Royal Dutch Shell (NYSE: RDS.A) (NYSE: RDS.B) is one of the largest publicly traded oil companies in the United States. The company has been pummeled, along with many other oil companies, since the recent oil crash and COVID-19 fears. This has pushed the company’s dividend past 14%, an unheard of amount for an oil major. As we’ll see throughout this article, the company’s recently announced financial measures support a safe dividend and shareholder rewards.

Royal Dutch Shell – Times Online

Royal Dutch Shell New Policy Announcement

Royal Dutch Shell recently announced its new financial policies as a result of the recent oil crash.

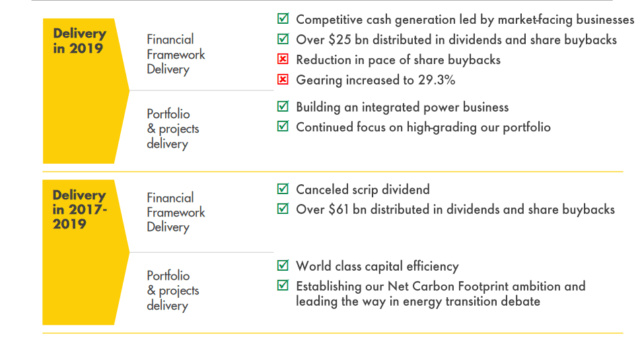

Royal Dutch Shell Announcements – Royal Dutch Shell Investor Presentation

Royal Dutch Shell has made two significant announcements as a response to the current oil crash. The first is that the company has announced that it’s halting share buybacks. That was previously estimated to be $5-10 billion on an annual basis. Lastly, the company has announced that it’s no longer going to be meeting its debt reduction goals. However, despite that, its debt loads are still manageable.

It’s worth noting that from 2017-2019, the company, in a fairly difficult environment, managed to generate quite impressive returns. However, in the coming years, the company will be able to continue to recover as oil prices do. The company’s recently announced initiatives show that it’ll be able to continue paying its double-digit dividend, even if shareholder buybacks slow down some.

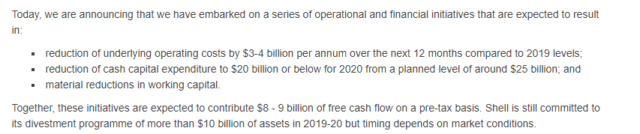

Royal Dutch Shell Announcements – Royal Dutch Shell Press Release

There are some other policy announcements that the company has made on top of deciding it’s no longer buying back shares. The company is reducing its operating costs by $3-4 billion / year and reducing its capital expenditures by more than $5 billion annually. These are significant reductions that will save the company $8-9 billion in FCF on an annual pre-tax basis.

That, combined with asset divestments, will place the company in, financially, quite a strong position. The company was originally expecting ~30 billion in organic FCF in 2020. These actions will save the company ~$10 billion. Additionally, at current oil prices, the company is earning ~$35 billion less. That means the company, at current oil prices, should still come close to maintaining positive organic FCF (calculations assuming ~1 billion barrels in annual production).

Royal Dutch Shell Impressive Portfolio

At the same time, the company’s recent portfolio announcements are backed up by the company’s impressive portfolio.

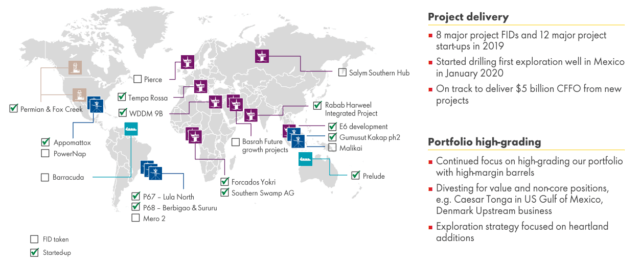

Royal Dutch Shell Assets – Royal Dutch Shell Investor Presentation

Royal Dutch Shell upstream and integrated gas assets are some of the most significant – especially the company’s hefty LNG focus. The company managed to start-up 12 major projects in 2019 and is considering 8 major project FIDs. At the same time, the company has started drilling some high potential exploration wells. Across the company’s portfolio, it’s using its global expertise to high grade its portfolio.

Two of the most expensive things to pay attention to here are the company’s diversity along with its focus on growing areas. The company is diversified across the world including North America, Europe, South America, Southeast Asia, the Middle East, and Africa. The company’s impressive and diverse portfolio of assets prevents it from geopolitical risk in any one area.

The second important thing here is the company is high-grading its portfolio and focusing on growth areas. The company has new assets in the Permian Basin, Gulf of Mexico, Brazil, and Guyana, some of the highest growth areas in the world. These growing assets are a part of the company high-grading its portfolio. Royal Dutch Shell taking advantage of the downturn to improve its assets should allow in strong shareholder rewards in a recovery.

