Herbert Pictures

Rolls-Royce Holdings plc (OTCPK:RYCEY) is a leading engine manufacturer supplying the global civil and defense aviation markets. Its civil aerospace business was severely impacted by the COVID-19 pandemic, as many airlines were grounded. Looking forward, as the Chinese traveler is set to return to the skies in the coming months and quarters, things are looking up for Rolls-Royce. I believe the shares can double if air travel volume can simply return to 2019 levels.

Company Overview

Rolls-Royce Holdings plc (not to be confused with Rolls-Royce Motor Cars, the manufacturer of luxury cars that is a wholly owned subsidiary of BMW) is a manufacturer of power and propulsion systems for commercial aircraft, defense, and other industrial applications.

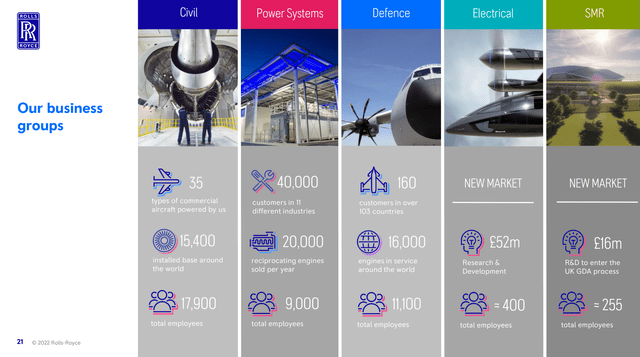

Rolls-Royce (“RR”) is based in the U.K. and has 4 main business segments: 1) Civil, 2) Power Systems, 3) Defense, and 4) New Markets.

Figure 1 – Rolls-Royce overview (RR investor presentation)

Market Leader In Civil Aerospace Engines

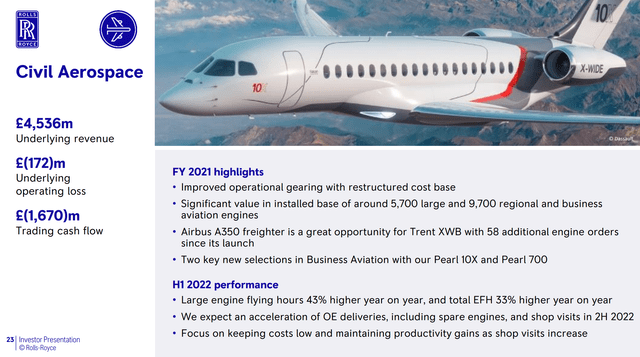

RR’s Civil Aerospace business is a major manufacturer of aero engines for commercial, business, and regional jets. The business recorded 2021 revenues of £4.5 billion, and is the largest of RR’s 4 business segments (Figure 2). However, the Civil Aerospace segment operated at a loss in recent years due to the COVID-pandemic (will be covered later in this article).

Figure 2 – RR Civil Aerospace segment overview (RR investor presentation)

