putilich/iStock via Getty Images

The SaaS (software as a service) industry is a really weird one. Capital has rushed into this sector at a rapid pace over the past decade, with investors hoping to get in on the bottom floor of the next Salesforce, Inc. (CRM). Everyone has been chasing growth, but with economic concerns mounting, I see an ugly phase ahead.

Consolidation in SaaS

That ugly phase can be summarized by one word: Consolidation.

SaaS companies are incredibly cheap to launch, relative to traditional businesses. The problem is that a large majority of these startups are launched not because of a novel idea, an ingenious solution to a persisting problem, or a passion for a type of software. Instead, SaaS just looks to be the easiest industry in which to launch a startup, and many founders don’t really care about the underlying product so much as riding the SaaS trend. Ultimately, many of the SaaS companies we see listed on the stock market will go bust, and this is especially true for newer companies.

Take Dropbox (DBX) as an example of a successful SaaS. Its introduction was met with backlash, naysayers who told the founders that no one would pay monthly for mere storage – that Dropbox should offer more than just file-sharing. The founders stuck with their original plan despite the negativity around them and now see almost full customer retention plus growth. While anyone else could easily launch a Dropbox clone SaaS in a couple months, put up a nice-looking webpage, and hire a marketing firm, the company is unlikely to have any staying power while Dropbox remains an alternative. Dropbox simply has more financing and established marketing to steal market share; it attracts non-users with its free storage, and once free storage runs out, the upgrade is an easy sale, especially considering all your files are already on Dropbox.

Right now, with the macro situation worsening (free money more difficult to obtain, loan rates increasing, consumers’ wallets tightening, etc.), I see a strong opportunity in the SaaS market, at least for us investors. The idea is this: Find strongly performing SaaS companies that will be the winners of the consolidation phase and buy them; find poorly performing, one-trick pony, newer, and speculative SaaS companies and short them. Do these two actions together, and you have a pair trade, thereby being sector-neutral and not subject to SaaS-specific industry risk.

Today, I offer one such trade:

Short Toast

Toast is a payment processor for the restaurant industry. The company has numerous problems that are escalating or about to escalate in the coming years. The first is endemic for the type of SaaS companies we want to short: scale prevailing over everything. This itself is a number of smaller problems bundled into one.

For example, Toast’s reliance and focus on a single industry led to huge growth of scale and market share until the pandemic hit, and the restaurant industry was no longer able to provide such scaling opportunities. The company’s financials took a dive, but the company itself didn’t adjust for similar future risks. That is, Toast is still overexposed to a single industry, one especially risky as we head into an economic recession and inflationary environment.

Consumers are feeling the squeeze of higher prices and are less likely to eat out. Restaurants, also feeling a pinch, are seeing heightened expenses and having difficulty acquiring labor even after raising wages. This is already a tough industry; sixty percent of restaurants shut down within the first year, and 80% shut down within the first five. Cost-cutting is the name of the game for the modern restaurant, and SaaS payment processors such as Toast are likely to be targets for such cost-cutting.

This goes hand-in-hand with competition. Should a cost-conscious restaurant require a payment processor, management will likely choose carefully. While Toast has surged in popularity in the recent years, Toast is not without its problems. Customer service, for one, is often cited as poor; this is common for new SaaS businesses, which emphasize large customers and often ignore or automate the general customer service – the theory is that most issues come from the lowest-paying tiers of customers, who can be ignored without much cost to the bottom line).

Moreover, Toast is really only a single-use tool for restaurants and lacks the versatility of most modern SaaS solutions. More specifically, as a mere payment processor, Toast can only handle point-of-sale transactions; it cannot solve any post-payment issues, such as incorrect orders, refunds, or menu pricing errors. The company really is the epitome of a Silicon-valley incubated startup: Create a single, low-cost SaaS solution for a specific niche and push it out the door as fast as possible, without regard to additional needed features, usability, or customer satisfaction.

Another problem here is that Toast will run into friction as customers become more discerning, as competition is fierce and heating up. Olo Inc. (OLO), for example, solves the same problem Toast set out to solve with Olo Pay. But Olo has features beyond mere ordering and payment. For example, a recent problem in the restaurant industry is Google “hijacking” orders, and Olo helps its restaurant clients to place themselves in the Google ordering platform with their own ordering systems so as not to lose profits from hijacking. Then you have PAR Technology (PAR), which works nearly the same as Toast but at a lower cost; it should be increasingly attractive to current Toast customers as the recession progresses.

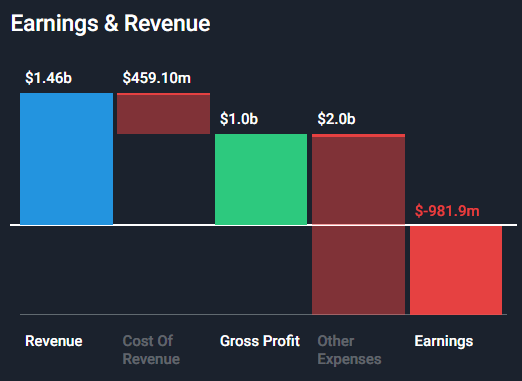

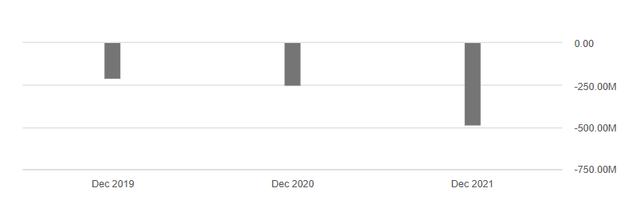

Toast’s financials are increasingly ugly as we enter difficult economic times. This is the problem with sacrificing everything for scale: black swans and significant economic pullbacks can destroy such a business. Take a look at Toast’s increasingly negative income, for instance:

TOST bulls are classic tech growth stock bulls: They see a growing userbase and revenue, believing that eventually the company will become profitable. The main problem is that the gross margin is simply not good enough to overcome the cost of revenue and other expenses, and this will be a higher hurdle to cross as the economy worsens:

To make things even worse, gross margin is on a downward trajectory; last year it was nearly 30%.

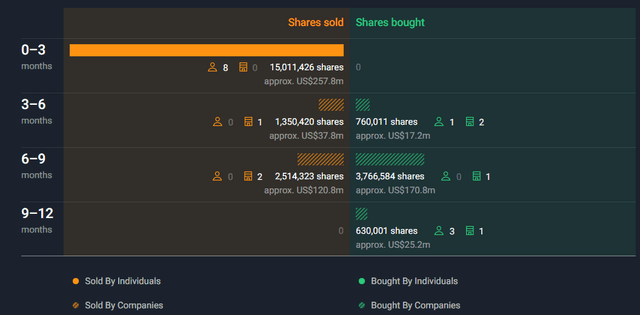

I think it’s a little unreasonable to want to buy-in at this point, as the financial trajectories – assumedly correlated to the stock price – are pointing to further downside. Insiders seem to agree, and they are ditching the stock.

That’s a lot of bottom-selling. Studies show that one reason insiders sell stock is that they have no expectations of the stock rallying in the near future. Logically, selling at these prices means that insiders don’t believe that the stock will recoup its losses in the near-term; the fact that no one is buying further bolsters this idea. Important to note: The IPO lockup period for selling shares ended in March, so we might be seeing the common Silicon Valley startup-SaaS business practice of dumping shares of a long-term unprofitable (analysts do not estimate positive earnings until after 2024, if even then) hype stock as soon as possible. If we can conclude anything here, it’s nothing positive for the stock’s performance.

Long OKTA

Back to the idea of the SaaS pair trade: Consolidation. We want to be short a struggling hype stock that will meet with competitive, macro, and financial pressures while being long a stock that is likely to be the consolidator, thereby benefiting from competitive advantage, a strong industry environment, and good financials. OKTA meets all these criteria.

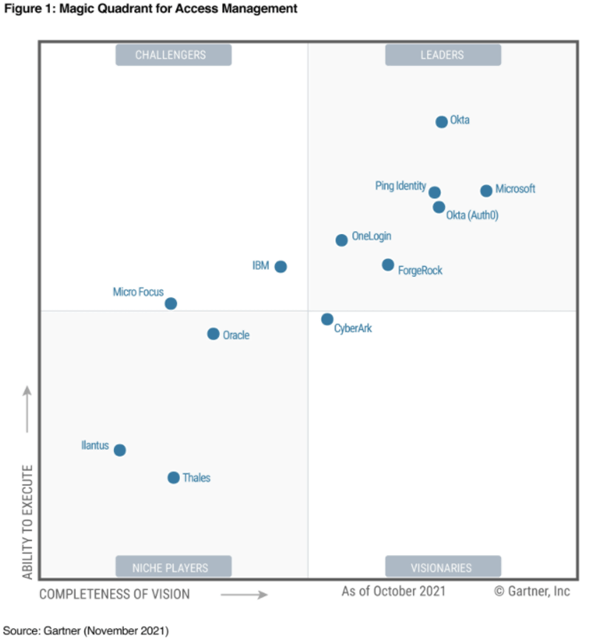

First off, Okta is the market leader in the identity and access management (IAM) market, surpassing even Microsoft (MSFT). Okta leadership position has been established doubly so after its purchase of Auth0 last year for $6.5B, a small price to pay to maintain leadership in a growing industry.

