JHVEPhoto/iStock Editorial via Getty Images

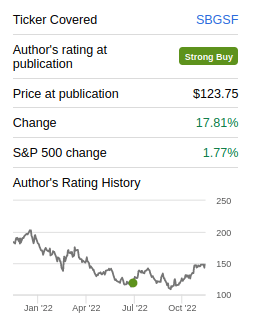

Since our last article on Schneider Electric (OTCPK:SBGSF)(OTCPK:SBGSY) where we argued that it was a great time to buy, shares have significantly outperformed the market. It did not hurt that the company delivered a solid third quarter with revenue growth of 12%. Energy Management grew revenue 12.1% to €6.8 billion while Industrial Automation grew revenue by 12% to €2 billion.

Seeking Alpha

Growth was also well balanced across the company’s three strategic pillars, but no doubt sustainable solutions was the star of the show with more than 20% growth. Meanwhile Software and Services grew ~10%, with the sub-segments of Energy Management Software and Digital Services both up more than 20%. Schneider also confirmed its 2022 earnings target, guiding for EBITA growth between +11% and +15% organic. This EBITA growth would be the result of revenue growth of +9% to +11% organic and Adjusted EBITA margin going up 30bps to 60bps.

Looking at end markets, most of them are performing well with strong market demand supported by accelerating energy transition trends and further recovery in late-cycle segments. There is some deceleration in consumer-linked segments such as residential building in Western Europe and China. On the positive side, there has been a gradual easing of the supply chains which is expected to continue improving despite some remaining pressure on electronics in particular remaining. Despite the overall inflationary environment, and remaining supply chain pressures, Schneider expects to be net price positive for the full year, including the impacts from freight and electronics.

Disposals & Acquisitions

Schneider reported making very good progress on its disposal program with €1.5bn of the €1.5 billion to €2.0 billion planned dispositions under way. This dispositions should help optimize the portfolio and finance the acquisition of the remaining AVEVA minority stake the company does not yet own, as well as continue financing the share buyback program. As a reminder, Schneider owns ~60% of industrial software powerhouse AVEVA and is now purchasing the remaining shares form AVEVA minority shareholders in a transaction that values the whole company at ~$10.8 billion. This full acquisition of AVEVA will increase even further the importance of industrial software for Schneider. The acquisition process for AVEVA minorities is expected to be completed by Q1 2023.

Some of the businesses being sold include the Industrial sensors business, where the company has a binding commitment for the sale of Telemecanique Sensors to YAGEO at an enterprise value €723 million. The company is also selling ASCO load banks to a US based private equity firm, and Eberle which is a heating & air-conditioning solutions company based in Germany.

Growth

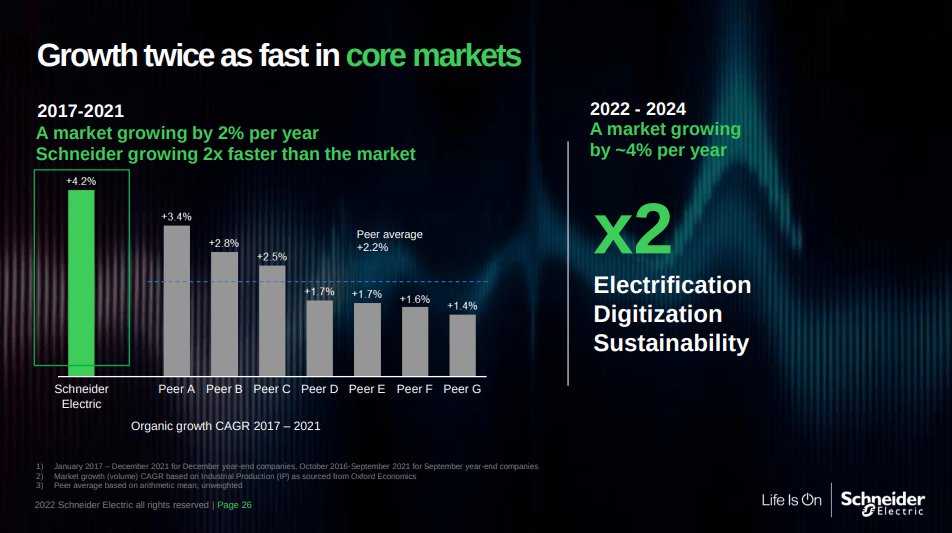

We believe that the increased focus on software and solutions, as well as on end markets focused on electrification, digitization, and sustainability, have made Schneider a more resilient company and able to grow faster than its core markets.

