lauradyoung/E+ via Getty Images

The Silver Lining To High Inflation

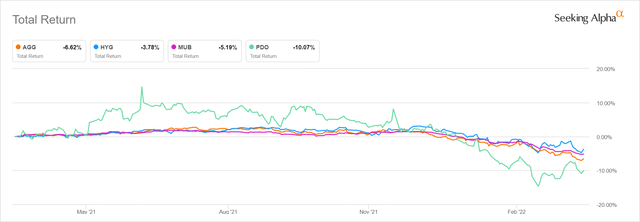

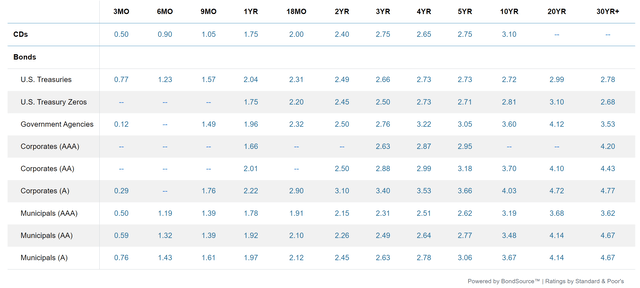

It’s been one year since my first article on Series I US savings bonds. If you followed my advice and bought some in May 2021, you set yourself up to earn 5.33% over the first 12 monthly interest payments. That’s a lot better than the sub-1% yields from CD’s and money markets and the negative returns from most bond funds.

The idea has started to catch on, with a few more authors discussing the merits of savings bonds since then. However, with the recent CPI release, it’s worth repeating. Series I savings bonds bought before May 1 are sure to earn 8.37%, as much as some closed-end high yield bond funds with almost none of the risk.

While rates on other fixed income investments have come up since last year, the current inflation spike makes the yield advantage of savings bonds even wider.

Inflation is not pleasant but the bright side is the opportunity to lock in a great return for the next year with limited risk. Purchases for each calendar year are limited to $10,000 bought electronically through TreasuryDirect plus $5,000 in paper bonds received as part of your income tax refund. This may not sound like a lot to some investors, but the current rates should make it worth your time to max out contributions for yourself and others in your household before committing funds to other fixed income investments.

8.37% Sounds Great! How Did You Calculate It?

Series I savings bond rates are adjusted every six months. The rate for the first six months changes on May 1 and November 1 of each year based on the change in the consumer price index (CPI-U) in either the October-March or April-September periods. The CPI report just released sets the first six-month rate for all savings bonds sold from 5/1/2022 to 10/31/2022.

Each 6-month change in CPI represents a semi-annual rate, so added together they make up the annual rate. For bonds bought in April 2021, the rate is determined as follows:

| April 2021 CPI | 264.877 | |||

| Sept. 2021 CPI | 274.310 | |||

| 6-month change | 3.56% | |||

| (sets semiannual rate for bonds sold from 11/2021 to 4/2022) | ||||

| Sept. 2021 CPI | 274.310 | |||

| March 2022 CPI | 287.504 | |||

| 6-month change | 4.81% | |||

| (sets semiannual rate for bonds sold from 5/2022 to 10/2022) | ||||

The 8.37% rate that I quoted is just the sum of these two semi-annual rates. If you wait until after May 1, your first six initial payments will be higher, but you run the risk of inflation cooling off during the 4/2022-9/2022 period that would determine your second six months of interest payments. It could be lower than the 3.56% shown above.

The Fine Print

The actual Series I rate is technically a combination of the 6-month variable rate calculated above plus a fixed rate which remains constant over the life of the bond. Since November 1, 2010 the fixed rate has been either zero or less than 0.5%. The Treasury does not disclose how they set the fixed rate but in my experience, it tends to creep above zero when needed to make the savings bonds competitive with prevailing CD rates. While this happened in 2019, current CD rates are so far below savings bond rates that the fixed component will almost certainly be zero when announced on May 1.

Another caveat is that there is a three-month delay in interest payments for the first 5 years of ownership in order to create a penalty for those who sell before 5 years. For example, if you buy a bond in April 2022, no interest will be credited to your account on May 1, June 1, or July 1. Starting on 8/1/2022 and running through 1/1/2023, the bond will be credited monthly based on the 3.56% semi-annual rate noted above. From 2/1/2023 to 7/1/2023, the bond will be credited monthly based on the 4.81% rate. This pattern continues until 5/1/2027 when you will be credited with an extra 3 months of interest at the then-prevailing rate.

Bonds must be held for a minimum of 12 months, so if you buy in April 2022 and sell in April 2023, your actual return will be only 3.56 + 4.81/2 = 5.96%. In the past, I have held savings bonds for the minimum 1-year period when CD rates were competitive. I do not expect that to be the case this time around, so I think it’s worth holding beyond the minimum 12-month period.

Interest is always credited on the first of the month at a full-month’s rate, regardless of the date you purchased the bond.

How Do I Load Up?

The $10,000 electronic limit can be a deterrence to higher net worth individuals. You have to decide for yourself if the work needed to set up the Treasury Direct account and track it is worth the payout. In my case, the minimal effort required to earn $837 with a maximum $10,000 savings bond purchase vs. $150 or less in a CD is worth it.

If that’s not enough incentive, for minimal extra work, you can set up TreasuryDirect accounts for others in your household. To own savings bonds, all you need is to have a social security number and meet any one of these three conditions:

- United States citizen, whether you live in the U.S. or abroad

- United States resident

- Civilian employee of the United States, no matter where you live

For children under 18, a parent may open a custodial TreasuryDirect account linked to the parent’s account. The parent can buy bonds in the child’s account on their behalf without it counting against the parent’s $10,000 limit. Any adult can also buy bonds to donate as a gift. The purchase counts against the recipient’s $10,000 limit and not the giver’s.

Savings bonds are not taxed until they are redeemed. At that time, they are exempt from state tax. They are not exempt from federal tax except when the proceeds are used for qualified higher education expenses. For parents of teenagers starting college soon, I Bonds are a great way to top off the college fund and earn a good return without worrying about loss of principal.

Conclusion

Since I and several others have written in detail on Seeking Alpha about Series I Savings Bonds, this article was not meant to answer every question about them. My point here is to highlight the excellent guaranteed 8.37% rate available before May 1. For more information, click on the links in this article, visit TreasuryDirect.com, check out Jim Sloan’s recent detailed write-up, or just post a question in the Comments. Seeking Alpha readers have been very helpful answering each other’s questions on this topic.

Inflation isn’t fun but it does create an opportunity to earn a safe, guaranteed high rate on a portion of your fixed income allocation. Buying Series I savings bonds in April 2022 locks in a return of 8.37% on the first year of interest payments.

Be the first to comment