the latest ex-dividend date on January 9, 2019, reads as follows:

Around the 9/14/2022 ex-dividend date investors could pocket in a total discount of $0.08 over the two days around the ex-dividend date. Expressed in terms of dividends this amounts around 0.2 dividends gained. Or put differently, the drop over the two days has been higher than the actual dividend. In this case, having bought the stock on the ex-dividend date + 1 would have led to a gain of almost one additional dividend per share!

Ares Capital Corporation – Discount vs Premium (Designed by author)

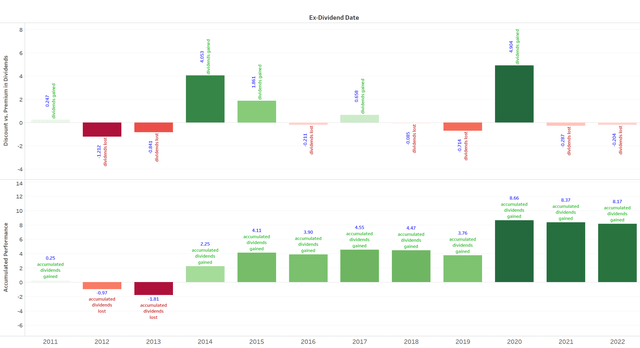

What’s more, while it is good to know what the best strategy is with the Ares Capital around ex-dividend dates, we also need to shed light on the size of the opportunity by looking at the total discount/premium in dividends across several ex-dividend dates and across many years.

In fact, disregarding commissions and taxes, investors could have gained additional dividends in 5 out of the last 12 years by forfeiting the dividend and buying the stock post its ex-dividend date.

Ares Capital Corporation – Dividends Gained or Lost (Designed by author)

Still, overall on an accumulated basis, the hypothetical investor that had purchased Ares on or after the ex-dividend date could have earned an additional 8.17 in accumulated dividends.

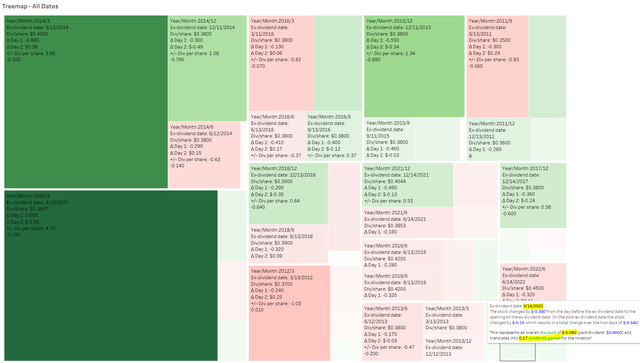

To better understand this behavior, let’s create a tree-map, which is sized based on the “discount/premium in dividends” metric. This clearly shows when the best opportunities have occurred in the past. Similarly, it also shows when investors have lost dividends by waiting too long for the stock price to drop following the ex-dividend date.

Ares Capital Corporation – Dividend Tree Map (Design by author)

Again, the reading example helps understand what exactly is shown here.

Ares Capital Corporation – Dividend Tree Map Reading Example (Designed by author)

I believe that this is a very powerful way of looking at the pricing action around ex-dividend dates for stocks.

Given the seemingly balanced success of that dividend strategy with Ares I will also extend this analysis to other high-yielding stocks in order to understand if we can observe similar patterns there or if they favor more enticing and one-sided strategies.

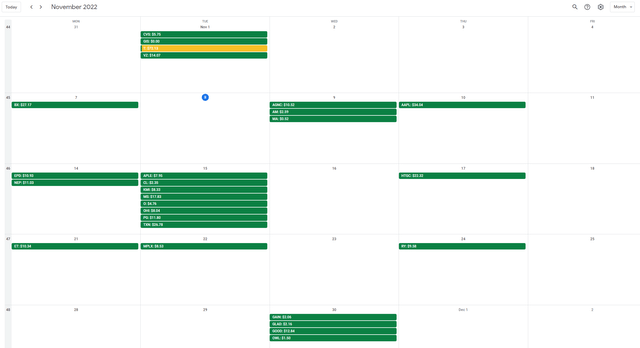

To keep track of upcoming ex-dividend dates, I use the Dividend Calendar Tool (make sure to follow instructions here). This handy dividend calendar view allows me to view the respective next ex-dividend dates. Here is a sample screenshot of how this looks like (showing expected dividend payments in November for my portfolio):

My Dividend Calendar (Designed by author)

Investor takeaway

In summary, dividend investors who want quick income from their investments without having to sell anything could screen the market for ex-dividend dates and time their purchases accordingly. However, in the case of ARCC, it makes slightly more sense to forego the ex-dividend date and instead buy the stock on or after the ex-dividend date. Historically, this has produced slightly superior returns.

Although, as so often, results are subject to one’s own individual interpretation. It shows that, for the Ares Capital, solely relying on the stock price to decrease following the ex-dividend date would have been the best decision in the cases covered in this article.

Naturally, the “buy” or “not buy” decision should depend on far more factors than just the ex-dividend date, but it is one variable to consider when trying to optimize your income.

Nonetheless, the data is not very convincing in that case as the results are fairly balanced. For ARCC I would not follow that strategy but simply buy the stock whenever I want and right now with the stock trading at a very attractive 9.9% after having just substantially raised its dividend over the last two quarters offers a great buying opportunity.

What do you think about the Ares Capital? Are you timing purchases in line with ex-dividend dates or not care at all about this?

Be the first to comment