blinow61/iStock Editorial via Getty Images

Introduction

As a dividend growth investor, I am always looking for additional income-producing stocks to fit my investment thesis. Every month, I either add to my existing positions or start a new one in companies that pay an increasing dividend at an average rate that surpasses the average rate of inflation.

When a company cuts its dividend, I sell my position in the company, as it symbolizes the management’s inability to allocate capital well. I did it with AT&T (T) recently, for example. After some time passes following the dividend cut, I may reexamine the stock and even buy it again as I did with Kinder Morgan (KMI). In this article, I will look at another company that cut its dividend recently: Shell plc (NYSE:SHEL)

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same methodology to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, Shell operates as an energy and petrochemical company worldwide. The company operates through Integrated Gas, Upstream, Marketing, Chemicals and Products, Renewables, and Energy Solutions segments. The company was formerly known as Royal Dutch Shell plc and changed its name to Shell plc in January 2022.

Wikipedia

Fundamentals

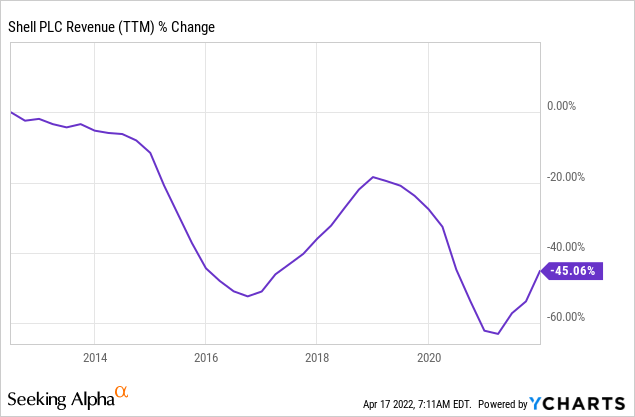

Shell’s revenues have significantly declined over the past decade. This has happened for two main reasons. First, the company, like many other supermajor oil companies, changed its strategy from focusing on volume to focusing on profitability. Shell only wants high ROI projects, even if it means extracting fewer barrels. Second, the business is cyclical and relies heavily on the prices of oil and gas. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Shell to enjoy 45% sales growth this year, and then a ~20% decline in the medium term as energy prices stabilize.

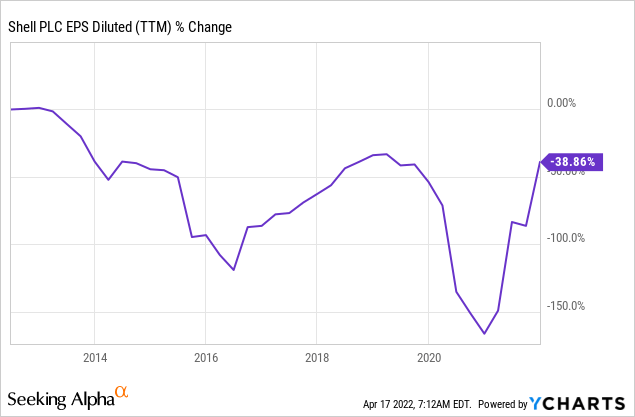

The company’s EPS (earnings per share) has also declined significantly, but it didn’t decline as much as the sales declined. The reason for that is that Shell as I mentioned focused on profitable projects. Therefore, despite significant share issuance, the company managed to contain the EPS decline. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Shell to enjoy ~80% EPS growth this year, followed by a decline in the medium term as energy prices are expected to stabilize.

