Ibrahim Akcengiz

Author’s note: This article was released to CEF/ETF Income Laboratory members on January 24th.

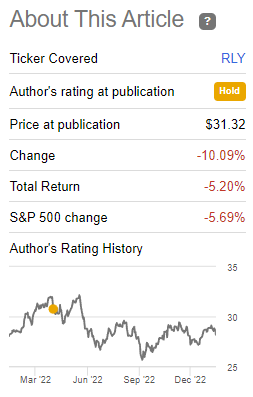

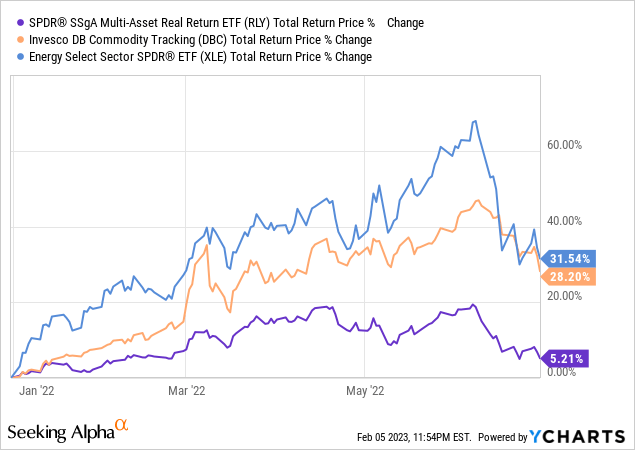

I last covered the SPDR SSGA Multi-Asset Real Return ETF (NYSEARCA:RLY), a diversified, multi-asset class inflation-hedge ETF, in April 2022. In that article, I argued that skyrocketing inflation and RLY’s effectiveness as an inflation-hedge made the fund a buy. Inflation has remained high since, with RLY moderately outperforming most asset classes, but only very slightly outperforming U.S. equities. Results were weaker than expected due to bad timing, and as inflation has started to normalize.

RLY Previous Article

Since my last article on RLY, inflation has started to normalize, economic conditions have softened, and the Federal Reserve has vowed to do ‘whatever it takes‘ to bring inflation back under control. RLY remains a broadly effective inflation-hedge, but inflation has gone down these past few months and will, I believe, continue to go down in the future. RLY would almost certainly underperform if inflation continues to normalize, so I would not be investing in the fund at the present time.

RLY – Overview

Strategy and Holdings

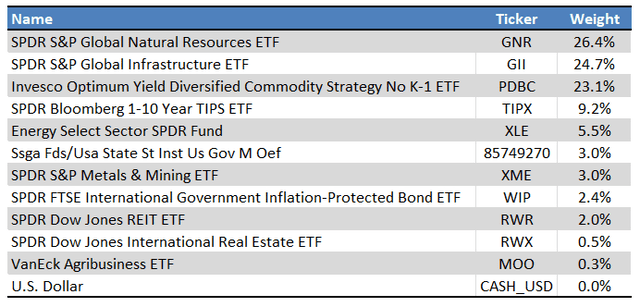

RLY is an inflation-hedge fund-of-funds, investing in most relevant inflation-hedge asset classes through cheap, simple, broad-based index ETFs. Asset classes include natural resources, energy, and mining companies, as well as commodity futures and TIPs. RLY leans towards asset classes with above-average risk and potential returns.

RLY is actively-managed, so security selection and weights are an active investment decision, taken by / dependent on the fund’s management team. RLY takes into consideration quantitative and qualitative factors in its investment process. From what I’ve seen, RLY’s managers rarely make aggressive trades or investments, opting for diversification and long-term investments instead. As such, investors should not expect significant outperformance or underperformance from the fund’s investment decisions, in my opinion at least.

RLY’s current holdings are as follows:

As can be seen above, RLY invests in ETFs covering all relevant inflation-hedge asset classes, including natural resource producers, commodities, infrastructure, treasury inflation-protected securities, and more. These securities tend to have exposure to prices / inflation. Natural resource companies are exposed to natural resource / commodity prices, and tend to outperform when these increase. TIPs are directly exposed to inflation, specifically CPI, and see higher dividends when inflation is high. Energy companies are exposed to energy prices, and tend to outperform when these increase. The same is true for RLY’s other holdings although in some cases, like for infrastructure and REITs, the relationship is a bit more indirect, and weaker.

