Elena Bionysheva-Abramova

I wrote on Sabina Gold & Silver (OTCQX:SGSVF) just over nine months ago (A Top-10 Takeover Target), noting that the fundamental thesis for the stock was stronger than ever, especially as we had seen M&A activity accelerate in the gold sector. The stock has since seen a 25% decline, with the Gold Juniors Index (GDXJ) taking another leg down, extending its peak-to-trough decline to 61%. Unfortunately, while the thesis for M&A would normally be much stronger at more attractive valuations, we’ve seen activity dry up considerably, impacted by changing priorities for some producers and the supply chain headwinds. In addition, a tight labor market and inflationary environment have increased the risk of growth projects going over budget and behind schedule.

For starters, intermediate and major gold companies appear focused on retiring debt and returning capital to shareholders, with some pursuing buybacks given their valuation disconnects. Secondly, the reduced incidence of acquisitions in the developer space may be attributed to greenfield projects seeing capex blowouts (Magino, Cote), making it more attractive for producers to look at expansions to current operations from a capex risk standpoint or potentially acquire already established producers. Fortunately, Sabina controls its destiny, and given its recent positive developments, there’s little reason for the stock to be trading at such a deep discount to fair value. Let’s take a closer look below:

Back River Project (Company Presentation)

Recent Progress

It’s been a very busy year for Sabina, with a $520 million financing package announced in January (stream, gold prepay, debt facility, financing) and a ~$90 million bought deal financing to provide additional flexibility completed in March. In addition, Sabina chose FLSmidth to supply key processing equipment ($39 million) and CGT Industrial with a fixed price proposal (~$100 million) for materials and consumables for the process plant, which is within 5% of Sabina’s Feasibility Study estimate (2021 FS). This has left just ~$50 million in remaining items to procure for the ~$175 million capex bucket, which was identified as direct equipment/materials purchases.

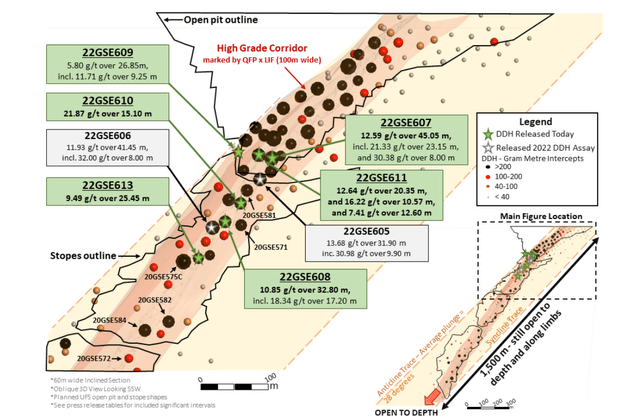

Meanwhile, Sabina also announced that it would start with a 4,000 tonne per day mill vs. the previous plan of 3,000 tonnes per day at the outset before an expansion to 4,000 tonnes per day in Year 3. This was made possible by continued geotechnical test work on tailings samples and the inclusion of a high-capacity tailings thickener, which has increased the storage capacity of the Echo Open Pit. Combined with the potential to pull higher-grade ounces forward (Umelt V2 Zone, which lies right beneath the Umwelt open pit), we could see some upside to Sabina’s first five-year production profile of ~287,000 ounces per annum. As shown below, the grades drilled at V2 have been exceptional, coming in at double and sometimes triple the average reserve grade at Back River.

For those unfamiliar, Sabina will use mined-out pits for its tailings, with Echo being the first pit to be utilized.

Umwelt Drilling (Company Presentation)

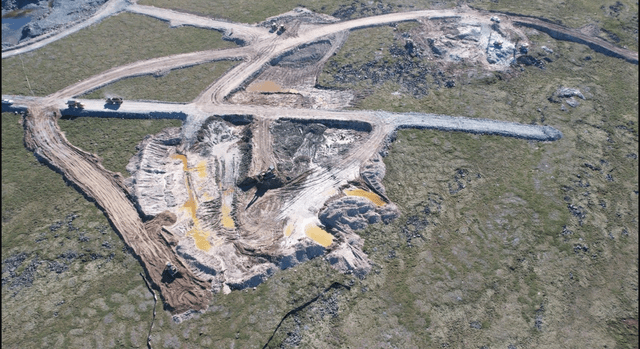

Finally, Sabina has made significant progress on-site from a development standpoint, with its underground ramp progressing 1,000 meters to its first ore access sublevel to enable more efficient underground drilling of the V2 Zone this quarter. Meanwhile, 45% of the project and 98% of plant site civil works have been completed or are underway, with a 25 million liter berm containment complete, a 10 million liter fuel tank prepared for the Winter Ice Road fuel offload, plant site dump pond lining placement is underway, and exploration camp upgrades completed. Lastly, work at the Echo Pit is well underway, with initial striping completed and the haul road and non-contact water diversion under construction.

Echo Pre-Stripping (Company News Release)

In addition to having two years of stockpiles to de-risk the mine plan, the company’s expedited work and early procurement have significantly reduced the risk of a capex blowout like other developers/producers have suffered, and its limited use of contractors for underground development is also helping with costs, with contractor use being higher cost in a tight labor market. As of September, Sabina’s workforce has quadrupled to 142 full-time employees. From a cost and logistics standpoint, Sabina continues to look at the potential to install wind turbines (4.5 MW each), a solar panel array (5 MW), and a battery storage system (50MW) to reduce traffic on the Winter Ice Road and the number of ships required.

Overall, this progress is very encouraging, and it’s great to see the company delivering on its promises, which has certainly not been the case for many developers this year. In fact, even some producers have failed miserably this year, with operations under care and maintenance at Tucano (Brazil), Madsen (Red Lake), and Revenue-Virginius. However, in a market where all of the focus is on the negatives, given the brutal downtrends that many stocks are stuck in, Sabina’s upside opportunities appear to be ignored.

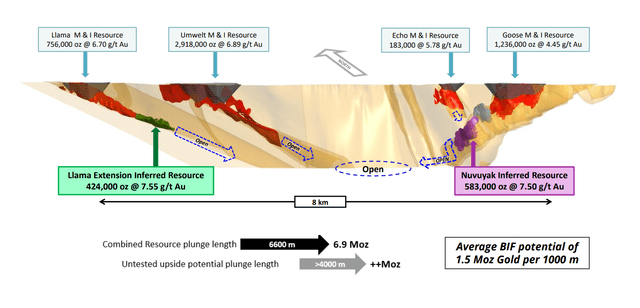

Upside Opportunities

As it stands, Sabina’s Back River Project hosts ~3.6 million ounces of gold reserves, and it will be one of the highest-grade open-pit mines globally (if not the highest), complemented with an underground component. However, this ~3.6 million ounce reserve base represents just over 50% of the company’s total resources at its Goose Project (~6.9 million ounces), and the company has an impressive conversion rate (73% from inferred to M&I) and an ultra-low finding cost since 2014 of ~$20.00/oz. Meanwhile, recent drilling at new deposits such as Hook and Wing could add additional resources, and its high-grade underground deposits (Umwelt, Llama Extension, and Nuvuyak) remain open at depth.

Goose Project Mineralization (Company Presentation)

While there are never any guarantees that ounces make it into a mine plan, these are extremely high-grade ounces, and recent exploration highlights suggest the potential for even higher grades beneath the Umwelt Pit in the high-grade corridor extending from VG to Vault. Therefore, it looks like Sabina could have a 20+ year mine life and a 5.0 million-ounce reserve base at its main Goose Project alone, making this a highly attractive project to a potential suitor and providing a boost to Back River’s NPV (5%). However, this upside case doesn’t even contemplate mining at Sabina’s relatively large high-grade satellite property, George, which lies 50 kilometers away to the northwest.

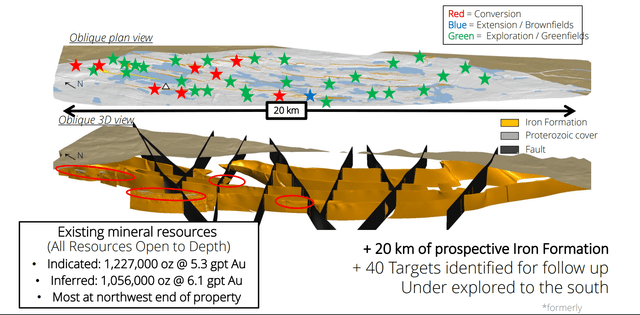

The George deposit has an iron formation that is 2.5x the size of Goose’s iron formation, but Sabina has been so busy advancing Goose that it hasn’t spent nearly enough time at George. This will change next year with drilling planned at this regional target, and the deposit is already home to a respectable resource of ~2.3 million ounces at 5.6+ grams per tonne of gold. The exciting part is that Sabina’s learnings at Goose can be applied to George, potentially leading to more efficient exploration and an even lower finding cost per ounce.

While it may not be an opportunity this decade, George is close enough that its material could be trucked to the Goose Mill (depending on gold prices and grades) with additional permitted capacity vs. the planned throughput rate of 4,000 tonnes per day. This could boost the total Back River NPV (5%) vs. simply adding these ounces onto the back of the mine plan and extending the mine life where they’d see a lower value after being discounted out from a cash flow standpoint. For now, I think it’s far too early to model this potential. Still, most juniors would love to have a property like George, and Sabina has this as its #2, sitting in the wings next to a permitted and operating mill (post-2024). Yet, it’s seeing limited (if any) value for this property.

George Property Drill Targets (Company Presentation)

A Depressed Valuation For A De-Risked Project

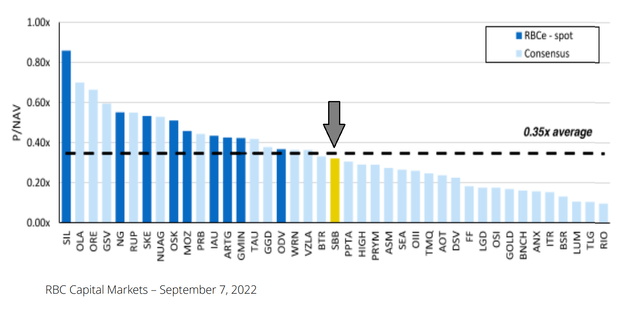

Based on ~565 million fully-diluted shares and a share price of US$0.85, Sabina trades at a market cap of ~$480 million, a very attractive valuation for a company sitting on a massive gold belt in a Tier-1 jurisdiction that’s set to become one of the lowest-cost producers sector-wide. If we compare this figure to an estimated net asset value of ~$1.19 billion ($1,700/oz gold), which includes a very conservative $280 million in resource conversion upside (1.40 million ounces of reserves added at $200.00/oz and $50 million assigned to the George Property), the company is trading at just 0.40x P/NAV. This is a significant discount relative to previous takeover multiples and relative to less-advanced developers elsewhere in the sector.

Sabina P/NAV Valuation vs. Peers (Producers/Developers) 09/07/22 (Sabina Presentation, RBC Capital Markets)

From a takeover attractiveness standpoint, we’ve seen companies pay up considerably for non-producing assets, with an average of ~0.80x for the past ten mid to large-scale transactions, with Kinross (KGC) forking over ~$1.45 billion upfront to acquire the Dixie Project (now Great Bear Project). This translated to over 1.0x P/NAV and a very steep total acquisition cost, given that Kinross will need to complete considerable infill drilling and studies to advance the project to a potential construction decision and then will likely see an initial capex bill north of $800 million based on its discussions of a ~15,000 tonne per day operation.

In comparison, Sabina already has all this work complete, making it much more attractive from a future spending and time value standpoint with only the actual construction capital left to spend and Back River ~30 months away from initial production. Despite this more attractive setup, the violent sector-wide correction has left the stock trading at a fraction of what Kinross paid for Great Bear (~0.40x P/NAV vs. 1.0x P/NAV), with the only major difference being scale (Great Bear will likely produce 380,000+ ounces per annum on average vs. Sabina’s ~223,000 ounces) and jurisdiction, with Great Bear benefiting from much less frigid temperatures in Red Lake and no need to do annual sealifts to transport fuel and materials.

