nuchao/iStock via Getty Images

Earnings season is underway!

In the coming two months, we’ll learn a lot about software businesses, their most recent quarter, and, more importantly, their updated outlook for the rest of the year.

In recent years, Software-as-a-Service (or SaaS for the rest of this article) has been the center of attention. IT purchasing has become decentralized, sales cycles are shorter, and product adoption is more nimble than ever.

Most SaaS companies offer the best aspects of a digital business:

- Virality with freemium models targeting developers and teams.

- Scalability with expanding total addressable markets.

- Optionality with rapid innovation and platform models.

- Profitability with gross margins often north of 70%.

- Predictability with an increasing level of recurring revenue.

- Strong tailwinds boosted by the global pandemic.

However, the macro backdrop is now top of mind. We are going through a very turbulent time with 40-year high inflation, rising interest rates, an energy crisis, and a strong dollar creating adverse effects for US companies.

ServiceNow (NOW) CEO Bill McDermott recently confirmed the macro environment is affecting spending decisions for enterprise customers. He expects longer sales cycles in Europe and believes no company is immune to currency fluctuation and slowing demand. However, he remains upbeat about the long-term opportunity:

This doesn’t fundamentally change the narrative that tech is the only way to cut through the crosswinds.

Bearish sentiment in 2022 has hit highs not seen since March 2009 based on surveys from the America Association of Individual Investors.

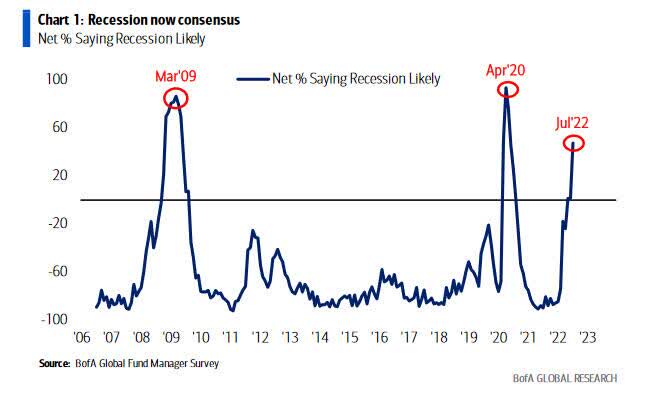

According to the latest Fund Manager Survey from Bank of America, global growth expectations have slumped as recession anticipation soars to the highest since April 2020.

Recession now consensus (BofA Fund Manager Survey)

In this context of record pessimism, most investors brace for a very challenging earnings season.

Yes, we might be headed for another recession.

So what?

From a market sentiment perspective, there is no doubt that a recession is already priced in. The relevant question is about the depth and duration of said recession and how it might impact earnings.

Market sentiment is the only thing that matters in the near term. However, we know it is futile to predict the stock market over the short run. You see, I’m a long-term investor. So my ideal holding period is “forever” until the thesis is broken or I need the money.

If you invest over a multi-year time horizon, pessimism is a contrarian indicator that can offer attractive entry points.

It’s not a scientific or back-tested analysis, but here how it looks like to me:

So while sentiment remains unpredictable in the near term, I’ll try to answer the following questions today:

- Have cloud software valuations cooled down enough?

- What happened to software businesses during previous recessions?

- What is different this time?

- What kind of guidance revisions should we expect?

- Did the long-term thesis change?

Let’s review.

1) Valuations ahead of earnings

While the Nasdaq (QQQ) is ~25% off its peak, the drawdowns have been brutal across software stocks:

- WisdomTree Cloud Computing (WCLD) is 53% off its peak.

- Many individual stocks are down a lot more.

It can be tempting to look at the current sell-off as a buying opportunity, but it’s worth repeating these stocks had quite a run in the 18 months that followed the start of the global pandemic.