Inflation Exposure

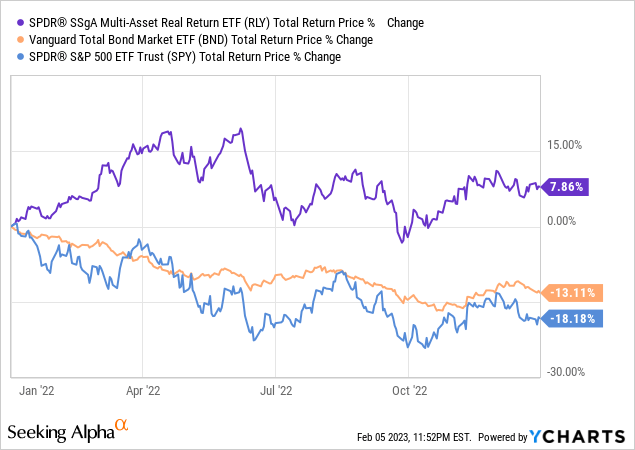

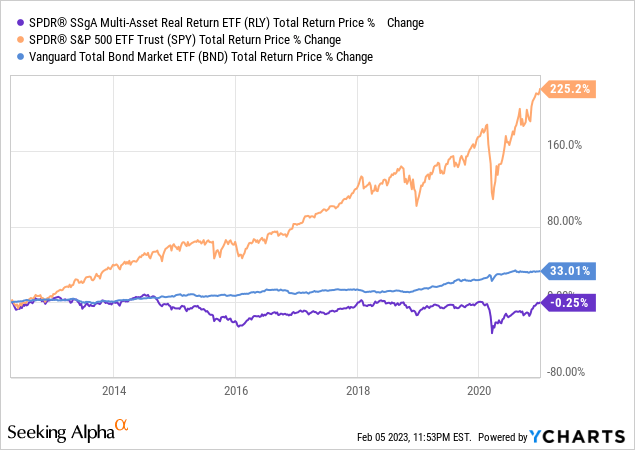

RLY’s underlying holdings tend to outperform when inflation is high and rising, as does the fund itself. As an example, the fund saw gains of 7.9% during 2022, a period of skyrocketing inflation. Most asset classes were down double-digits, including equities and bonds.

RLY’s effectiveness as an inflation-hedge is an important benefit for the fund and its shareholders, and key to the fund’s investment thesis and value proposition.

On the other hand, as RLY’s underlying holdings are all exposed to inflation, the fund tends to underperform when inflation is low. Inflation is generally low, and was almost always low before 2021. The fund significantly underperformed prior to that date, as expected.

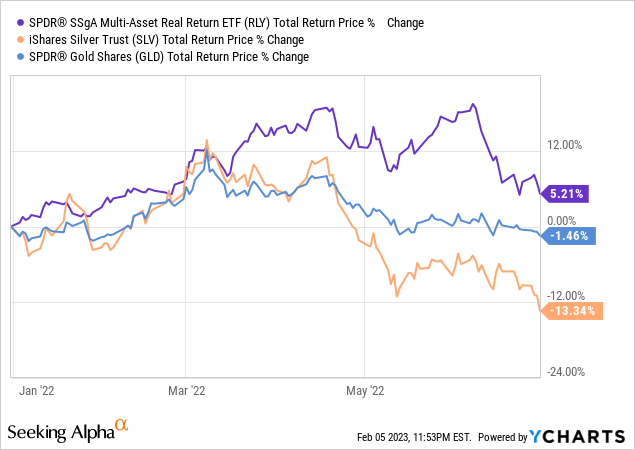

Diversification

RLY’s diversified holdings ensure reasonably good performance during most periods of heightened inflation, with few exceptions. This might not necessarily be the case for more targeted funds focusing on specific securities with inflation-hedge characteristics. As an example, gold and silver ETFs saw losses in 1H2022, because even though prices in general went up during said date, gold and silver prices, in particular, went down.

RLY’s diversified holdings effectively prevent the above from happening. If inflation is high at least some of the fund’s underlying ETFs will see strong returns, ensuring reasonable returns at the fund level. In the example above, RLY’s energy and commodity futures ETFs saw very strong returns, more than outweighing weakness in other sectors.

RLY’s diversified holdings are its key differentiator, and what sets it apart from most of its peers.

Inflation Analysis

RLY’s performance is strongly dependent on inflation: high inflation tends to mean strong performance, and vice versa. In my opinion, inflation is likely to decline moving forward, for three key reasons.

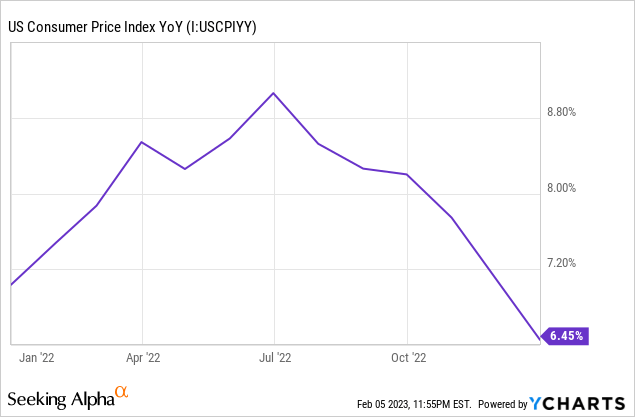

First, is the simple fact that inflation is plummeting. CPI has steadily declined since July, reaching 6.5% this past December.

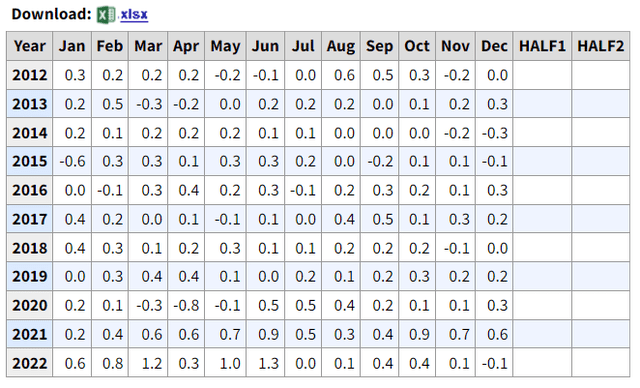

The figures above are accurate, but somewhat understate how much inflation has decreased these past few months. CPI is generally measured annually or YoY, and so that 6.5% includes price increases from early 2022. Looking at MoM CPI, which does not include these older data points, quite clearly shows inflation plummeting in July, averaging 2.0% annualizing since said date.

So, inflation has steadily decline on a YoY basis since July, and has completely normalized on a MoM basis since the same. Under these conditions, investors should expect low inflation moving forward, barring a sudden, unfavorable shift in economic conditions.

As an aside, and as should be clear from the above, annual CPI is on track to reach 2.0% by July 2023.

Second, is the fact that economic conditions are such that low inflation seems likely. Oil prices have steadily declined since the onset of the Ukraine War, as have prices for most commodities and energy products, including natural gas and coal. Higher interest rates, courtesy of the Federal Reserve, have led to tighter financial conditions, which should reduce consumer spending, corporate investment, and housing construction / demand, moving forward. Most analysts are expecting a shallow, technical recession this year, which should pressure demand and hence prices. Under these conditions, an inflationary spike seems incredibly unlikely, in my opinion at least.

Third, is the fact that the Federal Reserve is committed to doing ‘whatever it takes‘ to bring inflation back under control. Remember, the Fed targets a 2.0% long-term inflation rate, and it has the tools to reach said target: interest rates. The Fed can always hike rates high enough to trigger a recession, causing demand to plummet and prices to stabilize. It has been decades, since the 70s, since the Fed was forced into doing such a thing, but Powell might just have to do so do. I don’t believe this will prove necessary, and Powell could always flinch even if it is, but this is the Fed’s job, and I do think they’ll do it if push comes to shove.

In my opinion, and considering the above, inflation will likely normalize in the coming months, leading RLY to underperform.

Conclusion

RLY is a diversified, multi-asset class inflation-hedge ETF. Although the fund provides investors with an effective way to hedge against rising prices, inflation has likely peaked, and will decline moving forward. RLY is likely to underperform under these conditions, so I would not be investing in the fund at the present time.

Be the first to comment