Shopify Bear Taking A Nap After Digesting Her Fat Profits action74/iStock via Getty Images

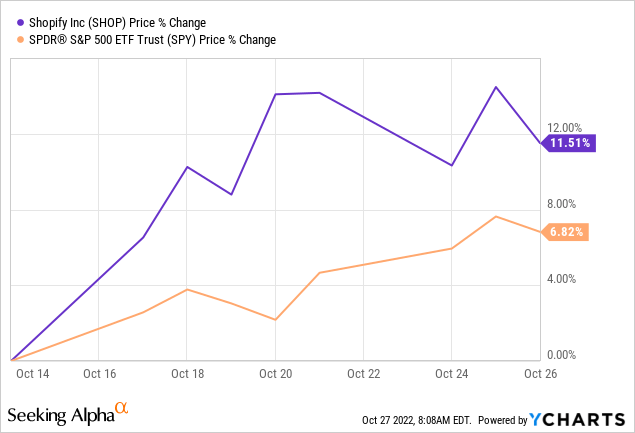

The trend is your friend. Playing countertrend moves requires a nimble approach with a firm eye on the exits. With Shopify Inc. (NYSE:SHOP) it was no different. We have had a strongly bearish view on it since the $140 level and of course we tactically moved to the sidelines once in a while. That’s the nature of the game. When we last covered the stock, we felt that the company could handily beat estimates and give bears some grief. Specifically, we said:

From a short side perspective, covering here is possibly the best bet as the next $10 is more likely to be up rather than down. If we got that up move, it would be incredibly hard to hold on as profits evaporate.

We see this discretion as the better part of valor and hence are upgrading SHOP to a Hold/Neutral rating until we see a better short side setup.

Source: Q3 Earnings Could Surprise The Bears

The stock bounced a little less than we anticipated.

It is up a further 7% in the pre-market (not reflected in the chart above). We discuss the Q3-2022 results and tell you why the next leg down could come a bit sooner than we anticipated.

Q3-2022

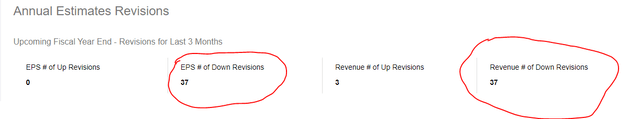

The results were better than average analyst expectations. Non-GAAP earnings per share of -$0.02 beat by $0.05. Revenues also came in $30 million higher. Of course, this game of rapidly lowering the bar to enable a beat has been played as far back as memory goes. In this case 92.5% of the analysts tried to help SHOP out with “here, jump over this instead.”

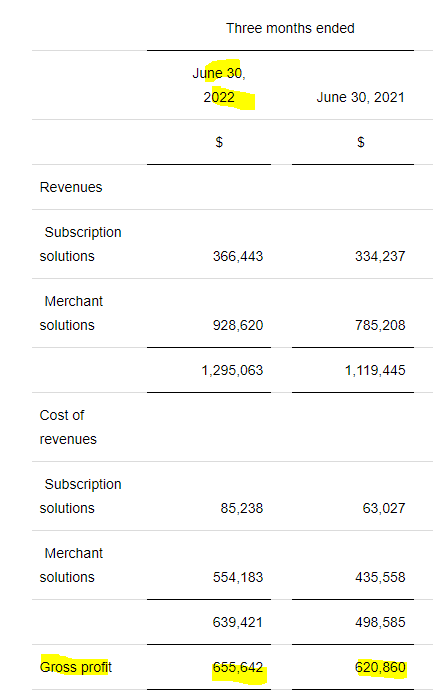

But underneath the mild revenue beat and the even milder adjusted EPS beat, a lot had gone wrong. SHOP’s revenue numbers looked good, but they were helped by the Deliverr acquisition closing during the quarter. Even then, the revenue jump of 21.5% was dwarfed by a 36.7% increase in expenses.

