Sean Gallup

Investment Thesis

Shopify Inc. (NYSE:NYSE:SHOP) is a leading ecommerce infrastructure provider, giving its customers the tools to help start, grow, market, and manage a retail business of any size. It is a founder-led company with a strong net cash position, and has seen phenomenal growth since it came public in 2015.

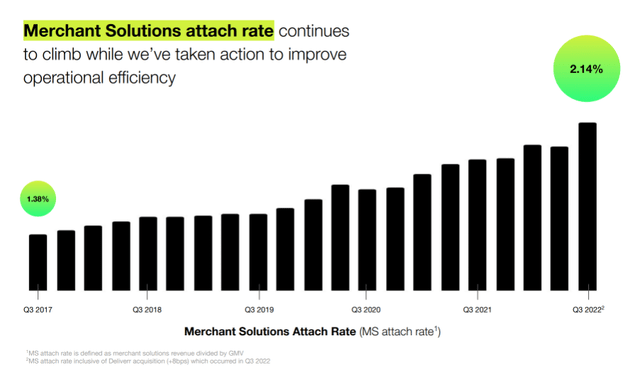

One of the most appealing aspects of Shopify, for me, is the split of its business model between the recurring, subscription-based revenues from its Subscription Solutions & the customer-aligned performance-based revenues from its Merchant Solutions. This enables the company to have a solid base of recurring revenues alongside Merchant Solutions that have the potential to grow quicker, as Shopify continues to roll out more and more solutions to its customers.

Shopify Q3 Earnings Presentation

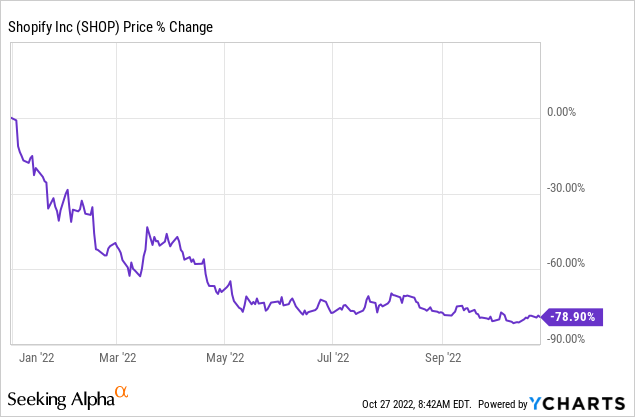

Yet 2022 has been a painful year for Shopify shareholders, and I mean painful. It has suffered from the broader macroeconomic difficulties such as inflation and a weakening consumer, whilst also lapping a 2021 that was great for ecommerce businesses. Shopify, in my view, has still coped better than most ecommerce businesses, but that hasn’t stopped shares from falling by almost 80% so far this year.

For this reason, investors are looking ahead to Shopify’s Q3 earnings in the hope that there are some reasons to be positive – so, are there? Let’s take a look.

Shopify Earnings Overview

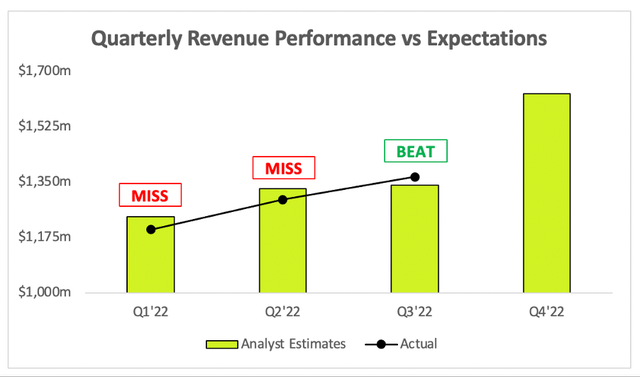

Shopify’s management team doesn’t give precise guidance on revenue or EPS, so it’s only possible to compare against analysts’ estimates.

Starting from the top, and Shopify saw its Q3 revenue grow by 22% YoY to reach $1,366m, beating analysts’ estimates of $1.34B – and boy does that make a pleasant change! Expectations were particularly low for Shopify this quarter, but the company managed to achieve a comfortable enough beat that should make investors feel somewhat relieved.

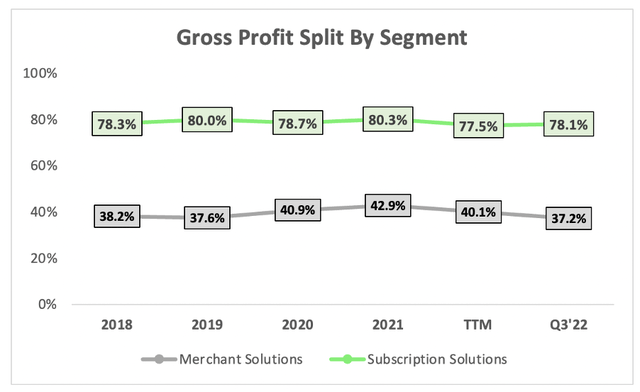

Moving down the income statement, and gross profit margins for the quarter came in at 48% compared to 54% the year before; this is quite a deterioration, but there are plenty of reasons for it.

