hapabapa

Thesis

Salesforce, Inc. (NYSE:CRM) has underperformed the S&P 500 (SPX) (SP500) since we upgraded it to Buy in August.

We had anticipated CRM to retake its long-term bullish bias, but CRM bears had other ideas. The market correctly anticipated Salesforce would release weak guidance in its previous Q2 report card, impacted by worsening macro and forex headwinds.

We assessed that the market remains tentative over Salesforce’s ability to deliver its FY26 (year ending January 2026) revenue target. Notwithstanding, Wall Street analysts have upgraded Salesforce’s FY26 adjusted operating margins in line with management’s guidance at its Dreamforce Investor Day.

Still, the market’s focus has likely turned on its ability to meet its FY23 guidance, as enterprise SaaS companies have turned in tepid guidance at their recent Q3 earnings releases.

Hence, we deduce the market has likely priced in another weak quarter for CRM, as consensus estimates were little changed from August. Therefore, we believe the market needs to account for higher execution risks through the worsening macro climate as companies pull back their spending.

However, the de-rating has improved CRM’s valuation markedly against its peers’ median. Despite that, CRM still trades at a premium (relative to peers), behooving management to execute well and outperform its guidance.

CRM’s recent price action has also not indicated any compelling buy signals, with sellers in decisive control. Therefore, we believe CRM is at a critical juncture with buyers needing to show conviction.

Notwithstanding, CRM’s cautious positioning heading into its FQ3’23 release forebodes well for the stock, as the market has likely baked in risks that Salesforce could revise its FY23 outlook, given recent trends. Therefore, it sets up CRM for a potential mean-reversion rally if management’s guidance is better-than-feared, helping move CRM toward retaking its critical August highs.

Maintain Buy.

Management Needs To Deliver A Confidence Booster

Salesforce reiterated its FY23 guidance at its Dreamforce Investor Day, with forward visibility through FY26. Notably, management emphasized “profitable growth at scale,” aligning its priorities with what the market has been looking for.

Management emphasized that it’s looking at least 25% in its adjusted operating margin but couldn’t commit to its GAAP margins, given its use of stock-based compensation. In one of our previous articles, we highlighted why its weak GAAP earnings remain a bugbear with investors.

Notwithstanding, management assured investors its operating margins target was not predicated on meeting its FY26 revenue target of $50B. CFO Amy Weaver articulated:

I think the multi-cloud adoption is incredibly powerful. I still do see a solid line to $50 billion. Now foreign exchange has taken about $2 billion. But right now, if that continues to go down, that would put a lot of pressure on that number. In terms of operating margins, we’re aiming to get to 25% or higher in FY26. If we have more revenue, my job gets a lot easier. But no, that’s not necessarily dependent on hitting that $50 billion. (Salesforce Investor Day)

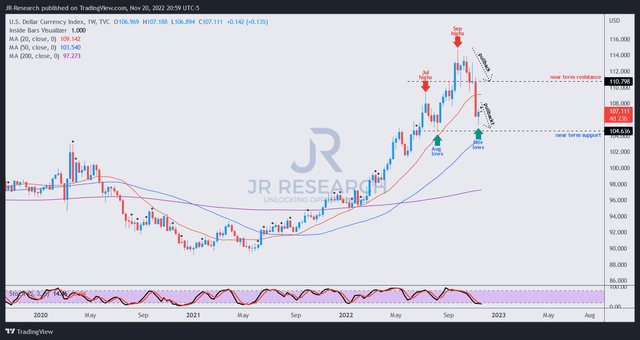

DXY price chart (weekly) (TradingView)

Salesforce updated guidance suggests revenue of $7.825B (midpoint) for FQ3 and FY23 full-year revenue of $30.95B. The Dollar Index (DXY) has pulled back nearly 7% from its September highs, which also lifted market sentiments from their October lows.

As such, Salesforce should have experienced less harsh forex headwinds than what the company experienced in September. However, we believe the market’s focus has likely shifted to assessing the fallout on enterprise cloud spending, given the increased cost-cutting announcements.

With Salesforce needing to deliver a revenue CAGR of 17.2% from FY22-26, the market is justifiably concerned that any disappointment from its interim outlook could impinge materially on Salesforce’s FY26 model.

Is CRM Stock A Buy, Sell, Or Hold?

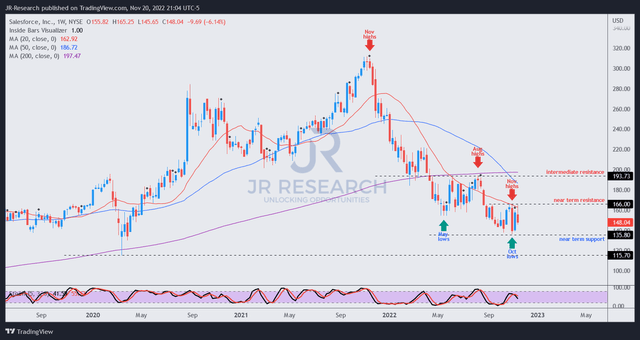

CRM price chart (weekly) (TradingView)

We gleaned that CRM remains nearly 25% below its August highs, suggesting that the market has cautiously positioned CRM heading into its FQ3 release.

Sellers remain in control, and therefore, the market has likely expected Salesforce to deliver a worse-than-expected report card coupled with tepid guidance.

Our analysis suggests significant pessimism has been baked into its valuation and price action. However, CRM’s momentum remains bearish, with November highs a considerable impediment to regaining its bullish bias.

While we remain optimistic about Salesforce’s commitment toward “profitable growth,” we cannot rule out a further re-test of its March 2020 lows.

Maintain Buy, but we encourage investors to layer in over time progressively.

Be the first to comment