Justin Sullivan

Thesis

Roku, Inc.’s (NASDAQ:ROKU) Q2 card sent shockwaves last week, but ROKU has recovered a considerable extent of its prior week’s losses. Therefore, we believe investors are curious to know whether this is ROKU’s ultimate bottom.

Our analysis shows that ROKU’s sell-off last week could be the market’s move to force a final capitulation, taking out as many weak hands as possible before staging an eventual bottom. However, we must emphasize that our valuation parameters have also been revised, given its investments, impacting its near-term profitability.

There’s little doubt that the CTV streaming leader is a force to be reckoned with, despite the hammering in its stock since its July 2021 highs. The CTV ad landscape is still in the earlier stages of its growth, as ad budgets have not followed the corresponding engagement in CTV. Therefore, we believe it makes sense for the company to continue investing in a challenging macro environment to solidify its leadership while the others pull back.

Despite that, we think investing in ROKU has always been about assessing its valuation as much as its underlying model. Due to its relatively weak profitability metrics, the market has always found it challenging to value ROKU, which could also explain its relative volatility against the market.

However, our price action analysis shows that ROKU has likely staged a sustained long-term bottom. Therefore, we are confident that with the recovery in the market sentiments, ROKU looks primed to follow the wave back up in the medium term.

As such, we reiterate our Buy rating on ROKU, with a medium-term price target of $120, implying a potential upside of 47.6%.

Long-Term Business Model Remains Intact

Roku initially shocked investors as it reported a weak quarter below the Street’s consensus, impacted by the marked downturn in ad spending. Notwithstanding, CEO Anthony Wood remains resolute in his belief that the company is solidly positioned to ride the subsequent recovery. He articulated (edited):

Of course, we are seeing advertisers worried about a possible recession and so we’re seeing them reduce their spending in places that are easy for them to turn off and turn back on. And so that’s impacting our growth rate in the short term. We’re in an economic cycle where advertising is trending down. It will turn around. And things like ad market share will become very important when that happens to the size of the rebound. So, for example, we are growing our share of the advertising market as advertisers continue to move dollars to streaming and platforms like Roku. Even though the scatter market we’re seeing softness, we had a robust upfront recently, where we closed over $1 billion in commitments for the first time. Upfronts are where advertisers commit dollars for the next year. (Roku FQ2’22 earnings call)

Of course, investors shouldn’t just take Wood’s commentary that indicates long-term CTV ad spending remains robust. We also discussed in our recent The Trade Desk (TTD) article, highlighting that Disney (DIS) also saw a record upfront, with 40% of the budget earmarked for streaming.

Hence, the long-term prognosis of CTV remains robust, and we think it’s critical for leaders like Roku to continue investing to take share while some of their competitors pull back their investments.

But, Be Prepared For Near-Term Uncertainties

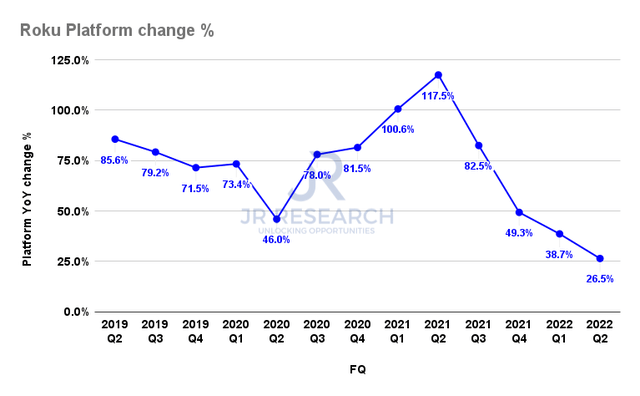

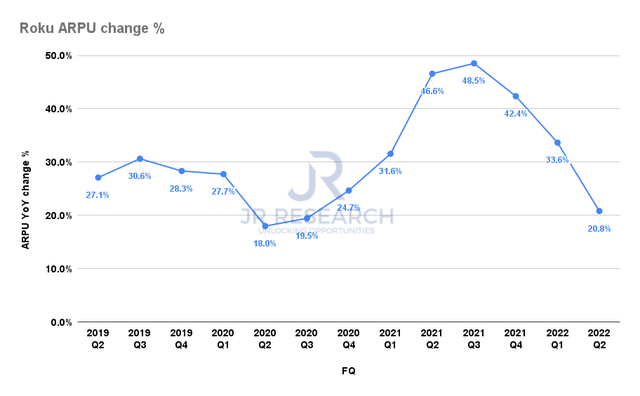

Roku platform revenue change % (Company filings) Roku ARPU change % (Company filings)

As seen above, Roku’s platform revenue and average revenue per user growth (ARPU) have been trending down markedly since Q2’21, which explains the battering in its stock price. Therefore, we believe the market’s de-rating of ROKU stock is justified, as its pandemic-driven growth wasn’t sustainable.

However, we believe the normalization of its growth has also brought a fantastic opportunity for investors to layer in. Given the cyclical nature of ad spending, Roku’s leadership and competitiveness should see it regain its revenue growth cadence when the economic cycle improves subsequently. Hence, investors should consider investing when the chips are down significantly, not when they have reached all-time highs (as we learned ourselves).

Is ROKU Stock A Buy, Sell, Or Hold?

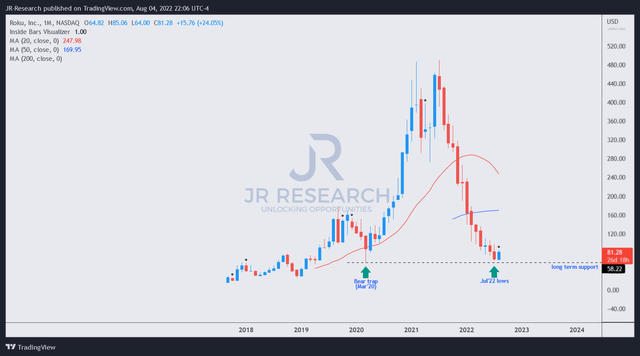

ROKU price chart (monthly) (TradingView)

As seen above, we believe ROKU is seeing robust buying upside as it closes in on its long-term support (March 2020’s bear trap). Therefore, we believe ROKU is increasingly close to its eventual bottom before staging a medium-term recovery.

As such, we are confident that last week’s post-earnings steep sell-down was a move to force capitulation, shaking out as many weak shareholders as possible.

Coupled with the improvement in market sentiments, we believe the buying momentum bodes well for ROKU’s recovery. Therefore, we reiterate our Buy rating on ROKU, with a medium-term price target of $120 (potential upside of 47.6%).

Be the first to comment