Sean Gallup

This story was originally written on October 28, 2022, for subscribers of Reading The Markets, an SA marketplace service.

Shopify (NYSE:SHOP) reported better-than-feared results last week, and now the stock may be poised to run much higher. The company reported a loss of $0.02 per share in the third quarter, better than estimates for a loss of $0.07 per share. Meanwhile, revenue came in at $1.36 billion, which was better than estimates of $1.34 billion.

The company also had strong segment beats, with merchandise solutions topping estimates by 3.7% and subscription solutions coming in 1.2% better than estimated. On the flip side, gross merchandise volume missed estimates by 1.3%, and monthly recurring revenue missed estimates by 4.1%.

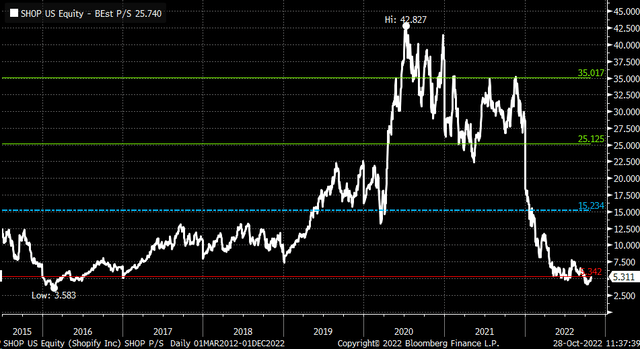

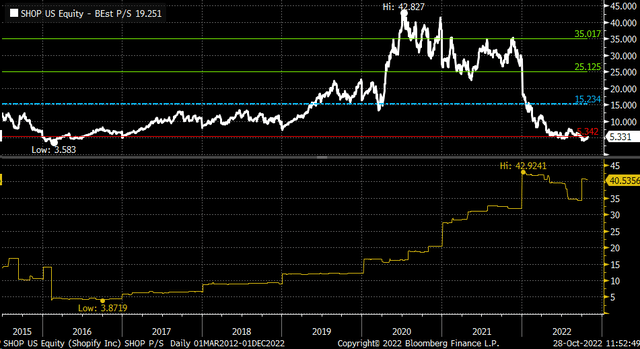

On a price-to-sales metric, Shopify is about as cheap as it will get at 5.3. Of course, it could get cheaper, but on a historical basis, the stock is trading very close to its lowest valuation going back to 2015.

The stock’s valuation has plunged because revenue growth is expected to fall to 19.1% in 2022 from 57.4% in 2021. But growth will likely reaccelerate in 2023 and 2024 to around 22% each year. A reacceleration in revenue growth could drive the price-to-sales multiple higher over time. Even a bump in the multiple to 6 could push the stock to around $40.

Big Bet Shares Rise

The improving fundamental outlook may have driven someone to bet on the shares surging over the next few weeks. The open interest for the SHOP January 20, 2023, $25 calls rose by around 40,000 contracts on October 28. The data shows that 25,000 contracts were bought for $10.63, 10,000 contracts were bought for $10.60, and 5,000 contracts were bought for $10.95. In total, it appears they bought 40,000 contracts and paid a premium of $42.6 million, which is a massive amount. It would imply that the trader sees the stock rising above $35.90 per share by the middle of January.

It is also worth noting that the trader likely rolled some of the proceeds from a prior options trade because it appears they sold to close 25,000 contracts of SHOP November $25 calls for $9.18 per contract. The open interest for these contracts dropped by around 25,000 contracts on October 28, as well. It seems they had initially purchased these calls on July 27 for $11.30.

Bullish Trends

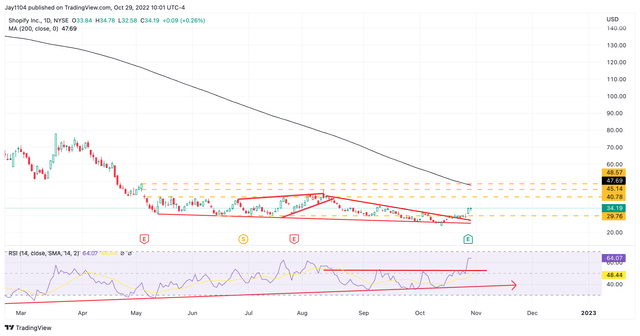

Additionally, SHOP has some bullish trends on the technical chart. The stock appears to have broken out, rising out of a technical bullish reversal pattern known as a falling wedge. Additionally, the relative strength index seems to have broken out from a recent range and has been trending higher, suggesting a change in momentum from bearish to bullish.

Should the stock rise above resistance at $36, it could run higher to around $41. However, if resistance holds, the shares could fall back to $27.

Overall, if it turns out that the worst may be behind Shopify and fundamentals can start to improve, then a bullish narrative could develop and send the shares higher from here.

Be the first to comment