Feverpitched

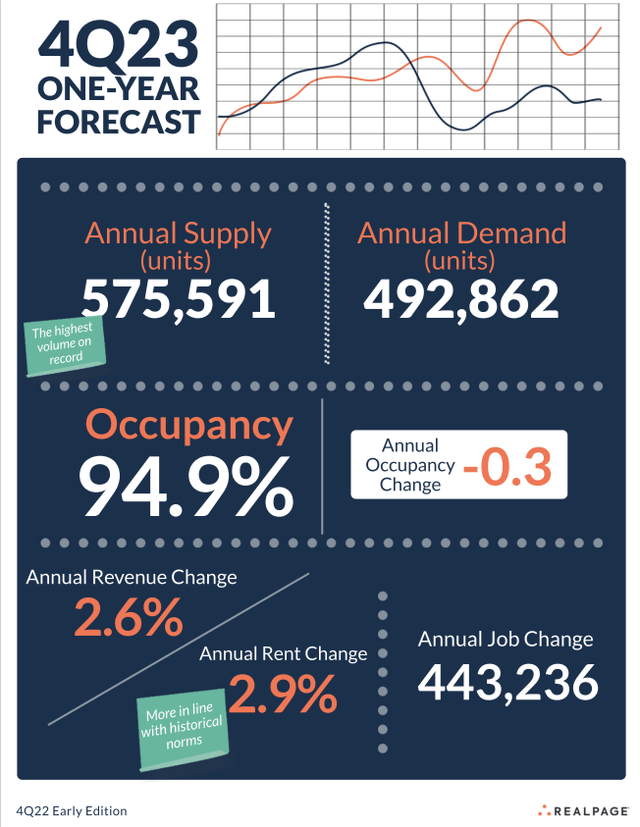

At the start of 2022, apartment real estate investment trusts (“REITs”) demonstrated one of the highest Price/FFO multiples of all asset classes. Coming off a strong 2021 performance, renewal rents logged year-over-year increases in the low teens. By July, however, the supply/demand engine started to lose steam. Rent growth slowed, stalled, and now in December may have reversed.

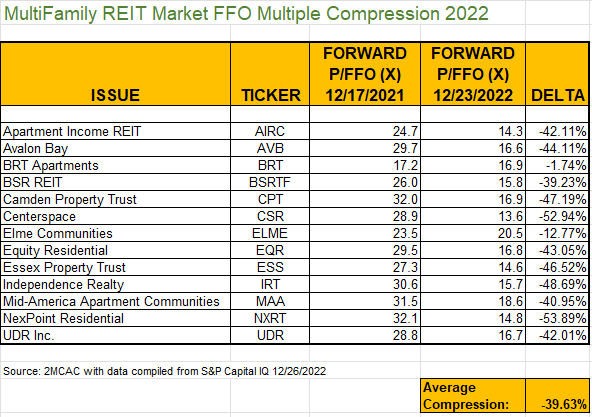

Various real estate reporting agencies now forecast that the apartment markets will return to historic trends of 94% occupancies (lower) and 3-4% annual rent growth. If that is the case, the 17X P/FFO pricing presented in the table below describes a fully valued sector.

In this article, we will catalogue 2022 Multifamily REIT share price performance, discuss the sector’s price multiple compression, and provide a general overview of expectations going forward. At the close, we will identify our pick for 2023’s top multifamily performer.

2022 Annus horribilis

Last January, every individual investor, pension fund, endowment, and Blackstone’s BREIT wanted to buy more apartments. No one was more enthusiastic about the sector than Blackstone (BX), and they demonstrated their conviction with the price premiums they paid to acquire Bluerock Residential Growth (“BRG”) and Preferred Apartment Communities (“APTS”). BX says their properties are worth even more now, but they won’t let you redeem your shares.