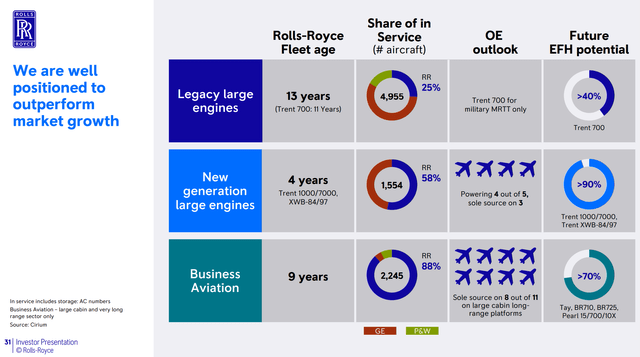

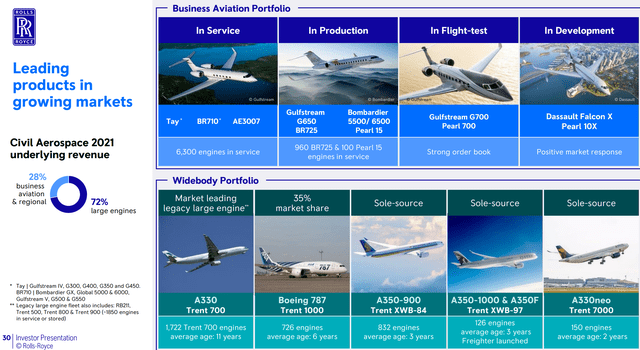

RR’s engine business competes mainly with GE (GE) and Pratt & Whitney (a subsidiary of Raytheon (RTX)) in an oligopoly structure. According to the company’s marketing presentation, RR has a dominant position in business aviation and has been gaining market share in new generation large engines (Figure 3). However, in terms of legacy installed fleet, it still lags behind the market leader GE.

Figure 3 – RR Civil Aerospace engine market share (RR investor presentation) Figure 4 – RR is sole-sourced on many leading aircrafts (RR investor presentation)

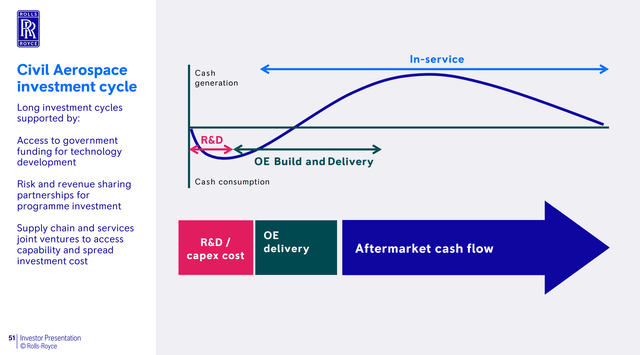

Engine development is a very long process with large upfront R&D costs. However, once the engine goes into production, there is a long tail of aftermarket cash flows, as aircrafts remain in service for many years, sometimes decades (Figure 5).

Figure 5 – Illustrative aerospace investment lifecycle (RR investor presentation)

For example, the Boeing 747 first entered production in 1970 and after 1,574 aircraft delivered, production of the 747 only stopped in 2022. With hundreds of 747 still in service, the 747 should continue to generate revenues for its engine providers (all 3 major manufacturers have 747 engines in service) for years to come.

COVID Was A Huge Negative Shock For Rolls-Royce

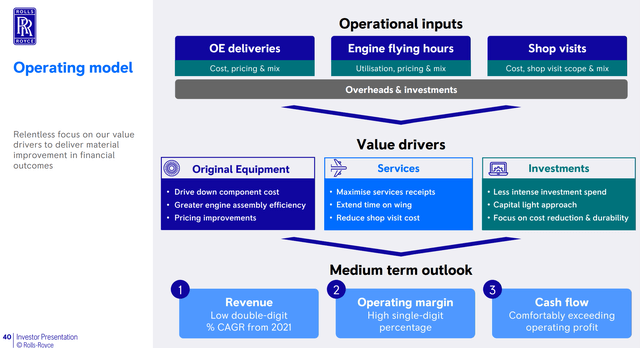

RR’s Civil Aerospace operating model is shown in Figure 6.

Figure 6 – RR Civil Aerospace operating model (RR investor presentation)

Historically, original equipment (“OE”) engines are sold at a subsidized loss, with profitability recovered through high margin Long-Term Service Agreements (“LTSA”) and spare engine sales.

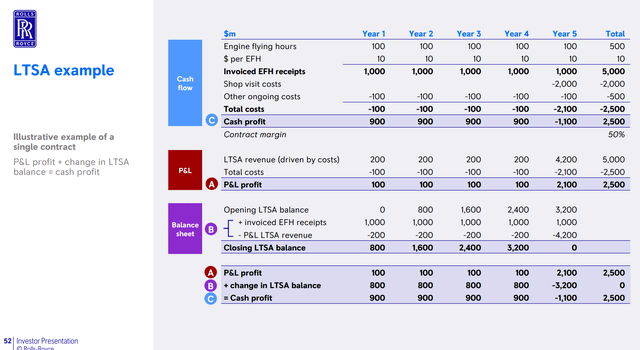

LTSAs are structured such that RR bill airlines based on Engine Flight Hours (“EFH”) and RR takes care of the routine day-to-day maintenance as well as major overhaul (‘shop visit’) expenses. Figure 7 shows an illustrative example of a LTSA.

