martin-dm

Published on the Value Lab 10/7/22

Banco Santander, S.A. (NYSE:SAN) is one of the recent ideas we had along the lines of income safety during a recession. With yield being a reasonable place to park money, we consider stocks that offer a fundamental profile that can support a decent yield in order to head-start returns where capital appreciation is becoming less likely. Banks are an interesting segment in general thanks to their positive exposure to higher rates, and Santander is a rather clean play into net interest income as opposed to fee and commerce-based income from where banks increasingly have been gaining income share. With a low payout and high yields at 7.6%, we think Santander could be of interest to investors.

Q1 Update

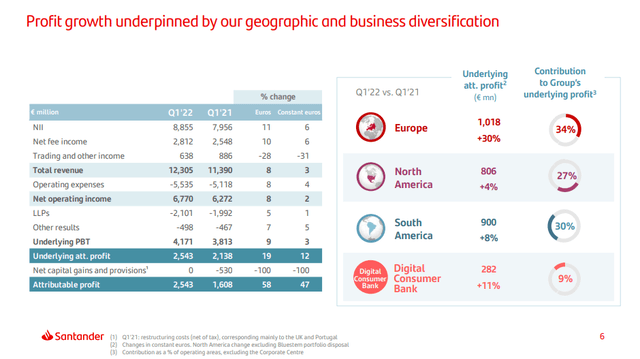

It’s worth getting the most recent Santander updates, keeping in mind that this is a quarter coming out of a much rosier macroeconomic environment. Nonetheless, we see several salient factors that are relevant in a downturn. The first is that their NII is a very large proportion of their overall income.

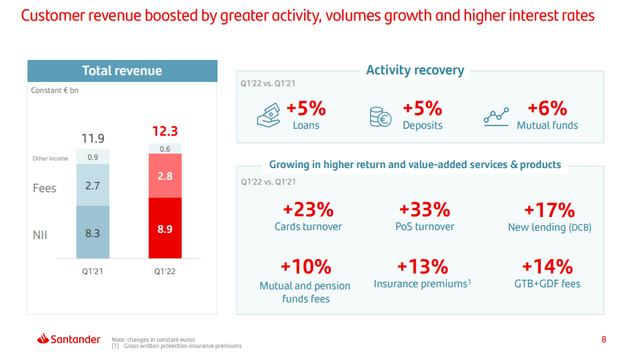

At 75% of the overall revenue, NII contributes meaningfully to the company’s growth as opposed to fee-based income, which is more based on commercial volumes and more subject to declines in a recession.

The other thing to notice is where growth in operating profit of 19% is coming from despite declines in trading income.

Financial Highlights (Q1 2022 Pres)