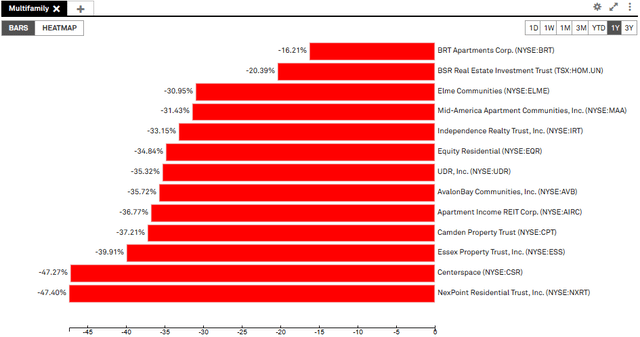

As the chart below describes, 2022 proved to be an inauspicious time to own REIT shares and multifamily shares in particular.

Multifamily REIT Share Price Performance 2022

The surprise here is that, operationally, apartment REITs performed exceedingly well. New leases saw rents jump and overall occupancy rose more than 100 basis points. Through the 3rd quarter, managements continued to raise guidance.

When rising FFO/Share is met with falling stock prices it might be that investors are no longer thinking about today, they are looking to the future. When the future no longer looks so bright, the market throws shade. You have multiple compression.

2MCAC

After the Fall

When a company is delivering record earnings and, simultaneously, its shares drop 35%-40%, it can look like a real buying opportunity. Or, when a company’s shares drop 35%-40%, it might be that they have gone from overvalued to simply fully valued. We think multifamily REITs are currently experiencing the latter phenomenon.

Earlier this month Apartment List, Yardi Matrix, and Real Page Analytics released reports, if not dire, at least more dour in description of the current and coming apartment rental markets. In short, supply is up, demand is down, and we haven’t even officially entered a recession yet. Most forecasts call for moderate rent growth and stable to slightly lower occupancy.

As investors, we want to consider if in this environment, at current share prices, we see overvaluation, fair value, or opportunity. We want to consider if existing and potential conditions present headwinds or tailwinds.

Headwind or Tailwind?

Higher Interest Rates – Headwind

External growth through acquisition will be more difficult to accomplish in an environment of higher interest rates/mortgage rates when cap rates are still hovering near historic lows. New development will be hard to underwrite with the higher cost of capital in the face of poorly priced new share issuance opportunity or tighter credit markets.

Higher Interest Rates – Tailwind

New development (supply) will slow dramatically in this higher interest rate, higher building costs environment; current over-supply can be absorbed. Would be homebuyers might be stalled by higher mortgage interest costs; renters will remain renters for longer, thereby sustaining apartment demand.

Recession – Headwind

Historically, recessions have been accompanied by job losses; job losses are anathema to new household formation, and stagnant or declining household formation reduces demand for apartments.

No Recession – Potential Tailwind

If we don’t experience a recession and new employment continues its present 200,000+/month pace the apartment demand remains strong. The oversupply on the horizon can be more quickly absorbed.

Demographics/Migration – Toss Up

The pandemic ushered in an unprecedented migration from expensive urban and coastal locales to the more spacious (lower cost) sunbelt markets. That migration has slowed dramatically and the hot spots are seeing less in-migration and New York and San Francisco are no longer experiencing a flood of emigration. Going forward, we will do well to monitor what is happening economically in each MSA (Is there really a new photovoltaic plant being built near Atlanta?).

The above are just a few of the many economic factors that will determine how an apartment portfolio will perform. Another major consideration influencing how a REIT’s share price might perform is “What are the alternatives?”

Competing Opportunities – Potential Headwind

If you consider that the 4.28% yield currently available from a 2-Year Treasury is the riskless alternative return benchmark, then you have to wonder if, say, Camden Property Trust’s (CPT) current 3.19% dividend yield is sufficient in the absence of growth. Based on recent share price performance, you might do well to find growth elsewhere to back up the dividend.

Growth

The 13 multifamily REITs in the tables above each had their own experience in enduring or capitalizing on the COVID pandemic. Many of the growth drivers of that era have abated, and each REIT now faces the difficulties of significantly slower rent growth in an interest rate environment that makes external growth through acquisition or development prohibitive.

Except for one.

NXRT = Sustainable Growth

Long before the pandemic, NexPoint Residential Trust, Inc. (NYSE:NXRT) was establishing the vanguard of how fast a multifamily REIT can grow. They didn’t issue rafts of new equity for new acquisitions or development. They grew internally by making silk purses out of sow’s ears.

NXRT

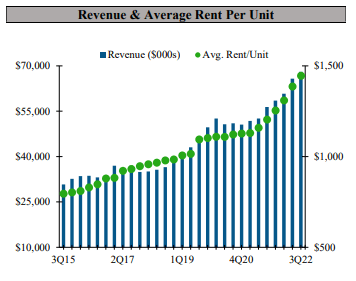

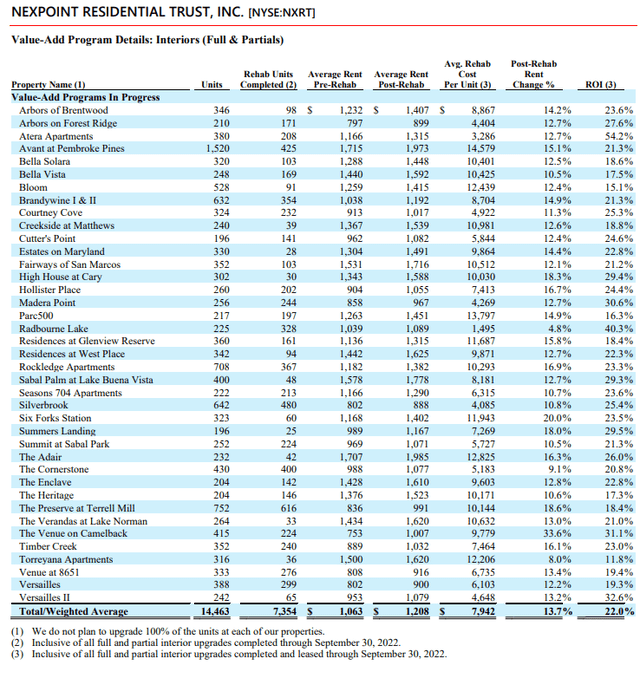

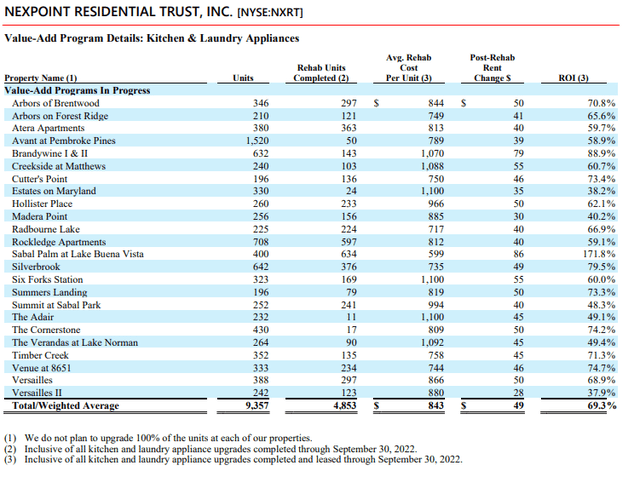

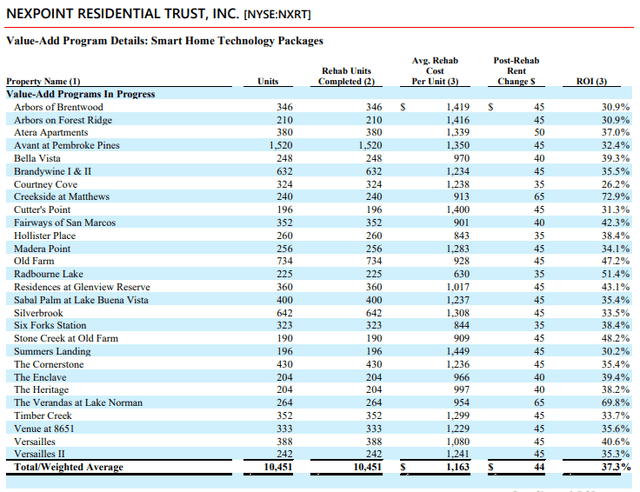

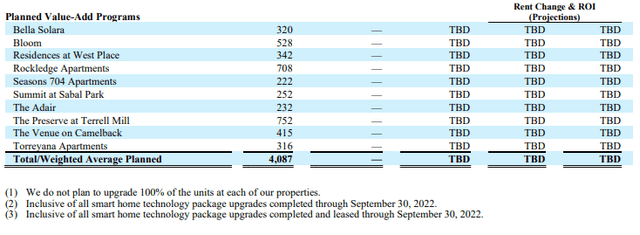

NXRT has been driven by a value-add strategy that has worked in every economy since its 2015 IPO. They acquired affordable workforce housing in targeted markets, performed apartment-unit level improvements on an industrial scale, and reaped the benefits of higher rents and property valuations.

The work and rewards have been extensive across the portfolio.

The Return on Investment (ROI) has been constantly astounding and there is more to come.

A key differentiator here is that NexPoint is targeting affordable housing that can be improved to generate higher rents but still be affordable compared to the local market’s competing offerings.

NXRT

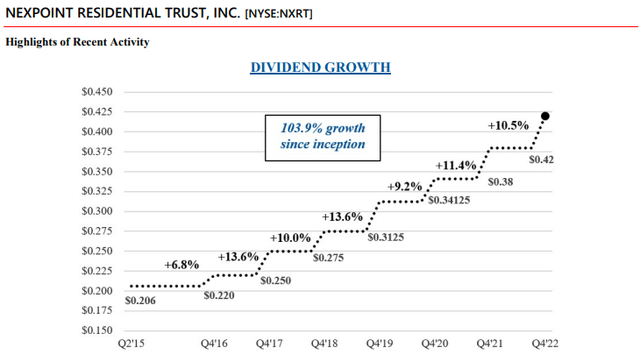

When thinking about investment alternatives, consider that NXRT has translated this strong rent growth, in good and bad economies, into unparalleled dividend growth.

Unlike the other multifamily REITs, NXRT’s operating design has a demonstrated turbo charger to drive rents higher in its portfolio, regardless of what is happening across the broader markets.

Where We Stand Now

