PeopleImages/iStock via Getty Images

A Quick Take On SentinelOne

SentinelOne, Inc. (NYSE:S) went public in June 2021, raising approximately $1.23 billion in gross proceeds from an IPO that was priced at $35.00 per share.

The firm sells cybersecurity software that enhances endpoint protection for organizations worldwide.

Given a slowing revenue growth trajectory and high & increasing operating losses, I’m on Hold for SentinelOne in the near term.

SentinelOne Overview

Mountain View, California-based SentinelOne was founded to develop its XDR platform that uses AI models to detect security vulnerabilities for each endpoint and cloud workload.

Management is headed by co-founder, Chairman, president and CEO Tomer Weingarten, who was previously Vice President of Products at Toluna Holdings.

The company’s primary offerings include:

-

XDR platform

-

Static and behavioral AI models

-

Singularity platform – multi-tenancy for multi-cloud environments.

The firm seeks relationships with medium and large-sized customers via direct sales and marketing efforts as well as through a variety of channel partners.

SentinelOne’s Market & Competition

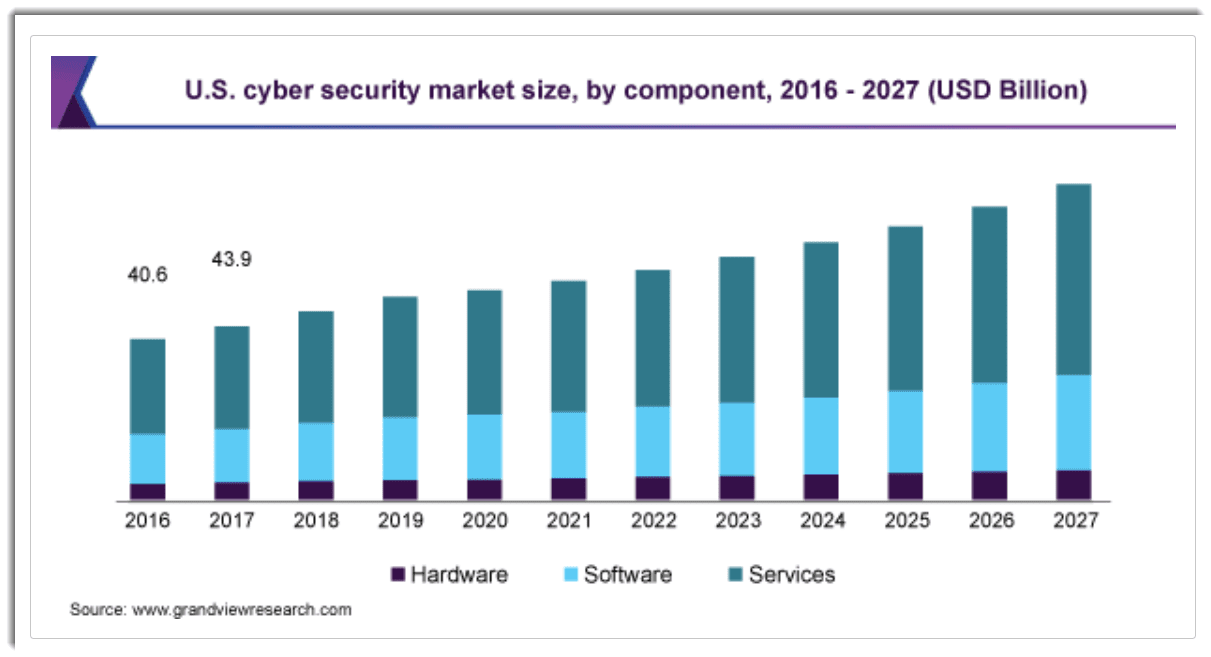

According to a 2020 market research report by Grand View Research, the global market for cybersecurity software and services was an estimated $157 billion in 2019 and is expected to exceed $300 billion by 2027.

This represents a forecast CAGR of 10.0% from 2020 to 2027.

The main drivers for this expected growth are constantly changing cyber threats against a backdrop of more complicated consumer and enterprise software requirements and infrastructures.

Also, the transition of enterprise IT from on-premises to the cloud will create significant new opportunities for new services and capabilities.

Below is a chart showing the historical and projected U.S. cybersecurity market dynamics by component:

U.S. Cybersecurity Market (Grand View Research)

Major competitive or other industry participants include:

-

CrowdStrike

-

VMware

-

McAfee

-

Symantec

-

Microsoft

-

Palo Alto Networks

-

Others.