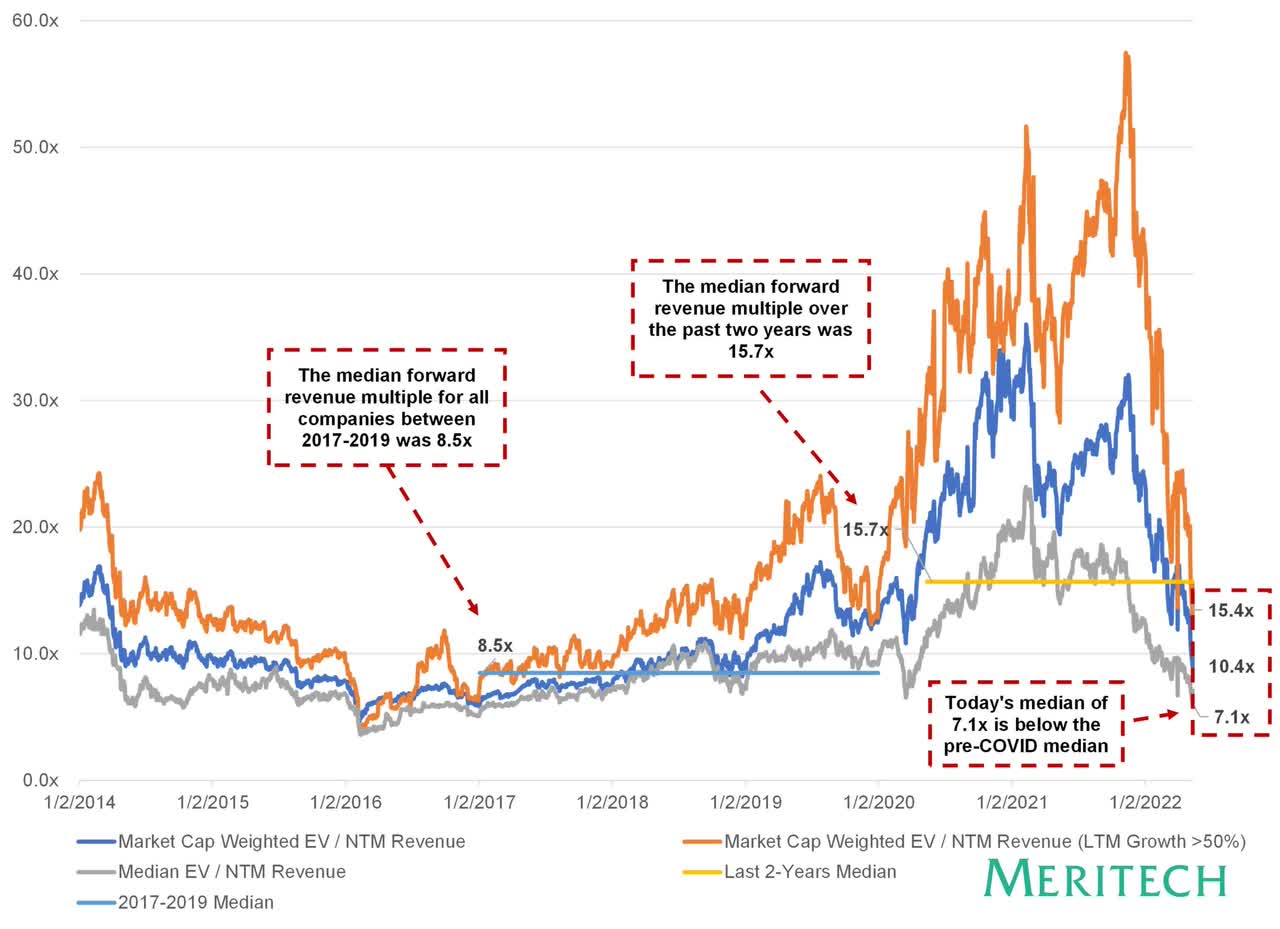

Despite these huge drawdowns, valuations have merely come down to the low end of their historical average pre-COVID. Additionally, the years leading to COVID cover a long period of economic expansion and may not be a good reference point anymore.

