caio acquesta/iStock Editorial via Getty Images

Banco Santander Brazil (NYSE:NYSE:BSBR) has a good business profile and a very good level of profitability, which are important factors to manage economic downturns, but credit quality may deteriorate in the coming quarters and impact negatively its earnings, capital position and ability to return excess capital to shareholders.

Background

As I’ve analyzed in previous articles, I’m bullish on Santander Brazil over the long term as I like its business profile as a quality bank within the Brazilian banking system.

The bank is part of the Spanish financial group Banco Santander (SAN), which is its largest shareholder with a stake of about 90% while the rest trades as free-float. Santander Brazil has been listed since 2009, due to Santander’s strategy of its local units having financial autonomy, which means that they don’t rely solely on funding from central operations, and is traded in the U.S. on the New York Stock Exchange through its ADR program.

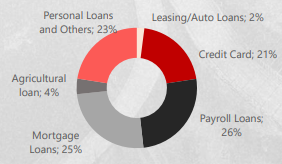

Santander Brazil’s operations are mainly focused on retail banking, being one of the largest private banks in the country. Its credit portfolio amounts to some $90 billion, with more exposure to individuals than corporates, and is well diversified by loan category within the individuals segment, as shown in the next graph.

Individual loans (Santander Brazil)

Since my last article on Santander Brazil, the bank has maintained its growth strategy of growing organically its business, a strategy that is progressing well as the bank maintained a solid growth path regarding the total number of customers, revenue and earnings growth.

Recent Earnings & Growth

Santander Brazil’s growth has been quite positive over the past year, as the bank continues to improve its customer offering and service, of which digitalization is a key factor. Santander Brazil has made an effort to move the vast majority of its operations to the cloud, which leads to a simplified offer and processes, and a better customer service through faster delivery times.

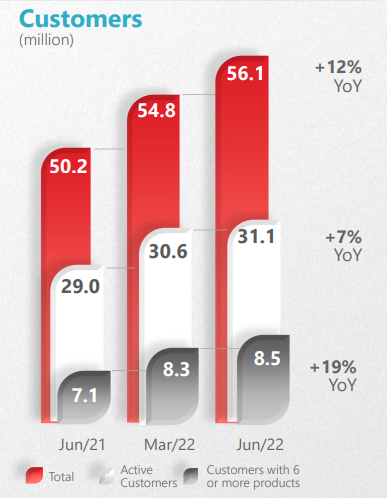

This strategy is positive both for customer growth and cost reductions, and is one important factor supporting sustainable customer growth and higher engagement with existing customers. As shown in the next graph, while the total number of customers increased by 12% YoY to more than 56 million by the end of last June, the number of customers with six or more products increased by 19% YoY. This shows that a better customer service leads to higher engagement, which is positive for revenue and earnings growth over the long term.

Customers (Santander Brazil)

During the first six months of 2022, Santander Brazil’s revenues amounted to close to $7 billion, up by 0.8% YoY, as the bank increased fees by 4.8% YoY, but net interest income (‘NII’) declined by 0.5% YoY due to lower revenue in markets as NII’s sensitivity to upward yield curve movements is negative.

Regarding costs, Santander Brazil has historically been good at cost control, but inflationary pressures led to wage increases and general expenses increased by 8.4% YoY in the last six months, a higher rate than revenue growth. This leads to a lower efficiency ratio, but nevertheless the bank continues to report a fantastic efficiency, measured by its cost-to-income ratio of only 34.9% in the first semester, among the best in the banking sector globally.

Indeed, even though the Santander Group as a good efficiency, its Brazilian unit is clearly superior on this metric considering that the group’s cost-to-income ratio was close to 53% in the first six months of 2022. This is important because a superior level of efficiency is a key factor for Santander Brazil to have a superior profitability level within the banking sector, which seems to be sustainable over the long term as the bank’s track record on cost control has been quite good.