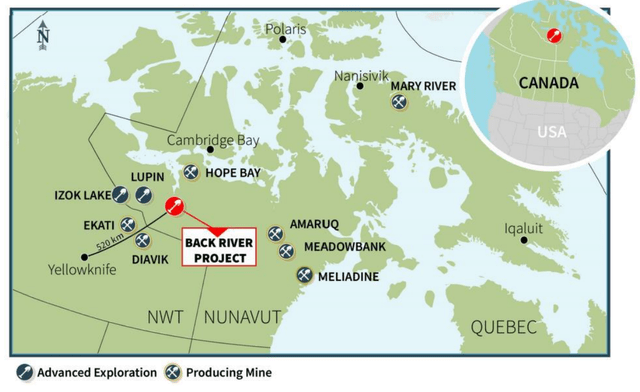

Back River Project Location (Company Presentation)

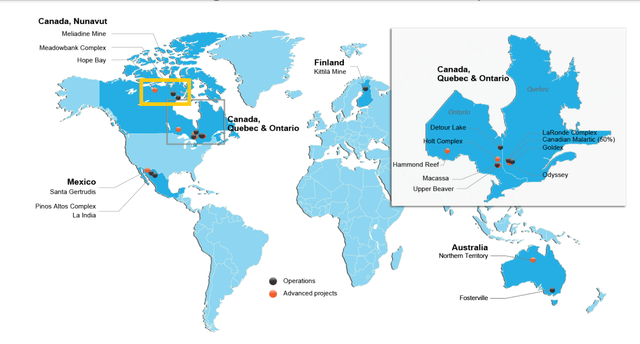

Sabina’s position in a frigid climate (with required sealifts) that most producers aren’t used to operating in is one negative from a takeover standpoint and may be one reason why some large producers with Canadian tax losses haven’t jumped on the opportunity. Meanwhile, when it comes to Agnico (AEM), it has its hands full with multiple organic growth opportunities and considerable infrastructure at Hope Bay, which is its priority if it is going to add incremental Nunavut production. So, while some developers have enjoyed a meaningful takeover likelihood premium, like Great Bear until it was acquired and Rupert (Q1 2022), Sabina hasn’t been so fortunate with a smaller list of potential suitors lined up to make the plunge in Nunavut and with Sabina being greenfields build in an inflationary environment.

Agnico Eagle – Nunavut Operations (Agnico Eagle Presentation)

Previously, this lower relative likelihood of being a takeover target weighed on the stock, with Sabina’s only clear path to an upside re-rating being to take Back River into production on its own. However, now that it’s checked off several boxes towards meeting this goal, there’s no reason for the stock to be trading at such a large discount to valuations paid in previous takeovers and its peers. If K92 Mining (OTCQX:KNTNF) can command a valuation of $1.0+ billion in Papua, New Guinea with a future ~350,000-ounce production profile at sub $600/oz AISC, there’s no reason Sabina can’t command a similar or higher valuation with a future ~280,000 production profile at sub $800/oz AISC in Northern Canada.

Based on what I believe to be a fair multiple of 1.0x P/NAV and an estimated net asset value of $1.19 billion, I see a fair value for Sabina of US$2.10 per share, translating to a 144% upside from current levels. Obviously, this story is not without risk, and with inflation at greenfields projects tracking well above brownfields projects, it’s understandable that some might be hesitant to invest in Sabina at current prices. That said, the team has made solid progress and looks to have only a slight funding gap if the project goes above budget to $560+ million, suggesting that much of the negativity priced into the stock here is unjustified. Hence, any pullbacks from here should present buying opportunities.

Summary

Sabina may carry a much higher risk than gold producers, given that it’s starting construction of a ~$500 million mine in an inflationary environment in a jurisdiction where most producers aren’t anxious to venture (Northern Territories of Canada). That said, the company has made solid progress to date from a financing and early works standpoint, and due to the extreme pessimism in the sector, Sabina doesn’t look to be getting any credit for its long-term resource growth potential or the ability to potentially increase production from bringing high-grade ounces forward and even looking at higher throughput at the end of this decade (6,000 tonnes per day permitted capacity).

Just as importantly, the risk of a capex blowout for Sabina appears low, given that its capex estimates were completed with more current estimates (Q4 2020) and a 5% to 25% contingency vs. Argonaut (OTCPK:ARNGF) which thought it was a good idea to finance itself based on only slight escalations to a Q4 2017 study, not baking in nearly enough contingency capital and having to dilute shareholders by ~100% with the project going over budget. So, while no developer is without risk, I would be surprised to see a significant miss on capex for Sabina, which is well-advanced from an engineering, procurement, and civil works standpoint. Given that I see Sabina as a medium-risk, high-reward story, I see the stock as a Speculative Buy at US$0.85.

Be the first to comment