Leon Neal

Investment Thesis

With the pandemic boom effect coming off and growing at a higher base, Roblox Corporation (NYSE:RBLX) is experiencing a normalization process while staying focused on research and development to reach its potential. We are constructive on the company’s business but cautious of the high valuation. We provide a framework to help investors to assess this new normal and provide a fair price for the stock.

Company Overview

Roblox, founded in 2012, is a company that builds an immersive 3D multiplayer online gaming platform that enables developers to use a desktop design tool called Roblox Studio to create and share the synchronous gaming experience with others online. The company has millions of developers, the majority of whom are under the age of 18, paying monthly visits to create their own games using its proprietary engine to play, learn, or buy, sell and create virtual items which can be used to decorate their virtual character that serves as their avatar on the platform. Roblox studio is built with an object-oriented & open-source programming language called Lua (also known as Luau). Robux is the proprietary virtual currency circulated on the platform among users for related transactions.

Strength

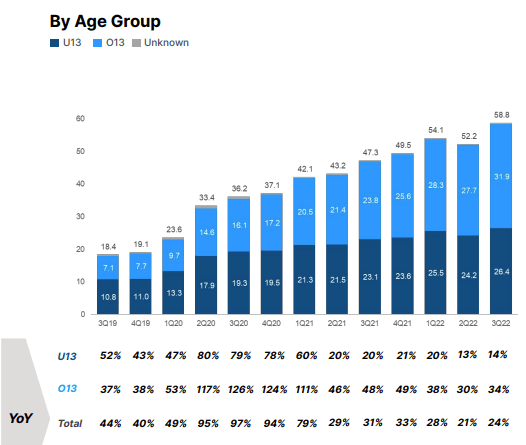

First of all, Roblox’s developers have more autonomy than Minecraft’s. Unlike Minecraft, Roblox itself isn’t a game. It is a platform that allows users to create everything from scratch, even the environment of their games, to the fruition of a complete gaming scenario fitted to their imagination. While as Minecraft always has a pre-set storyline and game environment for users to create their microsystems to adapt to and survive in. From the company’s point of view, Roblox’s growth model is even more robust because it doesn’t need to create content to attract users (Netflix would be jealous). While from the user’s point of view, he/she could have more creative freedom to code up anything he/she could imagine literally. This will support younger users to continue using Roblox into their teens or older as their ability to create also grows. See the chart below for its user breakdown by age group.

Roblox User By Age Group (Roblox Q3 Presentation)

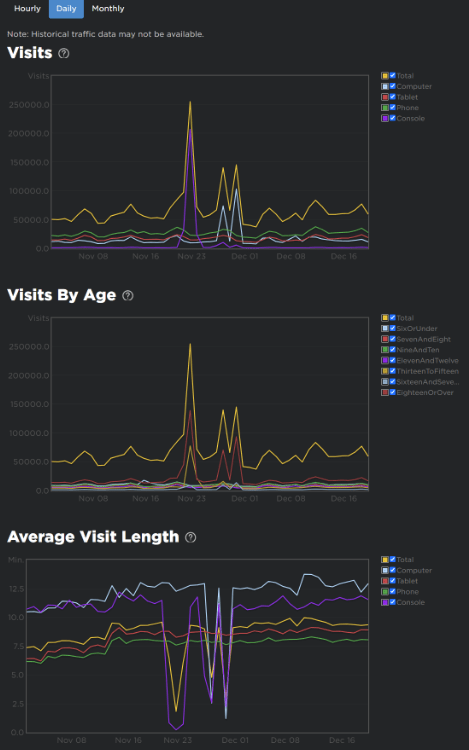

From this, we can see how Roblox has become more popular with teens, who have more pocket money to spend. And Roblox’s developer language is Lua, predominantly used in gaming (think the World of Warcraft). The flexibility on Roblox’s platform allows developers to create anything to their liking and translate that into real-world dollars through Robux. It is an economy of its own. See the screen below of how Roblox helps developers to monitor their games with the users. This is very similar to how some small business manages their customer traffic online.

Roblox: Visitor Stats for Developers (Roblox Developer Forum)

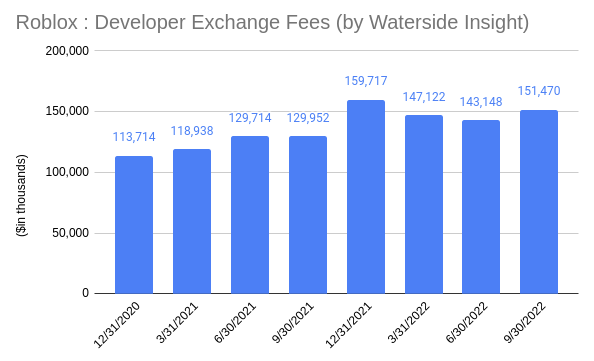

If this is like an economy of its own, how do the developers get paid? Roblox lets the developer exchange the Robux they received from the payers into USD, at $0.0035 per Robux, once a month to cash out their earnings. The company calls it developer exchange fees. The payers pay $1 for 100 Robux. Therefore, one Robux is worth $0.01. That means the company shares 35% of its revenue with the game developers. And it has been holding the conversion at around $136 million per quarter with a fairly consistent and steady growth rate. See the chart below.

Roblox: Developer Exchange Fees (Roblox Quarterly Presentations)

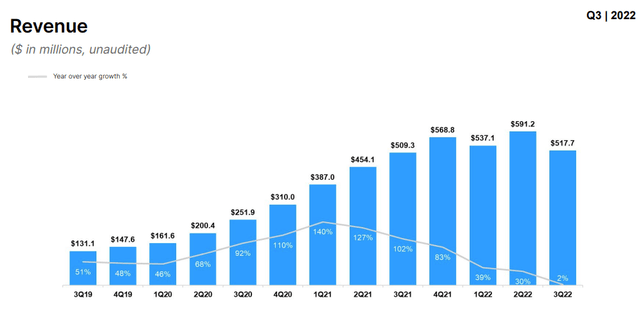

This is one of the reasons why we find Roblox attractive to us. The virtual economy as a prospect for Metaverse is one of the important factors that make it real. From Roblox’s experience, we get a taste of what it would be like. So far, its revenue has almost quadrupled where it was at the start of the pandemic, while its growth has slowed down to almost flat. How would it grow from here?

Roblox Revenue (Roblox Q3 Presentation)

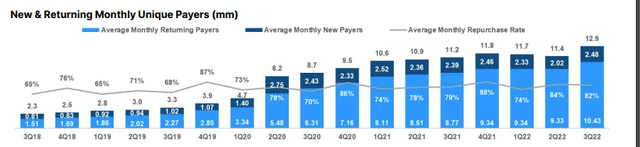

Another strength of Roblox is the social aspect of the gaming experience. It is built in for the company. The snowballing effect of users’ social networks can be seen in the steady growth of its payer community. See the chart below.

Roblox Monthly Unique Payers (Roblox Q3 Presentation)

Is there a deceleration factor at play for Roblox, or is it finding a new normal? We dig further.

The Pandemic boom

Roblox had a big jump in popularity and user engagement at the start of the pandemic, as its social aspect helped people connect online. This gave its revenue and overall performance a big boost. What happens when this effect wears off?

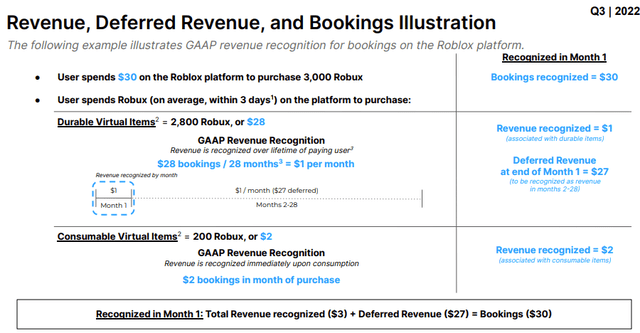

The major revenue of Roblox is the purchase of Robux to spend on the platform when the new users first become payers. But the purchase, usually $30, isn’t wholly recognized as revenue right away as it can be spent flexibly throughout the gaming experience. Statistically, the payers usually redeem $3 off the purchase on durable and consumable virtual items in the first three days. The durable items accounted for 89% of this $3 immediate spending, while virtual items accounted for 11%. Therefore, Roblox suggested a split in revenue recognition of $3 in the first year and deferred revenue recognition of $28 for the rest of the lifetime of the payers. While within the $3, it is $1 for durable and $2 for consumable. See the table below.