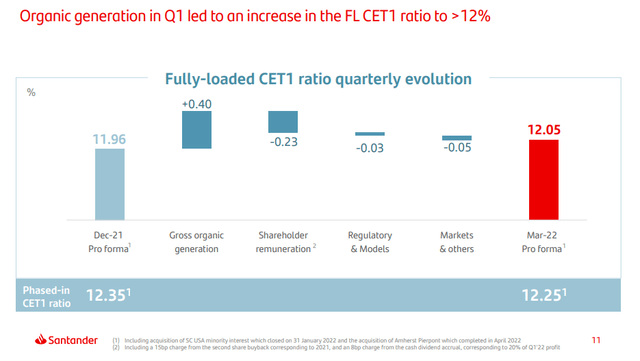

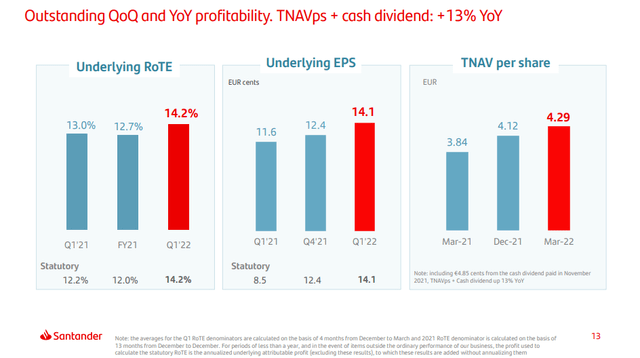

Loan growth is not driving it, which is positive, because it means Santander has not been sinking business into segments of the market that have only recently entered credit markets in force. A slower loan growth rate in a period of substantial credit expansion prior to this recession shows more capital discipline, and a likely lower volatility in loan growth rates in the future to support the Santander base of business. The driver for the operating income increases has been primarily from European markets and in the form of cost control and reduction of costs of loans. This has been while CET1 ratios improved, indicating even a reduction in leverage, which would have been higher absent shareholder payouts.

Consequently, all metrics for capital management have improved.

Dividend

A higher CET1 ratio is critical for assessing the sustainability of shareholder remuneration which comes out of the coffers that covers the bank for its risk-weighted assets. Growing CET1 ratios despite a continuing period of credit expansion is a positive move from Santander. Moreover, slower loan growth and ability to offset inflation when it is at its worst also was an impressive showing from the company, allowing for operating profit growth despite a still very low rate environment as of Q1 2022. Inflation should somewhat turn now that monetary authorities are putting the brakes on the economic boom, and the only new source of loan costs to be expected are higher reserves and costs from defaults and bad debt. However, with disciplined loan growth rates across markets, we don’t expect an exceptional need for higher reserves from Santander on a go-forward basis, as we get more clarity on the severity of the recession which will come after real layoffs materialize.

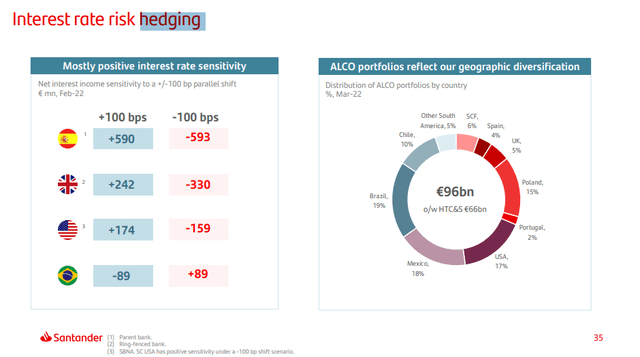

The dividend is also covered by the high proportion of NII income in revenue, which should only grow as higher rates take effects. While loan growth won’t likely provide a lot of rollover into higher rate fixed rate debt, where Santander currently has quite a lot of fixed assets (about 60%) issued to customers, hedging has put them in a position where, in spite of their fixed rate portfolio, they will benefit from interest rate increases thanks to derivative instruments.

100 bps increase in rates is reported to be able to boost NII from Spain by 40%, which will more than offset any fee declines. With Spain, the UK, and the U.S. alone accounting for 35% of NII, we know that major markets are hedged such that rate hikes will benefit Santander. Moreover, with large NA exposures, Santander is more exposed than other European banks to Fed action which should be sharper than the ECB.

The payout ratio for Santander is really low. The earnings yield on the company is about 25% on account of a very low P/E ratio. The dividend yield is 3.8%, and the total shareholder payout is 50:50 dividend and buybacks so the total shareholder yield is currently at 7.8%. This is a payout ratio substantially lower than 50%, which on top of fundamentals that could even improve in the current economic scenario, means the payout is very safe.

Conclusions

Yield is valuable to investors right now with capital appreciation being dicey. Investors should expect that an incoming recession could result in higher loan loss reserves, but we expect that Santander should be better positioned than other banks which have relied more on loan growth with the housing boom in particular. Santander appears to be more diligent, and its performance is coming more from the cost side. While a crash in real estate markets and a general recession is difficult to hide from when going long the equity markets, Santander should be relatively safe. Moreover, with a substantial yield that is very well covered, investors can benefit from a yield-based head-start on returns while capital appreciation languishes. We think Santander is a good play for the current environment and investors might be wise to consider it.

Be the first to comment