SentinelOne’s Recent Financial Performance

-

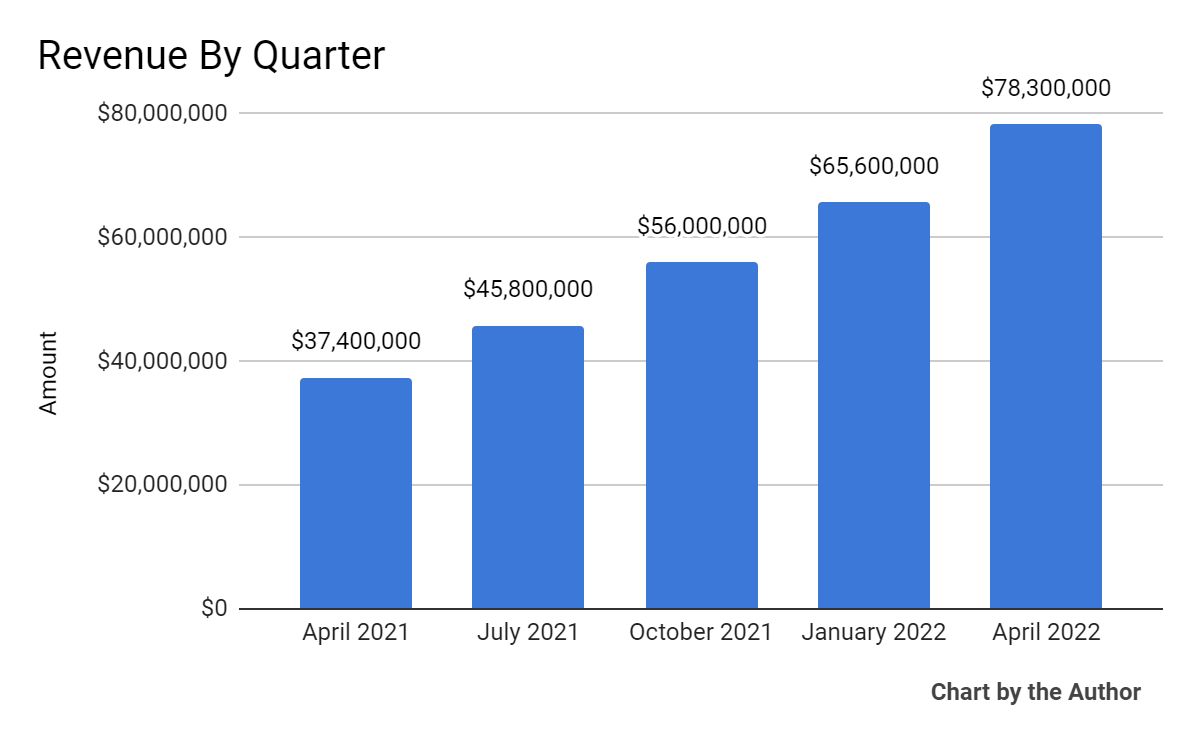

Total revenue by quarter has grown markedly in the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

