kokkai/iStock Unreleased via Getty Images

The following segment was excerpted from this fund letter.

Sea Ltd (SE)

We seek companies that have the potential for an Act 2. These enterprises have the ability to find a second phase of growth—a new product, additional market, or innovation—after their first growth engine, or Act 1, has run its course. Act 1 companies that successfully transition to Act 2 have been critical to our outperformance, and we aim to partner with them as early as possible.

When we look at an early Act 1 business, we want to know that it is building the people, processes, and systems necessary to keep winning at scale. We care about management’s willingness to invest for the future, not just its ability to execute in the present.

Transitioning to Act 2 requires a number of skills, including the ability to properly balance customers, employees, and shareholders; to construct a strong corporate culture; and to foster an ownership mentality. But most importantly, managers need the ability to adapt and transition.

Inevitably, the Act 1 to Act 2 transition will result in a challenging period, and transitions are difficult. Vital to doing this successfully is a commitment to intellectual honesty, diversity of thought, and emphasis on organizational adaptability.

– Henry Ellenbogen of Durable Capital (LINK)6

Sea Ltd represents a substantial portion of our portfolio, and this last market downturn has certainly been painful for shareholders. While I’d estimate (or rather guess?) that ~2/3rd of the stock price decline is due to concerns around the aforementioned rising rate environment hurting most long-duration growth companies, approximately ~1/3rd of the stock decline is likely due to investor’s concerns around Sea Ltd transitioning from “Act 1” to “Act 2”, which I’ll discuss in this section.

Previously, Sea has relied upon the exponential growth of its gaming business, Garena, and in particular that of the worldwide mobile game sensation, Free Fire, to provide the profits to reinvest into the Shopee ecommerce division within Southeast Asia. Between 2018 and 2021, profits from Garena grew over 10x, all of which was reinvested into building out the Shopee ecommerce platform.

This strategy has been tremendously successful, with Shopee now on track to achieve ~$100 Billion in GMV in 2022, making it one of the largest ecommerce companies in the world1. More importantly, these new-to-ecommerce customers are extremely sticky (ordering more than 4x per month, logging in several times per day, and spending 30 – 60 minutes inside of the app per day).

This isn’t simply “renting customers” via deeply discounted promo codes. But rather, Shopee has trained a whole new segment of the population to shop online via their addictive & engaging platform2. Nowadays, Shopee is definitively the dominant ecommerce leader in Southeast Asia (~55 – 60% market share), and the company feels that it is in a much more stable position versus just a few years ago.

As such, the company has been flexing its position to steadily increase its take-rates over the last few years (it started with 0% commissions prior to 2019). Today, it already generates ~7.5% take-rates3. This has allowed Shopee to achieve 30%+ margins in Taiwan, ~8% margins in Malaysia, and to break-even in Indonesia (it’s largest market) despite heavy investments in logistics and warehouses within the country. These take-rates will likely continue to increase, with our estimates exceeding 10% over the next few years alone4.

Sea Ltd is in a much different stage than just a few years ago. There are now over 720 million gamers actively playing Garena’s games around the world (with the bulk being Free Fire). That equates to almost 10% of the worldwide population, or ~15% of the global internet users playing per quarter!

Shopee’s Southeast Asia region is also much more stable, given their dominant market position. And the next few years will likely see Shopee’s SE Asia division inflect to profitability very shortly (especially as the take-rate will increase due to high-margin advertising revenues). The company is transitioning from a period of “hyper-growth” to “stable growth” within these divisions.

With the “twin engines” of Garena and Shopee SE Asia soon about to generate substantial profits, Sea has been looking for its “Act 2” to reinvest this capital. The company has been experimenting with several acquisitions on the Garena side, and launching new ecommerce markets outside of Southeast Asia. They are testing the hypothesis whether the appeal of its ecommerce marketplace solely resonates with Asian consumers, or whether it’s a playbook / shopping experience that appeals to emerging markets consumers more broadly.

