Bet_Noire

A Quick Take On Scripps Safe

Scripps Safe (SCRP) has filed to raise $15 million in an IPO of its common stock, according to an S-1 registration statement.

The firm sells pharmaceutical vaults and safes to a variety of U.S. healthcare delivery systems.

Given the extremely high valuation expectations, tiny firm size, thin capitalization and lack of significant revenue growth history, I’m on Hold for the IPO.

Scripps Safe Overview

Naples, Florida-based Scripps Safe was founded to provide pharmaceutical security solutions such as drug safes and vaults via an annual subscription revenue model.

Management is headed by Founder, Chairman and CEO, Jacqueline von Zwehl, who has been with the firm since inception in 2016 and has over 20 years of experience in the healthcare technology industry.

The company’s primary offerings include:

-

Secure storage vaults and safes

-

Access control system

-

Future

-

Inventory management

-

Supply chain tracking

-

Audit tracking

-

Diversion control

-

Advanced analytics

-

APIs

As of September 30, 2022, Scripps Safe has booked fair market value investment from investors including from the founder, von Zwehl.

Scripps Safe – Customer Acquisition

The company seeks customers among mobile pharmaceutical delivery organizations, private ambulance operators, home healthcare providers, and addiction treatment facilities.

The firm currently has more than 600 clients ‘who have purchased DEA-compliant vaults and safes.’

Selling, G&A expenses as a percentage of total revenue have risen as revenues have fluctuated, as the figures below indicate:

|

Selling, G&A |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Nine Mos. Ended September 30, 2022 |

96.6% |

|

2021 |

86.6% |

|

2020 |

45.0% |

(Source – SEC)

The Selling, G&A efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling, G&A spend, rose to 0.2x in the most recent reporting period, as shown in the table below:

|

Selling, G&A |

Efficiency Rate |

|

Period |

Multiple |

|

Nine Mos. Ended September 30, 2022 |

0.2 |

|

2021 |

-0.1 |

(Source – SEC)

Scripps Safe’s Market & Competition

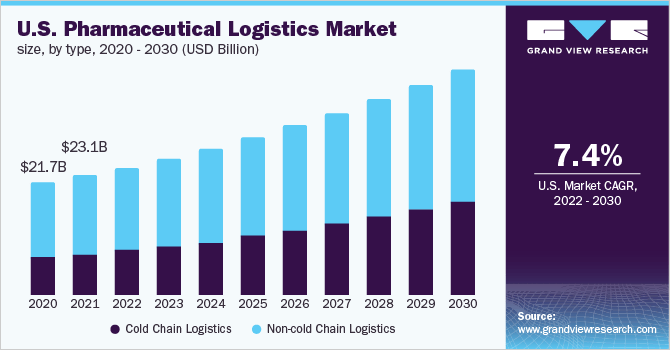

According to a 2021 market research report by Grand View Research, as a proxy for the drug security market, the global pharmaceutical logistics market was an estimated $78.5 billion in 2021 and is forecast to reach $164.9 billion by 2030.

This represents a forecast CAGR of 8.6% from 2022 to 2030.

The main drivers for this expected growth are strong growth in the distribution needs for vaccine makers and other drug companies, where manufacturers can track the chain of custody through the supply chain.

Also, the chart below shows the historical and projected future growth trajectory of the U.S. pharmaceutical logistics market, by type:

U.S. Pharmaceutical Logistics Market (Grand View Research)

Major competitive or other industry participants include:

-

Operative IQ

-

Knox Box

-

In-house solutions

-

Others

Scripps Safe’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

Fluctuating topline revenue, from a tiny base

-

Variable gross profit and decreasing gross margin

-

Increasing operating losses

-

Higher cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Nine Mos. Ended September 30, 2022 |

$511,249 |

17.7% |

|

2021 |

$505,143 |

-7.9% |

|

2020 |

$548,191 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Nine Mos. Ended September 30, 2022 |

$186,192 |

-27.3% |

|

2021 |

$150,375 |

-46.2% |

|

2020 |

$279,304 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Nine Mos. Ended September 30, 2022 |

36.42% |

|

|

2021 |

29.77% |

|

|

2020 |

50.95% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Nine Mos. Ended September 30, 2022 |

$(327,065) |

-64.0% |

|

2021 |

$(268,604) |

-53.2% |

|

2020 |

$30,243 |

5.5% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Nine Mos. Ended September 30, 2022 |

$(327,065) |

-64.0% |

|

2021 |

$(268,604) |

-52.5% |

|

2020 |

$30,243 |

5.9% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Nine Mos. Ended September 30, 2022 |

$(334,838) |

|

|

2021 |

$(138,387) |

|

|

2020 |

$(49,128) |

|

(Source – SEC)

As of September 30, 2022, Scripps Safe had $31,365 in cash and $895,531 in total liabilities.

