Andrii Yalanskyi/iStock via Getty Images

A common refrain the “yield chasers” find themselves defending is “what good is a 10% yield if the price declines 15% each year?” or something to that affect. Everyone’s investment situation and goals are unique; take for example the “reverse mortgage” whereby homeowners get to stay in their home but lose equity value each year (not entirely dissimilar to the yield chaser refrain described above). What’s more, this situation is actually preferred by some investors, and it may turn out to be an accurate hindsight description of an investment in Rithm Capital (NYSE:RITM) five years down the road. In this report, we explain why mortgage REIT Rithm Capital is an unattractive and systemically unimportant investment, and then offer two more-important big-dividend REIT alternatives that we believe are worth considering. We conclude with our strong opinion on investing.

Rithm Capital, Yield: 10.0%

Rithm Capital

Formerly known as New Residential Investment Corp (NRZ), Rithm Capital is a big-dividend mortgage REIT that should be avoided by most investors. Its balance sheet consists of a hodgepodge of difficult-to-manage legacy mortgage-related assets that are of little importance to the financial system, its CEO has a history of questionable behavior, the business just lost its credible external management team, and its opportunities are limited going forward. It’s basically dying money walking, as we will explain below.

Rithm History

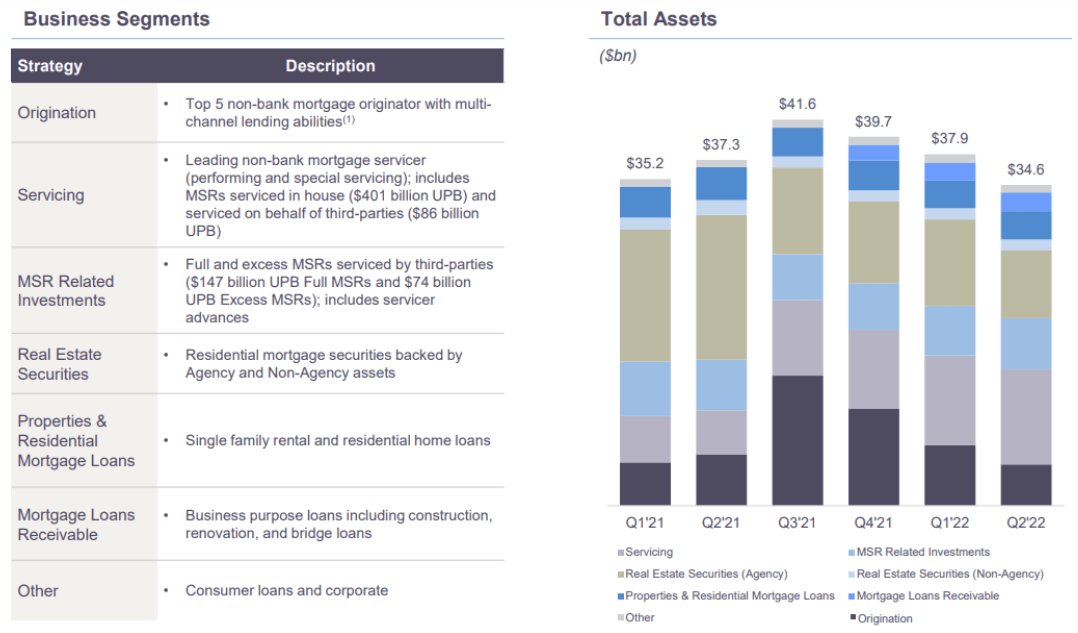

To provide some history, Rithm was initially founded around the time of the 2008-2009 financial crisis. It was a cleverly opportunistic business that benefited from the mortgage-related distress of the crisis. Specifically, it first owned Mortgage Servicing Rights (which became unexpectedly important when the housing bubble burst) and then Excess Mortgage Servicing Rights. In fact, it still owns many of these assets on its balance sheet, but the tremendous growth and very high-yield opportunities in this asset class (that emerged during/after the financial crisis) is now long gone. And since the opportunities were already gone, Rithm has been grasping for new opportunities (none of which are nearly as attractive as the ones that existed shortly after the 2008-2009 financial crisis began). And as a result, Rithm’s balance sheet now consists of a hodgepodge of mortgage-related assets that are risky and hard to manage, such as those in the graphic below.

Rithm Investor Presentation

Fortress Just Dumped Rithm

As a testament to the challenges and unattractiveness of Rithm’s business and balance sheet, the company just got dumped by its external management firm, Fortress Investment Group (FIG). And while Rithm tries to spin this as a great opportunity to become internally managed (thereby reducing expenses and eliminated conflicts of interest), it’s really just an indication that the company’s future is not particularly bright. CEO Michael Nierenberg tries to put a positive spin on it as follows:

“We have changed dramatically since our inception, from an owner of MSR assets to a company with complementary operating companies and a unique portfolio of investments. The new name and brand help distinguish us from our operating companies, including Newrez, and reflect our culture, team and ambitions for growth beyond residential mortgages.”

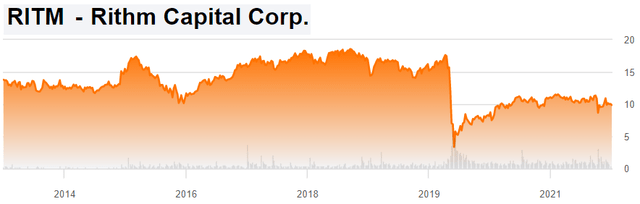

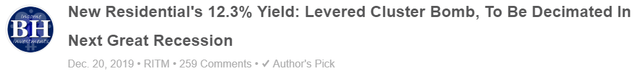

In plain English, the company is waiving the white flag and now trying to use shareholder capital to come up with other options. And for perspective, here is how the company’s share price has performed (remember it just recently changed its name from New Residential to Rithm Capital) since its risky assets got wrecked (and dividend decimated) when the liquidity turmoil of early 2020 hit (as we warned about at the end of 2019).