One of these experiments in particular – Brazil – seems to be showing results. Investors have been waking up to this development over the last few months, and at the same time, seem to be confused about the aggressive investment being spent on this experiment.

While the experiment isn’t a guaranteed success yet, there are early signs that the Shopee “playbook” is working. When we first invested in Sea Ltd, I laid out the KPIs that investors should look for as signs of traction in a presentation I gave at a conference in October 2018 (LINK).

In it, I discussed the key advantages of 1) being mobile-first, 2) focusing initially on high-margin, impulse / social media driven categories of fashion & beauty, leading to high engagement/addiction, as measured by 3) superior time spent inside the app vs. competitors, and 4) higher repeat order rates.

Once shopping habits are formed, investors should 1) watch for the discount / coupon strategy to be withdrawn (without decreasing customer mindshare), 2) category expansion and moving “upmarket” to branded products as merchants from a wider variety of categories outside of Fashion & Beauty want to sell to this engaged customer base, which in turn increases the Average Order Sizes (customers find more products they want to include in each order), and 3) for Shopee to steady increase take-rates as they monetize this engaged ecosystem.

As the base of customers (and thus order count) grows, the goal is to encourage investment by 3rd party logistics providers to build out logistics within the country, by increasing order density via the higher order count, and thus flip the profitability of the 3PLs themselves to make it profitable to operate within the country. As 3PL business models become more viable within the country, Shopee will have these 3PLs compete to offer the best service, at the lowest price, thus decreasing its own shipping costs per parcel. With the combination of higher order values per parcel + higher take-rates per order + declining customer discounts + decreased logistics costs, Shopee can then achieve profitability over time.

Astute investors will notice that this strategy is “reflexive”, in that the more orders Shopee generates, the more likely they & their 3PL partners are to achieve this state of profitability. This is why Shopee’s primary KPI in the early stages is focused on order count, and why they are investing so aggressively to increase this and kick-start the virtuous cycle.

In fact, this is the exact strategy Shopee pursued in Indonesia. 3PL shipping times used to be up to 2 – 3 weeks for instance in rural parts of Indonesia. This is now less than one week after Shopee’s involvement (and either same-day to 2 day shipping times within major metro areas).

The discount strategy also started to be withdrawn in Indonesia in early 2019, while customers have only increased their engagement & order frequency with the company over the same time period, while moving “up-market” to branded items – proving that these customers loved the “mouse trap” Shopee had built, well after they were initially enticed into it via the “free money”/coupons.

Will this playbook work in Brazil? That’s what Shopee is experimenting with right now, and the early signs point to yes.

Shopee has already achieved the first phase, of winning mobile and achieving “addiction” with these early customers. For example, Shopee has consistently been the #1 shopping app and within the top 5 apps overall on Brazil’s Google Play store for the last six months11. Additionally, app data indicates that Shopee’s Brazilian app is downloaded 2-3x more than local competitors (and is now the #1 downloaded shopping app cumulatively), has the highest monthly active users (MAUs) in the country at over 40M, and reportedly surpassed even incumbent Mercado Libre in terms of Net Promoter Score (NPS)12.

App data also indicates that customers spend 2x the amount of time per day inside the Shopee Brazil app, versus Mercado Libre. And these same customers are starting to order from Shopee multiple times per month (versus Mercado Libre’s ~1.3x per month), increasing in frequency in proportion to how long they’ve been a Shopee customer (indicating increasing comfort & trust with the platform).

The controversy among investors today, is regarding the next phase – whether this early traction is sustainable, and more importantly, whether Shopee Brazil can build a viable business out of it.

Admittedly, the unit economics today don’t look great as it stands. But neither did Shopee’s unit economics in SE Asia when we invested almost 4 years ago. In fact, Shopee Brazil’s business model stage reminds me a lot of their stage in Indonesia in early 2019 (see the unit economics slide in our 2018 presentation; LINK).

