Stephen Lam/Getty Images News

Thesis

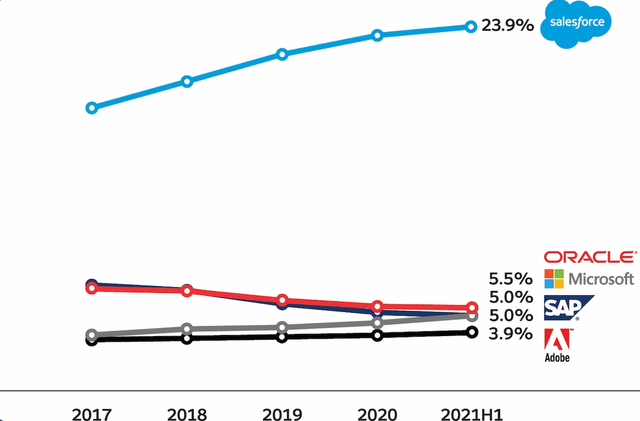

Salesforce is the dominant leader in the Customer Relationship Management software market with 23.9% of the market. The company is a buy here after a 40% drawdown from ATH and based on strong customer retention, upselling and being a leader & innovator in the industry.

CRM market share (International Data Corporation (IDC))

Macro Tailwinds

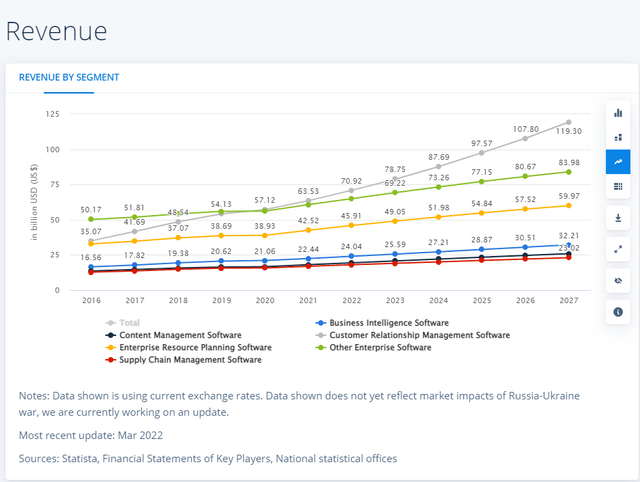

According to Statista, the enterprise software market is expected to grow from $243 billion in 2022 to $344 billion in 2027, a compound annual growth rate (CAGR) of 7.2%. Customer Relationship Management (CRM) is expected to grow the fastest among the six enterprise software niches, even though the segment is growing from the highest base of $63 billion in 2021. The segment is expected to grow with a consistent CAGR of around 11% until 2027, roughly doubling in size to $119.3 billion. Salesforce is expecting even faster growth in the market, expecting spending of over $1 trillion in 2024 for future of work technologies and a 13% CAGR in their TAM.

The reasoning for the expected outperformance of CRM software compared to other enterprise software niches is simple: The goal of any company is to sell products. This is where most of the spending goes to.

enterprise software market CAGR (Statista)

SaaS Checklist

I have a checklist of factors to look at for SaaS companies, so let’s take a look at the last earnings report and see how Salesforce is performing regarding:

- Retention rates

- Multi-product customers

- Number of customers with revenue > 10 mil / 100 mil

- Number of modules

- Gartner magic quadrant positioning

- Margins

- Rule of 40

Disclaimer: Salesforce doesn’t communicate all these metrics quarterly, so I will have to resort to annualized Q2 data for some metrics. Due to Salesforce’s very predictable business, these annualized values should be relatively accurate though.

Retention rates

High retention rates in SaaS business tell us about how well the company manages to keep existing customers (gross retention rate) and increase spending per existing customer (net retention rate). Sadly, Salesforce doesn’t disclose Net retention rates as SVP Evan Goldstein said at the Investor Day last September

We obviously don’t disclose that metric, right? But the way I would think about it is with the significant revenue increase and the continuing decline in attrition, you can get a sense of how the business is doing.

Regarding gross retention, this value has always been around 91% for Salesforce historically. Q3 and Q4 marked the first two quarters in CRM history with gross retention above 92%. Q4 saw the company’s highest gross retention around 92.5-93%. It is a shame that Salesforce doesn’t disclose the NRR, but GRR is going in the right direction and I assume NRR is too.

