JHVEPhoto/iStock Editorial via Getty Images

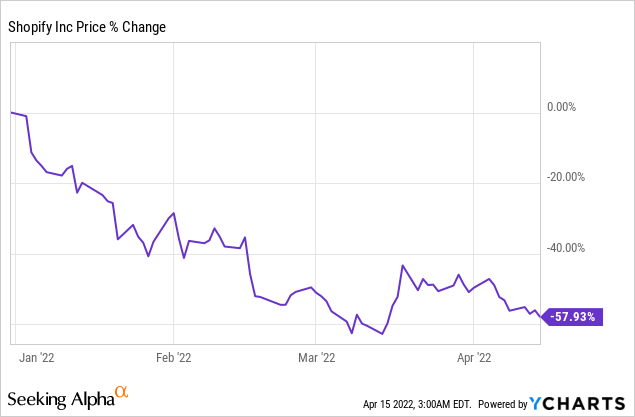

When I last took a look at Shopify (NYSE:SHOP) two months ago, the stock traded at $660. Now, with shares of Shopify dropping below $600, I am taking another look at the e-Commerce firm. What I have concluded is that Shopify continues to represent deep value for its merchant base and the stock’s prospects are even more deeply discounted today than two months ago!

Shopify Is Still Reeling From Its FY 2022 Outlook

Shares of Shopify continued to revalue lower after the e-Commerce warned of slowing post-pandemic growth in its fourth-quarter earnings sheet. However, I believe investors have become too bearish on Shopify and its prospects for growth in the market for online store solutions.

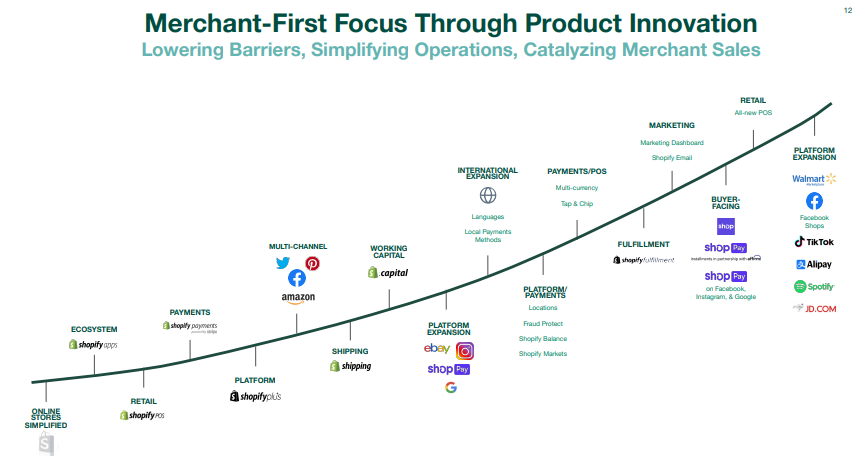

Partner Ecosystem Provides Deep Value For Shopify’s Merchant Base

Shopify’s ecosystem has evolved enormously over time. What started out as a company offering merchants simple, customizable store solutions to sell their products online has evolved into a full-fledged e-Commerce empire that dramatically expanded its product and service suite: Shopify now offers online sellers professional business solutions ranging from payment processing to the supply of working capital to buy now, pay later solutions meant to improve merchants’ store conversions. In a bid to attack Amazon (AMZN), Shopify partnered with large retailers like Walmart (WMT) and other e-Commerce platforms to allow online sellers to access their vast online marketplaces.

Today, Shopify’s ecosystem includes more than 8 thousand apps that give online sellers direct insights into store analytics and support inventory management. Shopify’s ecosystem also expanded to include more than 40 thousand ecosystem partners, offering merchants a larger support base and an increasing number of business opportunities in the digital realm.