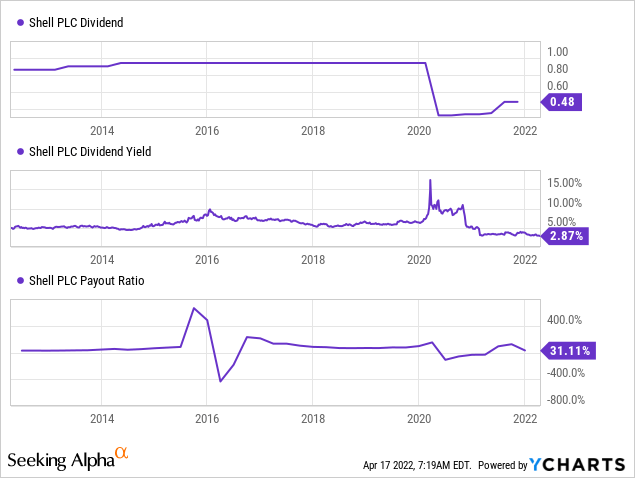

Shell used to pay a stable dividend. It didn’t raise it on an annual basis, yet it also did not cut until the pandemic hit. The dividend was reduced by over 50%, and as the economy and the energy prices recovered, it was raised twice. Therefore, Shell is not a dividend growth stock, but it is aspiring to become one again as management targets annual dividend increases. The current dividend is secured with a conservative payout ratio.

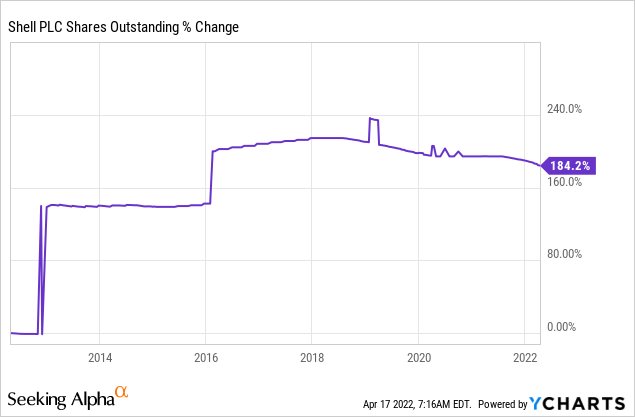

Shell is also executing buybacks in addition to the dividend. The company spent $3.5B on buybacks in H2 2021 and plans to spend $8.5B in H1 2022 as it uses the proceeds from the Permian divestment. As the company divests traditional oil and gas assets, it returns the proceeds to its shareholders. Despite significant buybacks, the number of shares has increased as the company is also issuing shares to fund acquisitions. Buybacks in addition to dividends are an advantage as the company transforms and sells assets while investing in future growth.

Valuation

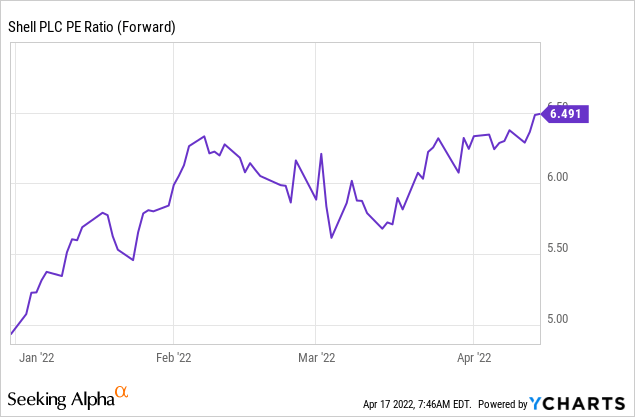

The company’s P/E (price to earnings) ratio is 6.5 when taking into account the forecasted earnings for 2022. This is a very low valuation even when taking into account the fact that it has the highest valuation seen in the past twelve months. The company’s valuation is low as investors believe that current high energy prices won’t last, and that Shell is transforming its oil and gas business.