First, remember Shopify’s two business segments: Subscription Solutions and Merchant Solutions. Subscription Solutions are higher margin, but Merchant Solutions are growing faster, and this is causing a shift in the gross profit margin.

Back in Q3’21, Merchant Solutions made up 70% of total revenue, and in the latest quarter it made up 72% – so, this is a small but impactful reason for the weaker overall gross profit margin.

However, investors may be concerned that the Q3’22 gross profit margins for Merchant Solutions have fallen down to 37.2%. This is lower than it has been for a while, and far below the figure for both the last twelve months and FY21.

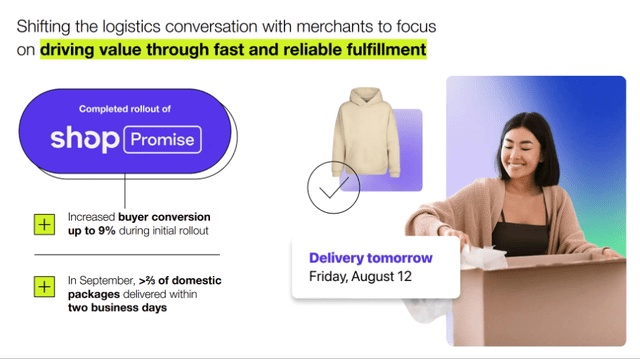

The drivers for this decline include higher processing fees for Shopify Payments as well as the inclusion of Deliverr (for Shopify’s fulfilment network) within Shopify’s Q3 results, following the completion of this acquisition. Whilst both of these are currently a drag on gross profits, I believe they are positive signs for Shopify’s competitive advantage.

One of the largest moats Shopify possesses is switching costs, and the increased revenue generated by Shopify Payments and Fulfilment imply that more customers are taking up Shopify’s additional solutions, thereby enabling Shopify to become more embedded in their platform. It’s also worth highlighting that the 2020 and 2021 gross margins show that Shopify Payments can improve margins at scale, and the fulfilment-related business will almost certainly benefit from scale – so, I think we’re currently seeing short-term pain for long-term gain.

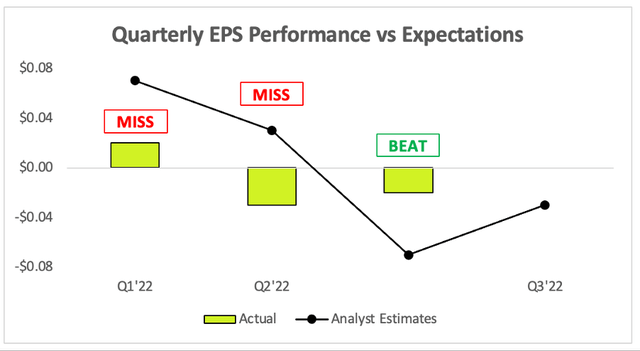

Moving onto the bottom line, and Shopify posted EPS of -$0.02, which came in ahead of analysts’ consensus estimate of -$0.07.

Whilst Shopify doesn’t focus too much on bottom line profitability, it is reassuring for both investors and Wall Street to see that costs are coming somewhat under control.

In fact, a lot of potential investors admire Shopify as a business, but are concerned about how it is dealing with costs; thankfully, Q3 showed some signs that the company is clamping down on the issues it has seen over the past year.

All Eyes On Cost Control

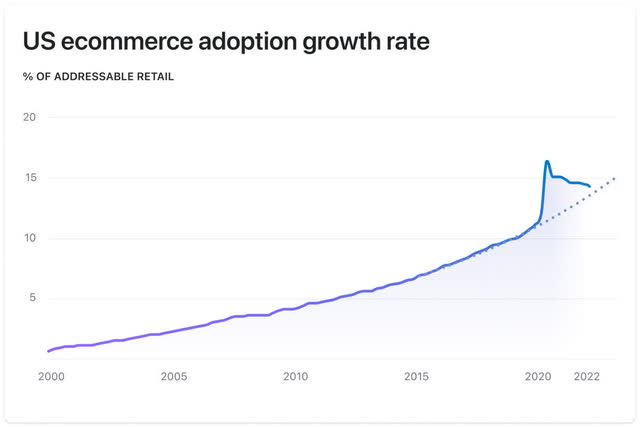

It’s worth remembering exactly why Shopify has found itself with a bit of a cost control issue. The company saw extreme demand throughout the pandemic, and assumed that this had resulted in a permanent leap in demand that would be sustained – sadly, that was not the case.