The chart below from Meritech illustrates the post-COVID “round-trip” for valuations, using EV/NTM (enterprise value / next 12 months revenue).

SaaS Valuations (Meritech)

It’s essential to note that the stock mix has changed over time. Companies like Snowflake (SNOW), Datadog (DDOG), GitLab (GTLB), HashiCorp (HCP), Bill (BILL), or Cloudflare (NET) only went public in the past three years. Given their rapid growth rate, the median EV/ NTM multiple should reasonably be higher than it used to, all things equal.

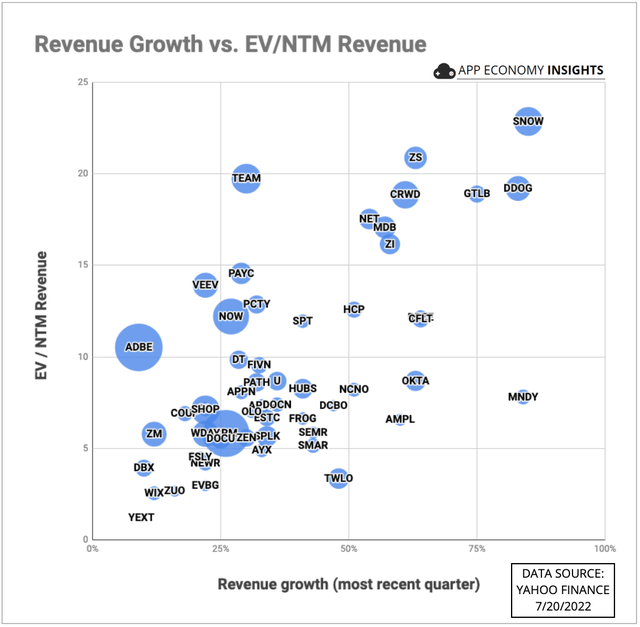

The graph below puts valuations in perspective with the revenue growth of the most recent quarter, with Snowflake being the fastest growing and sporting the highest multiple at the moment.

SaaS Revenue Growth and EV/NTM Revenue (App Economy Insights)

Zendesk (ZEN) was recently acquired by a consortium of private equity firms at about 6X FY22 revenue, illustrating that valuations have become attractive enough.

To put multiples in perspective, I love going back in time.

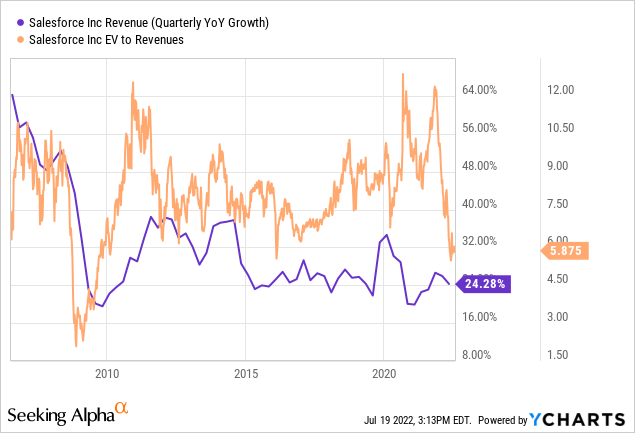

Salesforce (CRM) was one of the few public SaaS companies in 2008, and it’s been a stable grower over the years, making it a prime choice to evaluate the valuation spectrum over time:

- In the past 15 years, CRM has traded between 6X and 12X revenue.

- With one exception: in 2009, CRM traded at 3X revenue for a few months.

Today, CRM is trading slightly below 6X revenue. Again, only the Great Recession temporarily led to a cheaper valuation.

It makes me reach two conclusions:

- First, CRM is already cheap, on the low end of its valuation spectrum.

- Second, CRM could still fall another 50% if multiples contract as they did in 2009.

In short, valuations are cheap, but it doesn’t mean they can’t get cheaper. So I would not assume all outcomes are already priced in.

2) What happened in previous recessions?