Shopify

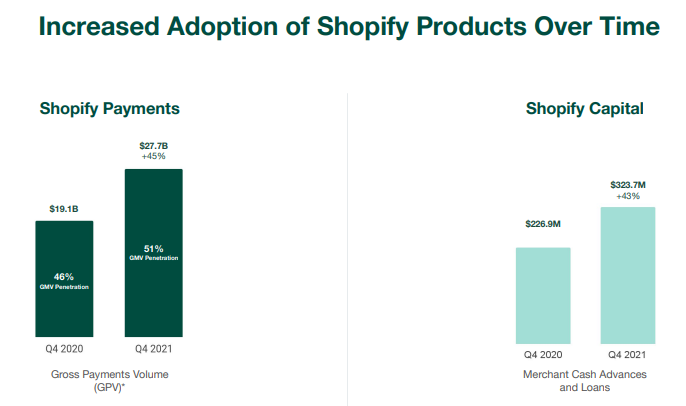

Merchants appreciate Shopify’s efforts to roll out more products and core services continue to see accelerating customer adoption. Shopify Payments and Shopify Capital — which are essentially Shopify’s payment processing and business financing services — have seen huge customer uptake in FY 2021, in part because online sales boomed during the pandemic. The use of Shopify Payments, which measures gross payment volume, increased a massive 45% in Q4’21 while Shopify Capital saw 43% year over year growth in the firm’s last fiscal quarter of 2021. Since small businesses need to overcome more obstacles to secure online payment and financing solutions compared to larger firms, Shopify will likely continue to see exceptional growth rates in these two core services going forward.

Shopify

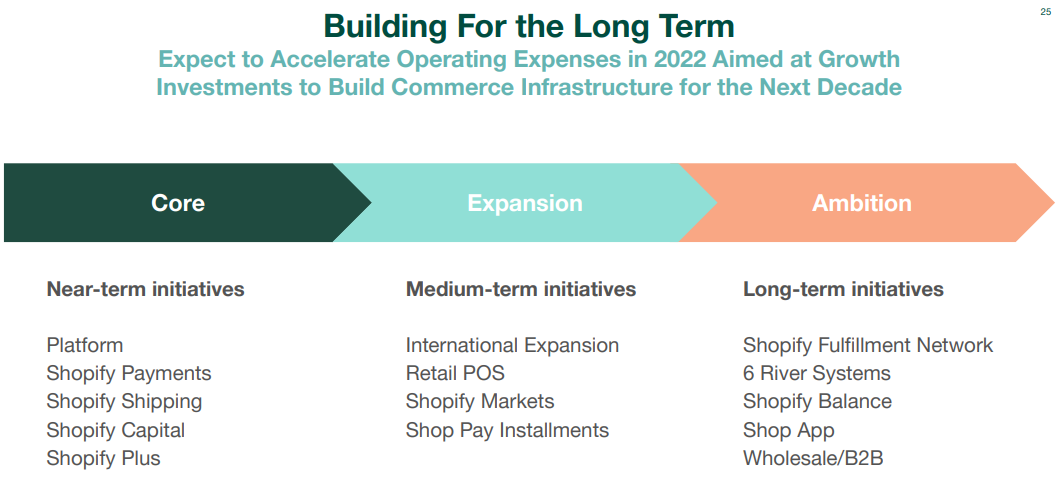

Shopify has many more near-term initiatives besides growing Shopify Payments and Shopify Capital. Shopify wants to build a commerce infrastructure that covers every aspect of online selling while opening up new opportunities for growth for Shopify’s large and expanding merchant base. Initiatives that Shopify is working on include the building of a fulfillment network to simplify inventory management and to reduce shipping times, building partnerships with leading retail brands and the scaling of Shopify’s buy now, pay later solution, Shopify Pay Installments.

Shopify

Being in tune with the merchant base is of extraordinary importance for Shopify… and it has translated into significant revenue growth for the company, long term. Shopify nearly doubled its merchant base during the COVID-19 pandemic and tripled its revenues since FY 2019.

