janiecbros/E+ via Getty Images

Recently, I have been running through countless daily charts of healthcare tickers looking for candidates to add to one of my healthcare portfolios for my Seeking Alpha marketplace service, Compounding Healthcare. Schrödinger (NASDAQ:SDGR) was one of the tickers I ran into and remembered how I am a huge fan of Schrödinger’s life science and drug discovery software after using it extensively in grad school. Admittedly, I have had very little interest in the company as an investment because I thought the company was simply a life science software company. I decided to dig a little deeper into Schrödinger’s business and fundamentals before making any decisions. Well, it didn’t take long for me to discover that Schrödinger is much more than a software company and that they have a legitimate clinical pipeline and an impressive list of partnerships. At first, I was incredibly surprised to see such an imposing pipeline, however, it makes perfect sense considering the company’s software is used to discover new drugs and therapeutics. So, Schrödinger is applying their expertise for both wholly-owned assets and partner programs. As a result, the stock is not a pure-play and could have several sources of revenue in the upcoming years that could fuel growth as well as diversify the investment.

Following my initial research efforts, I am incredibly intrigued by SDGR and will add the ticker as a prospect for my speculative Bio Boom Portfolio. Now, I must determine what a fair value is for SDGR and where I should be looking for entry.

I intend to provide a brief background on the company and its potential for growth. In addition, I discuss why I am so bullish on SDGR. Finally, I attempt to determine my entry point and my initial strategy for 2022.

Background on Schrödinger

Schrödinger’s software platform has altered the way the world can discover drugs and materials. The company’s computational platform is licensed to materials companies, pharmaceutical companies, biotechs companies, universities, and government agencies around the globe to support the research and discovery of materials and therapeutics. The company has developed a computational platform, which facilitates the discovery of first-class molecules for materials application and drug development at an accelerated rate. The company believes that this computational approach allows researchers to discover new candidates at a reduced cost with an improved likelihood of success compared to traditional methods.

Schrödinger has refined their computational algorithms for accurately mapping important properties of molecules. This expertise has been enhanced by a partnership with NVIDIA (NVDA) which will allow scaling the Schrödinger platform to “dozens of drug programs and screening and evaluating billions of molecules a week.”

Schrödinger, with many having standardized its platform as a key component of preclinical research.

Schrödinger Business Overview (Schrödinger )

The company’s software sales were $38.6M for Q4, which is up 55% over Q4 of 2020. For full-year 2021, the company pulled in $113.2M representing 22% growth compared to full-year 2020. The $113.2M exceeded the company’s guidance of $102M-$110M. This reveals there has been increased adoption of the company’s platform, by both current customers and new customers.

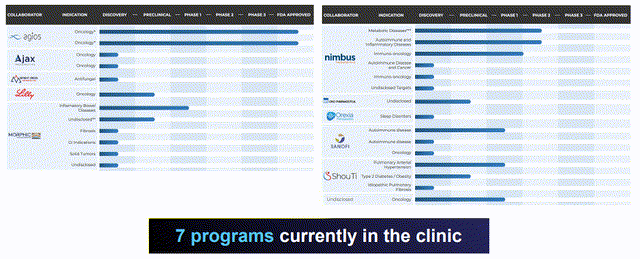

For the Drug Discovery Business, the company has more than 25 partnerships, which can deliver significant milestone payments. The Drug Discovery Business saw a 59% upsurge in revenue during 2021, which was largely due to the Bristol Myers Squibb (BMY) partnership. The Bristol Myers Squibb partnership has the potential to provide Schrödinger with a total of $2.7B in milestone payments. In addition, the company has another major partnership with Zai Lab (ZLAB) for DNA research worth up to $338M.

Schrödinger Partner Pipeline (Schrödinger)

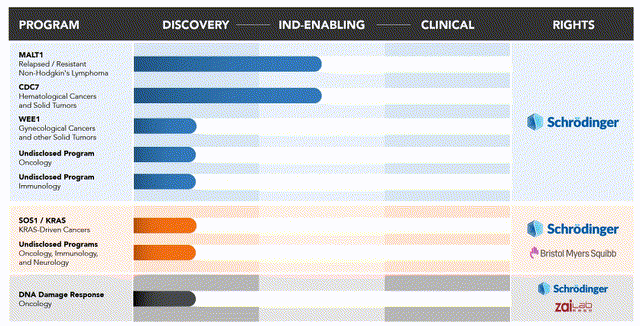

Moreover, the company has their own internal programs that could deliver first-rate products. The company has three lead assets including MALT1 for anti-tumor activity, CDC7 for DNA replication initiation, and WEE1 programs for tumor cell regression respectively.

Schrödinger Internal Programs (Schrödinger)

The MALT1 inhibitor program is taking aim at relapsed or resistant B-cell lymphomas and chronic lymphocytic leukemia. The CDC7 and WEE1 programs are pursuing cancer by exploiting replication stress and DNA repair mechanisms. CDC7 is attempting to address cancer’s ability to sidestep ordinary DNA damage reactions. WEE1 is a tyrosine kinase regulator of the G2/M cell cycle checkpoint, which could help trigger the cancer cell’s apoptosis process.

Make note, that all of these programs are still in the preclinical stage and are a long way from getting passed the FDA and onto the market.

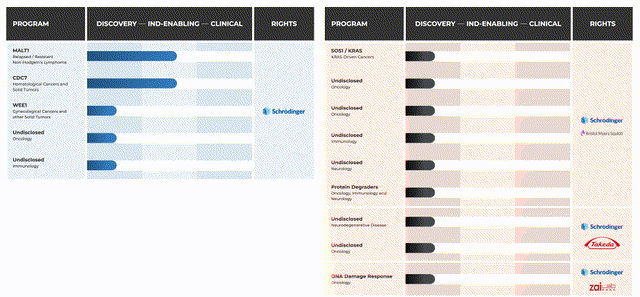

Schrödinger Internal Discovery Pipeline (Schrödinger)

Looking into the company’s internal discovery pipeline, we can see they have several other oncology programs, as well as immunology and neurology programs. Admittedly, these are just in the discovery phase, however, it does illustrate how the company can amass and replenish their pipeline.

Why I am So Bullish?

The reason why I’m so bullish on SDGR is that it is the industry leader in computational research and development, but at the same time, they’re able to use their own platform to discover and develop their own assets. As a result, Schrödinger is a healthcare technology and a biotech play, which will allow Schrödinger to benefit from the immense upside from the drug discovery business while also collecting a reliable revenue stream from their software business. What is more, Schrödinger could have gigantic upside potential because they have their own platform at their disposal, which will allow them to discover a plethora of candidates that they can license out, find a partner for, or decide to wholly-own for future programs. Schrödinger could see exponential growth as they continue to pump out more and more drug prospects… and they can have the pick of the litter.

Moreover, the growing software sales should increase in the coming years, thus improving the company’s intrinsic value and will help stabilize the investment if one of the pipeline candidates fails.

Perhaps one of the most overlooked scenarios is Schrödinger’s potential to become a major disruptor. Schrödinger essentially holds the keys to their software and can develop the best version of their software non-stop creating piles of drug prospects. As the company’s platform improves and the power of the computers multiply, we could those piles turn into mountains of drug prospects. At some point, someone is going to want to have those prospects and will want the power Schrödinger has. Therefore, I believe Schrödinger is a prime acquisition target.

Downside Risks

Despite Schrödinger’s upside potential, the company still has a few downside risks that investors should be aware of. First and foremost, the company is not reporting positive earnings and reported a net loss of $100M for 2021. Obviously, the company is going to burn through some cash as they move their lead drug candidates through the clinic. Another concern is the strong likelihood the stock is going to experience periods of volatility around data readout and pipeline updates. It is possible that the company will report disappointing results from one of their pipeline programs and the share price gets crushed for a prolonged period of time. This volatility will most likely increase as the company moves their programs into later stages of development. Obviously, regulatory failure will most likely prolong the cash burn, which will have a negative impact on the share price.

Finding A Price

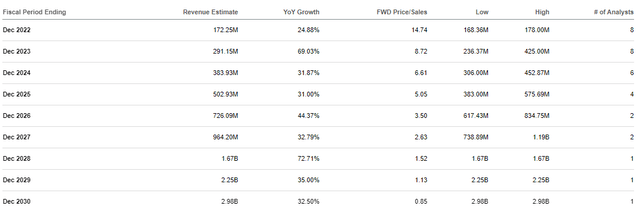

Now that I have decided to initiate a position in SDGR, I need to find an entry point. Using the Street’s revenue estimates for 2024, a discount for time, the company’s cash position, and the industry’s average price-to-sales of 5x, which gives me a $30 per share entry target.

SDGR Revenue Estimates (Seeking Alpha)

I will use the same data points and multiples along with a discount for error to get a discount target of $22 per share.

My Plan

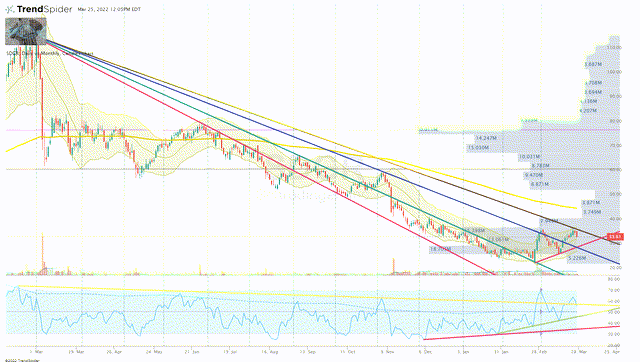

In most market environments I would set buy orders at my target entry price and allow the market to take the share price down to hit those targets regardless of technical setups or trend. At the moment, the market has been punishing stickers that were trading at high multiples but were burning through cash. SDGR is one of those tickers and has been punished to a greater extent thanks to it being a “Cathie Wood Stock” in her ARK Genomic Revolution ETF (ARKG). In this case, I’m going to set a price alert for SDGR and will look for a reversal setup below my entry price of $30 per share and will make a discretionary buy. Once I have established a starter position, I will look for the discount target of $22 per share to be my next buy threshold. In terms of taking profits, I will keep an eye out for “topping action” and will look to unload a portion of the position to obtain a “house money position”. I will follow this strategy until the company’s fundamentals justify a higher valuation and we are within sight of breakeven. At that point, I will look to transfer SDGR into by “Bioreactor” growth portfolio.

SDGR Daily Chart (TrendSpider)

Long-term, I am looking to hold SDGR for at least five years in anticipation the company will get one of their pipeline programs across the finish line and onto the market or the company is acquired for a premium valuation.

Be the first to comment