Figure 7 – LTSA example (RR investor presentation)

Assuming an aircraft flies 100 hours every year, RR invoices a large annual amount, most of which is kept on its balance sheet (similar to how insurance companies charges upfront premiums to pay out in the event of accidents). In year 5, the engine is taken offline and enters the machine shop for a major service, at which time the LTSA balance on RR’s balance sheet is used to overhaul the engine and final contract profitability is determined.

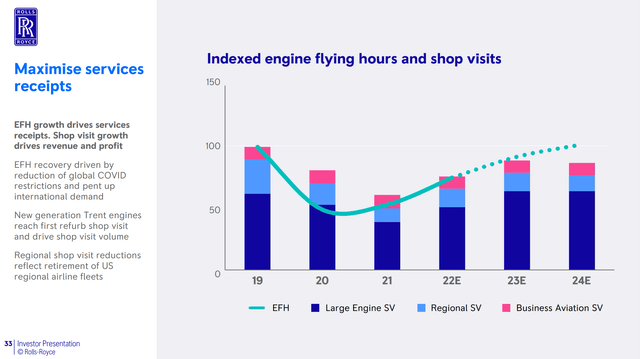

The COVID-19 pandemic was a huge negative shock to RR, as airlines around the world were grounded. This affected RR’s operating model, as EFH declined dramatically.

Figure 8 – EFH contracted severely due to COVID (RR investor presentation)

In order to shore up its balance sheet, RR enacted a hugely dilutive rights offering, raising £2.0 by issuing 6.4 billion shares. This brought shares outstanding from 1.9 billion pre-COVID to 8.3 billion.

Restructured Cost Base

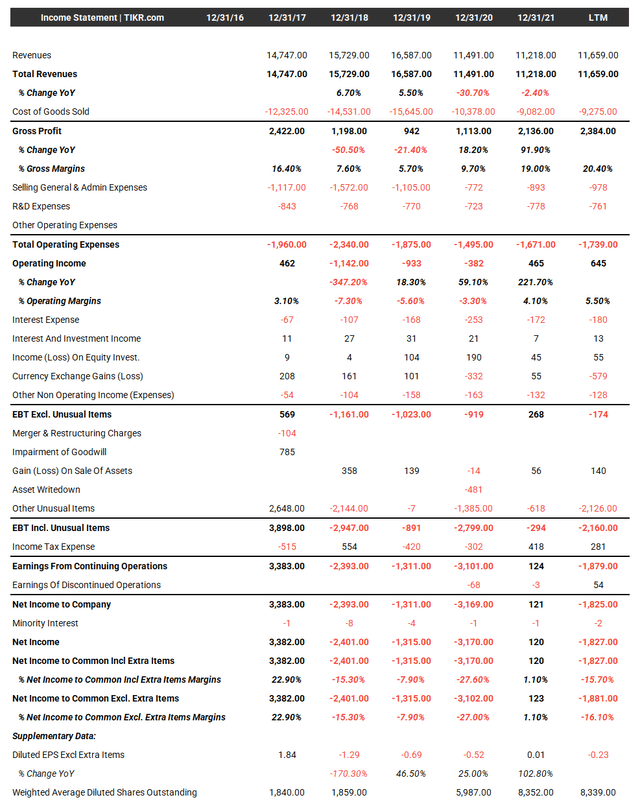

One silver-lining of the COVID-pandemic was that a near-death experience forced Rolls-Royce to re-evaluate its cost structure. Overall, RR reduced headcount and closed / consolidated plants, reducing operating costs by an annualized £1.3 billion. This has allowed the RR to return to operating profits in fiscal 2021, despite headline revenues down 33% from 2019 levels (Figure 9).

Figure 9 – RR financial summary (tikr.com)

Return Of The Chinese Traveler Bodes Well For EFH

In the most recent trading update from RR, the company reported that:

In Civil Aerospace, large engine flying hours continued to recover and were 65% of 2019 levels in the four months to the end of October and 62% year to date.