SHOP Q3-2022 Press Release

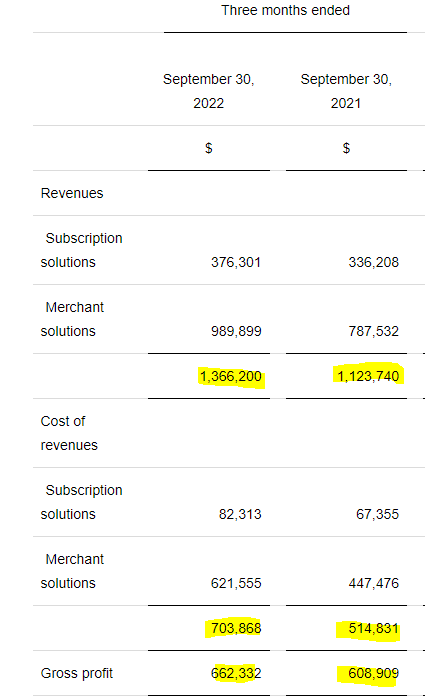

Gross profits were up less 9% and are rapidly becoming the only metric worth watching. If you go back and look at “the brief history of buying into the largest bubble”, you will see that analysts made valuation calls on taking gross profits, increasing them 10 fold and then saying that it made sense to buy SHOP based on 2030 gross profits. As entertaining as that idea was, it made no accounting for the fact that investors need to be paid with net and not gross profits. But even giving into that temptation, and buying into that flight of fantasy, is proving painful. Quarter over quarter, gross profits moved up by just 1%. Here are the Q2-2022 numbers below to job your memory.

SHOP Q2-2022 Press Release

Note also that revenues grew quarter over quarter by about 5%. So, this looks very close to hitting the reverse button and if gross profits start declining, the last bulls will run for the exit.

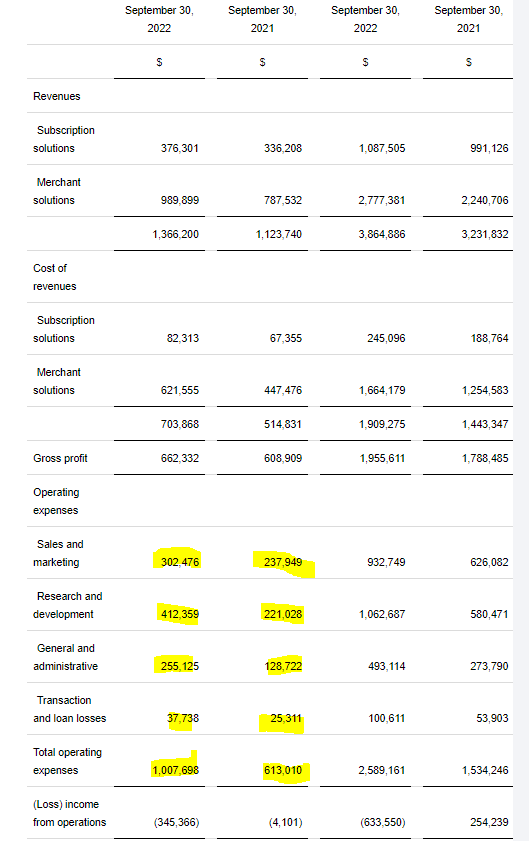

It would be great if that was the story and it certainly would be enough for our price target of $3.00, but there was more, a lot more. SHOP’s operating expenses in every single category increased pretty much how everyone wanted to gross profits to increase.

SHOP Q3-2022 Press Release

Sales and marketing were up a modest 27%, and that was in line with revenues. We will give them a pass for that. But research and development jumped 86%. General and administrative expenses came with a hair of being 100% higher. Transaction and loan losses were 49% higher. Total operating expenses were up 64%. All told, SHOP lost $345 million from operations.

A good way to put this into context is to ask yourself how long it would take for SHOP to break even, assuming you could freeze operating expenses and freeze gross margins. Obviously, the former are growing like a weed and the latter are sinking like a stone, but let’s play that out. The answer is 52%. If SHOP could grow sales by 52% at constant gross margins and zero increase in operating expenses the first dollar of profit would see daylight.

Verdict

You might see some more games around short covering. Possibly a couple of analysts might get optimistic again. The longer-term story looks really bad for the stock. With every quarter, the dream of real profitability goes further and further away. Keep in mind that we only entertain the logic of real profits. Not some made up fluff excluding everything bad. That became popular between 2020 and 2021 and cost investors billions in dollars. We are moving to a Strong Sell, a little earlier than what we anticipated. Our 12-month target is $15 (~3X 2023 sales). Our longer-term target is $3.00 (~0.5X 2024 sales).

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment