JHVEPhoto

Here at the Mare Evidence Lab, we always liked Sanofi (NASDAQ:SNY). Based on the net present value of new drug development, the French pharmaceutical giant has consistently scored among the lowest level versus its European peers. If we add the fact that the company is classified as a European dividend aristocrat and its management is continuing to lower the COGS expenses, we believe it represents a perfect match between value & growth. In our previous publication, we already detailed about Eurapi spin-off, and today we are focusing on the Q2 performance.

Q2 results

The French pharmaceutical company delivered a strong set of numbers beating Wall Street consensus expectations both in the revenue and operating profit line.

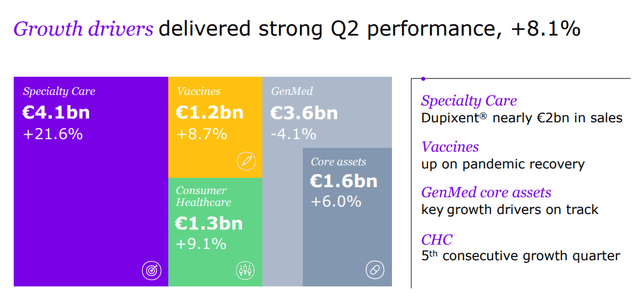

In the second quarter, Sanofi’s revenues climbed by 15.7% and reached €10.1 billion. In detail, top-line sales increased thanks to Dupixent, a drug used against asthma and certain dermatitis that delivered a plus 43% and now represents almost €2 billion in total sales. Including Dupixent performance in the specialty care division, revenue grew by approximately 22% over one year, exceeding €4 billion. A positive performance was achieved even in the vaccine division thanks to pediatric vaccines as well as the gradual recovery in sales of travel vaccines. Only the general medicine division which includes health products for diabetes and cardiovascular disease recorded negative sales results. However, looking at the analyst’s consensus estimate, the division beats expectations by 4%. We also note that there was a positive one-off for a total of €60 million due to inventory.

Source: Sanofi Q2 results

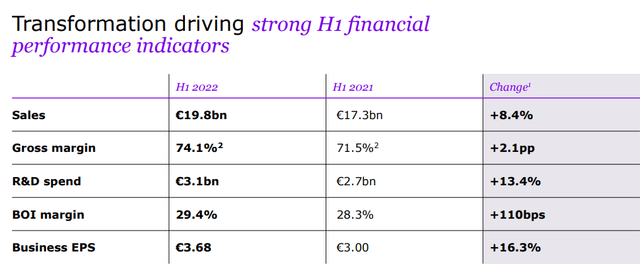

Going down to the P&L, the business operating income delivered a 13.2% growth, this was driven by Sanofi’s operating leverage. Looking at the image below, we can clearly state that our value/growth thesis is working pretty well.

Source: Sanofi Q2 results

Conclusion and valuation

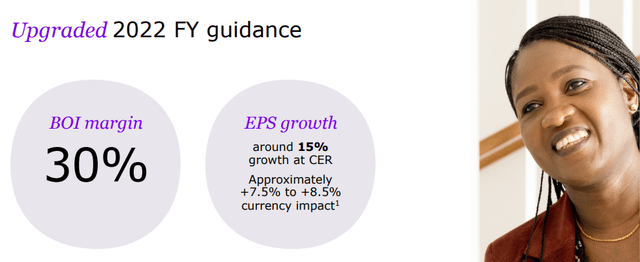

Reinforced by these good results, Sanofi has revised upwards its 2022 outlook and now anticipates growth in EPS by approximately 15% at constant exchange rates (it was previously expected at a low double-digit). We like Sanofi’s business model with a simplified organization, a restructured portfolio containing more organic products, a transformed R&D, and strong ambitions in terms of profitability and financial solidity. Thanks to the Eurapi spin-off and also the expected saving from Dupixent production, we believe this P/E discount compared to European pharmaceutical peers is not justified. More in detail, the French pharmaceutical company is trading on a forecasted 2023 P/E ratio of 12.5x with a discount of 10% versus its European peers, excluding Novo Nordisk (NVO). Adjusting our internal estimates after the Q2 results, we reaffirm our buy rating at €110 per share.

Source: Sanofi Q2 results

Be the first to comment