Justin Sullivan

After the bell on Thursday, shares of streaming TV platform Roku (NASDAQ:ROKU) plunged after the company reported Q2 results. While the stock was already significantly off its pandemic highs, results for the quarter were bad and Q3 guidance was quite awful. As a result, the stock is at a new multi-year low, with a lot of uncertainty moving forward.

For the second quarter, total revenues came in at $764.4 million, up roughly 18% over the prior-year period. Unfortunately, the street was looking for nearly 25% growth to almost $805 million, so this was a sizable miss. Platform revenues came in with 26% growth to $673.2 million, while player sales dropped 19% to $91.2 million. The company’s GAAP loss per share came in at $0.82, which was more than a dime per share worse than expected.

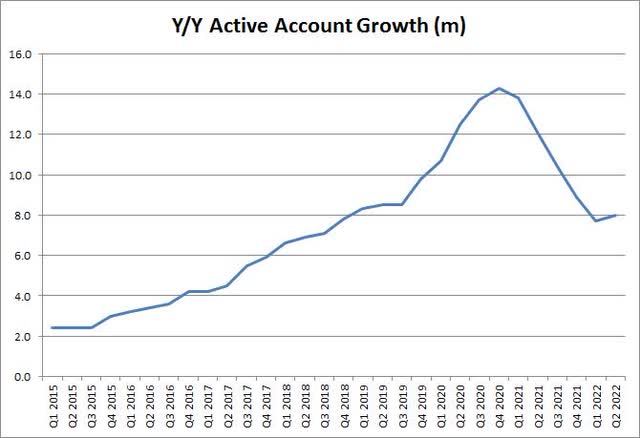

The company added 1.8 million active accounts in the quarter, and this key metric was up by 8 million or about 14% in the past 12 months. The year-over-year growth figure was up slightly from the 7.7 million number reported in Q1, but well off the company’s pandemic high of 14.3 million account adds in a twelve month period as seen in the graphic below.

Active Accounts Growth (Company Earnings Reports)

With the lower revenue figure reported for Q2, monetization efforts also struggled a bit. The year-over-year increase in average revenues per user dropped to $7.64, or about 21% growth, down from almost $11 in Q1 of this year and $11.54 in the year-ago period (46% plus growth). Given commentary from management about weak ad spending, I’m guessing the Q3 numbers aren’t going to look much better.

As bad as the Q2 results were, Q3 guidance was significantly worse. The company guided to total revenues of just $700 million for the period, or around 3% growth over last year’s period, whereas the street was looking for more than $902 million on the top line for the current quarter or nearly 33% growth. Management also withdrew its full year revenue growth forecast, while guiding to weaker sequential gross profits and a significant increase in both negative Adjusted EBITDA and net losses.

Interestingly enough, this is the second day in a row with a significant blowup for major supporter Cathie Wood and her team at ARK Invest. Yesterday, it was Teladoc (TDOC) that gave poor guidance, sending shares sharply lower. It was only about three weeks ago that the team at the active ETF firm released its 2026 price target of more than $600 for Roku, which was based on the company significantly expanding its active account base. ARK Invest is one of the largest holders of Roku, owning around 8% of the company’s outstanding shares at the end of June. The three active ETFs that hold it can be seen below, along with where they stood in each fund as of Wednesday.

- ARK Innovation ETF (ARKK): 3rd largest holding, 7.90% weight.

- ARK Next Generation Internet ETF (ARKW): 2nd largest, 8.60%.

- ARK Fintech Innovation ETF (ARKF): 26th largest, 0.98%.

In Thursday’s after-hours session, Roku shares lost more than a quarter of their value, trading down to less than $64 a share. As the chart below shows, this was one of the biggest beneficiaries of the pandemic, trading up into the high $400s a share. The slowdown in revenue and account growth has sent shares much lower, and I’m guessing the average price target figure that entered Thursday at nearly $136 is going to come down quite a bit in the following weeks.

Roku 5-Year Chart (Yahoo! Finance)

In the end, shares of Roku crashed more than 25% after the company’s awful Q2 report. The company missed revenue estimates by a sizable amount and reported a much larger-than-expected loss for the quarter. Even worse though was Q3 guidance that called for almost no year-over-year revenue growth, with lower sequential gross profits and an even larger loss. It will be interesting to see if major supporter Cathie Wood and her ARK Invest team add to their already large holding, given shares now only trade a little above 10% of their 2026 price target for the stock.

Be the first to comment