Free cash flow during the twelve months ended September 30, 2022 was negative ($417,014).

Scripps Safe’s IPO Details

Scripps Safe intends to raise $15 million in gross proceeds from an IPO of its common stock, offering 3 million shares at a proposed midpoint price of $5.00 each.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $42.6 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 27.27%. A figure under 10% is generally considered a ‘low float’ stock, which can be subject to significant price volatility.

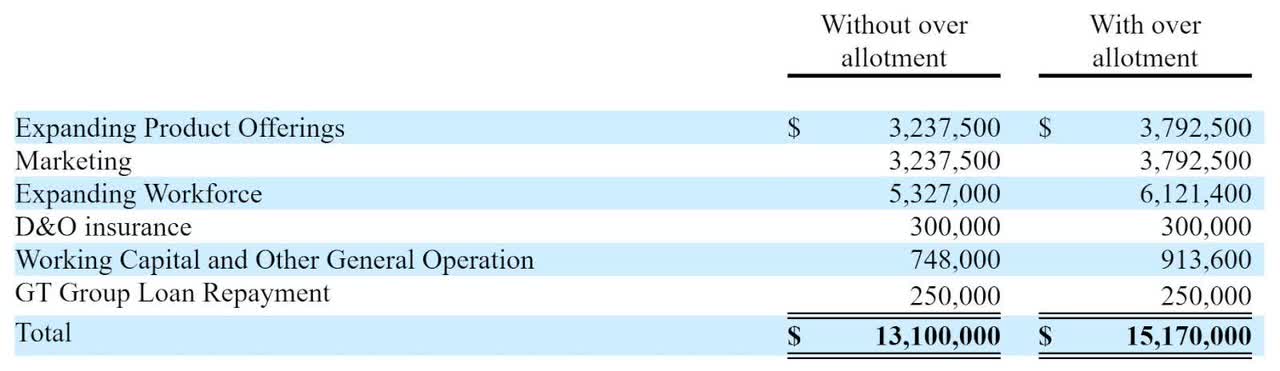

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of Proceeds (SEC)

“We believe that the net proceeds from this offering and our existing cash will be sufficient to fund our operations through at least the next 30 months.”

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the company is not a party to any pending legal proceedings.

The sole listed bookrunner of the IPO is WestPark Capital.

Valuation Metrics For Scripps Safe

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Market Capitalization at IPO |

$55,000,000 |

|

Enterprise Value |

$42,648,856 |

|

Price/Sales |

94.48 |

|

EV/Revenue |

73.27 |

|

EV/EBITDA |

-71.73 |

|

Earnings Per Share |

-$0.05 |

|

Operating Margin |

-102.14% |

|

Net Margin |

-102.14% |

|

Float To Outstanding Shares Ratio |

27.27% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

-$417,014 |

|

Free Cash Flow Yield Per Share |

-0.76% |

|

Debt / EBITDA Multiple |

-1.31 |

|

Revenue Growth Rate |

17.72% |

(Source – SEC)

Commentary About Scripps Safe’s IPO

SCRP is seeking U.S. public capital market investment to fund its hiring and general expansion plans and to pay down some debt.

The company’s financials have produced variable topline revenue, from a tiny base, fluctuating gross profit and decreasing gross margin, higher operating losses and growing cash used in operations.

Free cash flow for the twelve months ended September 30, 2022 was negative ($417,014).

Selling, G&A expenses as a percentage of total revenue have risen as revenue has varied; its Selling, G&A efficiency multiple was 0.2x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain future earnings for reinvestment back into its business expansion initiatives.

The market opportunity for providing supply chain services such as safes and vaults is substantial and likely to grow as the pharmaceutical logistics industry is expected to grow in the coming years.

WestPark Capital is the sole underwriter and the only IPO led by the firm over the last 12-month period has generated a return of negative (82.7%) since its IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company’s outlook as a public company include its tiny size, thin capitalization, and lack of significant revenue growth history as a private company.

As for valuation, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 73.3x.

Given the extremely high valuation expectations, tiny firm size, thin capitalization, and lack of significant revenue growth history, I’m on Hold for the IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment