Denis-Art/iStock via Getty Images

Investment Thesis

Royal Caribbean Cruises (NYSE:RCL) stock had obviously plunged during the heights of the pandemic, from $135.05 in January 2020 to $22.33 in March 2020. Its stock performance had also further worsened post FQ1’22 earnings call, from $73.59 on 5 May 2022 to $35.29 on 01 July 2022.

RCL 5Y Stock Price

RCL 5Y Stock Price (Seeking Alpha)

With the inflation and the Fed’s hike in interest rates, we are uncertain of RCL’s future recovery, given the potential recession reducing consumer spending moving forward. Though we saw a brief uptick of cruise bookings in May 2022, the recovery may be short-lived, given the pent-up travel post-reopening cadence. Once the surge is digested, we could potentially see slower sales recovery from H2’22 onwards, thereby triggering more stock volatility in the short term, brought on by the bear market sentiments.

As a result, despite the attractive risk/reward ratio, we do not recommend investors to add here, since a moderate retracement is possible prior to its FQ2’22 earnings call in August 2022, similar to before its FQ1’22 earnings call.

RCL Is Naturally A High Capex Business With Lower Profitability Margin

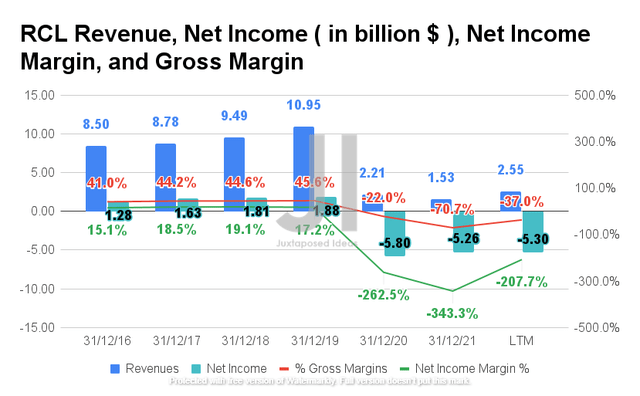

RCL Revenue, Net Income, Net Income Margin, and Gross Margin

RCL Revenue, Net Income, Net Income Margin, and Gross Margin (S&P Capital IQ)

RCL’s sales have been decimated in the past two years, with the company only reporting 23.2% of its FY2019 sales at $2.55B in the last twelve months (LTM). As a result, its gross margins have also plunged to -37% in the LTM, compared to 45.6% in FY2019. In addition, RCL also reported net losses of -$5.3B with net losses margins of -207.7% in the LTM, representing a tremendous decline of -73.8% and 82.6 percentage points from FY2019 levels.

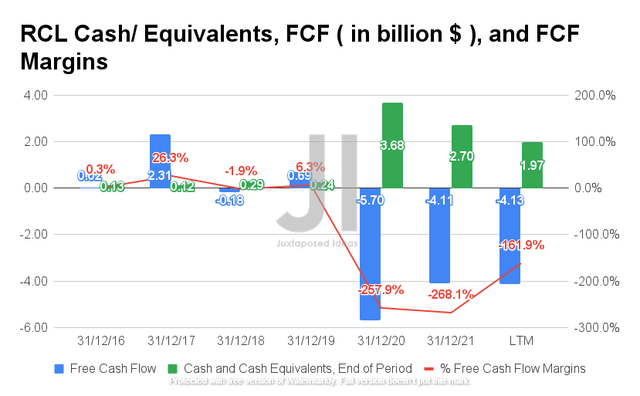

RCL Cash/ Equivalents, FCF, and FCF Margins

RCL Cash/ Equivalents, FCF, and FCF Margins (S&P Capital IQ)

Before the pandemic, RCL’s free cash flow (FCF) generation has not been overly impressive as well, given its high Capex business. As a result, the company’s recent balance sheet was obviously in the red, given the massive plunge of revenue in the past two years, with an FCF of -$4.13B and an FCF margin of -161.9% in the LTM. In addition, with a dwindling cash and equivalents of $1.97B on its balance sheet in the LTM, RCL desperately needs the massive turnabout provided by the global reopening cadence. We may expect to see the company report an exemplary FQ2’22 indeed, given the robust consumer demand due to the pent-up travel.