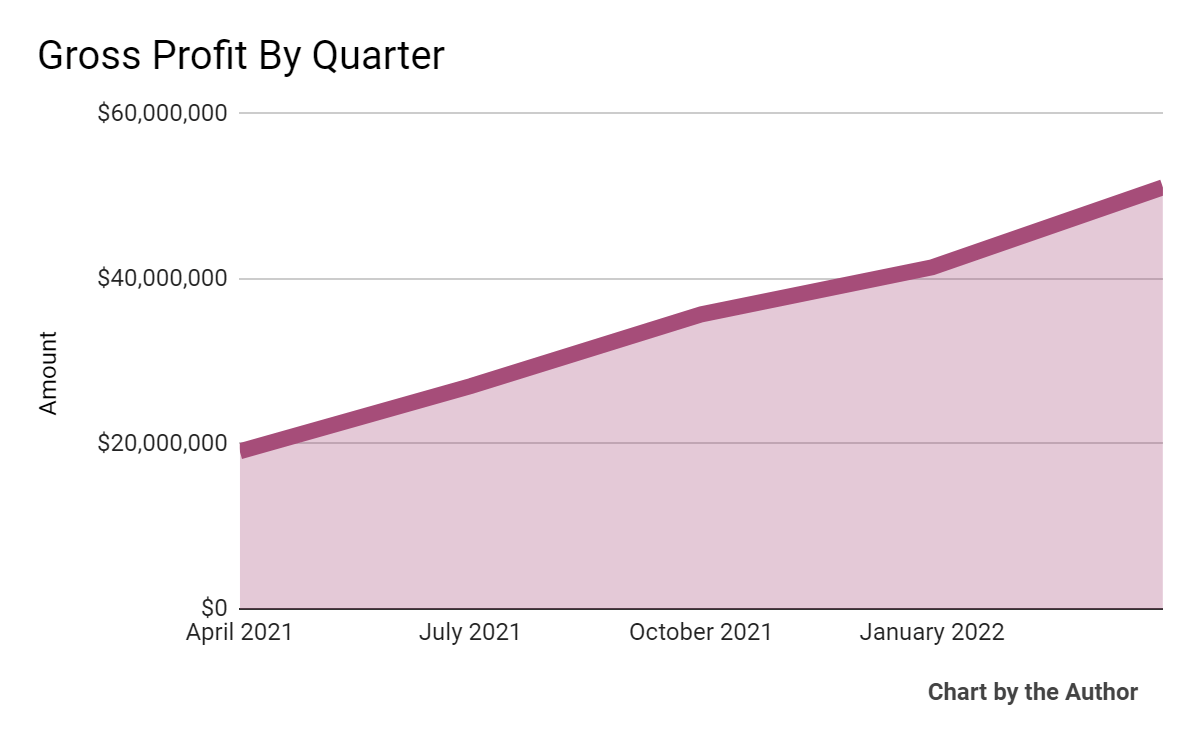

Gross profit by quarter has followed approximately the same trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

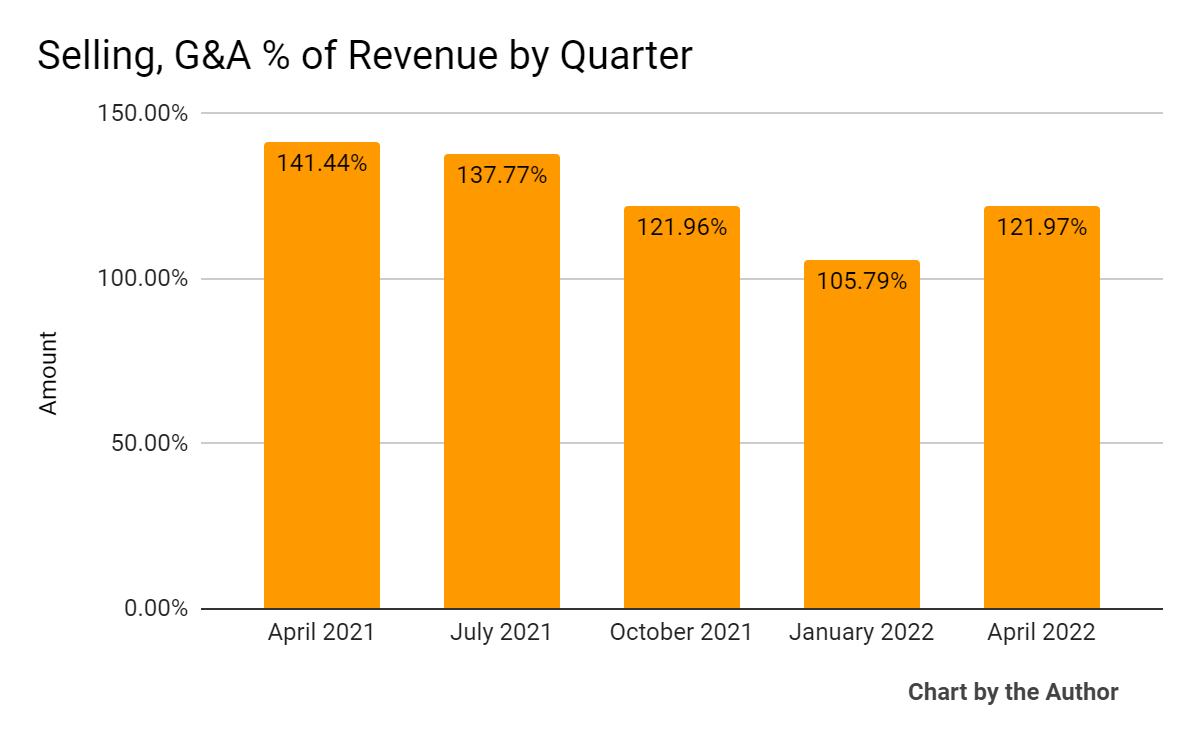

Selling, G&A expenses as a percentage of total revenue by quarter have remained elevated in recent reporting periods:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