Ecommerce growth normalised, and Shopify suddenly found itself with more resources than it required, which resulted in the difficult decision taken by management in July to cut headcount by 10%.

Shopify.com / US Census Bureau

The market has made it clear to CEO Lütke and his team that costs need to be managed going forward – and, it appears as if this message was received.

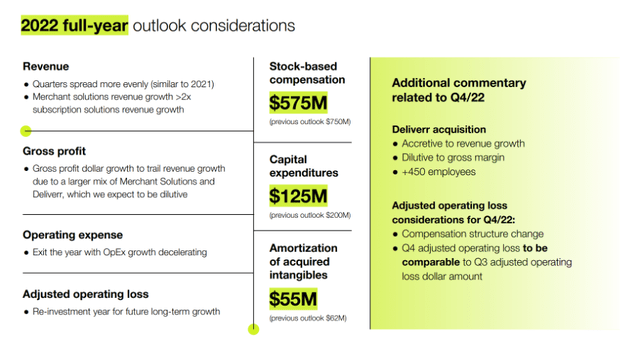

Whereas the market punished Meta (META) for not being strict enough with its cost controls, it appears happy with the forward guidance given by Shopify. The company cut its expenses heading into Q4, resulting in: lower stock-based compensation, lower capital expenditures, and exiting the year with operating expense growth deceleration.

Shopify Q3’22 Earnings Presentation

A bonus for myself as a long-term investor is the fact that Shopify is still investing in the important items, such as its fulfilment network. I believe this will help Shopify keep the competition of Amazon (AMZN) at bay, although I already outlined a strong defence I believe Shopify already has against Amazon in a previous article.

Shopify Q3’22 Earnings Presentation

All in all, I do believe that the business itself is continuing to succeed – it is certainly fulfilling its promise of outpacing the growth of the broader ecommerce market.

My view is that this quarter truly signals a turnaround when it comes to out-of-control costs, and I would expect Wall Street to be happier because of it. Combine this with the fact that Shopify is, in a couple of quarters’ time, no longer going to be coming up against extremely difficult 2021 comparisons, I think this quarter could be the start of Shopify’s recovery.

SHOP Stock Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Shopify is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

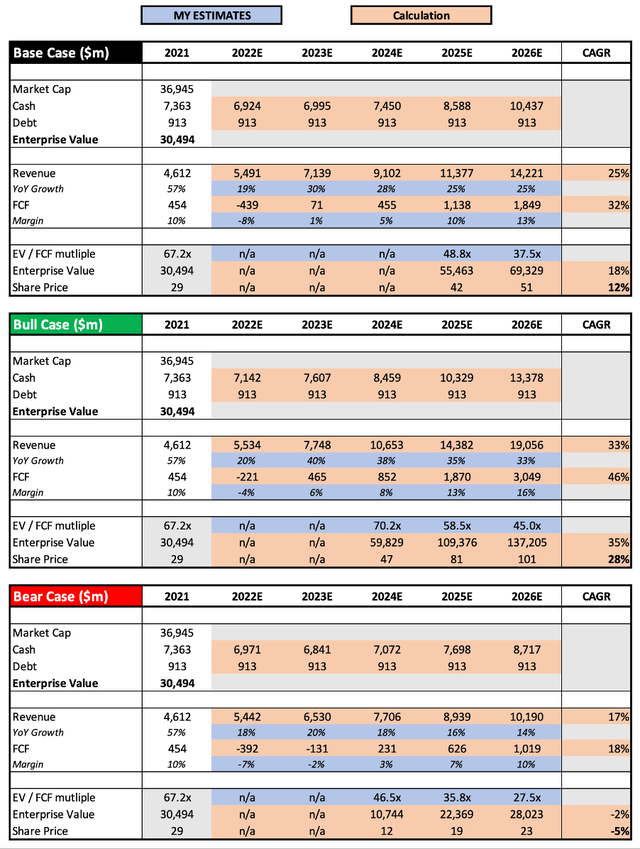

I have kept the assumptions fairly similar to my previous article, with slight improvements to the revenue figures for 2022 & a slight reduction to the 2022 free cash flow, as per Shopify’s latest results. I still think that Shopify is one of the most difficult businesses to value, so I use this model to ensure that I’m not paying an insane amount for the business – which, I don’t think I am at the current price.

Put this all together, and I can see Shopify shares achieving a CAGR through to 2026 of (5%), 12%, and 28% in my respective bear, base, and bull case scenarios.

Bottom Line

I have been very bullish on Shopify over the past few months, and I believe that this latest set of results could very well be a turning point for the stock. The guidance on cost reductions will be particularly well received on Wall Street, and I don’t think many people out there doubt that Shopify itself is a brilliant business.

Given all this, I will reiterate my previous ‘Strong Buy’ rating on Shopify shares.

Be the first to comment