AsiaVision/E+ via Getty Images

Investment Thesis

Robinhood (NASDAQ:HOOD) has seen its share price find a floor on the back of a rumored buyout.

However, I do not believe that is likely for the 4 reasons that I describe here. Namely, management’s ownership of the company, slowing revenue growth rates, the bear market backdrop in both crypto and equity markets, and Robinhood’s own reputation getting in the way of it meaningfully increasing new funded accounts.

I rate HOOD stock a strong sell.

Buy-Out On The Cards? Don’t Count On It

Readers have reached out to me and asked me about my views on Robinhood’s buyout potential, given that I’ve been so openly bearish on the company from the start.

Author’s coverage of HOOD

It’s not that I’m strongly committed to one idea. I’m very happy to change my mind if the facts change.

However, the reasons why I don’t believe that a potential buy-out could be around the corner is because of the following 4 considerations.

First, Robinhood’s founders have approximately 60% of the voting power. It’s very much their call on whether or not Robinhood is bought up.

HOOD proxy statement

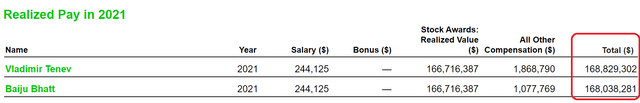

Along these lines, if Robinhood is bought up, the management team would have to give up their luxurious salaries as top executives of a public company. There’s no incentive to give up more than $160 million worth of compensation.

One could make the argument that this high level of compensation was when the company first became public. But I can assure you, the type of founders taking this much compensation out of the company, while shareholders get very little back, are not aligned with shareholders.

Simply put, it appears that this management team isn’t positioning themselves to win alongside shareholders.

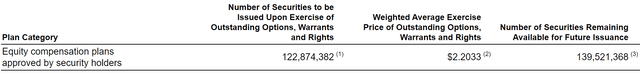

What’s more, their options get exercised at $2.20, as you can see below.

HOOD proxy statement

Consequently, not only are their options firmly in the money, but if Robinhood was bought out, their posts would be made redundant. There’s no need to keep the founders of the business at these elevated compensation packages.

Second, Robinhood’s fast growth rates are gone. I’ll delve further into this in a moment.

Third, with the markets in such turmoil, Robinhood’s ability to get more investors to use its platform is now going to be a serious uphill struggle. As you know, it’s not only that the equity market is in turmoil, but the crypto market is similarly in a bear market.

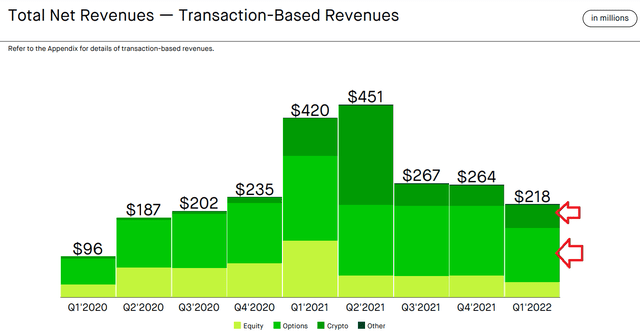

Robinhood Q1 2022 presentation

As you can see above, back in Q2 2021, Robinhood’s revenues were largely derived from its crypto revenues.

More specifically, Dogecoin (DOGE-USD) accounted for 32% and 8% of Robinhood’s revenues in Q2 and Q3 2021, respectively.

As you know, since last year, Dogecoin’s value has been wiped out by more than 75%. That means that investors’ appetite to speculate on Dogecoin will be a significant headwind that will be a struggle to replace.

Fourth, Robinhood’s own reputation makes its own ability to reach out to more investors to embrace its platform a massive uphill endeavor.

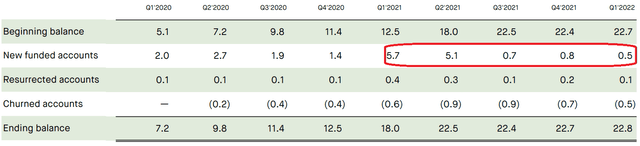

Robinhood Q1 2022 presentation

As you can see above, Robinhood’s ability to get new investors to open and fund a new account is moving in the wrong direction.

Don’t Think About Robinhood’s Next Quarter, Think Forward

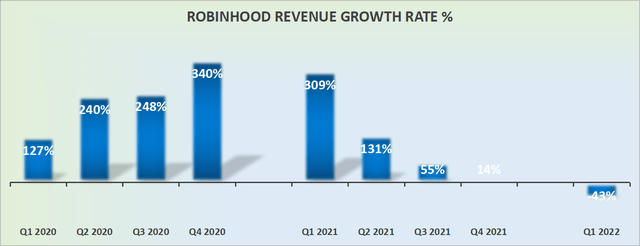

Robinhood revenue growth rates

On point three, Robinhood’s revenue growth rates.

At a recent conference call, Robinhood’s founder and CEO Vlad Tenev acknowledges the challenging retail environment that its young demographic of investors face.

Noting not only the high inflationary environment but also high petrol prices as causing headwinds to its customers’ discretionary income but the company’s near-term progress.

On this front, I believe that most investors have now come to terms with the fact that Q2 2022 will see Robinhood’s Q2 revenues report materially negative y/y growth rates.

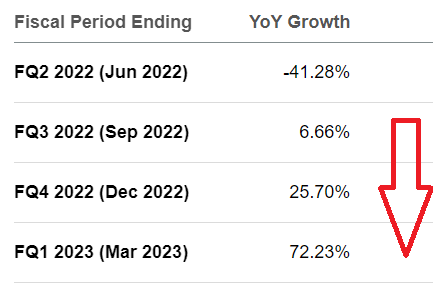

HOOD analysts’ consensus estimates

What’s more, as we look ahead, analysts are expecting that Robinhood will somehow bounce back with its upcoming quarters.

Yet, I do not see how that’s possible.

For the reasons already discussed above, there’s not only going to be fewer new accounts being opened, but also, I believe that over time, given the difficult market environment we are now in, there’s going to be a meaningful decrease in investors’ appetite to use options and trade cryptocurrencies.

The Bottom Line

Don’t buy the dip here. Don’t try to think that the stock was previously higher, therefore, and that in time Mr. Market will come to its senses and the stock will return to previous highs.

It makes absolutely no difference where the stock was last year. The only thing that matters is where the stock is headed.

I’m not opposed to buying the dip when the underlying business offers investors significant intrinsic value. But as we’ve just discussed, that’s not the case with Robinhood.

Be the first to comment