Schneider Electric Investor Presentation

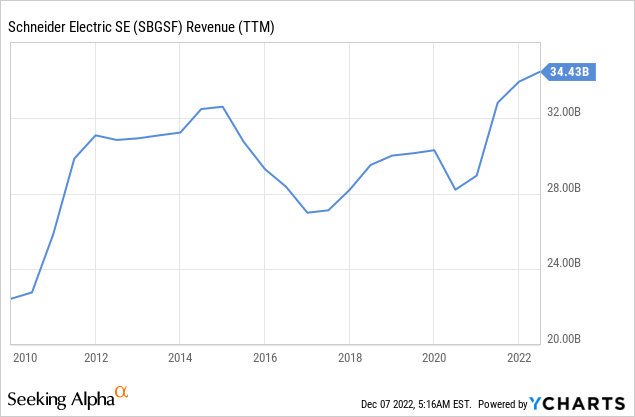

Over the past decade Schneider has grown revenues from a little over $20 billion to more than $30 billion, but it has experienced significant cyclicality along the way. Going forward we believe the company will be more resilient thanks to the increased focus on industrial software and recurring revenue businesses. Still, there are parts of its portfolio, such as those exposed to residential buildings and other consumer-linked business that will probably remain cyclical going forward.

Balance Sheet

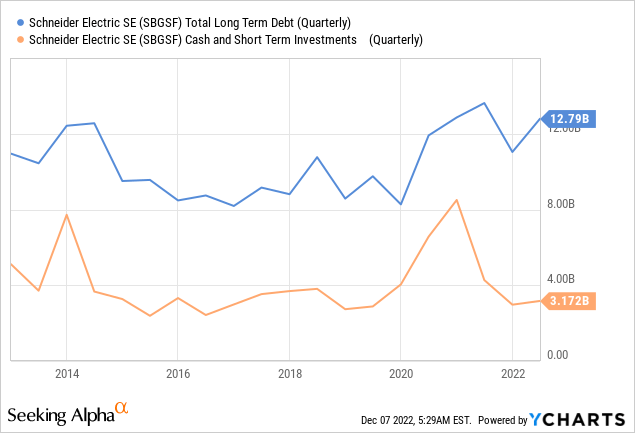

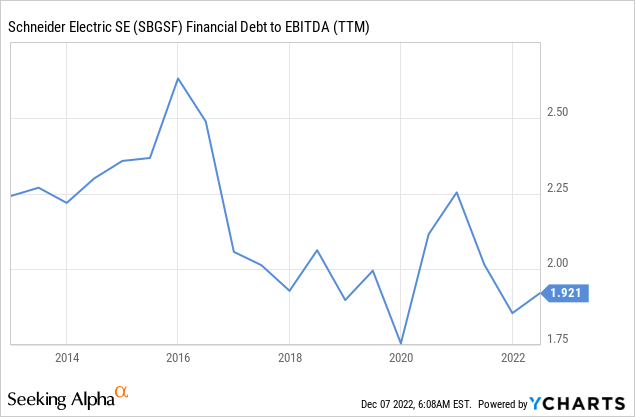

Schneider has plenty of liquidity with several billion in cash and short term investments, but with a meaningful amount of long-term debt. Given the strong profitability of the company and its investment credit rating we are not overly concerned.

The financial debt to EBITDA ratio remains within a reasonable level, even if the Altman Z-score is a little under the critical 3.0 threshold. We think the balance sheet is at a point where it remains strong, but it would be a bad idea to leverage it significantly more.

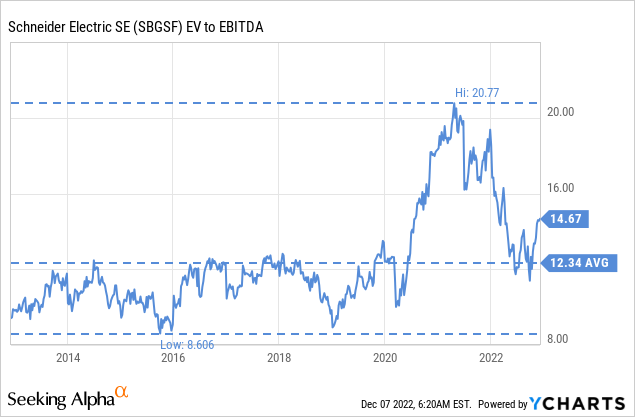

Updated Valuation

Shares are a little more expensive than the last time we covered the company, leading us to believe they are priced for high single digit returns, whereas it previously looked like low double digit returns looked more likely. The EV/EBITDA is a couple of turn above the ten year average, but to a certain degree this can be justified by the excellent performance the company has delivered recently.

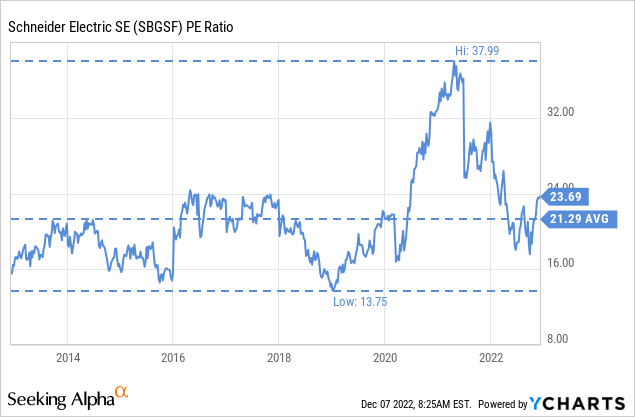

The price/earnings ratio is also a little bit above the ten year average, but nothing close to the peak it reached in 2021. The valuation therefore appears reasonable, even if no longer as cheap as the last time we covered it.

We are updating our valuation model to account for a stronger Euro (now about $1.05 dollars per Euro), and we are increasing the expected earnings growth rate to 9% from 7% for the coming decade. We are leaving 4% terminal growth and a 10% discount rate.

With the updated assumptions we estimate a fair value of ~$142 for the shares trading in OTC (SBGSF) and ~$28 for the ADRs (SBGSY). This is a little lower than where shares are currently trading, leading us to believe shares are currently priced to deliver high-single digits for long-term investors. We believe shares are still a decent buy, but no longer a ‘Strong Buy’, so we will adjust our rating accordingly. In addition to a reasonable valuation, there are other reasons to still considering Schneider as an investment, including the tailwinds from sustainability investments and benefits from the company controlling all of AVEVA.

| EPS | Discounted @ 10% | |

| FY 22E | 6.44 | 5.85 |

| FY 23E | 7.02 | 5.80 |

| FY 24E | 7.65 | 5.75 |

| FY 25E | 8.34 | 5.69 |

| FY 26E | 9.09 | 5.64 |

| FY 27E | 9.90 | 5.59 |

| FY 28E | 10.79 | 5.54 |

| FY 29E | 11.77 | 5.49 |

| FY 30E | 12.83 | 5.44 |

| FY 31E | 13.98 | 5.39 |

| FY 32E | 15.24 | 5.34 |

| Terminal Value @ 4% terminal growth | 253.96 | 80.92 |

| NPV | $142.44 |

Risks

In the short to medium term the biggest risk we see is that of a potential recession, which could mostly affect the more cyclical parts of the company. Other than that, we consider Schneider a very stable and well-managed company. The balance sheet is in decent shape, and profitability is solid, mitigating potential risks.

Conclusion

While shares are not as cheap as they were when we wrote our previous article, they remain a very solid investment candidate. We believe they offer high single-digit potential returns to long-term investors at current prices. There is the risk of a recession next year to consider. That said, we believe the company will continue to benefit from a number of secular tailwinds, including a move to sustainable and energy efficient infrastructure. We are updating our rating from ‘Strong Buy’ to ‘Buy’ to reflect our current evaluation of the company.

Be the first to comment