Michael Vi/iStock Editorial via Getty Images

Sempra Energy (NYSE:SRE) has outperformed the broad market by a wide margin this year. To be sure, the stock has rallied 14% whereas the S&P 500 has shed 18% during this period. Moreover, this high-quality utility is immune to recessions and hence it will continue to perform well if the aggressive interest rate hikes of the Fed trigger a recession. As Sempra Energy also has exciting growth prospects, it is ideal for the investors who are looking for growth at a reasonable price and simultaneously try to protect themselves from 40-year high inflation and a potential recession.

Business overview

Sempra Energy serves one of the largest utility consumer bases in the U.S., with nearly 40 million customers. It provides electricity and natural gas to more than 20 million consumers in California and owns a majority stake in Oncor, which is a transmission and distribution business with more than 10 million customers in Texas.

Investors are facing one of the most challenging investing environments in more than a decade this year. Due to the unprecedented fiscal stimulus packages offered by the government in response to the pandemic, inflation has soared to a 40-year high this year. This is an extremely strong headwind for investors, as inflation erodes the real value of their portfolios.

In an effort to lead inflation towards its normal range, the Fed has begun to raise interest rates aggressively. As a result, many analysts fear that a recession will show up at the latest in 2023. It is also important to note that consumers seem to have tightened their wallets due to inflation and thus the economy has already decelerated. All these conditions are strong headwinds for the economy and most of the stocks.

Sempra Energy is one of the very few companies that is hardly affected by the above headwinds. As a utility, it can easily pass its increased costs to its customers and hence it is resilient in the inflationary environment prevailing right now. In addition, it has repeatedly proved that it is essentially immune to recessions. To be sure, in 2020, the coronavirus crisis caused a fierce recession and led most companies to incur a significant decrease in their earnings but Sempra Energy grew its earnings per share 18% in that year, from $6.78 to an all-time high of $8.03, thanks to its defensive business model.

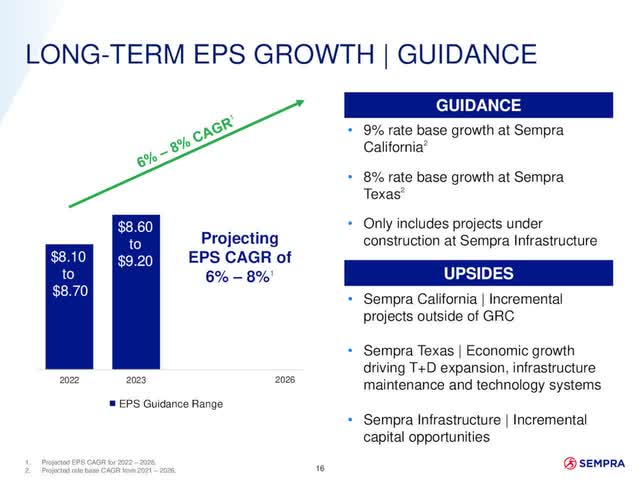

Even better, Sempra Energy grew its bottom line by another 5% last year, primarily thanks to the facility of Cameron LNG in Louisiana, which began to run at full scale in the summer of 2020. The positive business momentum has remained in place this year, with management providing guidance for earnings per share of $8.10-$8.70 in 2022 and $8.60-$9.20 in 2023. Notably, Sempra Energy has beaten the analysts’ earnings-per-share consensus in 13 of the last 15 quarters. This is a testament to the strong business momentum of the company and its solid execution.

Growth prospects

Utilities are well known for their resilience to recessions but most of them grow at a slow pace. However, this is not the case for Sempra Energy. The company has more than doubled its adjusted earnings per share over the last nine years, from $3.48 in 2012 to $8.43 in 2021.