Roblox: Revenue Recognition (Roblox Q3 Presentation)

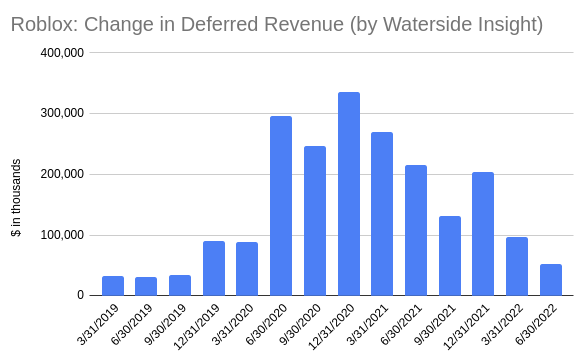

Now the question is, how long does it take for the payers to use the rest of the $28? By the company’s estimate, the average lifetime for a paying user was 28 months for the three months ending in Q3. This estimate has risen from 23 months a year ago, meaning it has taken longer for the company to recognize the deferred revenue. But still, armed with this info, we can try to answer the question about the pandemic boom. We can see its bookings growth peaked in Q2 2020. See the chart below. So for the payers who started in Q1 of 2020, then 28 months later, it would be Q2 of 2022 that this batch of payers’ average lifetime expired. Since the timeline for delayed spending could vary greatly from user to user, the deferred revenue recognition during these 28 months could also be hard to predict. Perhaps, for this reason, this deduction on our part doesn’t exactly match the revenue growth pattern. But it is quite clear to see in its deferred revenue growth, which dropped significantly since Q1 this year.

Roblox Change in Deferred Revenue (Calculate and Charted by Waterside Insight with data from the company)

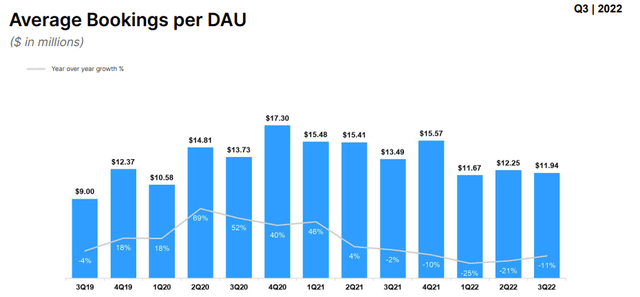

And a similar trend seemed to have been reflected in its average booking per DAU (ABPDAU), whose growth rate reached the lowest in Q1-Q2 this year. The just-released November key Metrics also confirmed this slowing trend for ABPDAU to be down by 7-9% YoY.

Roblox Quarterly Average Booking per Daily Active User (Roblox Q3 Presentation)

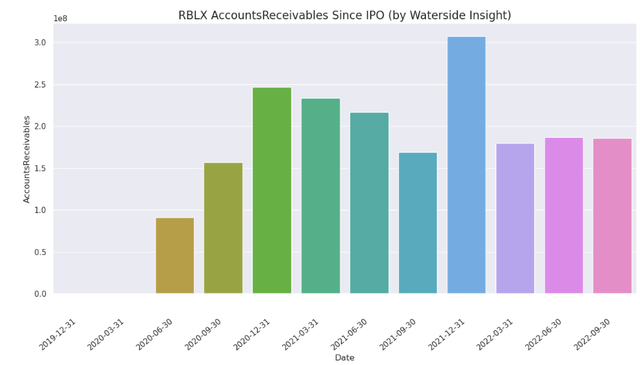

And when we apply this calculation to the account receivables, we also see some echoing as it started slowing down in Q2 this year.

Roblox Account Receivables (Calculated and Charted by Waterside Insight with data from the company)

If we consider this a normalization process that started in Q2 this year, then we think it could last for several more quarters to Q3 of 2023. In that case, investors need to figure out what a normal would look like for Roblox. Based on its historical data on average bookings per unique monthly payers since 2018, we estimate that the normal would still be about 10% lower from here in its recognized revenue growth. Suppose the new users are growing at the current pace. In that case, the combination of both the lower growth rate of new payers and the legacy payers’ deferred revenue recognition coming off could mean the YoY growth for 2023 would be negative. But we would also like to note that this slowdown is at a much higher revenue base than two years ago.

Now let’s look at some apparent weaknesses of the company.

Weakness/Risks

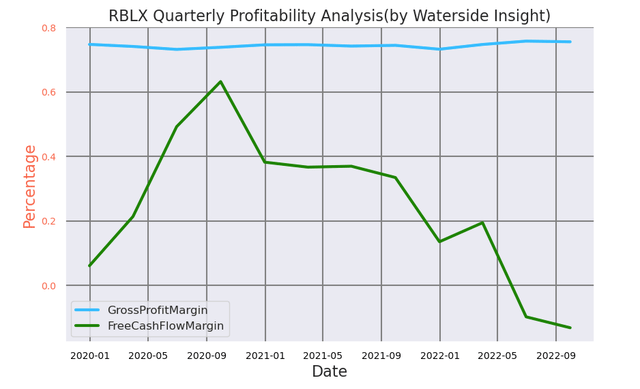

Roblox has a strong gross profit margin in the range of 70-80%, but its free cash flow margin has fallen off a cliff to now in the negative.

Roblox Quarterly Profitability Analysis (Calculated and Charted by Waterside Insight with data from the company)

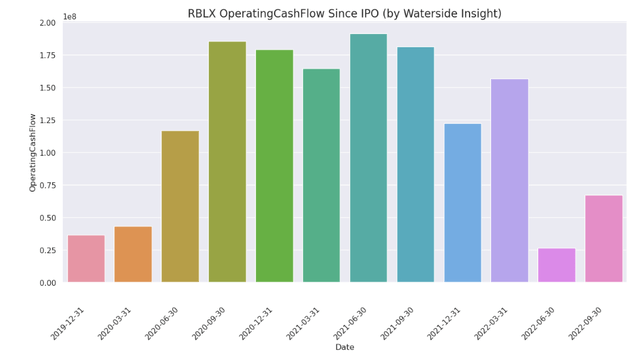

Operating cash flow has obviously taken a hit since Q2 this year.

Roblox Operating Cash Flow (Calculated and Charted by Waterside Insight with data from the company)

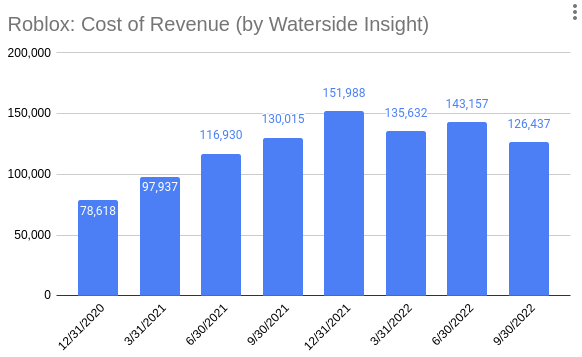

But its cost of revenue has flattened or lowered in recent quarters.

Roblox Cost of Revenue (Roblox Quarterly Presentations, charted by Waterside Insight)

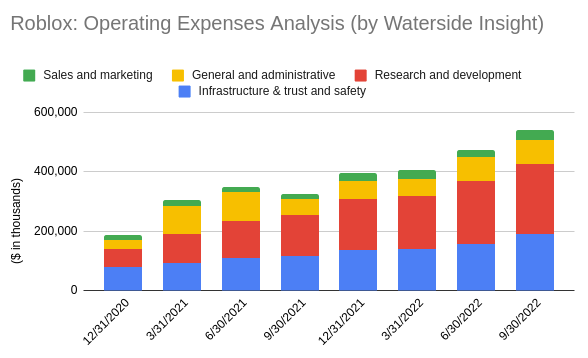

From what we can see, its rising operating expenses, which have almost tripled since 2020, are an important contributing factor that caused the lower operating cash flow and negative earnings. When we parse them, we can see its sales-related expenses are almost meager compared with the total expenses; its general and admin expenses seem to have even declined; the infrastructure& trust and safety expenses have some single-digit growth QoQ; only its R&D expenses which accounted for almost two third of the total operating expenses, have almost quadrupled.

Roblox Operating Expenses Break-down (Roblox Quarterly Presentation, Charted by Waterside Insight)

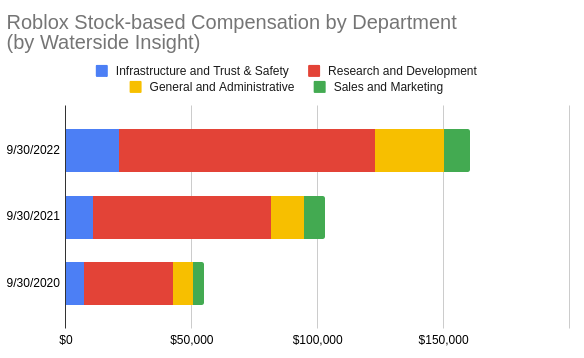

A similar heavily-leaning ratio towards research and development can be seen from its stock-based compensation parsed by departments. In the 3 months that ended in Q3, the research department received 63.54% of the total compensation, almost double that of all the other departments combined.