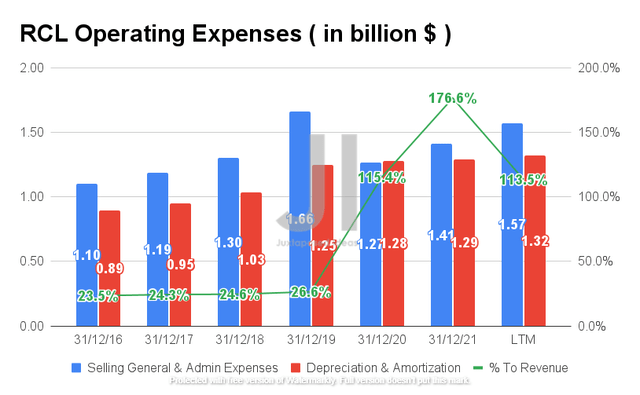

RCL Operating Expense

RCL Operating Expense (S&P Capital IQ)

Though RCL has tried to moderate its operating expenses in the past two years, it is evident that the ratio to its declining revenues has drastically grown over time. By the LTM, the company reported $2.89B of operating expenses, representing 113.5% of its revenues at the same time. Nonetheless, assuming that consensus revenue estimates are accurate, we may expect the ratio to normalize from FY2023 onwards. Moreover, RCL had made a wise choice by hedging its long-term fuel costs through FY2023, thus insulating its margins and profitability during current record-high oil and gas prices.

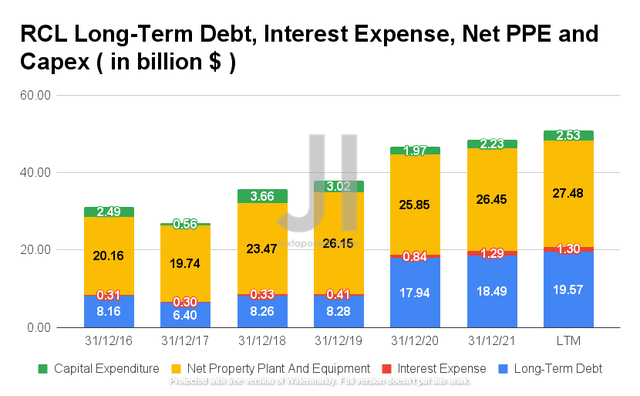

RCL Long-Term Debt, Interest Expense, Net PPE, and Capex

RCL Long-Term Debt, Interest Expense, Net PPE, and Capex (S&P Capital IQ)

As a result of the devastating effects of the COVID-19 pandemic in the past two years, RCL had also relied on more long-term debts, with a total of $19.57B incurred in the LTM. The increase is massive, since it represented an increase of 236.3% from FY2019 levels, with over 317% growth in interest expenses in the LTM.

RCL also increased its capital expenditure to $2.53B in the LTM, with the majority at $1.36B attributed to FQ1’22. Given the potential return of all its fleets before the summer holidays, we expect the company to incur more Capex by FQ2’22 as well. Though it would directly impact its FCF profitability in the short term, we are not overly concerned, since these would also eventually be top and bottom lines accretive.

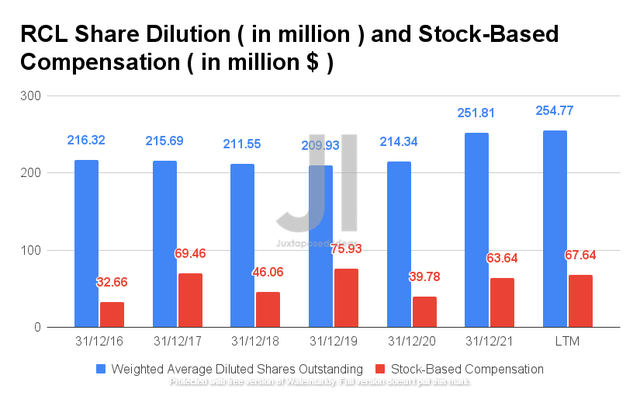

RCL Share Dilution and Stock-Based Compensation

RCL Share Dilution and Stock-Based Compensation (S&P Capital IQ)

Nonetheless, given its lack of profitability, it is natural that RCL has continued to rely on stock-based compensation (SBC) for the past few quarters. The company reported a total of $67.64M in SBC expenses in the LTM, increasing its total share count to 254.77M at the same time, given the suspension of its share repurchase programs and dividend payouts since the start of the COVID-19 pandemic. Nonetheless, we do not expect RCL to restart these programs by H2’22, since the company is still bleeding cash at the moment and for the next few quarters.

RCL’s FQ2’22 Performance Will Be Critical To Its Stock Recovery

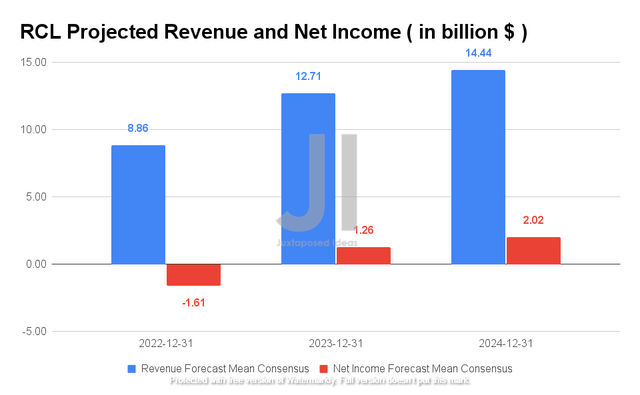

RCL Projected Revenue and Net Income

RCL Projected Revenue and Net Income (S&P Capital IQ)

Over the next three years, RCL is expected to record normalized revenue growth at a CAGR of 5.69%, while also reporting revenue and net income recovery by FY2023. For FY2022, consensus estimates that the company will report revenues of $8.86B and net incomes of -$1.61B, representing an increase of 579% and 326% YoY, respectively, though still a far cry of -19% and -53.8% from FY2019 levels.

Analysts will be closely watching RCL’s performance in FQ2’22 by early August 2022, with consensus revenue estimates of $2.1B and EPS of -$2.33. The market will also be using it to benchmark the company’s ability in maintaining consumer demand during the potential recession, assuming an optimistic guidance for FQ3’22. Jason Liberty, CEO of the Royal Caribbean Group, said:

Despite the impact of Omicron earlier in the year and the horrific conflict in Ukraine, we are encouraged by the strong demand for cruising and the steady acceleration in booking volumes. Since the beginning of March, booking volumes have exceeded the record levels achieved in 2019 and we are optimistic that 2022 will be a strong transitional year as we return to full operations and profitability in the second half of the year. (Seeking Alpha)

So, Is RCL Stock A Buy, Sell, or Hold?

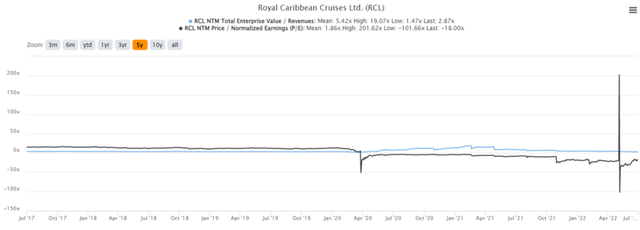

RCL 5Y EV/Revenue and P/E Valuations

RCL 5Y EV/Revenue and P/E Valuations (S&P Capital IQ)

RCL is currently trading at an EV/NTM Revenue of 2.87x and NTM P/E of -18.0x, lower than its 5Y mean of 5.42x and 1.86x, respectively. The stock is also trading at $35.29, down 66.8% from its 52-week high of $98.27, nearing its 52-week low of $33. Nonetheless, despite the strong buy rating from the consensus estimates with a price target of $87.33, we are not convinced of its 147.46% upside.

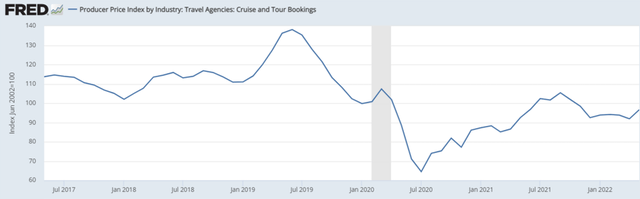

U.S. Bureau of Labor Statistics – Cruise and Tour Bookings

Cruise and Tour Bookings (U.S. Bureau of Labor Statistics)

Given the potential recession reducing consumer spending on unnecessary leisure travels, we believe that the RCL stock has more to fall to new lows, further worsened by its unprofitability, massive debts, and ongoing macro issues. A similar trend was observed in FY2009, when RCL reported a -9.8% YoY decline in revenue and a -73.4% in net income, during the heights of recession then. Though booking trends have picked up by 5.1% in May 2022, it would be prudent to also observe the cruise and tour booking trends in June 2022 for more clarity.

As a result, we encourage investors to wait a little longer before adding more exposure.

Therefore, we rate RCL stock as a Hold for now.

Be the first to comment