While air travel has largely recovered in the U.S. and Europe, it remains depressed in China and Asia:

The 36% growth year to date compared to the prior year reflects uneven recovery around the world, with stronger recovery in the US and Europe but lower travel in China and Asia due to ongoing Covid measures.

However, this update was presented prior to developments in China in the past few months.

As I have been detailing in some of my other articles, China began dismantling its Zero-COVID measures in early December. In the past few weeks, things have progressed to the point that China’s air travel volumes have surged to 65% of pre-pandemic levels on December 12, from just 22% at the end of November.

Now, instead of China restricting outbound air travel, it is the inbound countries like the U.S., Japan, and Canada putting restrictions on travelers from China for fear of the COVID-19 virus.

Looking forward, the Civil Aviation Administration of China (“CAAC”) expects air travel volumes to return to 75% of pre-pandemic levels in 2023, and that “the Chinese airline industry should also strive to break even in 2023”. This bodes well for RR, as the company should see a further recovery in EFH in 2023.

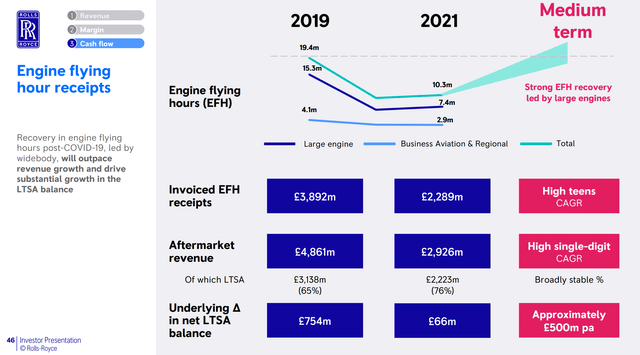

A return to 75% of 2019 levels could increase EFH receipts to £2.9 billion (vs. £2.3 billion in 2021) and aftermarket revenues to £3.6 billion (vs. £2.9 billion in 2021), potentially returning RR’s Civil Aerospace segment to profitability (Figure 10).

Figure 10 – Substantial upside in EFH recovery (RR investor presentation)

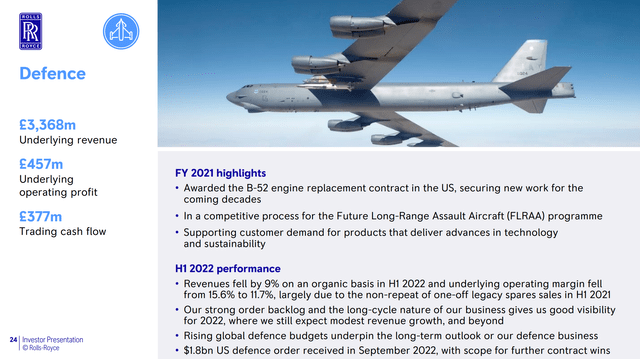

Defense Continues To Shine

The Defense segment provides engines for military transport and patrol aircraft, as well as power solutions for naval ships. RR designs, supplies, and supports the nuclear propulsion plant for all of the U.K. Royal Navy’s nuclear submarines. Despite troubles in the civil aerospace unit, RR’s Defense business continues to perform well, recording £3.4 billion in revenues in 2021 and £457 million in operating profit (Figure 11).

Figure 11 – Defence continues to shine (RR investor presentation)

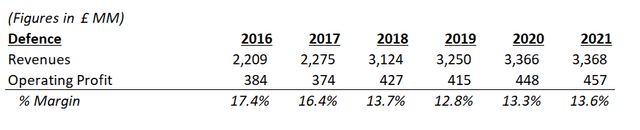

In fact, Defense continues to be RR’s most consistently profitable and highest margin business segment, with operating margins in the mid-teens (Figure 12).

