Matthew Horwood/Getty Images News

Skyrocketing energy prices are leading much of the global economy into a rapid slowdown. The U.S. average retail price of gasoline has risen from around $3.40 to $5.10 this year while crude oil pushes up toward its record high. This factor, combined with already high inflation, has led to a significant decline in consumer activity and sentiment. Most stock market sectors have declined considerably, with the energy sector being the only strong haven.

The energy sector has risen roughly 40% over the past year, while all others have declined. Typically, energy stocks are very cyclical and decline dramatically as the economy slows. However, because energy prices partly cause the economic slowdown, the sector has become a haven. Even more, many still trade at low valuations, with Exxon (XOM) having a forward “P/E” of 8.9X, Chevron (CVX) at 9.1X, and Shell (NYSE:SHEL) at only 5.2X. These low valuations are due to a rapid increase in expected earnings (due to prices), divestment from financial institutions, and potential financial risks relating to years of low cash flow.

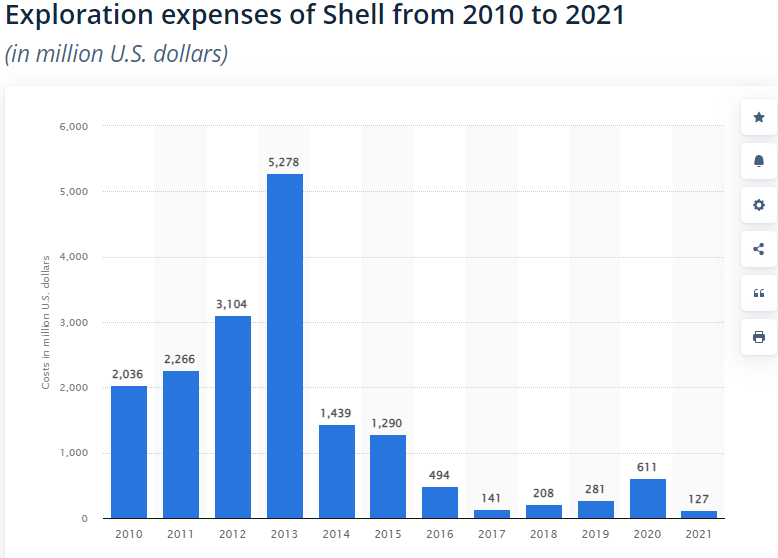

Notably, most energy companies were in a significant depression from around 2014 to 2020 as excessive growth in U.S. energy production (the shale boom) led to a global price decline. Most energy companies struggled to stay afloat during this period and dramatically reduced exploration spending. To illustrate, see Shell’s abysmally low exploration spending over recent years:

Shell PLC Exploration Spending 2010-2021 (Statista)

This is a crucial point, since low exploration spending in the past means no development today, meaning no new sources of oil tomorrow. Additionally, many modern oil wells experience significant production declines over their first two years (~70-80%), so for production to remain constant, there must be a constant level of exploration and development. In my view, this factor is the primary reason why both U.S. companies and even OPEC cannot normalize production levels.

Indeed, even if prices continue to rise, there may be little oil producers can do to increase production. Fortunately for investors, this may make integrated energy companies like Shell strong long-term investment options. In my view, Shell is attractive as it’s very similar to XOM and CVX but has a lower valuation. Of course, this may be due to specific business risk factors, such as its effort to exit the fossil fuel industry, that could harm its potential.

Crude Oil Likely Higher For Longer

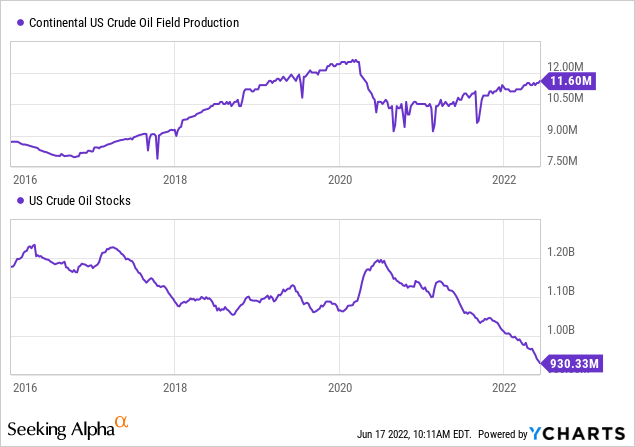

The irony of the energy crisis is that it is somewhat self-inflicted. For years, many major energy companies have made efforts to reduce investments in the fossil fuel industry, leading to lackluster production today and a sharp decline in storage levels. From late 2016 to 2020, U.S. oil production was rising at a robust pace, and storage levels were high, so high that there was a “lack of available storage” crisis in 2020 that caused oil prices to become temporarily negative. Since then, production levels have never recovered from the rapid shut-off of wells during 2020, causing storage levels to decline at an accelerating pace. See below:

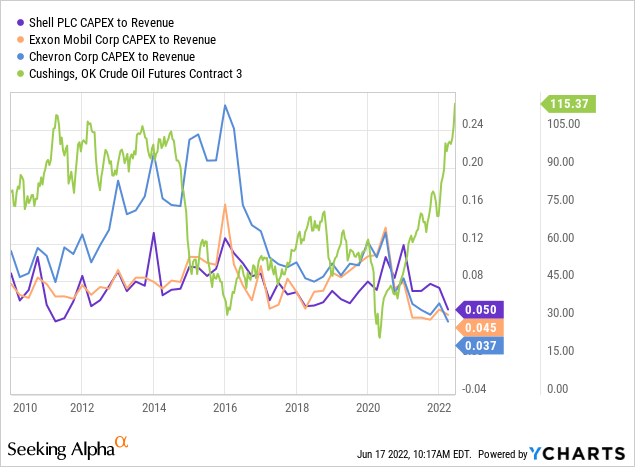

Crude oil is currently hovering around the $115 to $120 range and may rise higher over the coming months. As detailed in “USO: Why Crude Oil May Be On The Verge Of An Even Larger Breakout,” due to a lack of labor, years of low exploration, and regulation, many energy companies have been keeping capex spending at extreme lows despite high oil prices. See below:

Overall output has risen as older oil wells are slowly turned back online and previously “drilled-but-uncompleted” (i.e., “DUC”) wells are activated. Still, due to low capex and exploration, new drilling activity remains depressed. The U.S. rig count is starting to return to pre-COVID levels, meaning drilling should begin to increase. However, the fact remains that most oil companies have a very limited supply of freshly explored land to drill. Thus, while we may start to see a slowdown in the pace of oil inventory declines, the fundamental shortage seems likely to persist for years.

A Look At Shell’s Natural Gas Business

Of course, investors must also consider the natural gas segment, which has been highly volatile in recent months. Last year, Shell’s integrated natural gas business segment represented just over a third of its income. Since oil and natural gas are generally produced in similar areas, they’re subject to nearly identical fundamentals. The chief difference is that natural gas is comparatively easy to transport domestically over land but more costly to ship overseas (since it’s a gas, not a liquid). Shell generates a substantial portion of its income by liquefying and transporting natural gas.

As the E.U looks to reduce exposure to Russian natural gas, its demand for U.S. LNG has skyrocketed, benefiting U.S. LNG exporters such as Cheniere Energy (LNG). The price of E.U natural gas has skyrocketed even higher in recent days as Russia further restricted exports to Europe. Shell is generally a benefactor of this situation since it has a large fleet of LNG vessels capable of exporting to both the E.U and China where demand is high. Of course, demand for LNG in China may now be falling as it appears more of Russia’s gas is being diverted toward China.

On that note, until recently, Shell had significant investments and development projects in Russia. Most notably, the Sakhalin-2 integrated gas project is one of the world’s largest in scope. Shell is expected to see a mass $5B post-tax impairment due to its departure from Russian assets. However, the company has since garnered interest in some asset sales toward Asian energy companies. Overall, it seems that Shell’s natural gas business will represent a vital source of income during this volatile period and likely beyond as Asia becomes more dependent on natural gas.

The Downstream Dilemma

The energy crisis is being compounded by a more acute shortage in the downstream oil market. Last year, Shell generated slightly over half of its net income from its upstream oil (drilling) segment and about 15% from downstream oil products. This minor segment of Shell’s business is likely seeing substantial profits today as global “crack spreads” (the difference between gasoline, or similar, and oil crude oil prices) have risen dramatically to ~$50 (over 2X above average).

This factor is explained in more depth in “Valero Is Overvalued As Crack Spreads Are Unlikely To Sustain Extreme Highs.” The chief long-term cause for the increase is high gasoline demand in the U.S. combined with lackluster refinery capacity growth. However, there’s an acute increase in the spread due to a surge in U.S. gasoline exports to the EU, which has created a significant decline in gasoline inventory levels.

For Valero, which primarily operates refineries and other downstream assets, this will boost its short-term cash flow. However, I do not expect “crack spreads” to remain high for long as high gas prices are now resulting in demand destruction. Abnormally large crack spreads may boost Shell’s 2022 profits considerably, but it’s likely less of a long-term factor than is the upstream situation in oil and natural gas.

An Anti-Energy Energy Company?

The overall macroeconomic situation facing Shell is quite strong. Its Russia-related risk factors now seem to be played out, and I expect its LNG (and general natural gas segment) and its crude oil production to deliver solid profits for years. There’s the minimal capacity for global oil production growth, so even if prices eventually moderate, I believe they will remain well above production costs for many years.

Given Shell’s low valuation and strong expected earnings, I’m generally bullish on the stock and believe it’s a decent long-term investment. SHEL is currently trading at $49, below its January price, despite the considerable increase in prices since then. Compared to Chevron and Exxon, the stock has a much lower valuation but generally higher debt leverage and slightly worse growth. Still, its low valuation largely offsets these factors.

There are a few reasons behind Shell’s low valuation compared to the other largest oil companies. Chiefly, it has more significant global operations and exposure to geopolitical issues. Due to this, it also likely attracts far less U.S. investment (U.S. stock valuations remain elevated compared to peers). However, the primary reason may be because Shell is actively seeking to divest itself of its most productive assets.

Shell’s oil and gas reserves have declined considerably, and its production has, thus far, fallen slightly. Due to the company’s low capex and exploration spending, we can expect its reserves and production to continue to decline. A look at the company’s investor resources shows it’s marketing a considerable push to reduce fossil fuel use and increase renewables. However, for now, only a tiny fraction of the company’s income-generating operations are in the renewable sector, while most of its earnings come from fossil fuels.

From my perspective, its primary “ESG focus” is divestment and reduction in fossil fuel operations without a concrete plan to make up for lost earnings via renewables. To me, simply aiming for “net-zero emissions by 2050” is not a solid plan when there are minimal increases in revenue from renewable sources. Of course, there may be marketing benefits from doing so, but from an earnings standpoint, this plan may result in significant declines in output just as prices are highest.

Despite what seems to be a poor managerial plan, I believe SHEL is cheap enough today that it’s a solid bullish opportunity for longer-term investors. In the short run, significant financial market volatility may cause the stock to fall lower, particularly if gasoline slips further. However, SHEL has declined by nearly 20% over the past week and a half, so it may be a superior dip-buying opportunity compared to most stocks today.

Be the first to comment