Rithm CEO Contributed to Bear Stearns Demise

If you remember back to the distress of the 2009-2008 financial crisis, it was largely set off when Wall Street bank, Bear Stearns (followed by Lehman Brothers), collapsed. And a look under the hood reveals Rithm’s current CEO (Michael Nierenberg) worked at Bear Stearns and his risky behavior contributed very significantly to the collapse. And for reference, here is more color on what Nierenberg has been up to lately.

Rithm’s Assets: NOT Systemically Important

When the COVID pandemic broke out, Rithm was hurt badly because of its risky balance sheet assets. Critically important to note, the fed was working overtime to bail out the financial markets at this time (by buying all kinds of assets to pump liquidity into the system), but they were NOT bailing out Rithm’s various and exotic MSRs. The Fed was buying Agency Mortgage Backed Securities (Agency MBS) hand over fist (to the benefit of other mortgage REITs, but not so much Rithm). Rithm was actually trying to buy Agency MBS at this time to offset some of the MSR risk (as the quote from CEO Michael Nierenberg below explains), but it was too little too late as the lack of liquidity and book value damage had already been done.

As we think about the investment portfolio going forward, one of the areas that we’ve been focused on, we’ve added agency securities to offset some of our MSR portfolio.

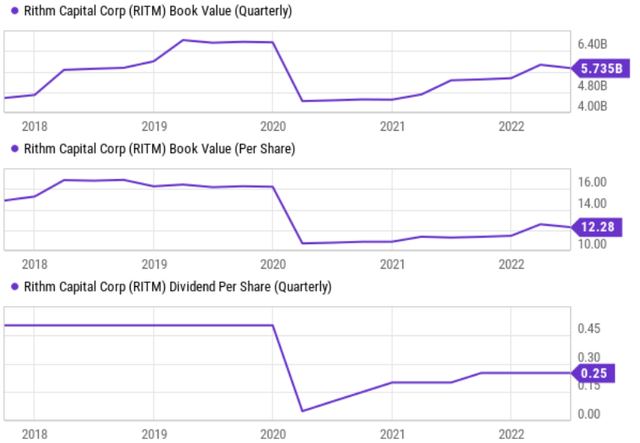

For reference, here is a look at what happened to the book value and the dividend.

2 Better Big-Dividend Opportunities

In our view, Rithm is simply dying money walking, whereby it’s just a matter of time before some localized market turmoil and risk drives it into distress and more book value declines. Of course it could pull a rabbit out of its hat and put itself on a path to miraculous recovery and gains, but that seems unlikely. Investing in Rithm is not an attractive risk in our view (regardless of the big dividend yield). Instead, we offer two better (and more systemically important) big-dividend opportunities below.

Annaly Capital (NLY) Preferred, Yield: 7.2%

Like Rithm, Annaly is also a mortgage REIT. However, unlike Rithm, Annaly’s balance sheet assets are more systemically important as increasingly demonstrated by the Federal Reserve’s clear commitment to supporting them. Specifically, the overwhelming majority of Annaly’s balance sheet assets (~71%) are Agency MBS, which are essentially backed by the government. For example, the fed bought massive quantities of Agency MBS quickly when the pandemic was hitting in order to pump liquidity into the system.

However, in the case of Annaly, it is actually the preferred shares (e.g. (NLY.PF) that we prefer (not the common). The preferred shares are higher in the capital structure and have less price volatility. Also, they trade at a small discount to their $25 redemption price (unlike the common shares which currently trade at large premium to their book value). We recently wrote up Annaly preferred shares in more detail in this report (which incidentally also includes several more top ideas and a data dump on over 200 big-dividend preferred stocks).

Medical Properties Trust (MPW), Yield: 7.3%

Although it’s a property REIT (not a mortgage REIT), Medical Properties Trust is another big-dividend REIT that we like more than Rithm. And one of the reasons we like MPW is because its assets (hospital real estate) is systemically important (unlike most of Rithm’s balance sheet assets).

Specifically, MPW owns the real estate that is currently occupied and operated by hospitals that are extremely important to the communities in which they operate. The basic business model is that MPW provides critical capital to hospitals by buying their real estate, and this is a win-win because it gives MPW ownership of important hospital properties, and its gives the hospital operators access to capital so they can improve their operations. We recently wrote up MPW in great detail in our report: “Medical Properties Trust: 50 Big-Dividend REITs Down Big.”

The Bottom Line

Every investor has their own individual goals and tolerance for risk. For example, some investors place such a high value on big dividends that they don’t mind when the share price deteriorates over time. In our judgement, that is likely what will happen with Rithm Capital over time. It will keep paying big dividends while its share price will fall (yes, there will be ups and downs, but we expect the long-term trend will be consistent share price declines).

Unlike Rithm, both Annaly Capital and Medical Properties Trust own assets that are important to the functioning of society (MPW owns important hospitals and NLY owns mostly Agency MBS that helps support the residential mortgage market so people can have homes to live in).

At the end of the day, you need to decide what investments and investment strategy works for you. Disciplined, goal-focused, long-term investing is a winning strategy.

Be the first to comment