Figure 12 – Defence historical revenue and operating profits (Author created from RR investor presentations)

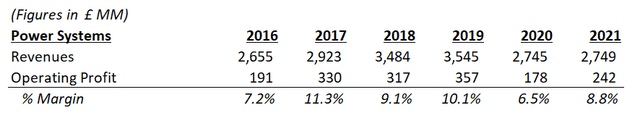

Power Systems

RR’s Power Systems business provides onsite power and energy storage solutions and has also been performing well. Although it does not enjoy the same high margins as the Defense business, it was able to record £2.7 billion in revenues in 2021 with £242 million in operating profit (Figure 13).

Figure 13 – Power System historical revenues and operating profits (Author created from RR investor presentations)

Intriguing New Markets Business

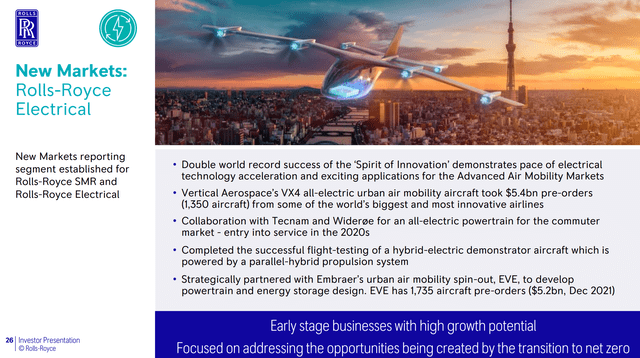

Finally, RR has a New Markets business segment where the company groups together early-stage businesses with high growth potential like an all-electric air mobility aircraft engine design for Vertical Aerospace (Figure 14).

Figure 14 – Electric engines in New Business Segment (RR investor presentation)

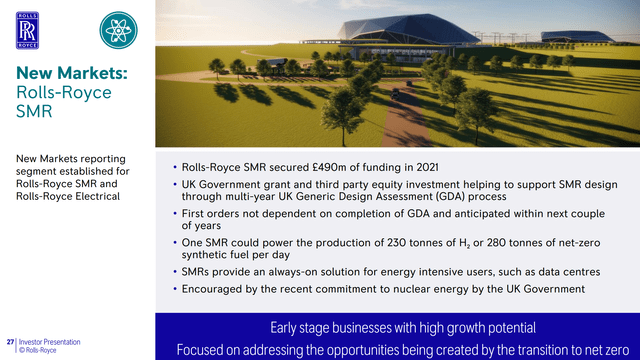

In my opinion, the business with the most upside potential is Rolls-Royce’s small modular reactor (“SMR”) business (Figure 15).

Figure 15 – SMR business in New Business Segment (RR investor presentation)

Due to climate change and energy security concerns, governments around the world are increasingly revisiting nuclear energy as a way to generate secure, carbon-free energy.

Historically, some of the major challenges to building new nuclear reactors have been major cost overruns, which can run into the tens of billions, and safety concerns, like the Fukushima nuclear disaster.

SMR can potentially address these problems as SMRs can be mass produced in purpose-built factories, reducing their construction costs. Furthermore, SMRs have much smaller footprints and are less likely to go into runaway fission reactions like the Fukushima disaster.

Financials Have Lots Of Upside

Valuation-wise, the past few years have been messy for RR, as it had undergone a massive corporate restructuring, as well as a dilutive rights offering.

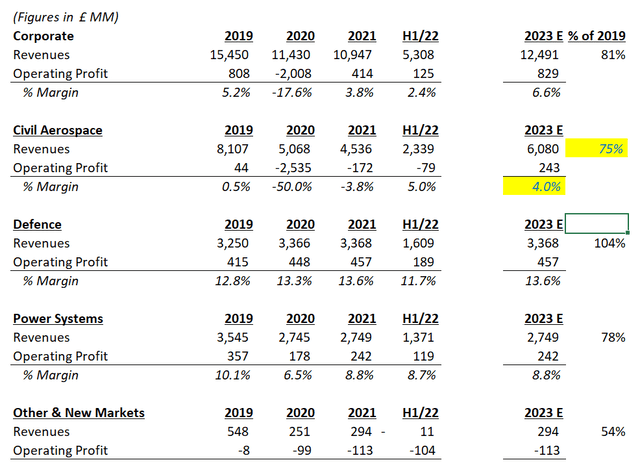

In 2021, RR reported essentially breakeven financial results on £11.0 billion in revenues from continuing operations. If, as we highlighted above, the Civil Aerospace segment can recover to 75% of 2019 results, we see significant upside opportunities in RR’s financial results.