At that time, Shopee had achieved the top position in mobile downloads, time spent, and had a superior NPS and mindshare among consumers. But logistics times were still slow (Shopee was just starting to build warehouses), the platform had just started charging any commission rate at all, and discounts were just beginning to be withdrawn. But over the next 2 years, Shopee was able to achieve break-even by following the strategy laid out above.

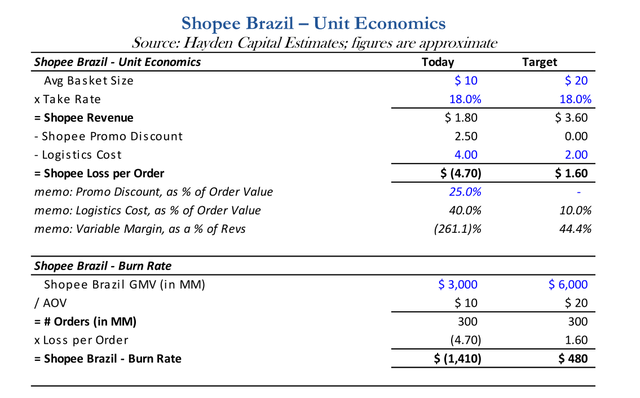

Shopee Brazil – Unit Economics (Source: Hayden Capital Estimates; figures are approximate)

At it stands today, Shopee Brazil’s average basket size is ~$10 USD, on which they charge merchants an 18% take-rate (which includes Free Shipping). I then assume a 25% discount for new customers (although this is highly variable, but seems to be the average). Shopee also provides free shipping, which costs the company on average ~$4 per order to fulfill. This results on a loss of -$4.70 USD per order. At its current ~$3BN GMV run-rate in Brazil (1/10th the size of Mercado Libre), I estimate this will cost them ~$1.4BN annually.

However, as mentioned previously, the key to Shopee’s strategy is order density / volumes. If they can get this first “domino” to fall, the rest of the strategy has a much higher chance of falling in-line.

And on this metric, we can see that Shopee is rapidly catching up to Mercado Libre. For example, Mercado Libre sells ~1.1BN items per year, with Brazil comprising ~50% of this volume13. Even if we’re conservative and assume only one item shipped per parcel, this equates to ~550M orders per year, at its current scale (and even less, if only accounting for the orders self-fulfilled by Mercado’s in-house logistics arm).

Meanwhile, I estimate that Shopee ships ~300M orders at its current run-rate (and rapidly growing ~8-10% per month). At this rate, it’s possible that Shopee will ship more orders than Mercado, within the next two years.

At that point, Shopee believes that it can encourage 3rd party logistics providers to invest into their networks to improve shipping times and reduce the shipping cost per parcel to ~$2 / order. This is what happened in Indonesia for example, with Shopee generating such a high volume of orders, that it actually lowered the break-even point for their 3PL partners, which allowed them to in turn lower the price charged to Shopee.

Mercado Libre KPIs – Source: Mercado Libre Q3 2021 Earnings Presentation

For example, I had heard that during the 2018-19 period, Shopee orders comprised ~40% of J&T’s total Indonesian order volume. Despite being the newest player (launched in 2015), J&T quickly surpassed the incumbent Indonesian logistics providers within a few years and has continued to follow Shopee as it expands world-wide.

J&T just followed Shopee to Brazil last year, for example, and already has ~350 local corporate employees (LINK). The two of them have historically grown in lock step / synergistically, with J&T owing much of its success to Shopee. In a sense, they are almost like an external subsidiary of Shopee – but with a lower-cost of capital, given the different nature of the business.

The company just raised $2.5BN at a $20BN valuation a few months ago, with a large portion of this ear-marked for investing in Latin America. J&T also plans to IPO in Hong Kong this year, which will provide it even more capital for expansion.

Tech in Asia just published a piece on J&T’s global ambitions & aggressive strategy, and I would encourage anyone interested to read that for background (LINK). For example, reportedly after J&T entered China in 2020, the largest incumbents had to drop their shipping prices by 20-30% to match. The company has a successful track-record of disrupting the logistics ecosystem in under-developed markets, is well-funded, and is now taking the battle to Latin America. As such, the Shopee – J&T partnership is something that has serious potential of disrupting the logistics economics in the region.

