traveler1116

I am told time and again that one should not fight the Fed. But, unfortunately, this is just a nicety which is believed by most in the market, but is not supported by the facts of history.

Let’s look at just two examples. Back in the spring of 2011, I outlined to those that followed me that I was looking for a bottom in the DXY in the 73 region, and expected a multi-year rally to the 103.32 region. That was an expectation for a 40% rally in the DXY, which is an extremely large move in the DXY.

But, what made this market call that much more outlandish at the time was that this was during a period of time when the Fed was engaging in aggressive quantitative easing. If you remember that period of time, the market was absolutely certain that QE was going to make the dollar crash. I was clearly told “you can’t fight the Fed” by all those that thought my call to be nothing less than ridiculous.

Well, as we now know, the DXY bottomed at 72.70 in May of 2011, and proceeded to rally over the coming six and half years until it topped at the 103.82 level (50 cents beyond my long-term target), and then went into a 4 year pullback/consolidation, as per our expectations. So, I guess you can fight the Fed.

Another major example of our ability to fight the Fed was seen in November of 2018. At the time, the Fed was engaging in a rate raising program, and was deeply entrenched in its intention. But, as the TLT was approaching the 112/113 region, I outlined to the members of The Market Pinball Wizard that I was going to be a buyer of TLT in the 113 region. Again, I was told that the Fed was still raising rates and that you cannot fight the Fed. Well, as we now know, TLT bottomed at 111.90, and proceeded to rally into 2020 towards the 179 region.

In fact, I even outlined this trade in a blog post I made a month later on Seeking Alpha:

Don’t Fight . . . Er . . . I Mean Don’t Follow The Fed

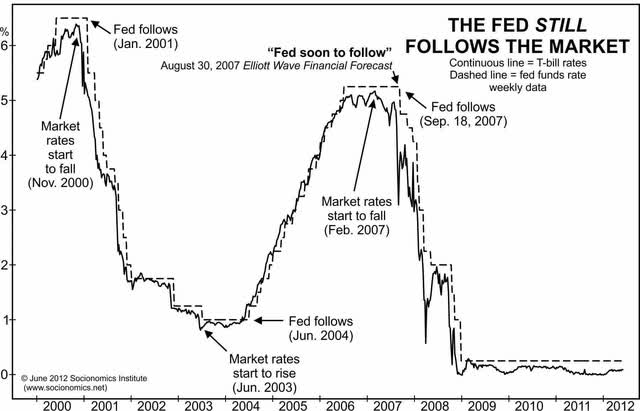

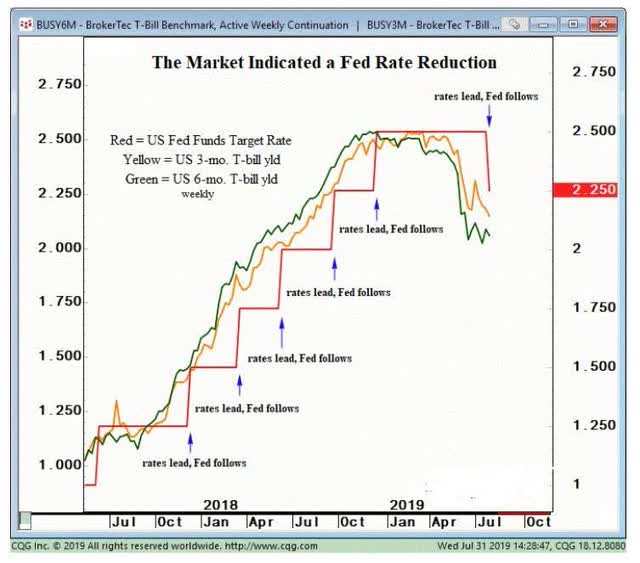

Now, for those of you that think the Fed controls rates, I have another surprise for you: The Fed follows the market. It does not lead it. And, if you don’t believe me, maybe you will believe your own eyes:

So, I am seeing another opportunity to fight the Fed developing. As we know, the Fed is raising rates quite intently once again. And, the predominant question being asked by market participants is just how fast will the Fed raise rates to control inflation? Yet, the market is telling me again that it is going to see lower interest rates as we look into 2023. And, I have outlined this view in prior articles on Seeking Alpha.

We are now approaching the culmination of the decline which began at 179.70 in TLT back in March of 2020. I am seeing the market completing the final segment of this decline, which should then resolve in a reversal to the upside and the commencement of a multi-year rally in TLT to at least the 150 region.

Our parameters are simple. Support is in the 100-105 region. As long as this support holds, I am looking for the market to bottom out and begin a long-term rally. A rally through the 115 region will provide us with an initial indication that the bottom has been struck and that the rally has potentially begun. Confirmation is seen on a move through 121.

Is it time to take another shot at fighting the Fed? I think so. But, clearly, with risk management parameters well in place.

Housekeeping Matters

If you would like notifications as to when my new articles are published, please hit the button at the bottom of the page to “Follow” me.

As far as upcoming presentations, I will be presenting in person at the MoneyShow in Toronto on September 16, in Orlando on October 31, and will then be hosting a panel discussion on November 10th with Elliottwavetrader analysts Lyn Alden Schwartzer, Garrett Patten, and Ryan Wilday regarding our views about the equity, gold, bond, and cryptocurrency markets for 2023.

Be the first to comment