Robert Way

As the EV industry grows and matures, investors must be wary of the risks associated with new entrants into the space. A company’s success in capital-intensive industries largely depends on scaling the execution of their innovation initiatives. Given the current backdrop for the equity markets and the increasing cost of capital, profitability matters more than ever. We view China’s BYD Company Limited (OTCPK:BYDDF) as one of the best positioned pure-play manufacturers in the EV sector. With rumors swirling that Warren Buffett is parting ways with his 225 million shares of the world’s largest EV maker, shares of BYDDF appear to be on sale (dropping over -10% this week).

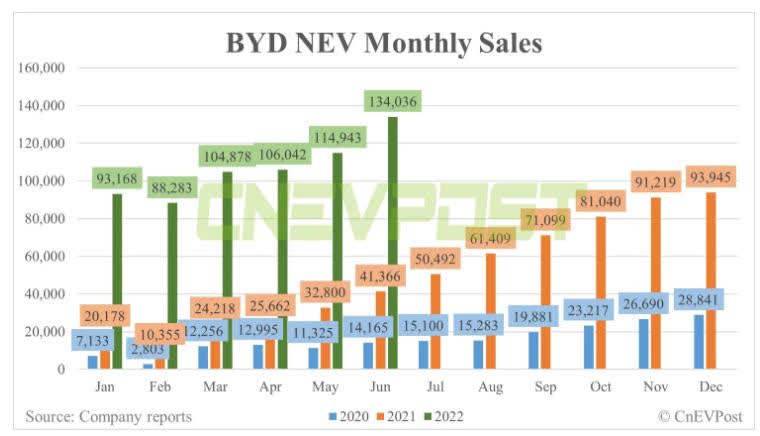

BYD continues to ramp-up deliveries, doing so in spite of Beijing’s zero-COVID policies. Topping more than 100,00+ deliveries for four months in a row (beginning in April 2022) has turned the former cell phone battery maker into the largest EV producer in the world. Through the first half of 2022, BYD has sold 641,000 vehicles, topping Tesla (TSLA) 564,000, unseating them from atop the EV world. The chart below illustrates just how quickly BYD has been able to scale production and sales, delivering 224% more than in June 2021.

CnEVPost (via BYD reports)

BYD’s ability to produce and deliver more vehicles has made a dramatic impact on the EV maker’s profitability. Cash flows from operating activities jumped to $1.76B in Q1 2022, vs. just $21.3M in Q1 2021. Earnings per share also grew 250% year-over-year to $0.04 per share, a trajectory we expect to continue. BYD is continuing to ramp up production and is expected to approach 300,000 vehicles this August. Couple this with their growing list of partnerships (recently inking deals to provide batteries to Tesla and a charging station venture with Shell), and you can see why BYD’s future earnings growth has a high degree of visibility.

Best Stock Now App

Our rankings blend both fundamental analysis and technical indicators. As portfolio managers and individual investors, we find ourselves in a unique conundrum. When evaluating tech firms that tend to be longer duration, fundamentals/valuations are beginning to look attractive, given how far the Nasdaq and S&P 500 have fallen. However, from a technical perspective, the underlying charts have not confirmed the perceived intrinsic valuations predicated solely on fundamental factors.

BYD has been one of the diamonds in the rough, consistently ranking at the top of the 6,000-plus names we evaluate. The largest EV maker currently sits at No. 5 in our database, combining high sustainable earnings growth with a constructive stock chart.

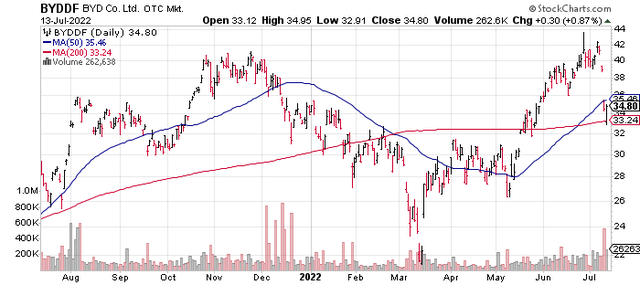

Once a potential equity investment meets our fundamental screening criteria, I turn to the charts to gauge a stock’s current health and preferred entry point. BYD is one of the few constructive charts in the tech arena. Since early March, BYD has gained significant traction with the 50-day moving average crossing the 200-day in late June. The combination of improving profitability, elevated gasoline costs, and global governments’ propensity to subsidize EV ownership, provide significant tailwinds for shares of BYDDF.

The EV industry is still in the early innings, where execution risks remain elevated. Plenty of uncertainty exists around which manufacturers will survive the next decade. In the case of BYD, the downside risks have been greatly reduced and the EV maker’s go forward earnings growth has a high degree of visibility. Through the first half of 2022, unfilled orders now sit at 700,000 and BYD is positioned to meet the strong demand for its’ products in the second half of this year.

We currently own BYDDF in our Ultra Growth portfolio strategy and maintain a “Strong Buy” on the shares. Our five-year price target now sits at $112, a significant uptick from our $25 valuation for BYD in our September 2020 article.

Best Stocks Now Premium gives you access to Bill Gunderson, professional money manager & analyst with 22 years of experience.

You get Bill’s daily “live” buys and sells in his six portfolios: Emerging Growth, Ultra-Growth, Premier Growth, Dividend & Growth, Best ETFs Now, and Best Mutual Funds Now.

JOIN NOW to get daily “live” buys and sells, our weekly in-depth market-timing newsletter, access to Bill’s proprietary database with daily rankings on over 6,000 securities, and a daily live radio show!

Be the first to comment