Over time, Shopee will continue to diversify their categories outside the fashion & beauty categories, into home goods, electronics & accessories, etc. Currently average basket sizes are only ~$10 USD per order (~2 items per order), but this will naturally increase over time. I believe the company can achieve ~$20 USD per order within the next two years, which still compares conservatively versus Mercado Libre’s ~$28 USD per item.

In the short-term, logistics costs will remain a fixed cost despite the larger order sizes (the parcel is still the same size & shipped the same distance, despite the contents being more valuable), thus helping the company achieve higher margins. In the medium term, increased 3rd party logistics competition the region could cut this cost in half.

In addition, I expect discounting to start being pulled back soon. Shopee already has ~20% of Brazil’s population using the platform on a monthly basis (at ~40M MAUs out of a ~210M population base), and it’s around this level that Shopee similarly started withdrawing discounts in Indonesia in 2019.

With a combination of 1) higher order sizes, 2) lower discounts, and 3) lower logistic costs, I believe this will soon “flip” the profitability of the Brazilian division within the next few years.

Admittedly, it’s still early and there’s a fair amount of execution needed for what I laid out above to become reality. But given the virtuous cycle dynamics, the hardest part is getting the first “domino” to fall, to kick start this chain of events. So far, we’re seeing that first domino of order volume scale start to come down. And execution-wise, if there’s anyone who can make this happen it’s the Shopee team, who’ve executed this exact playbook in many countries already.

Note, I first flagged Shopee’s Brazilian expansion two years ago in our Q4 2019 letter. Those interested can find our original thoughts here: (LINK).

So what if we’re wrong, and Sea’s geographic expansion turns out to be a failure? What’s the downside risk here? Well at today’s ~$75BN market cap, realistically not very much…

Sea currently has ~$11BN of cash on its balance sheet14. At its current rate, this should last the company at least 4-5 years, even if Garena declines and Shopee maintains its current negative margin profile (contrary to this, I expect Shopee to turn profitable during that time frame).

In a most pessimistic scenario, the company will burn a majority of this on its Latam and other new markets experiments, with little to show for it. At today’s prices, the market seems to think the management team would continue to be aggressive in such a scenario, and even “mortgage” the gaming / SE Asia divisions to finance this expansion. I find this highly unlikely.

Instead, after billions of capital and several years of trying, the management team would certainly be willing to cut their losses by that point, and retrench to their core gaming & SE Asia roots.

In such a scenario, what’s the company worth? Well if we assume the $11BN of cash is Shopee’s “R&D” budget and will eventually be spent, what we’re left with is Garena and Shopee SE Asia.

While the market seems to think that Garena / Free Fire are about to unravel quickly, we haven’t seen that in the latest app data. It’s true that Garena is decelerating its growth rate – but what else would you expect from what’s already the most popular mobile game in the world, that has 720M quarterly players? Instead, I expect Garena to generate more realistic teens / high single- digit type CAGRs over the next few years.

In such a scenario, I expect Garena to be worth ~8x EBITDA today. This is lower than other gaming developers, which generally trade ~15x EBITDA15. However, a discount is likely warranted because these other developers have IP that are more diversified and have also proven to withstand the test of time (for example, Fifa, Call of Duty, Warcraft, League of Legends, etc.).

Krafton, the maker of PUBG, is probably the best comparison for Garena. Both derive >80% of their revenues from their flagship games (PUBG for Krafton, and Free Fire for Garena), have a player base that’s weighted towards Asia, and the games are the in same battle-royal shooter style too. Growth is similar as well, with sell-side estimates having Krafton decelerating into the teens / high-single digit growth rates over the next few years. Krafton currently trades at ~8x EBITDA today (and reached as high as ~16x a few months ago; the stock is down -55% from its November peak).