Large companies like Apple (AAPL) or Google (GOOG) have announced a hiring freeze. We are bracing for a challenging time ahead with a decelerating economy.

A helpful way to anticipate what might come ahead is to look back at previous recessions and review how software businesses were impacted.

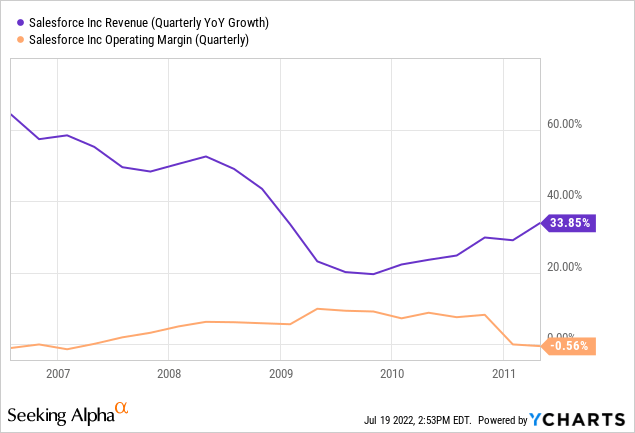

Here again, Salesforce is a great reference point. In 2008, the company was approaching $1B in annualized revenue run rate and growing over +50% Y/Y. Then, during the Great Recession, revenue growth dropped to +20% Y/Y and only started re-accelerating at the end of 2009.

Notably, as illustrated in the chart below, the operating margin slightly expanded in 2009, demonstrating that the company could align its spending with its revenue growth.

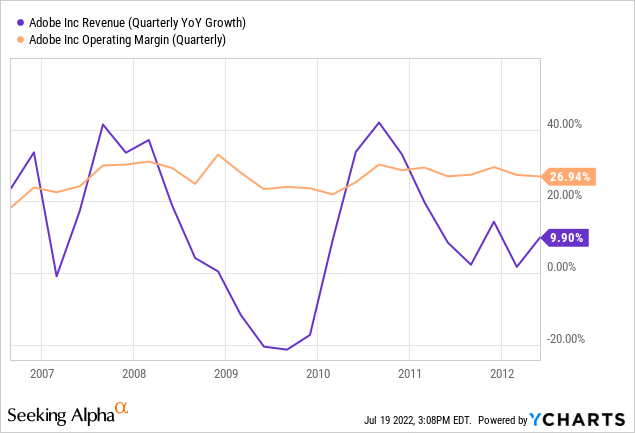

Adobe (ADBE) is another excellent example. In 2008, the revenue growth in the high 30s collapsed and turned negative in 2009 (-20% Y/Y). However, like Salesforce, revenue growth started re-accelerating by the end of 2009. Meanwhile, the operating margin held up very well and stayed above 20%.

Software companies with high gross margins can adjust how aggressive they want to be in a heartbeat. They have the flexibility to change their cost structure in real-time.

During the 2020 recession, software companies were impacted differently based on the type of businesses they cater to.

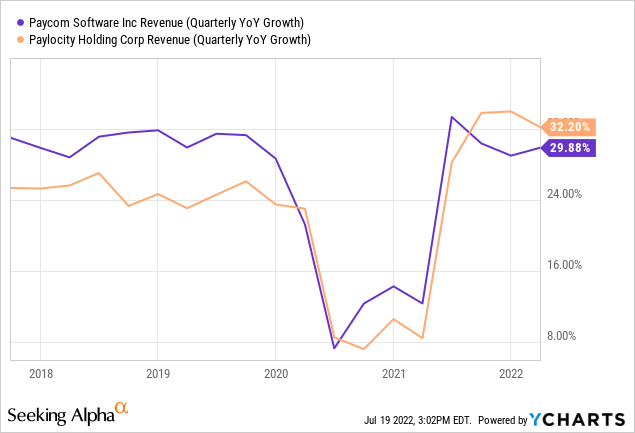

For example, human capital management solutions like Paycom (PAYC) and Paylocity (PCTY) serve small to mid-sized businesses. They were adversely affected in Q2 2020 due to their customer mix. However, revenue growth returned to its pre-COVID run rate for both companies a year later. Of note, the operating margin of these two companies also held up very well.

While it may seem obvious today that the challenges PAYC and PCTY were facing were temporary, it was not so easy in the moment.

It’s precisely for moments like these that I try to help members of the App Economy Portfolio community keep a long-term perspective. Since Paycom is a company in the portfolio, here is what I shared with members as I updated my view on earnings (November 2020):

While PAYC is going through a turbulent year, I continue to believe the challenge should be only temporary and the business should rebound nicely as SMBs recover from the pandemic in the quarters ahead. I remain a happy shareholder, in it for the long-term.

As we go through the motion of the upcoming earnings seasons, I believe maintaining this mindset will become paramount.

We should expect mixed fortunes based on the nature of the underlying business and the type of customers. However, above all, we want to recognize that slowdowns in economic growth are temporary by nature.

3) What is different this time?

Using past recessions as a reference point would be unfair without acknowledging the key differences today.

The strong dollar

For one thing, the euro hit parity with the dollar for the first time since 2002. While it benefits US consumers traveling to France or Italy this summer, it adversely impacts the overseas revenue of US companies.

For example, Netflix (NFLX) reported a +9% Y/Y revenue growth in Q2 FY22, which would have been +13% Y/Y in constant currency. As a result, it will be critical to look beyond the noise of the headline, with revenue and EPS ‘misses’ due to the temporary impact of the strong dollar.

Digital normalization

We are still on the back-end of a precipitous acceleration of society’s digital transformation across work collaboration, productivity, commerce, and more.

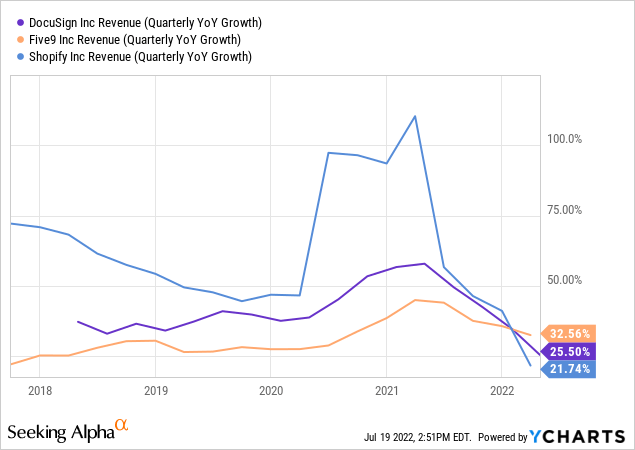

I excluded Zoom Video (ZM) in the chart below (it would be way off the chart). Still, we have countless examples of companies that have tremendously benefited from COVID tailwinds and now have to deal with a more normalized environment. I have in mind DocuSign (DOCU), Five9 (FIVN), and Shopify (SHOP), to name a few.

While these businesses were already adjusting to a “new normal,” they may face additional headwinds in a recession. A double whammy, if you will.

A mix of secular trends

Not all companies are impacted straightforwardly, like PAYC and PCTY in 2020. For many businesses, we need to dig deeper into the underlying trends.

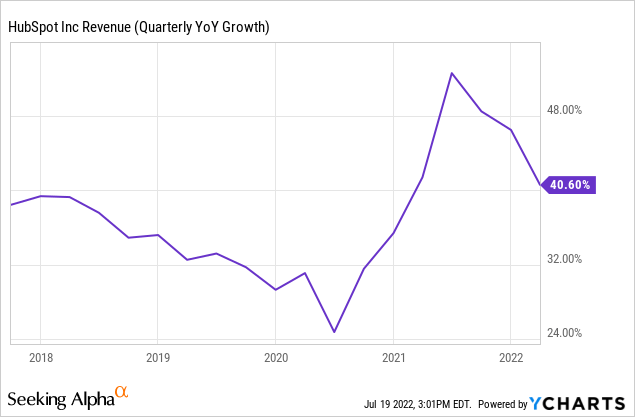

For example, HubSpot caters to SMBs and initially saw a slowdown in Q2 FY20. However, the solopreneur frenzy and multi-product adoption have been a boon for the business in the following quarters.

In short, there is usually more to a story than meets the eye.

Record-high inflation and rising interest rates

In 2000 and 2008, interest rates were going down. Today, until inflation is under control, they are likely to go up.

Access to capital may become harder. With this in mind, I focus on companies with the balance sheet and cash flow to withstand several quarters of economic slowdown.

Rising interests could also continue to put additional pressure on multiples, at least temporarily.

4) Guidance revisions are coming

All eyes will be on the outlook for the rest of the year and beyond.

Some companies have already made significant adjustments to their guidance. A great example is the automation platform UiPath (PATH). The company derives more than half its revenue from outside the US (including almost a third in EMEA), creating several headwinds.

UiPath reported earnings at the end of March 2022, weeks after the beginning of the Russian invasion of Ukraine. As a result, they could evaluate the conflict’s impact on their financials early on. In June’s earnings call, management slightly raised full-year guidance thanks to their conservative approach.

Conversely, the management teams that didn’t make sure they had some buffer in their full-year projection will likely have to lower their guidance to factor in the worsening spending environment.

Given the uncertainty ahead and the wide range of outcomes, I think it’s reasonable to expect conservative forecasts for the rest of the year. Moreover, as someone who has handled financial forecasting at a public company for over a decade, I believe it’s just common sense.

5) Did the thesis change?

It’s always tempting to extrapolate the current situation.

- If stock prices are down, they probably have more to fall.

- If management cut guidance last quarter, they’ll probably do it again.

We all suffer from some form of recency bias.

When we go through a turbulent time, as we did at the end of 2018 or the beginning of 2020, I always like to zoom out and ask myself:

Will this matter 10 years from now?

A helpful way to fight recency bias is to return to the original thesis.

In 2020, research firm ARK Invest provided an update on their software market forecast, with a focus on five main factors:

- The decentralization of IT: Cloud-based software removes friction and accelerates time to adoption.

- SaaS for every worker: The user base used to be only specialized departments like HR or IT, but now all knowledge workers are SaaS users.

- Enterprise software with consumer virality: Freemium and self-service models have improved sales efficiency. Customers turn into sales reps, and payback periods have come down.

- SaaS companies as enablers of AI: Automation, data analytics, and prediction keep improving with new use cases.

- Shift to remote work: New needs have emerged from the global pandemic for collaboration and security.

Are these factors still at play?

I would answer this question with a resounding yes.

Closing thoughts

Given the potential growth ahead and the inherent risks of continued disruption from existing players and newcomers, investing in SaaS requires a mindset that can only work for some investors.

With a potential challenging earnings season ahead, you need:

- A strong stomach since most SaaS stocks are highly volatile.

- A leap of faith since many of these businesses are unprofitable.

- A long time horizon since gains will compound for the best performers.

- A diversified approach to improve the odds of a home run.

Given the extreme volatility of high-growth SaaS companies, the question shouldn’t be if you should buy stock XYZ but how you should buy it.

Patience is your most important virtue in investing because recessions and bear markets can last years before a new all-time high.

As we go through a period of uncertainty, it’s critical not to miss the forest for the trees and put a quarterly performance in perspective with the rest of the market.

Nobody knows where stocks are headed in the near term, and it would be futile to try to predict it.

Things could get worse before they get better, and that’s all part of the process. That’s why I’m bracing for a challenging earning season.

As best put by Maya Angelou:

Hoping for the best, prepared for the worst, and unsurprised by anything in between.

What about you?

- What do you expect for SaaS this earning season?

- Are you investing in the category, or would you rather avoid it?

- What are your favorite software businesses?

Let me know in the comments!

Be the first to comment