jittawit.21/iStock via Getty Images

Thesis

Rithm Capital Corp.’s (NYSE:RITM) investors who capitalized on the recent panic selloff have benefited markedly as the market forced out weak holders at RITM’s October lows.

We also reminded investors then not to give up on the capitulation move even as the market sentiments seemed bleak. Accordingly, RITM has recovered nearly 15% since our previous article, outperforming the S&P 500’s (SPX, SP500) 7% uptick. It’s also well above its all-time total return CAGR of 6.55%, demonstrating the immense benefits of capitalizing on market dislocation moves.

With RITM’s valuation moving closer to its all-time average and our previous price target (PT) of $9.5, we believe it’s appropriate for investors to take a slight pause. Moreover, RITM’s price action suggests that sellers have returned to test buyers’ conviction, with its medium-term downtrend likely resisting marked upward advances from the current levels.

Therefore, we postulate that RITM’s reward/risk is more well-balanced at the current levels and much less appealing compared to early October.

Revising from Buy to Hold, we urge investors to be patient.

Street Analysts Brought Out Their Bear Case

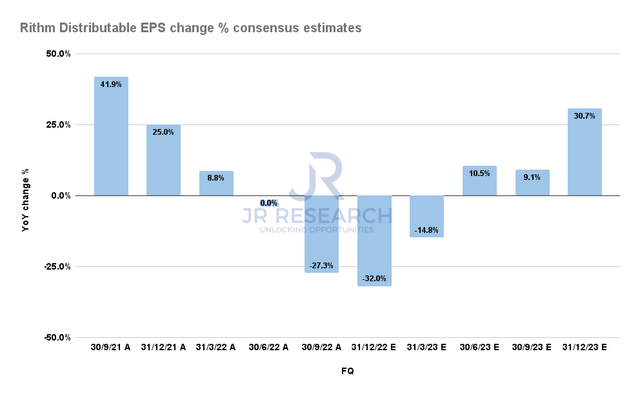

Rithm Distributable EPS change % consensus estimates (S&P Cap IQ)

Street analysts slashed Rithm Capital Corp.’s estimates in October after the turmoil in the bond market, coupled with the record surge in mortgage rates that went past 7% in late October.

However, Rithm’s recent FQ3 release proved that analysts were overly pessimistic, as the leading mREIT outperformed on its distributable EPS. Accordingly, Rithm posted a distributable EPS of $0.32, well above the slashed analysts’ projections of $0.28.

Management highlighted that its mortgage serving rights (MSRs) portfolio has continued to benefit from the Fed’s rapid rate hikes, recognizing a mark-to-market gain of $143M. Its custodial deposit base of $12B also capitalized on the rising rates. Portfolio speed and amortization also slowed for the seventh straight quarter.

However, the company remains “bearish” over the state of the housing market, expecting a further correction moving forward. Notwithstanding, Rithm accentuated it remains well-positioned to leverage a potential recovery in 2023 as the Fed could slow down its hiking momentum. CEO Michael Nierenberg articulated:

I think what you’re going to see now and what we’re trying to do is moderate the origination business, stay in it, grow it prudently and make sure that we’re ready for recapture when we come out of this rate environment. We think you could see something happening in [Q2’23]. And it doesn’t necessarily mean that interest rates need to drop a ton. (Rithm Capital FQ3’22 earnings call.)

But The Market Has Also Normalized RITM’s Valuation

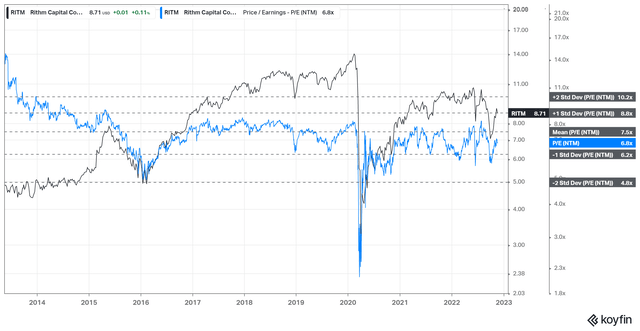

RITM NTM Distributable earnings multiples valuation trend (koyfin)

The market was quick to force a rug pull on weak RITM holders, but it also quickly normalized its dislocation in October.

The market had likely anticipated a relatively robust FQ3 card for Rithm, as the panic selloff bottomed out in October (pre-earnings), as we discussed in our previous update.

Hence, RITM’s NTM Distributable earnings multiple of 6.8x has moved much closer to its all-time average of 7.5x. We don’t expect the market to re-rate RITM much further from here, with the need to reflect higher execution risks through a potential recession.

Is RITM Stock A Buy, Sell, Or Hold?

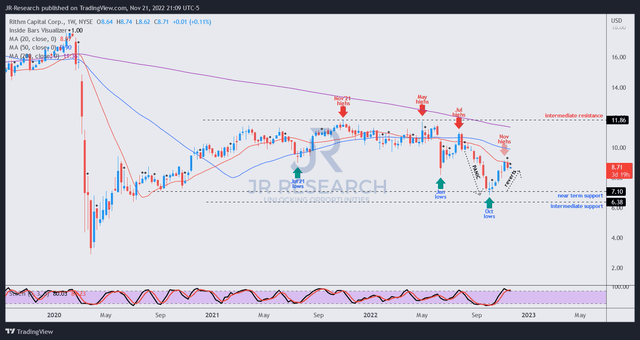

RITM price chart (weekly) (TradingView)

RITM rallied about 33% from its October lows toward its November highs, benefiting “brave souls” who picked its panic selloff astutely, outperforming its total return CAGR by 4.7x.

However, we gleaned that RITM could face strong sellers at the current levels, positioned along its 20-week moving average (red line), attempting to resist further buying upside.

Its 50-week moving average has also moved further downward to set up a medium-term bearish bias, with sellers seemingly in decisive control.

Coupled with just a 9% potential upside to our previous Rithm Capital Corp. PT of $9.5, the reward/risk is no longer appealing at the current levels. As such, we urge investors considering adding more positions in Rithm Capital Corp. to bide their time for a possible pullback.

Revising from Buy to Hold for now.

Be the first to comment