FilippoBacci/E+ via Getty Images

An interesting situation in the casino gaming industry. Light & Wonder (LNW) is a $4.7bn developer of casino-themed games and land-based products, such as gaming cabinets. In May’19, the company spun-off its mobile-focused subsidiary SciPlay (NASDAQ:SCPL) (which develops casino games for mobile and web platforms) and has retained a controlling 81% stake (97% of voting power). In Jul’21, LNW put forth a proposal to acquire the remaining shares of SCPL at ~$16/share. The offer was eventually withdrawn in Dec’21 as both parties did not come to terms on the acquisition price.

Recently, however, activist Engine Capital has built up an 8% stake in class A SCPL shares (1% economic interest). Engine issued a letter to both companies, urging them to merge again. The activist argues that LNW could purchase the remaining 19% stake using only SCPL’s cash on the balance sheet which Engine Capital estimates at $380m by year-end. Given SCPL’s cash position of $316m and $68m in H1’22 operating income, activist’s target seems realistic. The activist puts $15-$16/share as an appropriate SCPL buy-out price given comparable transactions, DCF analysis, and analysts’ targets – 16-24% upside. Engine Capital is also advocating for a review of strategic alternatives, including an option of sale to a third party, should the transaction fail to materialize.

While it is very questionable if activist letters are going to affect LNW actions in any way, there are several arguments suggesting that the companies might come to an agreement to re-merge:

- The transaction would seem to naturally follow LNW’s recent strategic turnaround efforts as the completed sale of its $7bn lottery and betting businesses. Several years ago at the time of SCPL spin off, LNW used to have a significant overhang of debt and SCPL’s spin-off was intended to help deleverage the business. Since then, LNW has significantly reduced the net debt from $8.7bn to $2.9bn. Meanwhile, LNW management has repeatedly stated that after the sale of lottery/betting segments their goal is to expand company’s digital offerings. It seems that the buyout of SCPL’s minority shareholders would fit this strategy.

- SCPL is a high-margin FCF generating machine ($458m in FCF since going public). Since the spin-off, the company has expanded into the potentially lucrative casual gaming space through multiple acquisitions (Alictus, Come2Play, Koukoi Games). Moreover, Engine argues that a transaction would allow LNW to access SCPL’s consistently generated cash flows which then could be used for LNW’s more capital-intensive businesses and/or share repurchases. The activist estimates that the merger would lead to cost savings of $5m-$10m.

- LNW CEO was very optimistic about future prospects for SCPL in its recent Q2’22 earnings call:

All in all, SciPlay is a durable, highly cash-generative business. And even as we have delivered significant gains with revenues growing 36% over the past 3 years, we think there’s even more upside in the business going forward, fueled by their evergreen franchises, sticky cohorts and disciplined approach to investing and monetizing their players.

[…]

So stepping back, if you look at SciPlay, SciPlay is a — has grown 36% over the last 3 years. And as you alluded to, there’s obviously some natural normalization post COVID and adapting to some things in the environment. But we continue to outpace the market in the social casino space, and there’s actually tremendous upside in the $70 billion TAM business today.

- Industry-wide sell-off and lower public peer trading multiples might make it harder for SCPL management to reject a potential merger offer this time. At $15/share price SCPL would be valued at 9x EBITDA multiple compared to 5.7x for Playtika (PLTK) and 7.4x for PLAYSTUDIOS (MYPS). In comparison, last year’s offer valued SCPL at a discount to peers – 8.9x EBITDA vs 11.5x for PLTK and 17.8x for MYPS. It is worth noting here PLTK is much more levered while MYPS is a significantly smaller industry player compared to SCPL.

- As part of the spin-off, SCPL and LNW signed an IP license agreement which provides SCPL with exclusive access to LNW’s newly created gaming content. Importantly, the agreement expired in May’22. The companies managed to extend it to Jul’22, however, since then negotiations on the new contract terms haven’t come to a conclusion yet. Engine previously sent a letter to LNW/SCPL, arguing that extension of the IP agreement between the companies was not beneficial to SCPL’s minority equity-holders and thus highlighting the conflicts of interest in the current ownership structure.

SCPL Share Structure and Ownership

SCPL has issued 23.6m class A shares and 103.5m class B shares. Notably, class B shares provide ten votes per share while class A entitles equityholders to one vote per each share. Whereas LNW owns 100% of class B shares (97% of voting power in total), class A shares are held by the activist Engine Capital and numerous institutional investors, including Vanguard (8% of class A), Caledonia Investments (7%) and Cowen & Company (5%), among others. Notably, several of these investors, including Vanguard and Blackrock acquired their stakes in 2019-2020, suggesting they would cash out at a premium if a merger offer would materialize at $15-$16/share.

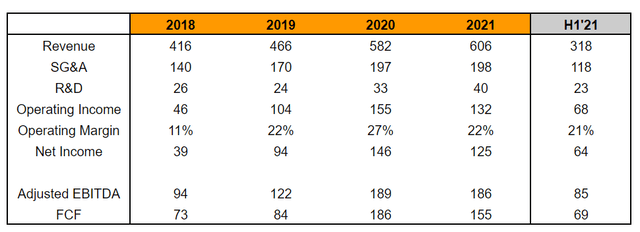

SCPL Financials

SCPL has displayed steadily improving operational/financial performance in recent years, with revenue growth ranging from 12% to 25% (other than 4% in 2021). The growth has partially been driven by expansion with above mentioned acquisitions in the casual gaming space. Management recently reiterated 2022 revenue growth guidance at 10%. Importantly, SCPL has been able to convert a large portion of earnings (i.e. adjusted EBITDA) into free cash flows, with FCF conversion ranging from 78% to 99%.

It is worth noting here that SCPL’s management has recently authorized $60m in share repurchases over a two-year period. In Q2’22, the company repurchased $15m (1.1m of class A shares) or 25% of the authorized amount.

SCPL Filings

Engine Capital

Engine Capital is a New York-based hedge fund (launched in 2013) with previous/existing activist positions in numerous companies, including PFSW, HIL, CMCT, KSS, and HBIO. Engine Capital has successfully participated in the sale of women’s apparel retailer Ann Inc. In 2014, the activist acquired a reported 1% stake in Ann and started pushing for a company sale. The stock was trading at $37/share at the time of the report. Ann Inc was eventually acquired by Ascena Retail Group in May’15 in a cash+stock deal with an implied value of $47/share.

Conclusion

The investment thesis/expected upside is admittedly somewhat speculative here given that it is based solely on the activist’s claims. Having said that, SCPL currently presents an interesting investment opportunity. As it stands, I see numerous reasons why LNW might opportunistically decide to acquire the mobile-focused subsidiary amid the recent market sell-off. SCPL has in recent years displayed strong operating performance and has a high-margin/free cash flow profile. Meanwhile, LNW’s recent asset disposals have allowed the company to significantly delever the balance sheet. Also considering LNW management’s bullishness on the social casino segment, I expect an acquisition to be announced here at a premium to current prices.

Be the first to comment