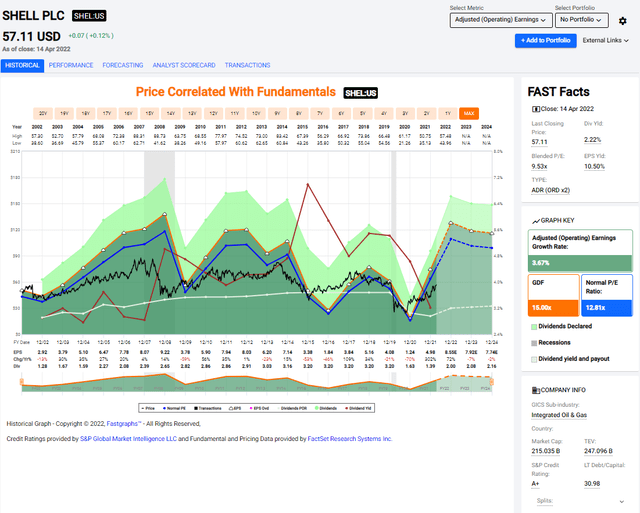

The graph below from Fastgraphs.com shows how cheap Shell is compared to its average valuation. Over the last two decades, the average P/E for Shell was 12.8, and the current forward P/E is less than half of that. We see such low pricing when cyclical companies enjoy a peak in their sales as forecasted for Shell. While investors should be cautious, the current valuation does seem attractive.

To conclude, Shell is transforming from a traditional oil and gas company as it divests assets and invests in renewables and carbon capture technologies. We see sales and EPS declining and a reset to the dividend to allow enough capital to be invested. A transformation is always risky, and that’s why we see a low valuation as investors are still skeptical.

Opportunities

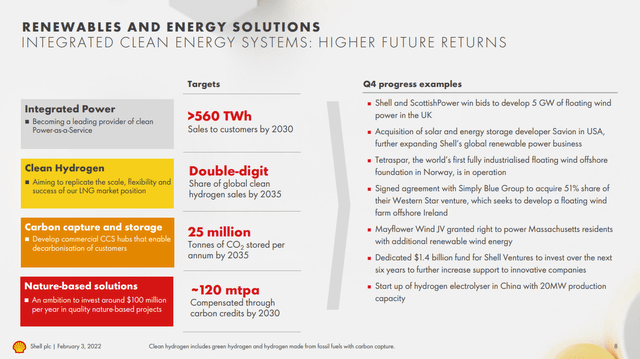

The transformation of Shell towards a business with high exposure to renewables is its main growth opportunity. The company expects high future returns following its investments. The company is also going to enjoy a more stable stream of revenues. Unlike basic materials prices that fluctuate, services like electric vehicle charging stations are easier to monetize as the company is not a price taker.

Carbon neutral investment also enjoys regulatory support. Lawmakers around the world support investments in renewables, and that includes both energy production and infrastructure for electric transportation. Shell will enjoy this tailwind as it keeps investing both in clean energy production and storage and electric vehicle charging stations as its peers suffer from growing scrutiny by regulators.

Moreover, less focus on oil and gas will mean more assets in Western countries. Shell has suffered from its investments in Russia as it is now divesting due to the Russian invasion of Ukraine. Operating in stable markets will lower the level of uncertainty in Shell’s investments and will increase the confidence of investors in the stability of the free cash flow.

Risks

The first risk is the transformation, as it is raising the level of uncertainty. Transformation requires significant investments in new projects where there is some very high interest. Therefore, it will not only require significant investments, but it will also be hard to find great deals with ROI similar to what Shell and other supermajors are used to from traditional oil and gas projects.

The second risk is execution risk, and it is also significant. Shell historically has the expertise when it comes to oil and gas exploration, sales, refining, and transportation. It is not an expert when it comes to renewables or other “green” solutions and services such as charging stations. Therefore, there is a risk that Shell won’t be able to execute these projects well and it may struggle to achieve high ROI on its investments.

Another risk is the competition for investors’ capital. The company is competing with other supermajors like Chevron (CVX) and Exxon Mobil (XOM), who do not deploy significant capital on renewables projects and keep focusing on oil and gas. With high inflation and higher rates, investors may prefer present cash flow over investments for future cash flow from renewables and it may pressure the share price in the short term.

Conclusions

Shell offers investors a great vision and the free cash flow to fund it. The company has a great prospect of shifting into a carbon-free economy. It funds it with its oil and gas assets as it slowly divests them. The company trades for an attractive valuation as it works on the transformation into a new energy company, that will be different from its peers.

However, this transformation contains some risks mainly around the execution as the company is not experienced in this new realm. Therefore, I believe that the right way to gain exposure to Shell is by combining it with Chevron and Exxon which will rely more heavily on oil and gas in the medium term. This way investors will have complete exposure to both short-term trends and long-term investments.

Be the first to comment