Royal Dutch Shell Retail – Royal Dutch Shell Investor Presentation

Royal Dutch Shell also has an incredibly impressive and growing retail business. The company opened >1500 new stores in 2019 and is focused on growing the business through its credit card business. The company has had >8 million active cards in the past 12 months and it’s expanding rapidly into both growing countries and developed countries. The company’s retail expansion should help significantly increase earnings.

Royal Dutch Shell Emerging Businesses

Lastly, one of the most bullish aspects of Royal Dutch Shell’s business is its focus on emerging areas. As a fossil fuel company, the company has significant geopolitical risk, and the company’s diversification efforts into new businesses are helping to protect the company.

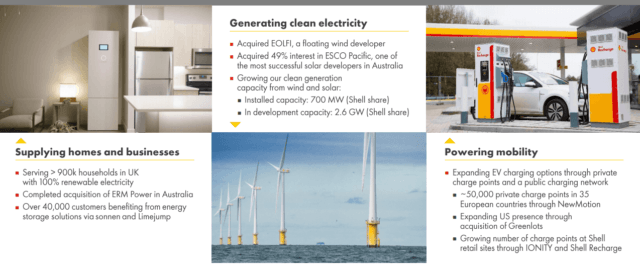

Royal Dutch Shell Clean Infrastructure – Royal Dutch Shell Investor Presentation

Royal Dutch Shell is focused on effectively becoming a utility company, generating clean electricity, and simultaneously being a part of the transition to electric vehicles. For clean energy, the company has focused on rapidly acquiring different businesses to increase its share in the wind and solar businesses. The company makes some fixed amount per kWh and can use its scale to undergo huge projects.

As a utility company, the company is supplying 900k of the 27.6 million (~4%) of the households in the UK with 100% clean acquisition. As a result of the company’s acquisitions, the company is able to provide these households with clean energy and rapidly growing as a clean energy utility. This cash flow can be considered incredibly secure.

Lastly, the company is growing its clean charging portfolio, which can tie into its utility business and be deployed through the EU or the world. The company already has 50 thousand private charging points, and is looking at expanding that further. This highlights the company’s focus on its retail businesses, which combined with its utility businesses, is a way to use its cash flow to generate significant shareholder cash flow.

Royal Dutch Shell Shareholder Rewards

Royal Dutch Shell is using this portfolio to generate significant shareholder rewards. As we discussed above, the company’s organic FCF, with the recent share price drop, is ~$5 billion annually. That’s not horrible for a $130 billion company, but it doesn’t support shareholder buybacks and it definitely doesn’t support the company’s annual dividend which costs it $13 billion annually.

However, the company’s potential for shareholder prices is significant should prices recover. As discussed in this article, we expect oil prices to recover to $60 Brent by YE 2021. At that level, the company will go back to its forecast of $30 billion in organic FCF expected for 2020. That’s ~25% of the company’s market capitalization, which has the potential for significant shareholder rewards.

At current prices, should the company’s buyback and dividend levels resume, the shareholder reward level will be almost 20% annually.

Royal Dutch Shell Risk

However, with all of this said, Royal Dutch Shell has two major risks worth paying attention to. The first is the risk of continued low oil prices and the second is the risk of a lack of returns on capital spending.

Looking at the low oil price risk, risks like COVID-19 at any time can drive the company’s share price lower as it decimates oil prices. Oil prices, from something that didn’t exist 4 months ago, have fallen more than 50%. Oil prices will continue to be susceptible to so-called “black swan” events and that’s a risk that shareholders must always be cognizant of.

The second risk is a risk of a lack of return on the company’s capital spending objectives. The company is continuing to spend significantly on capital projects, even after its recent spending cuts. The company cut its spending from $25 billion to $20 billion in 2020, but that’s still >15% of its market cap currently. That’s a significant amount of spending, and whether the returns are there is a huge part of shareholder returns. At lower prices, the chance of strong returns is also smaller.

Conclusion

Royal Dutch Shell has had a difficult time recently, however, as a result of recently announced measures, the company should still earn ~$5 billion in annual organic FCF in 2020. The company has a significant annual dividend of $13 billion it isn’t covering, but this is in the midst of one of the worst oil downturns that’s ever been experienced due to an unsustainable event.

The company, assuming oil prices recover to where we expect by YE 2021, should have a FCF yield of ~25%. That’s a significant FCF yield and one that has the potential to generate incredibly impressive shareholder rewards. Investors who invest today get a double-digit dividend that hasn’t been cut on the downside, and on the upside, the potential for significant shareholder rewards.

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.

Disclosure: I am/we are long RDS.A, RDS.B. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment