Richard Drury

Investment Thesis

Roku, Inc (NASDAQ:ROKU) continued to expand aggressively in the streaming industry, given its continually expanding acquisition to 61.3M accounts, growing streaming hours to 20.9B, and improving Average-Revenue-Per-User (ARPU) to $42.91 by FQ1’22. Therefore, ROKU is the potential winner in the streaming wars between Netflix (NFLX), Amazon Prime (AMZN), Disney (DIS), and others, since its operating system, Roku US, remained the No. 1 selling TV OS there while also growing its market share over time. However, it is also evident that ROKU’s valuations will always be tied to these production companies, given its home base role in the streaming industry.

Nonetheless, Mr. Market has greatly moderated ROKU’s valuation and stock price thus far, since the stock had plunged by 82% from its all-time highs. Probably, a time for hyper premium valuations is behind us and the companies finally need to prove their execution with viable net income and FCF profitability, especially given the rising inflation and potential recession. Since ROKU is not expected to report sustained positive net incomes until FY2025, we may expect to see further temporary headwinds to its stock valuations, putting more downward pressure on its stock price until then.

Therefore, given the speculative nature of the stock, ROKU is only suitable for those with a higher tolerance for volatility since we do not expect to see another pandemic rally anytime soon.

ROKU Continues To Struggle With Profitability

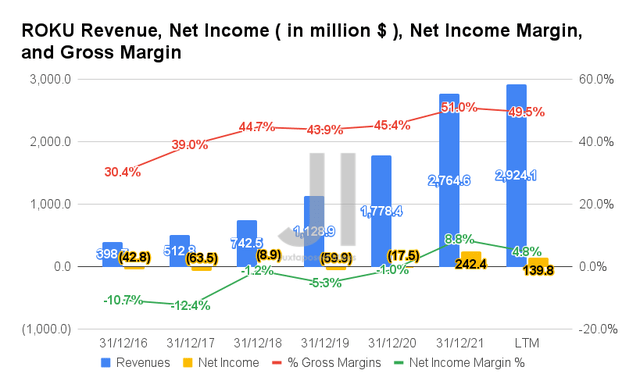

ROKU has massively benefitted from the lockdowns in the past two years, given the exponential growth in its revenues thus far. By the LTM, the company reported revenues of $2.92B and gross margins of 49.5%, representing a massive improvement of 64.9% and 4.1 percentage points from FY2020 levels, respectively.

In addition, ROKU also managed to report profitability in the past few quarters, with a net income of $139.8M and net income margins of 4.8% in the LTM. Nonetheless, the company had also guided a break-even adj. EBITDA for FQ2’22, thereby potentially indicating its short-lived profitability since it also reported net income of -$26.31M for FQ1’22.

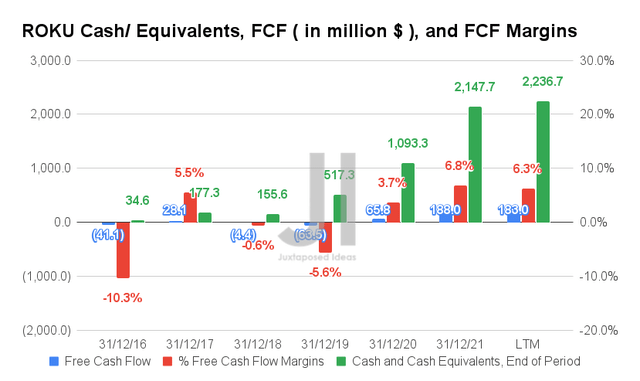

Nonetheless, it is apparent that ROKU has been able to report a sustained (broadly) positive Free Cash Flow (FCF) thus far, with an FCF of $183M and an FCF margin of 6.3% in the LTM. It represents an improvement of 278.1% and 2.6 percentage points from FY2020 levels, respectively. In addition, the company also reported a growing war chest of $2.23B in cash and equivalents on its balance sheet, further strengthened by the previous $1B capital raise in FQ1’21. Therefore, ROKU has more than enough capital to ride through the turbulence for the next one or two years, speculatively.

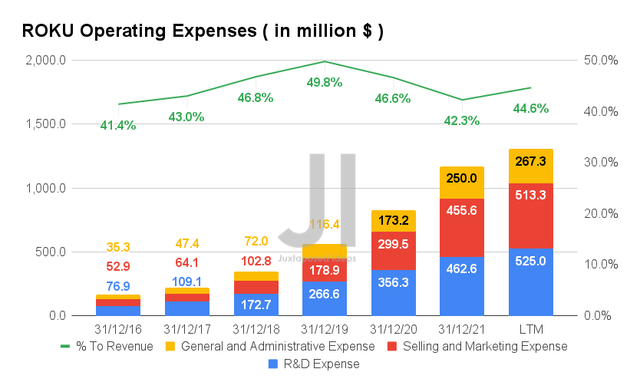

ROKU has also been investing in the business in the past few years, given the aggressive growth in its operating expenses. By the LTM, the company reported total operating expenses of $1.3B, representing a tremendous increase of 98.2% from FY2020 levels. Nonetheless, it is essential to point out that the ratio to its growing revenues has been kept relatively stable at 44.6% by the LTM. Therefore, we are not overly concerned since these will eventually be top and (maybe) bottom lines accretive.

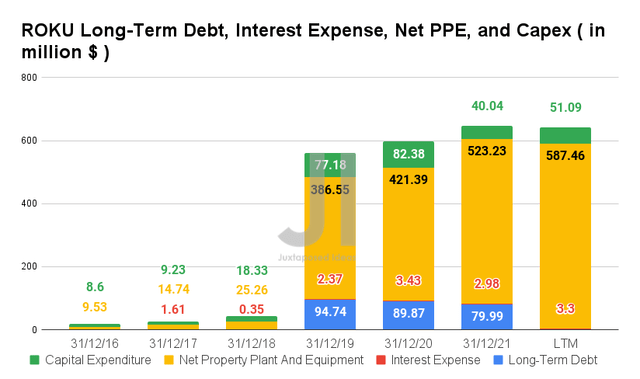

Based on the chart above, ROKU has been very capable in its capital management, since it paid off all its long-term debts that were incurred in FY2019. In contrast, the company continued to grow its net PPE assets to $587.46M by the LTM, representing a massive increase of 51.9% from FY2019 levels. Furthermore, ROKU continued to re-invest in the business, with a capital expenditure of $51.09M in the LTM.

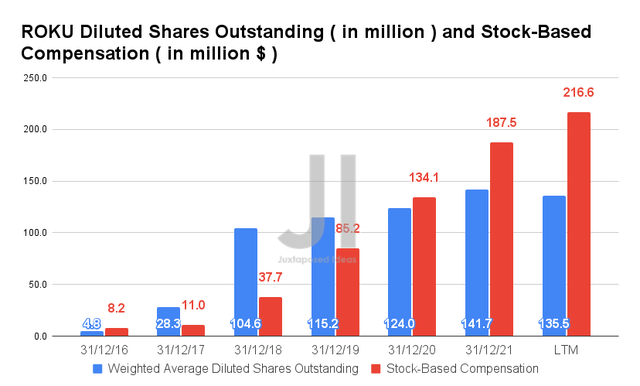

Nonetheless, it is clear that ROKU had and will continue to rely on share dilution and Stock-Based Compensation (SBC), given its lack of sustained profitability until FQ3’20 and the projected return to profitability only by FY2025. By the LTM, the company reported SBC expenses of $216.6M, representing a notable increase of 61.5% from FY2020 levels. These have directly contributed to ROKU’s slow but steady growth in shares count thus far, with a total of 135.5M reported for FQ1’22. Combined with the $1B capital raised through a stock offering in FQ1’21, the current share count represents an increase of 29.5% from FY2018 levels. Not a big concern, since the share dilution remains relatively controlled for now.

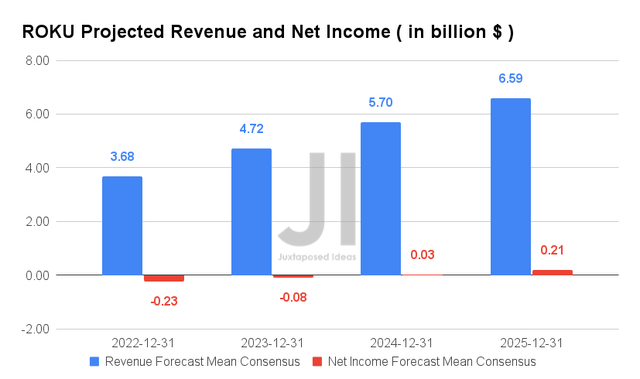

For the next four years, ROKU is expected to report excellent revenue growth at a CAGR of 24.31% while returning to profitability by FY2025. For FY2022, consensus estimates that the company will report revenues of $3.68B and net incomes of -$0.23B, representing YoY growth of 33.3% though a decline of 51.2%, respectively. It is evident that operating expenses will remain elevated for a while longer, worsened by the ongoing supply chain issues and rising inflation. Thereby, indicating the company’s cash burn for a while longer.

In the meantime, analysts will be closely watching ROKU’s FQ2’22 performance, with consensus revenue estimates of $805.35M and EPS of -$0.67, representing a YoY increase of 24.84% though a decline of 43.6%, respectively. Nonetheless, given the company’s mixed performance in the past three consecutive quarters, this particular earnings call may be similar as well. We shall see.

So, Is ROKU Stock A Buy, Sell, or Hold?

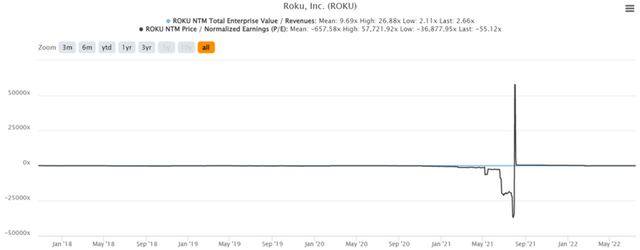

ROKU 4Y EV/Revenue and P/E Valuations

ROKU is currently trading at an EV/NTM Revenue of 2.66x and NTM P/E of -55.12x, lower than its 4Y mean of 9.69x and -657.58x, respectively. The stock is also trading at $88.22, down 82% from its 52 weeks high of $490.76, nearing its 52 weeks low of $72.63. It is evident that the stock’s valuation has been normalized from the hyper-pandemic growth.

ROKU 4Y Stock Price

Therefore, despite the attractive buy rating from the consensus estimate with a price target of $138.50 and a 56.99% upside, we are not sure if this is the right time to add. We prefer to wait for its upcoming earnings call to glean more information on its performance thus far and most importantly, its guidance for FQ3’22. The latter would provide the much-needed information for the consumer’s behavior moving forward, given the potential reduced discretionary spending.

However, given ROKU’s decent execution thus far, speculative investors with a higher tolerance for risk may choose to nibble at $60s, given the attractive risk/ reward ratio for long-term hold. This is assuming another moderation in its PE valuations to -35x, which would be a more reasonable entry point for the rather speculative stock. Nonetheless, it is would be advisable to size the portfolio accordingly, given the potential volatility ahead.

Nonetheless, we rate ROKU stock as a Hold for now.

Be the first to comment