With Garena generating ~$3BN in EBITDA today, and applying an 8x EBITDA multiple, this implies the business is worth ~$24BN.

Subtracting this from Sea’s ~$75BN current valuation, it implies a ~$51BN valuation for Shopee, Shopee Pay, and Shopee Food in Southeast Asia.

Granted, all of these business lines are still investing aggressively, so they’re not yet profitable. But Shopee is the clear leader in Southeast Asia by now, and continues to gain market share, while also increasing its take-rates (i.e. utilizing its dominant position, to flex its pricing power).

As an example of its market position, just compare its take-rates to Alibaba for example. With Southeast Asia being a less competitive market, Shopee is already able to charge ~7.5% take-rates versus Alibaba at ~4.5% take-rates. This is with ecommerce penetration being only ~8 – 10% in Southeast Asia, versus ~35% in China. In addition, Shopee is growing 3x as quickly, and has only begun monetizing via advertising (an extremely high-margin revenue driver).

I believe Shopee will reach 10% take-rates within the next couple years, and realize 35-40% margins at scale16.

For example, Sea currently spends ~50% of its revenues on sales & marketing spend, primarily for discounts to attract new customers. As ecommerce matures in the region and users become familiar with Shopee, I expect this to decline to global mature marketplace peers, at ~25% of revenues. This alone should contribute +25% to its margin profile. Combined with rising take- rates from high margin drivers like advertising (which will drastically increase Gross Margins, and something the company only started focusing on within the past year), and continued scaling off its other fixed expense bases, I believe the company can hit this margin profile over the next decade.

So given all this, I believe Shopee is worth more than the ~$51BN the market is implying. Shopee should generate ~$9BN in revenues within its core SE Asia market this year, while continuing to grow rapidly. This indicates a ~5.5x revenue (or ~14x structural margins) multiple.

I expect GMV to grow ~40% y/y over the next few years, revenues will grow even faster due to the increasing take-rates on this GMV, and earnings even faster than that due to the increasing mix from high-margin advertising revenue. This “stacking effect” of multiple growth drivers is what creates the exponential earnings growth profile we expect from Shopee.

Intuitively, this screams as a bargain to us, especially considering I think revenues can grow multiple-fold by the end of the decade, in addition to getting the call option on Shopee’s Latam & new market experiments proving successful, along with the continued development of Shopee Pay (which itself has the potential to be a large 3rd driver for Sea Ltd).

Footnotes

- 1For context, Shopee was at only ~$8.5BN GMV (TTM) when we invested in 2018.

- 2As customers built a Shopee “addiction”, these discounts have been steady withdrawn over the last 3 years.

- 3Admittedly, a portion of this higher take-rate is from “pass-through” revenue from cross-border logistics, payment fees, etc., which are borne on behalf of merchants. But I expect this to decrease as a mix of the take-rate over time, as Shopee focuses on increasing its advertising and commission fees.

- 4Advertising is still a nascent piece of Shopee’s revenues, and one that has almost 100% margins. For example, the company only just launched the ability for Shopee Mall brands to buy banner ads on the Shopee homepage a few weeks ago.

- 5Google Play / Android is more relevant than iOS, since ~85% of Brazilians are Android users.

- 6Shopee NPS’s is 64, while Mercado Libre’s NPS is 61. Survey conducted by Bank of America.

- 7Based on latest quarter’s run-rate. In Q3 2021, Mercado Libre sold 259M items overall, of which 138M orders were attributed to Brazil, or 53% of the total. Of this, Mercado’s own shipping service shipped 248M of these items.

- 8~$6BN of which they raised in September 2021, when the stock was at $318. In hindsight, this may have been one of the smartest moves management has made in recent years.

- 9Electronic Arts is trading at ~13x EBITDA, Take-two at ~19x, and Square Enix at ~10x. Microsoft just bought Activision at ~18x EBITDA as well.

- 10Under a 3rd party marketplace business model.

Be the first to comment