RiverNorthPhotography/iStock Unreleased via Getty Images

When it comes to the retail pharmacy space, there really are only two large players in the market that have a meaningful foothold. When you have dominant players in a space, it can be dangerous to buy into a third-string prospect. But at the same time, it can also result in significant upside potential. One interesting and certainly binary company for investors to consider in this market is Rite Aid (NYSE:RAD). Over the years, the company has struggled to generate a profit but cash flows have been generally robust. Shares look dirt cheap at current pricing, but this comes with the downside of significant leverage that undoubtedly elevates the company’s risk profile. But given how cheap shares are getting today, it may not be a bad opportunity for investors who champion the deep value strategy of acquiring struggling enterprises at extremely low prices.

The situation is improving for Rite Aid

From a share price perspective, things have not been particularly great for drugstore chain Rite Aid. Since I last wrote about the company in September of 2021, shares have generated a loss for investors of 46.6%. That compares to a 0.3% loss experienced by the S&P 500 over the same period of time. Such a significant departure from the market’s return usually indicates that the picture for the company in question is anything but good. But interestingly, in most respects, the opposite has actually been true. Fundamentally, Rite Aid is showing some signs of gradual improvement.

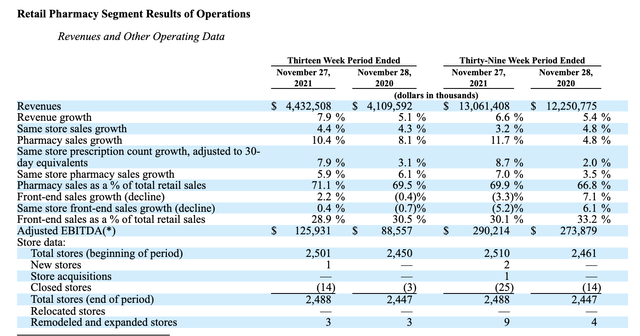

To see what I mean, we need only look at recent financial performance for the business. In the third quarter of its 2022 fiscal year, for instance, the company generated revenue of $6.23 billion. This represented a 1.8% increase over the $6.12 billion generated the same time one year earlier. The company was aided by a couple of positive factors here. One of these was a 4.4% increase in the same-store sales year over year. Although the company has continued to struggle with weak front-end same-store sales, even that metric came in relatively strong in the quarter, clocking in at 0.4%. To put that in perspective, in the third quarter of its 2021 fiscal year, this metric was negative to the tune of 0.7%. The company has also benefited from a slight increase in the number of stores in operation. Today, it boasts 2,488 locations. That’s up from the 2,447 reported one year earlier. It is true that the company did see its bottom line worsen during this time frame, with its net loss of $36.1 million coming in far worse than the $4.3 million profit experienced in the third quarter of 2021. But set against the broader picture, that was only one bump in the road for the firm. The rest of the picture for the first nine months of the year is rather encouraging.

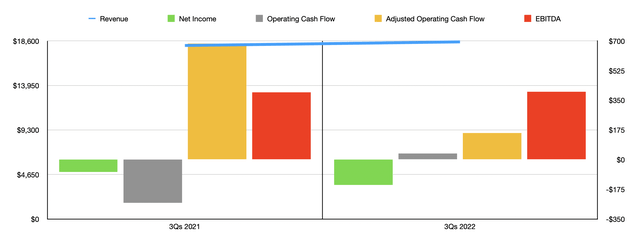

During the first nine months of its 2022 fiscal year, the company generated sales of $18.50 billion. That’s 2.1% above the $18.13 billion experienced at the same time frame one year earlier. Same-store sales for the company expanded during this time frame by 3.2%, though front-end same-store sales declined by 5.2%. This means that the company is relying a great deal on strong pharmacy results, while struggling to sell non-pharmacy products. From a profitability perspective, the picture was rather mixed. The firm’s net loss of $149.4 million dwarfed the $72.4 million loss experienced one year earlier. But operating cash flow for the company turned from a negative $253.8 million to a positive $36.6 million. Over that same timeframe, EBITDA for the retailer inched up from $396.4 million to $399.8 million.

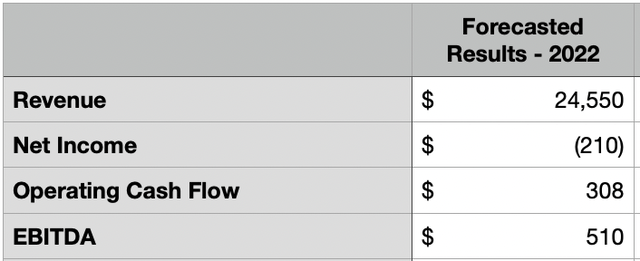

Looking into the past has value because it tells us where we came from. But as investors, it’s also important to look to the future. And the picture we start to get from the company begins to look even more promising. Consider, for instance, management expectations for the 2022 fiscal year as a whole. Sales should come in at between $24.4 billion and $24.7 billion. At the midpoint, this would imply a year-over-year increase of 2.1%. This should be driven in part by strong pharmacy sales of between $7.1 billion and $7.2 billion. Seeing sales increase is great. But what we really need to look at is profitability. Yes, the company is still expected to generate a net loss for the 2022 fiscal year. This loss should be between $189 million and $230 million. That compares to the $100.1 million loss generated in 2021.

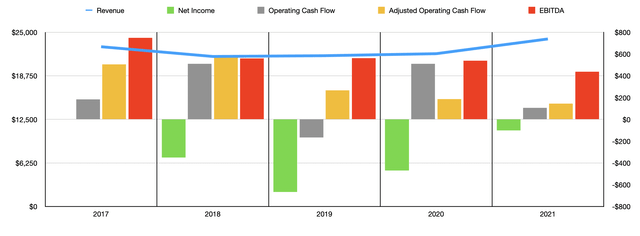

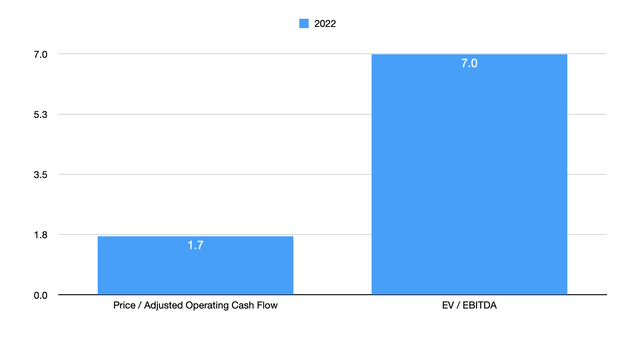

Despite this anticipated net loss, cash flows for the company should come in stronger year over year. For instance, management anticipates EBITDA coming in at between $500 million and $520 million. At the midpoint, that is 16.5% above the $437.7 million the company reported for 2021. Though it is lower than what the firm reported in the years between 2017 and 2020. If we use EBITDA minus interest expense as a proxy for operating cash flow, then operating cash flow for the year should be around $308 million. This price is the company at a price to operating cash flow multiple of just 1.7. And the EV to EBITDA multiple for the company should be 7.

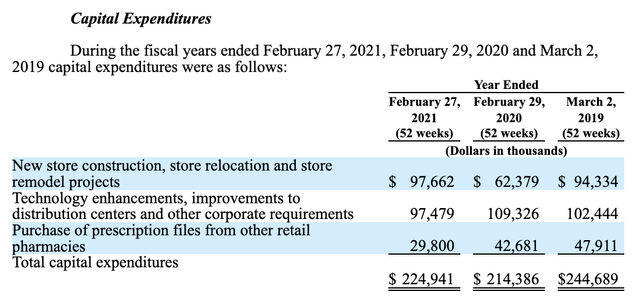

These are dirt cheap prices. But one thing that investors might point to is that the company doesn’t get to keep all of this cash flow. In fact, for 2022 as a whole, management anticipates spending about $275 million on capital expenditures. That’s up from the $224.9 million the company spent in 2021. And, unfortunately, that would leave the company with just $33 million in excess cash to spend on debt reduction or otherwise returning value to shareholders directly. With net debt of $3.0 billion, an increase of $42.9 million compared to one quarter earlier and up $107.9 million from the end of its 2021 fiscal year, implying a net leverage ratio of 5.95, this is not an ideal scenario. However, investors should view management’s spending plans as an investment into the company’s prospects moving forward.

Because it’s not required, Rite Aid does not report what its maintenance capital expenditures are. Maintenance capital expenditures or a measure of how much the company needs to spend in order to keep operations running as they have been. But we do have some other information about capital expenditures. Of the $224.9 million spent on it in 2021, $97.7 million was allocated to new store construction, store relocation, and store remodeling projects. Realistically speaking, the store relocation and store remodeling spending should be considered a maintenance capital expenditure item, while the new store construction spending should be growth-oriented in nature. But the company does not split the data up in that way.

We also know that $97.5 million of spending was dedicated to technology enhancements, improvements to distribution centers, and other corporate requirements. While the other corporate requirements category may include some maintenance spending items, it’s likely that this part of capital expenditures is focused on improving the company’s existing business. And the final $29.8 million in spending last year was dedicated to purchasing prescription files from other retail pharmacies. This is spending dedicated entirely to growth. What’s more, this kind of spending has been within a fairly narrow range across all three categories for at least the past three years. This stability gives confidence in saying that overall capital expenditures made by the company probably are focused more on growing and improving the company than on keeping operations maintained. And as a result, investors should view much of this spending as voluntary, meaning that the business could reallocate cash flow to paying down debt if it so desired.

Takeaway

At this point in time, Rite Aid makes for an interesting prospect for investors. Don’t get me wrong. The company is clearly a risky prospect that could result in significant losses. But it is also priced low enough that continued improvement could lead to meaningful upside for long-term investors. The biggest problem for the company right now is net leverage. But given the nature of cash flows and how cash is spent, I believe the company could reallocate this capital to pay down debt if it needed to. So while investors should never get complacent if they do decide to buy into the business, I do think that, for a diligent bargain buyer, this could make for a good play moving forward.

Be the first to comment