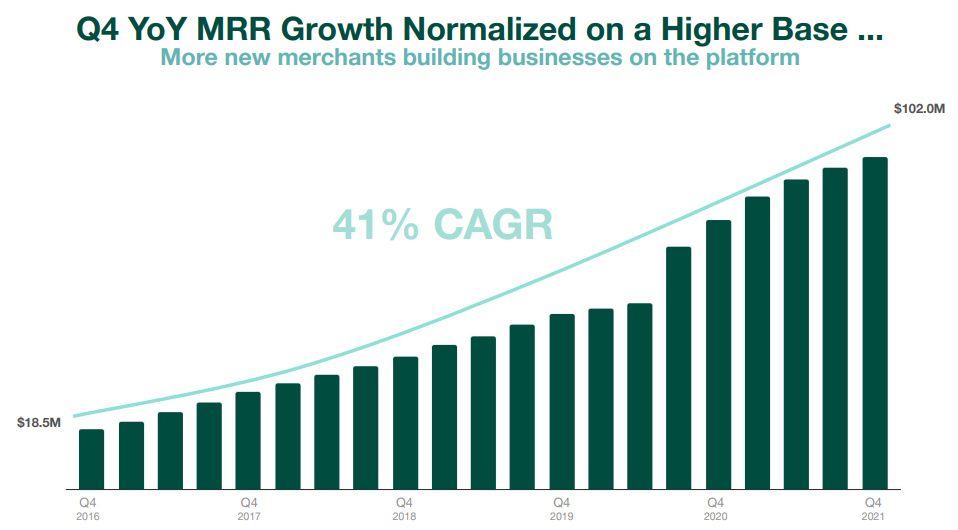

Shopify’s monthly recurring revenues have been in a long-term uptrend also. In the fourth-quarter, Shopify’s monthly recurring revenues hit an all-time high of $102M, showing growth of 23% year over year. Growth in monthly recurring revenues is driven in part by ShopifyPlus which is an enterprise e-Commerce platform for high volume stores that offer merchants more customization and automation tools than Shopify’s base plans that are direct at merchants that achieve lower volumes. As Shopify rolls out more products and services for merchants, I believe monthly recurring revenues will continue to grow at double-digit rates annually and I estimate that Shopify’s monthly recurring revenues could triple by FY 2025.

Shopify

Shopify Is Cheap

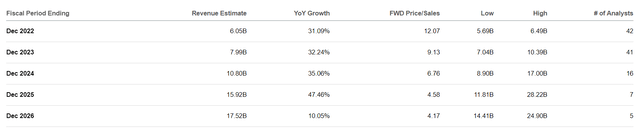

Shopify is going to continue to grow rapidly which is why I believe concerns over the firm’s top line growth as well as the share price drop below $600 are exaggerated. The firm is expected to grow its top line by 30-35% annually over the next three years. Because of the material growth in revenues that is expected to benefit the e-Commerce firm in the foreseeable future, Shopify’s P-S ratio of 9.1 X is actually not as high as it seems.

Risks With Shopify

Many stay-at-home stocks that benefited from the COVID-19 pandemic have revalued lower in recent months. While the pandemic boosted Shopify’s revenue and merchant growth in the 2020/2021 period, investors now expect much lower growth rates. Risks for Shopify chiefly relate to the company’s slowing revenue growth which could result in a lower valuation factor. Given Shopify’s prospects for top line growth, however, I believe the market has it wrong and undervalues the firm’s potential in the rapidly growing e-Commerce market.

Final Thoughts

Shares of Shopify have dropped too much and are now undervalued. Shopify is deepening merchant relationships and expanding its partner network, all of which are actions designed to offer merchants more ecosystem value and higher store conversions… which ultimately translates to more money in merchants’ pockets. While there are legitimate concerns over the firm’s top line growth, post-pandemic, I believe investors overreact to Shopify’s moderating top line growth and the stock remains a buy!

Be the first to comment