Roblox Stock-Based Compensation (Roblox Q3 Presentation)

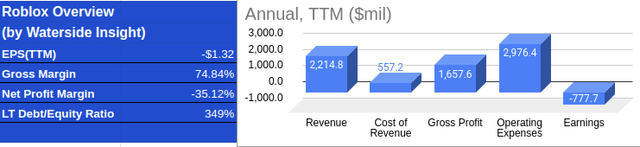

Besides the high regular expenses, Roblox also has a high debt problem. Its debt-to-equity ratio reached 349% in Q3, mostly ramped up in the past year or two. The company said in the 10-k that it planned on “making significant investments…may require additional funds…” to create new experiences, improve infrastructure or acquire complementary technology. And it warned that its profitability would be hurt if the revenue growth could not keep up with this expansion. In other words, what we saw in the drop in profit margin in Q3 could be what the management had anticipated.

Last but not least, the foreign exchange rate risk posed to Roblox’s foreign revenue could still be a headwind in the near term. The company has over 75% of daily active users based outside of the US & Canada. Converting the revenue from these users against rising USD will further reduce its revenue growth rate. For example, its November Key Metrics report estimated that such a headwind reduced the YoY growth for the bookings by 4-5%.

What it looks like to us is that Roblox has been relentlessly expanding research and development efforts while the pandemic boom is wearing off this year. Both factors contributed to the sharp drop in net earnings and net cash flow. In other words, Roblox is investing heavily in its future growth and has extracted some of its current profitability while doing so. With its revenue going up by almost five times, its sales and admin expenses have only gone up much slower, which tells us that there is indeed organic growth with Roblox. We don’t think Roblox is heading in the wrong direction. In fact, for a tech company, this is exactly what it should be focusing on – its core competitiveness in technological innovation through research and development. However, currently, Roblox is entering a normalization with lower revenue growth, higher debt load, and searching & expanding new technology on the platform. It will require investors to assess this new normal and reprice the stock.

Financial Overview

In Q3, Roblox’s annual revenue TTM was $2.21 billion, which declined by 12.4% QoQ while growing 2% YoY. The company’s cost of revenue was at $557.2 million, which came down from $560 million in the previous quarter. Its gross profit margin has maintained at a similar level to the previous quarter at 74.84%, while its TTM annual net profit margin has dropped to -35.12% versus the previous quarter’s 25.1%. Its debt-to-equity ratio is at 349%, almost 5 times more YoY. Overall, its revenue maintained a high level, with growth slowed, while earnings remained negative with a high debt burden.

Roblox Financial Overview (Calculated and Charted by Waterside Insight with data from the company and Yahoo Finance!)

Valuation

For Roblox to be valued at the current price of $27.91, the stock must achieve over $100 million in its net cash flow in 2023 and continue with an almost 40% growth rate annually for the next ten years. We don’t think that is likely. We assess its fair valuation with a ten-year projection using our proprietary models based on all the analyses above.

In a bullish case, Roblox achieves positive net cash flow for 2023 and maintains an average 25% growth rate per year for the next ten years; it would be valued at $7.26. In a bearish case, where the company has negative cash flow growth for the next two years but still sustains the growth rate in the 20% range, it is valued at $4.56. In our base case, it has negative cash flow growth for 2023 but pulls back to positive from 2024 onwards and still assumes an average 25% growth rate, and it was valued at $5.75. In any case, its stock price is overvalued at the current level.

Conclusion

Roblox’s pandemic boom is wearing off and is coming into a new normalization period. Investors should take this opportunity to reassess the company’s growth prospects. The company continued to focus heavily on research and development to capture the next growth opportunity. We are constructive about the underlying business and the platform’s attractiveness but anticipate a lower profit margin ahead. We believe the current price is highly overvalued. Investors should sell at the current price of $27.91 and look for a better entry level at $5.75 to $7.26.

Be the first to comment