Sundry Photography

Investment Thesis

ServiceNow (NYSE:NOW) has drawn the attention of many investors lately as it is a company that manages to grow at a rapid pace in an environment where other companies struggle to keep being lucrative. Moreover, ServiceNow is a profitable company with a great cash flow generation capability, so it is not surprising that it managed to reach a market capitalization of more than $140 billion.

However, the fact that it is currently trading at a P/E of 396 is posing the essential query: “Is it worth the money?”

The short answer is NO. I don’t believe that ServiceNow will outperform the market in the long run and I rate it as a sell.

ServiceNow Business Model

ServiceNow Business Model (medium.com)

By using ServiceNow, a cloud-based workflow automation platform, enterprise firms can increase operational efficiencies by streamlining and automating common work operations.

About 95% of ServiceNow’s revenue comes from subscription fees; the exact amount a client must pay depends on the features they need and the degree of customization.

The company has three (3) sources of revenue:

1) The Now Platform

The Now Platform is a pre-built solution with several features that can be used with both custom apps and cloud services. Web services offered by the Now Platform include edge encryption, automated testing frameworks, performance analytics, and reporting. Additionally, there are higher tiers of functionality available for customers who want greater personalization.

2) The Nonstop Cloud

The cloud architecture used by ServiceNow is known as the “Nonstop Cloud,” and it is constantly operational. The Nonstop Cloud is safe, reliable, and adaptable to meet the needs of individual clients while still complying with international laws.

3) Cloud services

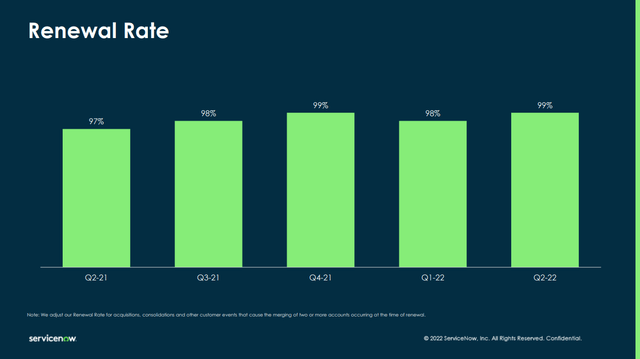

The five categories that make up cloud services are business software, security, customer support, HR, and IT. Each area is further divided into a number of sub-functions, including project portfolio management, agile development, incident response, and customer and staff satisfaction. The percentage of consumers whose contracts are renewed when their subscriptions expire is known as the renewal rate.

Renewal Rate

The percentage of consumers whose contracts are renewed when their subscriptions expire is known as the renewal rate.

The fact that ServiceNow has a renewal rate of 99% implies that the services it offers are high quality and are well worth its customer’s money as they are willing to pay it again and again.

This will help the company limit its expenditures and thus increase its margins as compared to keeping a current customer, acquiring new customers is five times more expensive.

Fundamentals And Stock Price

Although ServiceNow is a $70 billion company it managed to still grow its top-line revenue at tremendous rates every and each year since it was listed in the stock market back in 2012.

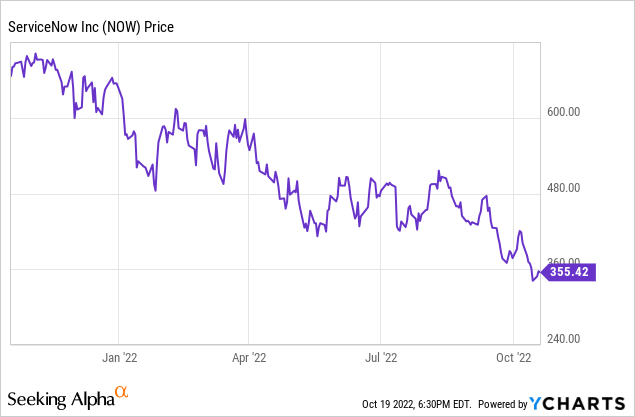

However, this high growth and the strong financials that characterize the company are not depicted in the stock price as it has plunged about 50% from its all-time high of $707.60.

Now that the price has reached $355, many investors may believe that this is a good time to buy the dip, but is this really the case?

ServiceNow P/S is 9.39 compared to its sector’s median of 2.50. The company also is trading at a quite high P/E GAAP (TTM) of 396. Investors often only pay for this kind of valuation during the early phases of a company’s growth to those that are expanding the fastest. A company will expand more slowly as it matures, and the P/E ratio will typically drop. Thus, in order for ServiceNow’s P/E to be justified, the business should possess a very promising future in addition to a strong moat.

According to analysts, ServiceNow checks at least the first box as the revenue forecast for the company is 20%-25% for the next 4 years. But is that enough?

At the end of the day, without profit, sales increase is pointless and at this point NOW barely makes ends meet, having a net income margin of 2.79% although it has been lucrative since 2019.

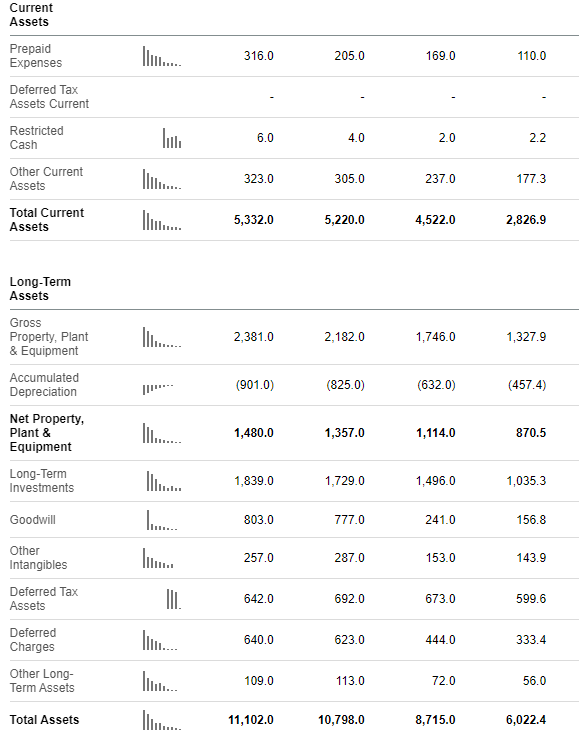

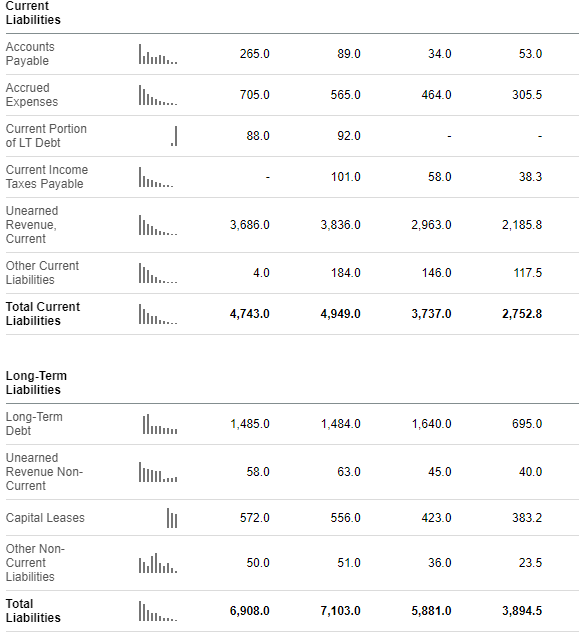

ServiceNow – Balance Sheet

Seeking Alpha Seeking Alpha Seeking Alpha

I would say that ServiceNow’s balance sheet is neither good nor bad. The company’s long-term debt is more than what I usually like to see, especially in a high-rate environment, but it’s manageable. The worth of its total assets outnumbers the total liabilities that the business has, which is reassuring for the company’s investors as they at least know that the company will most probably not go bankrupt at least in the near future. However, I would like to see its current liabilities being higher than its total liabilities in the future just to have a bigger margin of safety.

Valuation, Is It Worth The Risk?

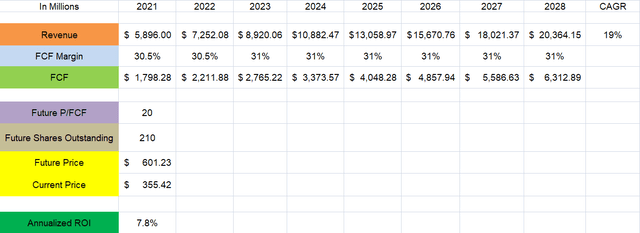

This time I went a bit more aggressive on the revenue growth rate, just to prove my point, projecting a CAGR of 19% for the next 6 years. I kept the FCF margin at 31%, about the same as it is now. I believe 31% is pretty rational as it is high enough for a SaaS business but low enough to cover the case of the increasing competition that will cause margin pressure. Add to that a P/FCF of 20 (which is also a bit aggressive if we take into consideration the fact that historically, the S&P 500’s average P/E ratio has fluctuated between 13 and 15) and you get a future price of $601.26 in 2028.

By buying the stock at $355.42, even in the bull case scenario that the numbers above do come true, you are going to have an annualized ROI of less than 8%. By investing your money in an ETF that tracks the S&P 500, you are going to have an average ROI of almost 10% as history has shown by taking much less risk as you are putting your money in the 500 large companies listed on stock exchanges in the United States instead of just one.

So is ServiceNow really worth it?

Risks

Competition

The only conspicuous risk that I see at the moment is competitive pressure. There are numerous other players who might create items to rival the company’s offering, which could put the company under further competitive pressure. Furthermore, if these players adopted a more aggressive expansion plan, the numerous businesses that are active in the ITSM industry would result in increasing competitive pressures. Additionally, there are specialized competitors in each industry that ServiceNow enters beyond its more established, which might compete with it and make operating circumstances more difficult for a new entry.

Conclusion

Overall, ServiceNow is a great business with strong fundamentals and a decent balance sheet; just not the right price. Personally, I would consider buying the company’s stock for under $200. At $355, it is just not worth the risk for me and I would rather put my money in another stock that I consider to be a bargain.

Be the first to comment