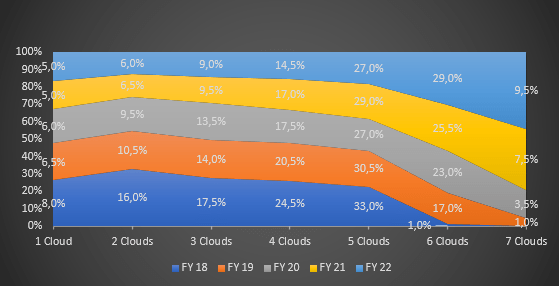

Multi-product customers

To effectively upsell customers, you need to have customers adopt as many of your services as possible. In the graphic below, we can see that Multi-Cloud adoption is accelerating. The categories of customers with more clouds are rising significantly faster than the categories with fewer clouds. The graphic below visualizes this trend. Customers with 6 Clouds grew from 1% in 2018 to 29% in 2022. 7 Cloud customers grew from 0% in 2019 to 9.5% in 2022. At the same time share of 1-, 2-, and 3-Cloud customers declined from 8% to 5%, 16% to 6% and 17.5% to 9%. Upselling doesn’t seem to be an issue for Salesforce, which indicates a good NRR, even though they don’t disclose that.

CRM Multi-Cloud customers (Authors model)

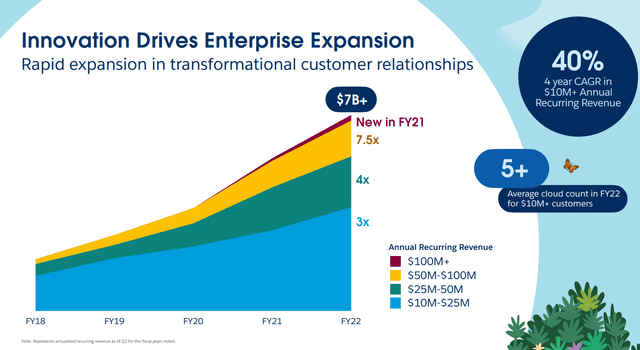

Number of customers with revenue > 10mil / 100 mil

The upselling in the existing customer base should also be visible in the number of big customers. As we can see in the graphic below Salesforce sees acceleration in growth here too. The revenue contributed by customers in the $50-100 million ARR range is growing almost twice as fast and more than twice as fast as $25-50m ARR and $10-25m ARR respectively. Additionally, Salesforce has its first customers spending more than $100 million annually in FY 21.

CRM big customers (Salesforce Investor Day)

Number of products/services

To upsell existing customers with new products and services, Salesforce needs to have a pipeline of new products available to clients.

Although I did not see new products in the last earnings, Salesforce did set a company emphasis on the Sustainability Cloud 2.0, which got introduced in Q2. Since its founding Salesforce was run with the “1-1-1 Model” in mind: A model established by Founder Marc Benioff in 1999, which dedicates 1% of the company’s equity, product and employee time to giving back to the community. This firmly ingrained a culture of sustainability into the company and is one of the core values, it makes sense that Salesforce is expanding more in this direction. To quote Benioff from the last earnings call:

Bret and I just looked at a very cool company together. When you say we were surprised the type of companies that we’re looking at in carbon relationship management that before we were not, it’s the new CRM, carbon relationship management. Because there’s a lot we can do in analytics, in information management, and in helping our customers get the carbon that they need to be successful.

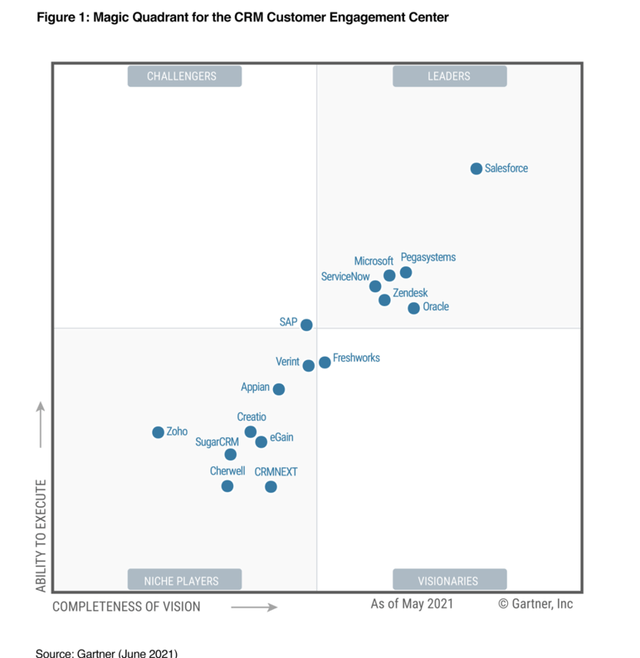

Gartner magic quadrant positioning

Technology research and consulting firm Gartner (IT) frequently release their so-called “magic quadrants” for different industries and niches. The magic quadrants are a graphical representation of the competitive positioning of four types of technology providers in fast-growing markets: Leaders, Visionaries, Niche Players and Challengers. In the graphic below we can see the latest magic quadrant for CRM. For the past few years, Salesforce has been the company furthest in the leaders and visionaries quadrant, underlining its competitive advantage and innovation.

