piola666

Investment Thesis

SentinelOne (NYSE:S) has upwards revised its guidance not once but twice so far this year. It’s executing all around and delivering results that the market craves, both on its top line, and perhaps more importantly in the current market, on its bottom line.

But is this enough? I don’t believe it is. And even though investors are fully anchored to the recent past, particularly where the share price was this time last year, I argue that last year’s environment has very little resemblance with the current environment.

I maintain that SentinelOne is best avoided.

What’s Happening Right Now?

SentinelOne bounced hard from the lows it made in early summer. There’s been a lot of stocks in tech that are now revisiting the summer lows, but SentinelOne isn’t one of them. There are a few others that are showing some strength, such as Netflix (NFLX) and Snowflake (SNOW), but for all intents and purposes, outside of a few names, the bear continues to gnaw through tech names.

SentinelOne’s Near-Term Prospects

SentinelOne is an “out-of-box”, Extended Detection Response (“XDR”) platform. Its core product Singularity XDR continues to see strong adoption by its customers.

S shareholder letter, Q2 2023

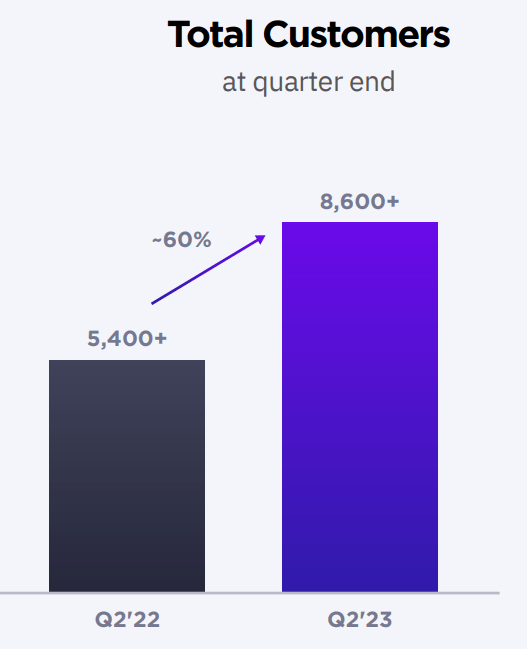

In fact, what stands out most from its recent results is not only that it saw customer adoption grow by 60% y/y, but that this total customer growth actually accelerated from Q1 2023 when it was up 55% y/y.

Clearly, this is a very bullish indicator that customers are strongly resonating with SentinelOne’s XDR offering.

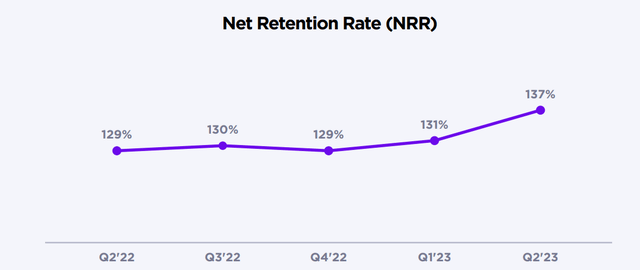

Next, consider SentinelOne’s net retention rate.

As a growth investor, the NRR above is just so alluring. Not only is it above the high-quality SaaS-average hurdle of 120%, but it has continued trickling higher over the past few quarters.

Altogether this echoes the bullish thesis, that irrespective of what’s happening in the macro environment, enterprise IT spending is non-discretionary. And I fully agree with that premise, in fact, I do own a cybersecurity name, just not SentinelOne.

Moving on, as enterprises nearly unanimously move towards a multi-cloud environment, workloads require automated breach defenses, against increasingly fast and accurate cyberattacks. Thereby providing a strong and secular tailwind for cybersecurity companies.

What’s more, on the back of SentinelOne’s acquisition of Attivo Networks, SentinelOne’s product portfolio is now increasingly broad from endpoint detection, to cloud, and now identity capabilities.

Clearly, SentinelOne has a lot of promise.

But Are Shareholders Benefiting?

Here’s one problem, on the back of revenues growing 124% y/y, the total number of diluted shares was up 130% y/y. As an investor, one has to think, at what point does this business model start to work in my favor?

If revenues are up triple digits, but my holding is getting diluted in the triple digits too, there’s a problem with the overall business model.

What at first glance seems to be an asset-light business with high returns on investment, all of a sudden doesn’t seem that asset-light.

S Stock Valuation — Finding Intrinsic Value

We all want high-quality secular growth businesses. We all want to buy and hold positions. Nobody wants to have to underwrite their investment every 90 days. And the great advantage of high-growth compounders is that if the business has a large TAM, you only have to make the decision once, set it and forget it. It’s relatively low maintenance. With strong tax advantages.

What’s more, since the stock has already sold off substantially in the prior year, therefore it “must” today be undervalued today.

However, that’s where I disagree. What made sense when interest rates were at 0%, is not the same as what makes sense when interest rates are at 4%. It’s a whole different story.

And if the business clearly free cash flow negative, different decisions need to be made. There’s no way that SentinelOne will be able to continue to “investing for growth” without having to figure out at what point can it start to carve a sustainable path to profitability.

Because there are other cybersecurity names that are already much more profitable (at least non-GAAP), that are being priced at 12x forward sales, and sometimes even cheaper than 10x forward sales.

It makes no sense to declare that SentinelOne is undervalued at its still today priced at 10x next year’s revenues.

The Bottom Line

Just because SentinelOne has sold-off and has been a poor performer in 2022, does not mean that the stock is undervalued.

It doesn’t make any difference the place where SentinelOne was being valued last year. The only consideration that matters is where SentinelOne’s stock is headed in the future. And I believe that there’s still more multiple compression to come for SentinelOne.

Be the first to comment