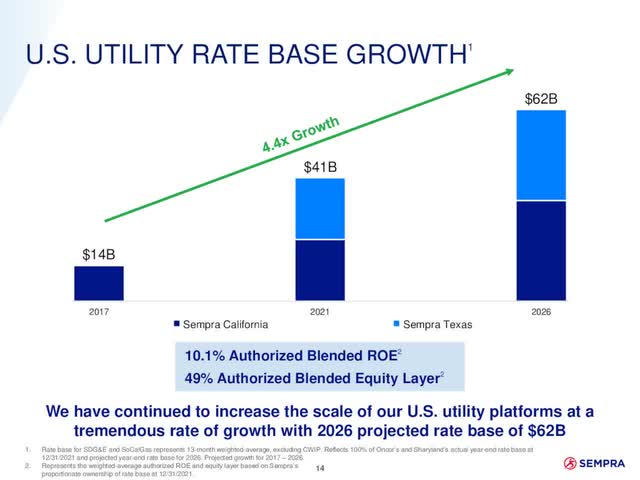

Despite its impressive growth for a utility, Sempra Energy still has ample room for future growth. More precisely, it expects to grow its U.S. utility rate base from $41 billion in 2021 to $62 billion until 2026, for an average annual growth rate of 8.6%.

Sempra Energy growth (Investor Presentation)

Moreover, Sempra Energy has a 5-year investment program of $36 billion. As this amount is 76% of the current market capitalization of the stock, it is evident that the utility is investing heavily in its future growth. Thanks to this capital program, Sempra Energy expects to grow its rate base in California by 9% per year and its rate base in Texas by 8% per year until 2026. As a result, it expects to grow its earnings per share by 6%-8% per year on average until 2026.

Sempra Energy growth (Investor Presentation)

This is undoubtedly an attractive growth rate for a company with such a reliable performance and resilience to downturns.

It is also remarkable that Sempra Energy is ideally positioned to benefit from the latest developments in the global LNG market. Europe, which purchases approximately one-third of its natural gas from Russia, is doing its best to diversify away from Russia. As a result, numerous LNG cargos have been exported from the U.S. to Europe this year. As this shift of Europe is only in its early stages, Sempra Energy is likely to greatly benefit from this trend thanks to its LNG business.

Dividend

Sempra Energy has a decent dividend growth record. It has grown its dividend for 18 consecutive years. This may not be impressive but the utility has grown its dividend at an 8.1% average annual rate over the last decade. This growth rate is nearly double the median dividend growth rate of the utility sector (4.5%) and hence it is outstanding.

On the other hand, Sempra Energy is currently offering a dividend yield of 3.1%, which may seem uninspiring to most income-oriented investors. However, the stock is likely to reward its long-term shareholders with material dividend hikes for many more years. It has a payout ratio of 53%, which is undoubtedly healthy, especially for a utility. Given also the guidance of management for 6%-8% average annual growth of earnings per share until at least 2026, the company is likely to raise its dividend by nearly 8% per year over the next four years, in line with its historical growth rate. Overall, Sempra Energy is offering a slightly lower dividend yield than the median yield of its sector (3.1% vs. 3.3%), but its reliable growth trajectory is likely to highly reward patient investors.

Valuation

The only effect of inflation on Sempra Energy is its negative effect on the valuation of the stock. High inflation results in higher interest rates, which render the dividends of utilities less attractive and thus they exert downward pressure on their valuation. On the bright side, Sempra Energy grows faster than the average utility and hence the stock is less vulnerable to high interest rates than most of its peers.

Sempra Energy is currently trading at a forward price-to-earnings ratio of 17.7, which is lower than its 10-year average of 18.8. On the one hand, the relatively low price-to-earnings ratio this year is somewhat justified, given the 40-year high inflation prevailing right now. On the other hand, inflation is likely to revert towards its normal range in the upcoming years thanks to the aggressive stance of the Fed. As soon as this occurs, Sempra Energy is likely to revert towards its historical valuation level. It is also worth noting that the stock is trading at only 13.8 times its expected earnings in 2026.

Final thoughts

Investors are facing a perfect storm this year due to 40-year high inflation and fears of an upcoming recession. Very few companies can claim that they are immune to the rough economic environment prevailing right now. Sempra Energy is one of the extremely few companies that are resilient to recessions and high inflation. It also offers a rare combination of promising growth potential, reasonable valuation, attractive dividends and resilience to downturns and hence it is a great candidate in the current investment landscape.

Be the first to comment