On the other hand, a negative factor for the bank’s earnings and profitability in recent quarters have been higher provisions, justified by a global economic slowdown and the prospects of a recession in the near future, plus some deterioration in its consumer business. As the bank is usually conservative in its risk models, provisions increased to nearly $2 billion in H1 2022, an increase of 59.7% YoY. Despite that, its non-performing loans ratio was stable in the last quarter at 2.9% of gross loans, a sign that credit quality remains good for the time being. However, investors should note that credit defaults usually have a time lag of about six to twelve months from the start of an economic downturn, thus this is a critical factor to follow in the next few quarters.

Due to much higher provisions, Santander Brazil’s net income was close to $1.6 billion in H1 2022, down by 0.5% YoY, while its profitability level remained at a very good level, measured by the return on equity (ROE) ratio, of 20.7% in the first semester of the year.

Going forward, Santander Brazil is expected to maintain a positive operating momentum, especially in its top-line which is expected, according to analysts’ estimates, to grow to about $14 billion in 2022 (+37% YoY), and increase by double-digit in the following two years. However, earnings growth should be slower as the market is expecting provisions and credit quality to be a headwind over the next couple of years, even though the impact on profitability should be manageable and ROE is only expected to drop to 19% by 2024.

Despite these headwinds, Santander Brazil’s strategy is not expected to change much, remaining focused on organic growth, even though small bolt-on acquisition may not be ruled out in the future. Its strategy to streamline its operations and invest in technology should also remain key to offering better customer service, which is a key factor to gain customers and increase engagement with its current client base over the long term.

Capital & Dividends

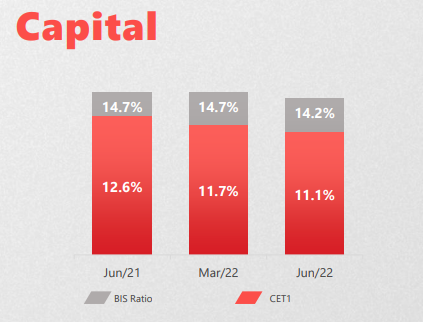

Regarding its capitalization, Santander Brazil has a good capital situation, given that its core equity tier 1 (CET1) ratio was 11.1% at the end of June, but declined significantly compared to its position on June 2021, due to higher risk weighted assets in market securities justified by higher volatility on capital markets and higher credit risk in its loan portfolio.

Capital (Santander Brazil)

Even though this is still an adequate capitalization and the bank has a strong balance sheet due to a comfortable funding and liquidity position, the decline in its capital ratio means that its excess capital position has decreased and the bank’s buffer to distribute capital to shareholders is now lower than it was some months ago.

Santander Brazil’s capital return policy has been to distribute excess capital to shareholders, through dividends and interest on capital being the preferred way. This has not changed in recent months, with the bank maintaining a strong capital return policy, in-line with its strategy of distributing about 50% of its annual income to shareholders, with a quarterly dividend frequency.

However, the bank’s distributions are to some extent discretionary and don’t follow a predictable path, which makes it difficult to forecast how much Santander Brazil will distribute in coming quarters. Moreover, the bank has recently cut its distributions, which seems sensible due to macroeconomic headwinds and a lower capital buffer, and further cuts may happen in the near future. Considering its distributions made during 2022, Santander Brazil currently offers a dividend yield above 6% at its current share price, which is quite interesting for income investors.

Conclusion

Banco Santander Brazil is a bank with a very good business profile, but economic headwinds have led to a surge on provisions and there are some questions on the bank’s credit quality in the coming quarters. Moreover, its capital ratio declined substantially in recent months, which is a warning sign.

Therefore, even though it offers a high-dividend yield and its valuation of about 1.5x book value is not excessive considering its quality profile and high ROE, I’m now neutral on Santander Brazil stock and think it is better for investors to wait a few quarters to see if credit quality remains resilient or if it will impact negatively its earnings over the coming quarters.

Be the first to comment