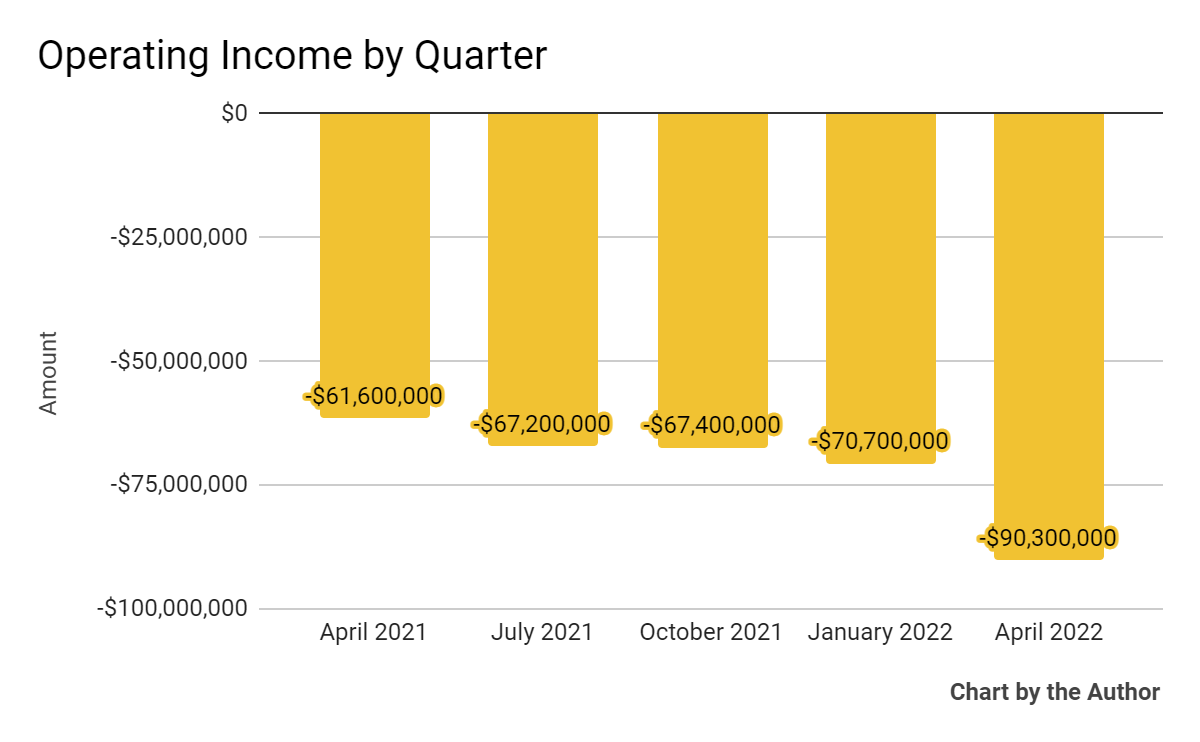

Operating losses by quarter have worsened substantially in the most recent quarter:

