benedek/iStock Unreleased via Getty Images

$50B revenue + 25% adj. EBIT margin in FY26

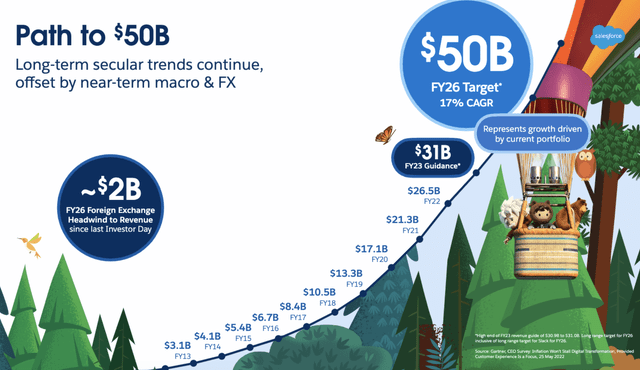

On 9/21 Investor Day, Salesforce (NYSE:CRM) reiterated its FY26 (C25) revenue target of $50 billion which indicates a 17% 3-year CAGR from FY23 (C22) revenue guidance of $31 billion (+17% YoY). Despite a worrying macro narrative and a $2 billion FX headwind, the outlook provided management seems to be better than feared.

Salesforce Investor Presentation

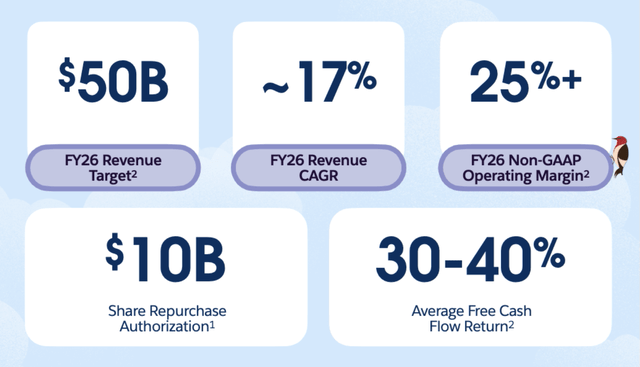

What’s perhaps a positive surprise to the market was that for the first time, Salesforce openly communicated a minimum adj. operating margin target of 25% in FY26 including the impact of potential M&A. Additionally, the $10 billion buyback program with no expiration date was the icing on the cake.

Salesforce Investor Presentation

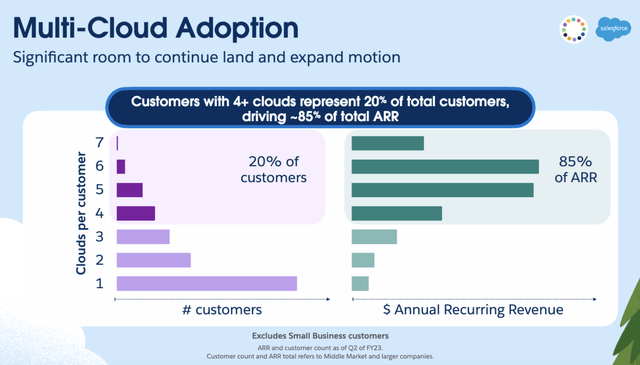

Customers with 4+ solutions = 20% of total customers

Salesforce communicated a number of growth drivers for its 2025 outlook with the most important one being customers using more than 4 cloud solutions currently make up just 20% of the total customer base. This group generates roughly 85% of total ARR and speaks volume for the good old 80/20 rule. Salesforce has a diverse product portfolio meaning there’s plenty of cross-selling opportunities for existing customers (82% of new ARR from existing customers in FY23).

The potential to expand ARR is illustrated by the fact that the average ARR of a customer with one solution could increase by 3x/9x/24x when that customer purchases up to 2/3/4 solutions. The benefits of customers purchasing multiple solutions also include higher retention rates, which improve from 15% to 19% for users with 2 products and mid-single digits for larger customers.

Salesforce Investor Presentation

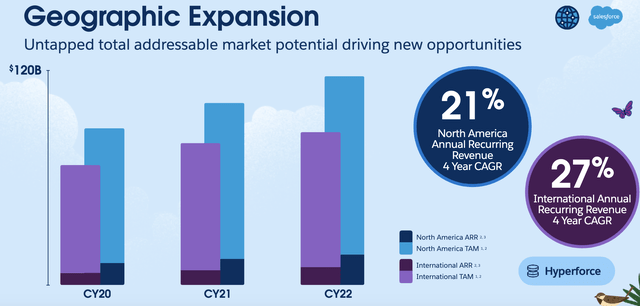

International growth still in early innings

Salesforce has plenty of white space to grow in non-US markets as international ARR has been growing at a 4-year CAGR of 27% vs. North America ARR at 21%. The US typically leads the rest of the world in cloud CRM which is a healthy sign that there’s plenty of opportunities in international markets. Salesforce is the second-largest CRM software vendor in Japan and is well positioned to penetrate similar markets despite FX headwinds. Additionally, Salesforce estimates that roughly 40% of its projected $290 billion TAM in FY26 will be international.