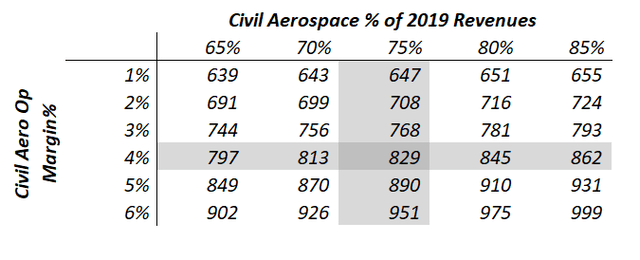

For example, in the simple model below, I assumed 2021 revenues and operating profits are carried over to 2023, with the only variables being Civil Aerospace’s revenues as a % of 2019 levels, and the segment’s operating margin. Assuming the segment can achieve 75% of 2019’s revenues, and can deliver a 4% operating margin (I believe this is reasonable given the structural cost cuts implemented), I believe it is possible for the company to generate £829 million in operating profits, essentially the same level as 2019 (Figure 16).

Figure 16 – RR can return to 2019 operating profitability with modest gains in Civil Aerospace (Author created)

Figure 17 shows a sensitivity table on the two assumptions above.

Figure 17 – Operating Profit Sensitivity (Author created)

Will Rolls-Royce Recover To Pre-Pandemic Price?

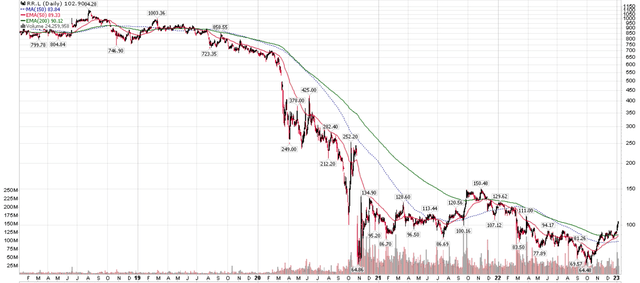

Can RR return to pre-pandemic share price? Unfortunately, I believe the simple answer is no. Recall, due to the pandemic, RR enacted a very dilutive rights offering, issuing 6.4 billion in new shares in exchange for raising £2.0 billion in capital. This essentially quadrupled the share count, from 1.9 billion to 8.3 billion shares.

Looking at Rolls-Royce’s share price, the shares traded at ~£10.0 prior to the COVID pandemic. Therefore, if operating profitability can return to pre-pandemic levels, it is possible for the shares to trade to £2.00 to £2.50 per share, or a return of 100-150%.

Figure 18 – RR share price (stockcharts.com)

Risks

Although the upside is substantial for RR, there are also significant risks. For example, with soaring inflation in the U.K., RR has implemented blanket 6.5% wage increases for its workers in recent months. There is a risk that this will not be enough, and further wage increases will be required.

Furthermore, RR’s Long-Term Service Agreements may lock in revenues at unprofitable rates if inflation continues to soar in the coming years. Fortunately, RR’s LTSA does have catch-up provisions that can adjust revenues to account for cost increases. However, it is unclear whether the increases can fully offset the negative impact of inflation.

Another risk is that there could be design flaws in RR’s engines that could lead to substantial penalties or extra remediation costs. For example, in 2016, a design flaw was discovered with RR’s Trent 1000 engines, causing the engine blades to crack. Ultimately, RR was forced to take a £1.4 billion charge in 2019 to remediate the issue.

Conclusion

Rolls-Royce is a leading engine manufacturer supplying the global civil and defense aviation markets. Its business was severely impacted by the COVID-19 pandemic, which caused a substantial decline in revenues. However, with the Chinese traveler set to return to the skies in the coming quarters, things are looking up for Rolls-Royce. I believe the shares can double over the next year or two if air travel volumes can return to 75% of 2019 levels. I am a buyer of Rolls-Royce’s shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment