naphtalina/iStock via Getty Images

Thesis

ShiftPixy’s (NASDAQ:PIXY) costs are growing too quickly and are not sustainable for the business in my opinion. The recent capital raise is beneficial but is not long-lasting and will likely not cover the costs long enough. Expect the stock price downturn to continue unless costs are tamed.

Google

(Source: CEO Roadshow)

Intro

PIXY is a staffing solution provider that offers services such as HR consulting, payroll processing, and works comp admin which is managed through an HR information platform. The service is best used in industries that utilize the gig economy, where operators need shift workers or part-time workers. The platform then connects employers with employees and manages the relationship. The company is headquartered in Miami and was founded in 2015 and IPO’d in 2017, but unfortunately, performance has been rough, and the share price has declined by over 90% year to date.

Google

Diminishing Financial Health

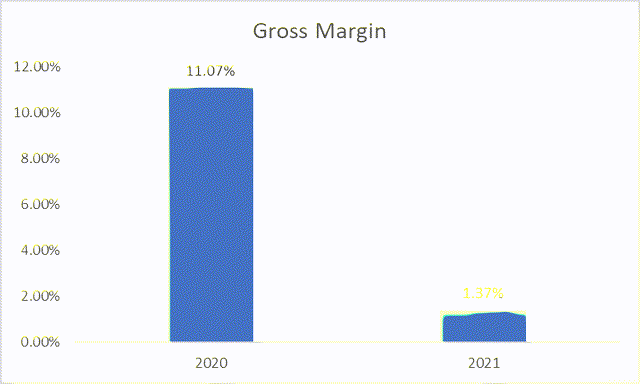

PIXYs share price has been falling due to growing costs. Revenue itself has been healthy, growing to $23m in 2021, a 171% increase from the prior year. Revenue is expected to continue growing, but Q2-2022 revenue was reported at almost $10m, which is only 2% higher year over year. However, the issue with the company is not with revenue, but with rising costs. Firstly, the gross margin has fallen off a cliff, dropping from 11% to less than 2% within a year.

(Source: Company accounts)

While revenue grew 171%, the cost of revenue grew 200%, which consists of employer taxes, worker comp insurance premiums, and staff costs. The company stated that the cost of revenues grew due to the conversion of certain existing clients to a staffing revenue recognition during 2021. Therefore, this should mean that revenue costs should become more normalized the year after given that it is seen as a one-off cost increase.

However, this is clearly not the case, as the cost of revenue for the last reported quarter (Q2-22) was only down less than 10% compared to the quarter of the previous year, Q1-21, so surely it should have declined further. Margin improved slightly to around 6%, but remains incredibly low for a gross margin, and nowhere near the 11% achieved in 2020.

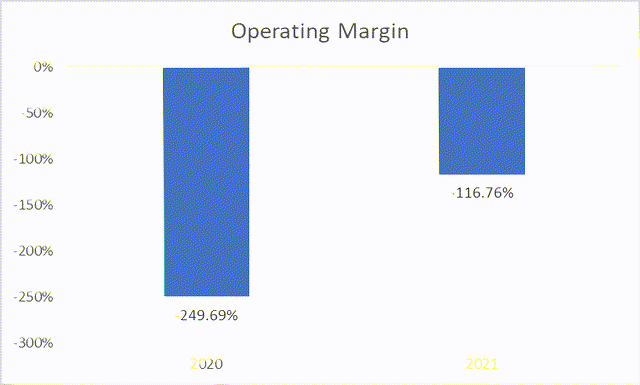

(Source: Company accounts)

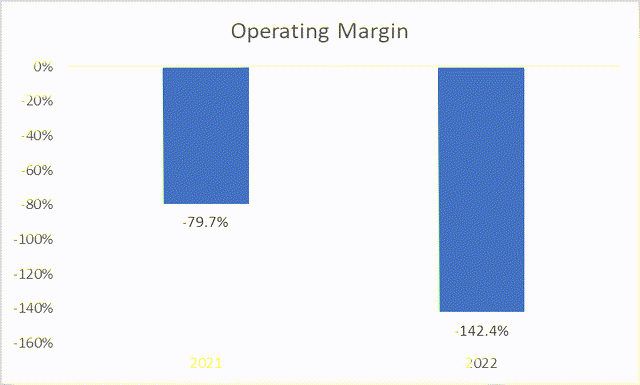

On the other hand, the operating margin has improved (despite being negative), from -250% to -116%. This is clearly a positive, but unfortunately, again, does not show the full picture. Last year, the operating margin did improve from the year before, but unfortunately, this year, the operating margin declined. The operating margin for Q2-22 was almost -150% compared to only -80% for the quarter one year before, indicating that the operating margin has been left worse off and the improvement made before was not sustained.

(Source: Company accounts)

On an individual basis, operating costs are made up of major items that include staff costs, professional fees, software development, and G&A. Looking back at 2021 fiscal year results, staff costs grew 54%, professional fees grew 22%, software development grew 68%, and G&A grew 58%. While operating profit improved, costs actually became more expensive on a per-employee basis. Where the number of employees grew to 68 from 45, but staff costs increased from $160k per employee to $163k.

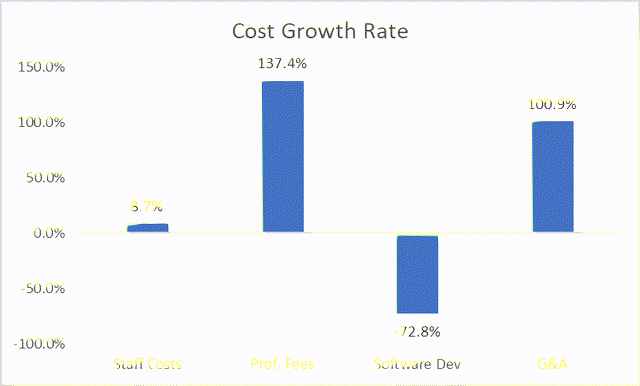

The picture looks worse for the recent quarter. While sales only grew around 2%, staff costs grew almost 9%, professional fees grew 140%, and G&A grew 100%. The only major cost to improve is software development costs, which dropped -72%. However, given that this company’s major product is a tech-based platform, their software costs should be high.

(Source: Company accounts)

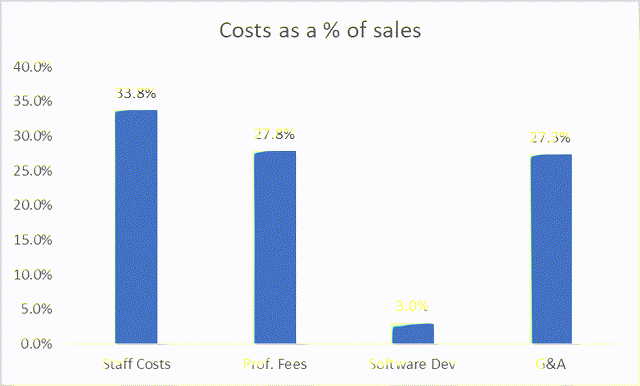

These growing costs have made a dent and left a steep operating loss. To put it into another perspective, the costs as a % of sales look like the following: staff costs are 34%, professional fees are 28%, software development is 3% (down from 11% the year before), and G&A is almost 30%.

(Source: Company accounts)

Again, given that software development costs are so crucial in a tech company, these should be significantly higher in my opinion.

Overall, this growth in operating costs are clearly not sustainable and has left a substantial hole in the company. The balance sheet is no longer healthy and now has a shareholders deficit (currently sits at around -$32m). If these costs are to continue growing at this pace, the company will soon run out of money and the stock could deplete further, despite the recent cash injection (e.g., the $5m private placement recently announced in Sep-22 only covers G&A and professional fees expenses combined for 1 quarter only, making a fraction of a difference in overall cash flow).

Risks

- The most obvious risk to this thesis and the financial forecast is if operating costs were to turn around and begin to improve in the near term. For example, software development fees have successfully been brought down over the past year to a more suitable figure, what is to say they could not do the same with G&A or professional fees? (Professional fees are the area where cost improvements can be made, which could free up over $10m of cash per year if these are brought down to a more normalized level).

- A major influx of cash from the spinoff of ShiftPixy Labs could help improve the company and improve its balance sheet. However, this will not affect the unsustainable operating costs, unless the cash is used to improve these costs somehow.

- If the company has value in their IP, then the company could be acquired (at a cheap valuation) and cost synergies could be made. However, it highly depends on who the acquirer would be and for what for.

Conclusion

In conclusion, PIXY has had a recent slowdown in revenue growth, and a continued decline in operating margin due to the unsustainable cost of sales and operating costs that continue to rise. The most recent operating margin sits at almost -150% and operating expense continue to rise at a rate higher than 100%, leading to a poor performance by the company. The stock has already declined by over 90% year to date as investors can see poor results quarter to quarter and expect this to continue. Unless these costs are tamed and revenue is back on an improved growth rate, expect the share price to continue declining further.

Be the first to comment