Salesforce Investor Presentation

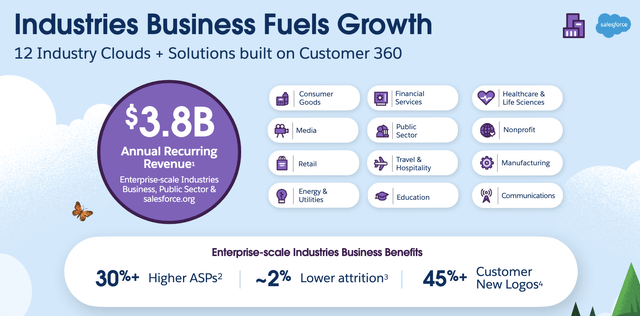

Industry clouds present high-value opportunities

Salesforce offers Industry Clouds for 13 different industries from retail to non-profit. Per company disclosure, the top 3 Industry Clouds generate roughly $3.8 billion ARR and have 30% higher ASPs compared to core offerings. At Dreamforce, Salesforce launched its 13th industry cloud solution for the auto industry. Industry-specific solutions are a meaningful driver as customers will only need some customizations to get going. In case of a recession, a decline in digital investments within one industry may also be offset by an increase in another industry.

Salesforce Investor Presentation

New product: Genie

Genie is a new customer data platform built on Salesforce’s native platform – Hyperforce. Genie automatically updates the entire Salesforce platform with real-time data by combining live and historical data using AI/ML/RPA (Robotics Process Automation). This allows Salesforce’s Customer Data Platform to generate real-time customer 360 views. For example, Genie can be used in Marketing Cloud to produce customized marketing campaigns and in Service Cloud to better communicate with customers whenever customer info is updated. Further, Genie is also interoperable with partners such as Snowflake (SNOW), Google (GOOG) (GOOGL), Facebook (META) and Amazon Advertising (AMZN) and AWS. The new product already has ~500 customers.

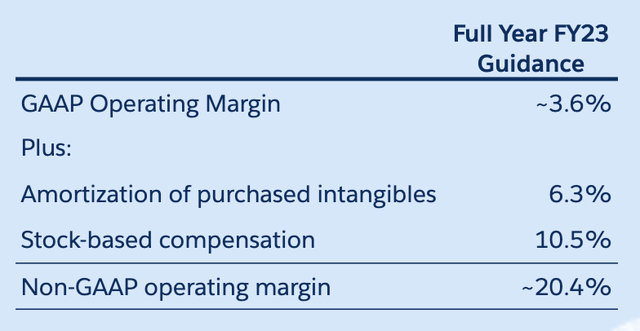

Sources of margin expansion

Salesforce’s C2025 adj. EBIT margin target of 25% is a step up from 20.4% in C2022. Per management, sources of margin expansion include the following:

- Sales & marketing to be 35% of revenue in C2025 vs. 40% in C2022, driven by higher penetration of self-serve sales.

- G&A leverage driven by workflow automation. Salesforce now allows employees to embrace a hybrid work model permanently so office rent could be reduced.

- On the other hand, R&D is not expected to provide incremental margin upside as Salesforce will continue to invest in product innovation.

- Leverage from large acquisitions following integrations.

Salesforce Investor Presentation

Thoughts on the stock

There’s a lot to like about Salesforce as the company remains a dominant force in cloud CRM with a large and expanding TAM. Product innovation will continue to drive corporate transitions towards cloud and international markets are still under-penetrated. Within the CRM space (largest segment of the $600 billion global software market), Salesforce commands a share of just under 25% so there’s plenty of opportunities to increase its market share with higher-value offerings like Industry Clouds. My only concern is the relatively lower margin profile compared to software peers like Adobe (ADBE) and Microsoft (MSFT) and whether or not markets will be willing to value the stock based on non-GAAP earnings which are boosted significantly by adding back the company’s stock-based compensation. While I’m not ready to be a buyer at current price levels, Salesforce will certainly be on my watchlist.

Be the first to comment