5 Quarter Operating Income (Seeking Alpha)

-

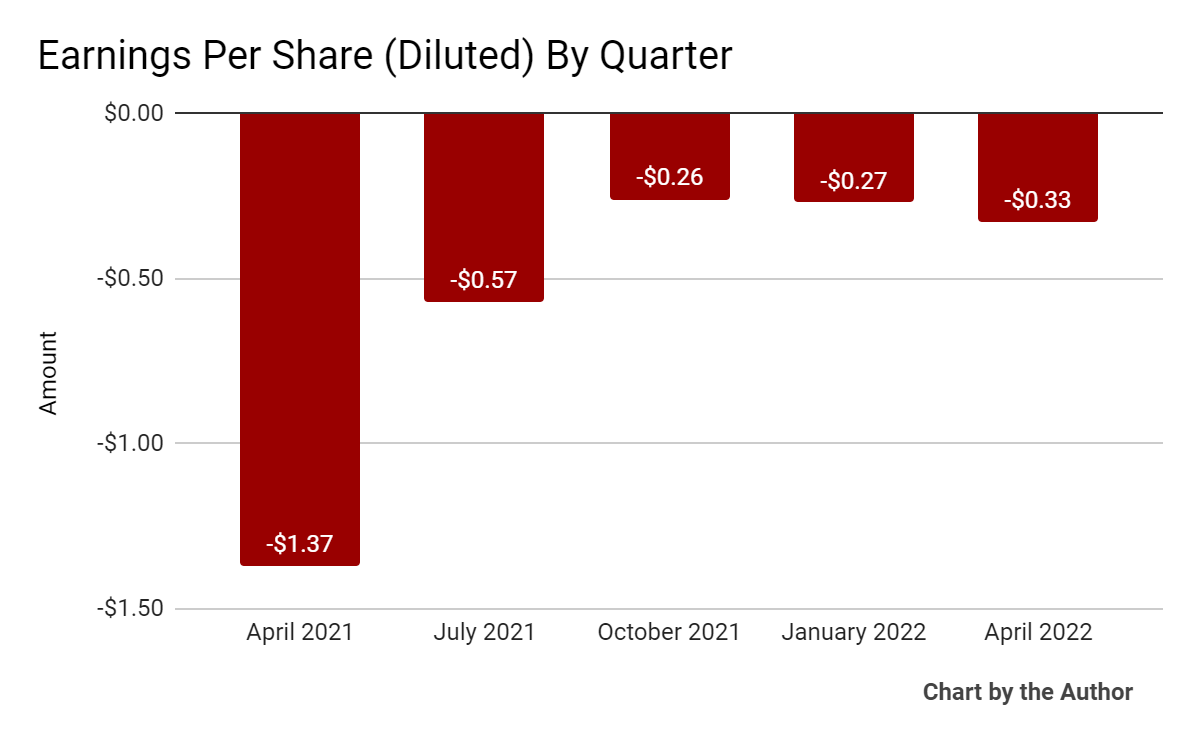

Earnings per share (Diluted) have remained heavily negative, as the chart shows below:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP).

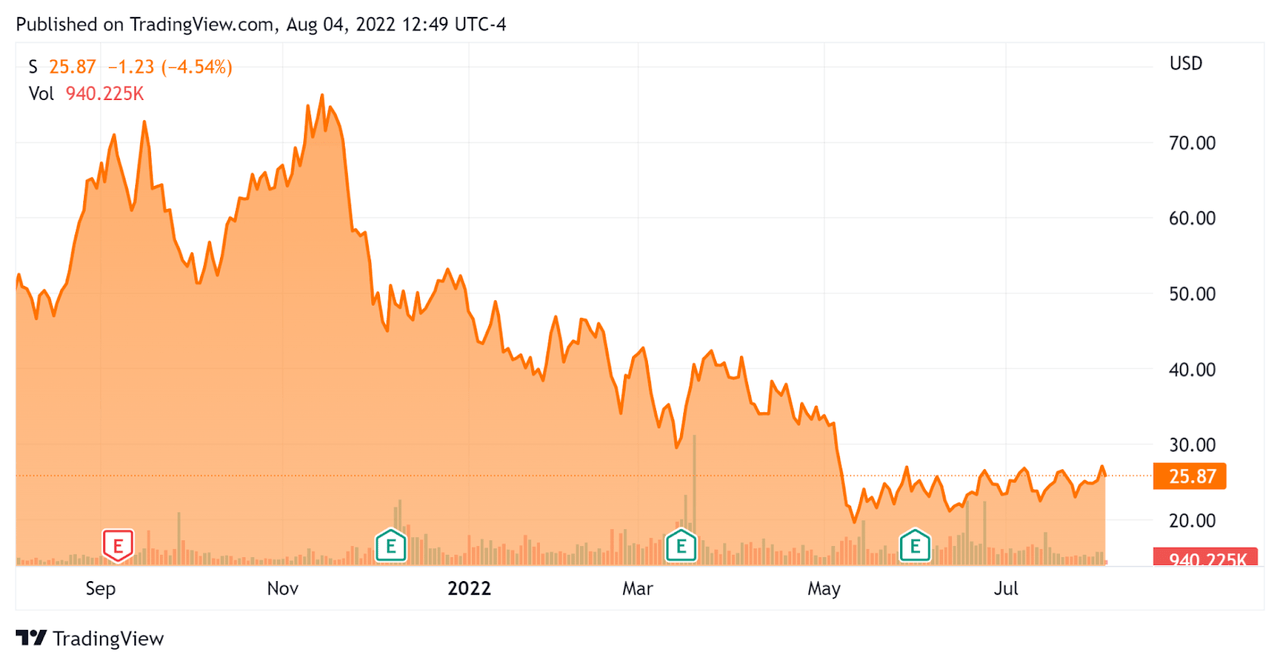

In the past 12 months, SentinelOne’s stock price has fallen 50.3% vs. the U.S. S&P 500 Index’s drop of around 5.8%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For SentinelOne