At current pricing, NXRT is trading at 15.0x forward consensus funds from operations (“FFO”) estimates. That represents a small discount to the multifamily sector average of 17.3x. In addition to the value add machine, there are 3 other catalysts that might deliver share price growth in coming quarters.

At the heart of the slowing rent growth trend is that the consumer has reached his limit; rents can’t go higher because he can’t pay more. NXRT has been and remains the affordable alternative across each of their markets. They still have room to raise rents while the top end has stalled out.

In prior articles, I detailed how NXRT was facing some share price pressure over fears of its substantial floating rate debt exposure. In December the balance sheet was significantly de-risked through refinancings with KeyBank and Freddy Mac. The agreement lowered their cost of capital and extended the weighted average maturity to 6.3 years.

- 3. Share Repurchase Authorization

In tandem with their 3Q22 earnings release, NXRT announced the authorization of a $100MM share repurchase authorization. The repurchase will be funded with proceeds from the sale of Houston properties which will settle this month. I suspect the buyback has not yet begun.

The Multifamily Sector Today

From June of 2020 to June of 2022, it was a bonanza for apartment REITs. Investor expectations were high, but share prices have since declined by as much as 50%. This doesn’t mean shares are cheap, it is simply an acknowledgement that all of business faces headwinds in the inflationary/high interest rate/recessionary nebula of our current economy.

NexPoint Residential Trust, Inc. has the goods to withstand the storm and can regain a premium valuation. We believe NXRT shares are headed higher.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment