putilich/iStock via Getty Images

Thesis

SAP SE (NYSE:SAP) delivered better than expected Q3 results, clearly beating analyst consensus with regards to both cloud and non-cloud revenues. Moreover, SAP confirmed a solid guidance and highlighted to investors a very strong cloud business – with an order backlog of about €11.27 billion, jumping 26% year over year.

On September 13, I pointed out SAP’s underappreciated strength in cloud, and I assigned a ‘Buy’ recommendation. SAP stock is up about 8% since my analysis, versus a loss of about 4% for the S&P 500 (SPX). Today, following a strong Q3, I am confident to reiterate my ‘Buy’ rating for SAP and confirm my $110.18/share price target.

SAP’s Q3 Results

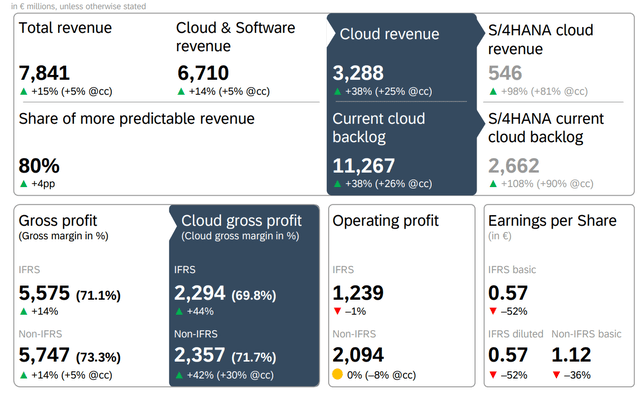

During the September quarter, SAP generated total revenues of €7.8 billion, which represents an increase of about 15% (5% currency neutral). Over the same period, gross profit increased by 14% to €5.6 billion. However, adjusted operating profit remained approximately flat year over year, coming in at €2.09 billion for Q3. Analysts had expected revenues to be €300 million lower, at €7.5 billion.

Excellent Performance From Cloud

SAP’s strong Q3 was driven by an excellent performance from cloud. SAP’s cloud revenues jumped 38% year over year (25% currency neutral), to $3.29 billion, versus analyst expectations of around $3.21 billion (Source: Bloomberg, EEO, 25 October). The cloud segment’s gross profit surged by 44%, to €2.3 billion.

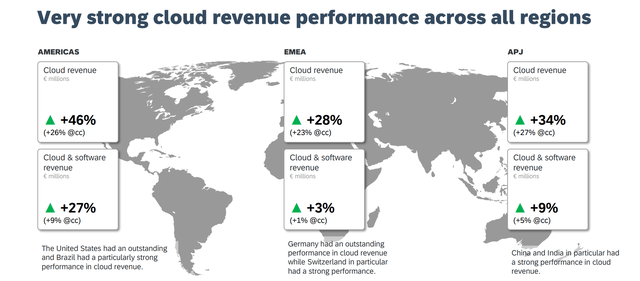

Notably, SAP’s cloud business recorded strong growth rates across all key regions, growing as much as 46% in the Americas. Luka Mucic, SAP’s CFO said:

We have delivered a strong cloud quarter with accelerating momentum across all key cloud indicators. We’re at an important inflection point in our transformation which we anticipate will lead to accelerating revenue growth and double-digit operating profit growth in 2023.

In line with a SaaS cloud expansion, SAP managed to deliver a 4% point increase in recurring revenue, which now accounts for 80% of the company’s total sales exposure. Christian Klein, CEO commented:

With a recurring revenue share of more than 80%, it’s clear that our transformation has reached an important inflection point, paving the way for continued growth in the future.

Outlook Remains Strong

Perhaps the most notable takeaway from SAP’s Q3 results is the continuing strong demand for SAP’s cloud business. Despite macroeconomic challenges, the software giant’s order back log increased to about €11.27 billion in Q3, which represents a year over year growth of approximately 26%.

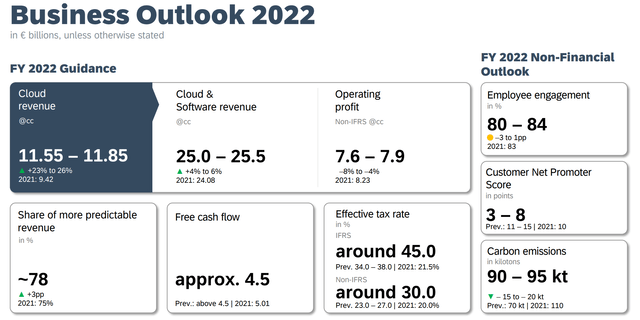

On the backdrop of a strong demand for cloud, management reiterated a solid guidance for 2022. For the FY, SAP expected cloud & software revenues between €25 billion and €25.5 billion; and operating cash flow between €7.6 billion to €7.9 billion.

If the estimate is correct, SAP would effectively be trading at an EV/Operating CF of about x14.4.

Not Without Risks

But of course, there remain risks – with a recession-driven demand destruction for IT spending being the most severe. In that context, Bloomberg Analyst Anurag Rana pointed out that:

SAP’s high exposure to Europe, with 44% of its sales coming from the region, makes it more susceptible to any pullback in enterprise IT spending vs. other large, diversified software companies.

In my opinion, if the macro-economic outlook worsens significantly, expectations for SAP’s earnings outlook should be adjusted downwards. In that case, it wouldn’t help that SAP delivered a strong FY outlook following Q3. In fact, it would make the disappointment only more pronounced.

Moreover, given the uncertainty surrounding the global economy, and Europe in particular, investors should consider that much of SAP’s current share price volatility is driven by investor sentiment towards risk assets and stocks in general. Thus, investors should expect price volatility even though SAP’s fundamental business outlook remains unchanged.

Reiterate Buy Rating

Following a stronger than expected Q3 from SAP, I am confident to reiterate my ‘Buy’ rating for Europe’s largest software company. I continue to believe that investors are lagging to appreciate SAP’s accelerating cloud transformation, which could sustain not only +80% of recurring revenues, but also EBIT margins close to 25% – in line with US’ peers.

In my opinion SAP remains undervalued, as I see the fair value per share at $110.18.

Be the first to comment