Gartner

Instead of targeting exclusively restaurants, an industry vulnerable to economic changes, Okta targets small-to-medium sized businesses of all types, making its customer base much more antifragile in a recession. Pretty much all businesses are shifting to cloud-based and SaaS solutions for their workforces, especially with the recent surge in remote work. This shift is inevitable and will only be delayed, not stopped, by an economic downturn, and thus the downside risk for OKTA is much less steep than it is for Toast, which offers a service that is not seen as absolutely necessary (at least as long as obvious alternatives exist).

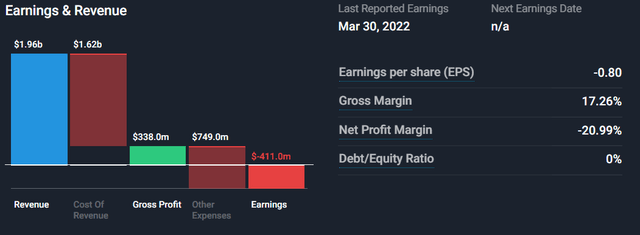

Financially, OKTA is strong for a SaaS growth stock. Gross margin for the current quarter is 72%. In fact, gross margin fell, but this is primarily due to the Auth0 acquisition, which has a lower gross margin.

Some might notice that Okta is, as Toast, unprofitable. However, there is a key difference: A 72% gross margin is easy to work with in creating profitability in the end-game. The current unprofitability is primarily due to high spend, mainly on customer acquisition.

Were Okta to stop the customer acquisition process, it could easily and quickly become profitable, unlike Toast. This is why I consider OKTA to be financially sound despite the company continuing to fuel its growth phase at a net loss. While both Toast and Okta are sacrificing profitability for growth, Okta is the only company that has a clear exit ramp.

I expect the coming recession to push Okta’s management to cut down on costs, which could ironically lead to early profitability. Consider this: By cutting costs by half, Okta would become immediately profitable:

Simply Wall St

Actually, Okta wouldn’t even need to cut costs by that much, as the current expense numbers include the acquisition of Auth0. Most of Okta’s spend is in sales and marketing, at nearly $700M, which is roughly half of the company’s revenue. And a cut to sales and marketing spend wouldn’t hurt Okta all that much, at least according to a study by Sammy Abdullah.

In any case, the bad side of Okta’s financial numbers is mostly the company’s own spending fault and not indicative of any underlying unprofitability of the business model. As the market leader, Okta likely feels pressured to keep sales and marketing spend high to stay on top. But as the economy turns south, I think the industry will start to emphasize more conservative spending habits.

And one result of this will likely be consolidation. Okta has already engaged in a sort of consolidation by acquiring Auth0. It wouldn’t be unreasonable to expect more acquisitions. This would be bullish for OKTA, as such actions would further solidify the company as the market leader in a continually growing industry.

Risks

But on the other edge of this consolidation double-sided sword lies risk: Okta is also susceptible to increased competition should other players in this field consolidate. Okta’s Auth0 acquisition marks the company as the clear king-of-the-hill to be targeted for displacement. Smaller players might respond by merging and offering truly competitive offers.

In addition, investors could simply stop believing in SaaS growth stories – at least during the economic downturn – and pull out of stocks that are showing growth but no profitability. Or value stocks might make a comeback during such a time.

Of course, the fact that we are engaging in a pair trade hedges against this risk. Still, in a pair trade we typically want the long side to perform well more so than the short side to perform well (due to the potential upside of a long position always being larger than the potential upside of a short position). But I ultimately feel that the entry point for the long side of trade is timely, as OKTA is selling at a 50% discount relative to March and seems to have found a level of support in the $80-$90 region.

Trade Idea

So, the trade idea is obviously to go short TOST while going long OKTA, and you would do so as a pair trade, ensuring your positions are roughly split 50/50 between the two. Of course, when you short a stock, you expose yourself to unlimited upside risk. Hence I offer you an alternative trade idea.

First, let’s use long put options on TOST to prevent against the (SLIM) possibility of getting killed in a TOST rally. TOST could be acquired or announce a spectacular earnings report one quarter… trading stocks entails many unforeseen events that can lead to unexpected rallies. Put options prevent us from getting hurt by these rare events. I recommend the following:

Buy Sep16 $12.50 TOST puts

These cost $185 each at the time of writing.

Next, you can go with OKTA stock or alter the play a bit if you – as I do – believe that the economy and market are headed for some hard times. I think the downward pressure is undeniable for now and that we should probably not expect a huge rally in the near future. Being so, covered calls on OKTA make sense here.

Because a short put is mathematically equivalent to a covered call, I recommend the following:

Sell Sep16 $90 OKTA puts

These cost $1080 (thus bringing you $1080 in profit if OKTA is above $90 by Sep16) at the time of writing.

If you have any questions about this trade, let me know. Alternatively, just go with the traditional short/long stock pair trade, but be aware of the upside risk (and margin requirements) needed for shorting stock.

Be the first to comment