CRM Gartner magic quadrant (Gartner)

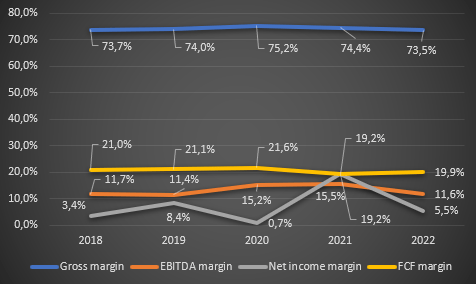

Margins

It is important to check how margins have developed over the years. For Salesforce we can see that margins don’t look too great. Gross margins have been stagnating between 73-75%, a high level, but we are not seeing much leverage here. Free Cash Flows have been fairly consistent between 19-21% margin, but we also see a decline here. EBITDA has also been fluctuating, no leverage to see here. Salesforce does not optimize earnings for Net Income, so we see a lot of fluctuation here, swinging between 0-15%. Overall Salesforce is still fully focused on expansion, organically and inorganically through acquisitions. Margins are a yellow flag for the company and have to be monitored going forward. Given their market position and customer focus, they should have great operating leverage kicking in along the road. Investors have to look closely to monitor if this happens or not in the next years.

CRM margins (Authors model)

Rule of 40

The rule of 40 is a metric to see if a SaaS company is growing healthily. The rule is calculated by adding the growth rate to the profit margin. There are different versions of the rule of 40, depending on the type of profit margin used. For Salesforce, I will use the Free Cash Flow margin of 19.9% and their last quarterly revenue growth rate of 27%, leaving us with a score of 46.9: This means that Salesforce has a healthy mix between profitability and growth.

Risks

1) For any SaaS company cyber security is a thread. If hackers would manage to gain access to Salesforce’s data center and extract sensible customer data, that could lead to serious damage to their reputation.

2) If Salesforce services experience a prolonged outage, this would also lead to serious damage to their reputation. A lot of companies have Salesforce deeply entrenched into their workflow and an outage could stop the whole company from working.

3) As most of you probably heard by now: Elon Musk is trying to take over Twitter (TWTR) and make it private. In response to that, the Twitter board of directors initiated a poison pill. A poison pill is a very unfriendly situation for shareholders. Why am I bringing this up in an article about Salesforce? Bret Taylor, Co-CEO of Salesforce is the chairman of the board at Twitter. The question now is will Bret act in a similar shareholder unfriendly way as the CEO of Salesforce?

4) Profitability and competition are other risks for Salesforce. So far they have done a great job at improving their market position and fending off competitors. The question is can they achieve significant operating leverage in the future?

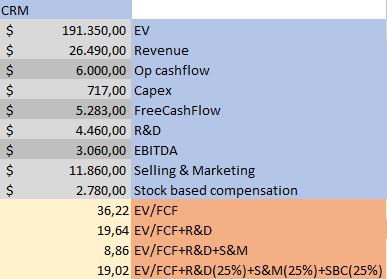

Valuation

Salesforce is a tough company to value. Much like Amazon (AMZN), Salesforce suppresses earnings by aggressive reinvestment. In the last 12 months, Sales and marketing expenses equaled 44.7% of CRM revenues, R&D was 16.8% and Stock-based-compensation (SBC) was 10.5%. 73% of revenues for the three factors. Valuing Salesforce on earnings doesn’t make much sense, considering their low net income margins. I rather look at Free Cash Flow. I also use enterprise value, to account for their $3.8 billion in net debt. Salesforce currently trades around 36 times Free Cash Flow. In the graphic below you can see that I had a look at the different factors and how small changes can improve the valuation significantly. Salesforce is still compounding customers and revenue at a very rapid pace, 26% revenue growth at their scale is unprecedented in enterprise software. At some point, they will be able to focus on profitability though. If we assume a reduction of 25% in R&D, S&M and SBC spending, we’d be left with a 19 times FCF multiple, or a 5.2% FCF yield. I think that the current valuation is reasonable for a company growing at the rates (25%~) and scale Salesforce is growing at. Over the next few years, it will be important to observe where the percentage of revenues for R&D, S&M and SBC goes.

Salesforce multiples (Authors model)

Conclusion

I consider Salesforce a buy at these levels and bought more shares last week. Salesforce now accounts for 4% of my portfolio. An investment into Salesforce doesn’t come without risk though, as there are a lot of moving parts:

- Transition to a new CEO eventually, especially looking at the Twitter controversy of Co-CEO Bret Taylor.

- Increasing profitability through better cost controls and SBC easing.

- Fending off competition in a highly competitive market.

I am confident in Marc Benioff and the team to deliver market-beating returns for shareholders as they did in the past.

Be the first to comment