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$5,970,000,000 |

|

Market Capitalization |

$7,560,000,000 |

|

Enterprise Value/Sales (TTM) |

24.31 |

|

Revenue Growth Rate (TTM) |

118.38% |

|

Operating Cash Flow (TTM) |

-$114,140,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.43 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be CrowdStrike (CRWD); shown below is a comparison of their primary valuation metrics:

|

Metric |

CrowdStrike |

SentinelOne |

Variance |

|

Enterprise Value/Sales (TTM) |

26.86 |

24.31 |

-9.5% |

|

Operating Cash Flow (TTM) |

$642,210,000 |

-$114,140,000 |

-117.8% |

|

Revenue Growth Rate |

63.8% |

118.4% |

85.6% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

S’s most recent GAAP Rule of 40 calculation was just 1% as of Q1 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

118% |

|

GAAP EBITDA % |

-117% |

|

Total |

1% |

(Source – Seeking Alpha)

Commentary On SentinelOne

In its last earnings call (Source – Seeking Alpha), covering FQ1 2023’s results, management highlighted its margin expansion results from its land and expand go-to-market strategy.

The company “added a record number of new customers in the quarter,” performing better than its fiscal 4th quarter just ended.

Notably, its net retention rate was 131%, the highest in company history and an impressive result. A net retention rate above 100% indicates negative net churn, so the firm is performing well in its land and expand strategy.

As to its financial results, revenue grew 109% year-over-year, with strong demand across all major geographies. International revenue rose 129% to now account for one-third of total revenue.

Non-GAAP gross margin increased to 68%, growing 15% year-over-year.

However, GAAP operating losses increased markedly, reaching a breathtaking $90.3 million during the quarter, driven by large increases in SG&A expenses and R&D costs.

For the balance sheet, the company finished the quarter with cash, equivalents and short-term investments of $1.6 billion and no long-term debt.

Free cash use was $52.2 million, the highest quarterly use of cash in the past nine quarters.

Looking ahead, management raised its full-year revenue growth guidance to approximately 98%, a very high figure that would nonetheless result in a slower-growth result than the 118% trailing twelve months growth rate.

Regarding valuation, the market is valuing SentinelOne at a similar EV/Revenue multiple as it is valuing the much larger firm CrowdStrike.

Both companies are generating significant operating losses while producing strong topline revenue growth. Stock-based compensation is a large expense item for both companies, diluting equity investors in the process.

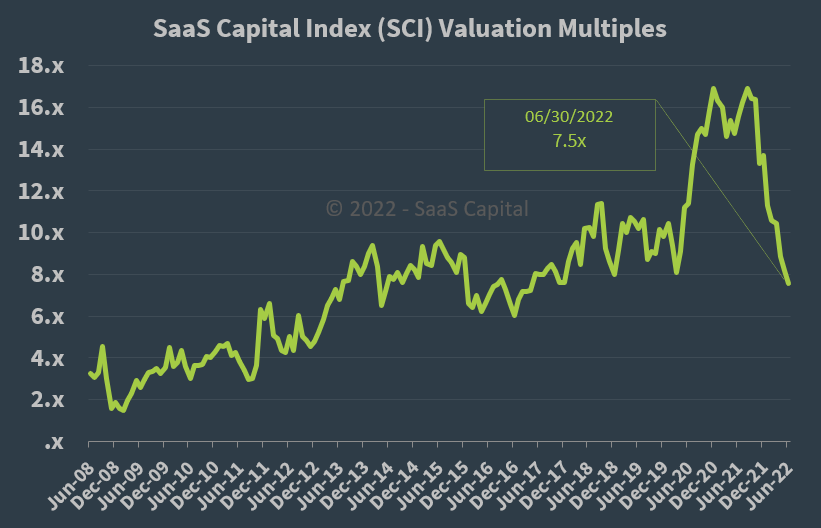

The SaaS Capital Index of publicly held software as a service (“SaaS”) software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, with an EV/Sales of 24.3x by comparison, S is currently valued by the market at a very high premium to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth estimates.

Although the firm is producing strong growth and high net retention results, management appears more than willing to generate high operating losses to pursue growth.

Investors who are willing to wait for better operating results may wish to consider SentinelOne as a high-growth component in their portfolio.

However, the stock already has a high multiple by the market and growth appears to be slowing somewhat.

Given a slowing revenue growth trajectory and high & increasing operating losses, I’m on Hold for SentinelOne in the near term.

Be the first to comment